The performance by an employee of an official task not at the place of his permanent work is directly related to certain expenses.

The legislator assigns the obligation to cover travel expenses for travel, accommodation, daily allowance, as well as the performed labor function to the sending enterprise (organization).

Payment of funds from the company's cash desk is possible only on the basis of a special document - an order on travel expenses.

Business trip concept

A business trip is understood as sending an employee, by order of his management, for a specific period of time to another location, in order for the employee to perform a professional task. Only trips of persons who have an officially registered labor relationship with the employer are recognized as business trips. All other legal relations regarding the performance of work have their own mechanism for regulating the movements and sending of employees to another area to perform work, and are not included in the concept of “business trip”.

The law contains a requirement that a business trip is mandatory for an employee; refusal to travel without good reason is recognized as a violation of labor discipline and entails liability.

However, some categories of employees are exempt from business trips or can be sent on business trips only by expressing their written consent. Such restrictions apply to employees during their pregnancy, raising children, or are related to the employee’s age.

Travel by employees whose work involves travel is not recognized as business trips and is paid according to other standards.

When is an advance report issued?

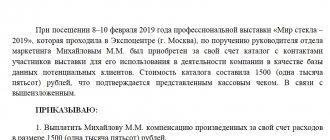

According to clause 6.3 of the Bank of Russia instructions on conducting cash transactions dated March 11, 2014 No. 3210-U, an advance report is drawn up in the case when an employee was given money in advance against the report to purchase something for the needs of the company. The issuance of money must take place on the basis of an expenditure cash order, which is drawn up in the presence of an application from an accountant, approved by the manager, or on the basis of an administrative document (order, instruction) of the head of the company (or individual entrepreneur). The application (or administrative document) must indicate the amount and period of use of funds.

The advance report, in turn, is submitted by the employee to the accounting department within 3 days after the deadline. Next, it is checked and approved by the manager.

Thus, if an employee first bought the goods and then demanded reimbursement of expenses, it is incorrect to draw up an advance report as a supporting document, since this employee can no longer be called an accountable person.

We also note that an employee can use personal funds to pay for any purchases that the company needs, and also has the right to reimbursement of these expenses, since the law does not prohibit such transactions. But it is important to correctly document such relationships.

What should be displayed

The header of the document should contain the following:

- full name of the organization;

- the date when the order was drawn up;

- registration number;

- title;

- wording: “Based on the reporting documents provided... (the full name of the employee is written here) I ORDER”;

- text;

- signature of the person responsible for the execution of the order and its transcript;

- director’s signature and its transcript;

- signature of the employee (who needs to reimburse the expenses) and its transcript in the familiarization column.

The text itself should contain the following information:

- Full name of the employee who needs to be reimbursed.

- The structural unit in which the employee works, as well as his position, rank, class, qualifications.

- Wording: “To pay as compensation for expenses in excess of the advance received in connection with the stay in ... from ... to ... year ... rubles .... kopecks ... (amount in words).”

- Basis and listing of supporting documents.

- Wording: “Control over the implementation of this order is entrusted to ... (position and full name of the responsible person).”

Types of expenses associated with business travel

An employee’s travel at the direction of the employer, associated with the execution of an assigned official assignment, involves the following types of expenses:

- for residential premises. This means renting the living space in which the employee will live during a business trip. An employee can rent a room, apartment, or hotel room. This type of expense is not provided if an agreement is concluded between the employee and the organization on the provision of free housing during the business trip.

- For travel to the place of execution of the order and back. Labor legislation establishes the ability of an employee to get to the place of execution of an assignment by rail, water transport, road transport, and air transport. The type of expenses under consideration includes the cost and issuance of travel tickets.

- For payment of daily allowance. This includes expenses related to the employee’s accommodation on a business trip, not related to travel costs and rental accommodation. The amount of daily allowance is determined by agreement between the employee and the organization. Tax legislation allows the payment of daily allowance in the amount of 700 rubles within the Russian Federation, without taxing it; if the daily allowance is more than the specified amount, it is subject to personal income tax.

If an employee is sent on a business trip abroad, the employer, in addition to the types of expenses considered, pays for the preparation of the employee’s documents allowing travel to another country, insurance for travel to a foreign country, transportation of luggage by the employee, and telephone conversations.

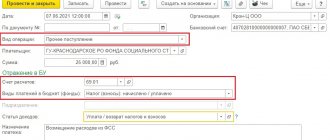

Order on sending an employee on a trip

The manager’s order must be issued in writing (Resolution of the Government of the Russian Federation dated October 13, 2008 No. 749), and this can be done in the form of any document, the form of which is accepted by the employer. Usually in this case a business trip order is issued. Until 2013, it had the mandatory T-9 form, approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

Since the T-9 form fully meets all the requirements for a document that must be issued as an order to be sent on a business trip, most employers continue to use it now. You can also take this form as a sample order for sending on a business trip when developing it yourself. Form T-9 contains the following required fields:

- name of the employer, sending employee, his OKPO code;

- number and date of the document being drawn up;

- Full name of the employee sent on the trip, his personnel number, the name of the unit that is the place of work, the position held;

- the place where the employee is going on a business trip: country, name of the locality, name of the receiving party;

- number of days of the trip, approximate start and end dates;

- the purpose for which the business trip is arranged (it is important for the correct reflection of the costs of it in the accounting and tax records of the employer paying for the trip).

Read about accounting for business travel expenses in this material .

- the source of payment for business trip expenses - usually it is the employer himself who sends the employee on the trip, but there may be cases when the business trip is carried out in the interests of a third party who will bear the costs of it; in this case, the party that sent the employee on a business trip will take them into account as re-billed expenses;

- reason for the business trip - this field either remains blank (if the decision to travel is made directly by the employer), or contains a link to the memo (if the initiative to register comes from the employee himself or his managers);

- position and signature (with transcript) of the head of the employer or the person to whom he delegated such right;

- signature of the employee sent on a business trip and the date of his familiarization with the order.

To issue an order to send a group of workers on a business trip, you can use the T-9a form approved by the same resolution of the State Statistics Committee, in which for each of the workers it is possible to separately indicate the place, purpose, timing of the trip and source of payment.

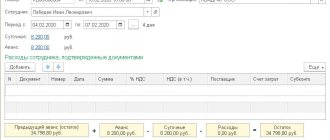

Procedure for reimbursement of expenses

The organization, before sending an employee on a trip, issues a special order, on the basis of which an advance is allocated in a certain amount. It can be transferred to the employee’s bank account, or issued in cash. After returning from a trip, the employee is required to report to the employer and provide information about expenses, with a full package of documents confirming expenses.

The employer, by internal regulations, establishes the procedure for reimbursing an employee for expenses related to a business trip. An organization may establish special requirements for the procedure for reimbursement of expenses if this does not worsen the employee’s situation. As a general rule, compensation occurs in the following order:

- housing expenses are reimbursed to the employee in full if the employee provides documents confirming the expenses.

- Travel expenses are reimbursed in full, provided that the expenses are supported by documents. At the same time, the law provides for travel in a train compartment, in an economy class airplane, in a fifth-class cabin on a sea vessel and a second-class cabin on a river vessel, in general vehicles.

- Daily allowances are calculated and paid for each day you are on a business trip. Weekends and holidays are also taken into account and paid. The employer is obliged to pay for the days that the employee spends on the way to the place of business trip and back. If an employee is forced to stop along the way, the days of the stop are also paid.

For a one-day business trip related to movement within the territory of the Russian Federation, daily payments are not provided, however, the employer is not prohibited from assigning them at his own discretion. If the departure took place outside the Russian Federation, the employee is entitled to payment of half the amount applicable to foreign business trips.

Budgetary organizations are guided by established rules

As for organizations financed from the budget, the procedure for reimbursement of expenses, in particular, expenses for accommodation on a business trip, is established by special regulations.

For federal government bodies, extra-budgetary funds and federal institutions, the procedure for reimbursement of travel expenses is established by the Government of the Russian Federation. For regional government bodies and institutions, the procedure is established by the executive authorities of the constituent entities of the Russian Federation. For local government bodies and municipal institutions - local executive authorities (Parts 2, 3 of Article 168 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated October 2, 2002 No. 729).

Moreover, budgetary institutions can increase these amounts by saving budget funds, as well as money received from business activities (clause 1, clause 3 of the Decree of the Government of the Russian Federation dated October 2, 2002 No. 729, letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2 -291).

Reimbursement amounts

For employees of government organizations, the Government Decree on reimbursement of expenses related to business trips provides the following reimbursement amounts:

- expenses associated with renting housing - in the amount of the amount spent, but not more than 550 rubles, subject to confirmation of expenses with documents; if the employee does not provide supporting documentation, he is credited 12 rubles.

- Expenses associated with travel - in the amount actually spent, but not more than the cost of travel documents. If the employee cannot provide documents related to transportation costs, he is paid the minimum cost of travel in a reserved seat, or in a tenth type cabin on sea transport and a third on a river or public bus.

- Daily expenses are paid in the amount of 100 rubles every day of a business trip.

In a non-state organization, the amount of daily payments is established by local regulations.

Calculation of daily allowances for the period of performance of a work assignment

Payment of daily travel expenses in 2022 is subject to the previous rules. The company has the right to set their size independently, but excess payments are subject to personal income tax and insurance premiums. The current standard is established by the Tax Code and is:

- 700 rubles per day - in Russia;

- 2500 rubles - abroad.

You can calculate the amount of daily allowance using our calculator.

Any amounts that exceed the established norms are subject to not only personal income tax, but also insurance premiums (on the excess amount).

Payment of travel expenses in 2022, if they are documented and economically justified, are not subject to contributions to funds and personal income tax (except for cases provided for by law). The taxpayer-employer has the right to take into account the amount of expenses for the purpose of reducing income tax or the simplified tax system.

What expenses are not eligible for reimbursement?

The given list of expenses, according to the Ministry of Finance of the Russian Federation, is closed. Based on this, any employee expenses not related to renting housing, travel to and from the business trip, and exceeding the amount of daily payments established by the agreement are not reimbursed.

For example, the employer is not obliged to pay for the employee’s trips by taxi or other transport to the place of business travel, the employee’s visits to entertainment venues, or telephone conversations not related to work activities. However, the law does not prohibit the employer from paying any expenses of an employee on a business trip if an agreement has been concluded to this effect.

Author of the article

In what cases are expenses reimbursed?

Before planning a business trip, an enterprise needs to familiarize itself with up-to-date information on the procedure for organizing and financing it.

The basic rule, according to the law, remains maintaining the salary and position at the same level during the period of absence of the traveler.

Reimbursement of funds to the employee is established in the following situations:

- The person spent his own resources on the business trip;

- The employee paid for the service in advance, but the trip was cancelled;

- The company closed the project on the day of the planned departure.