Adjustment of calculation of insurance premiums 2022

→ → Current as of: February 20, 2022

You will have to submit a new Calculation if (): section 3 contains unreliable personal data of an individual; in section 3, errors were found in numerical indicators (in the amount of payments, base, contributions); the sum of the numerical indicators of sections 3 for all individuals does not coincide with the data for the organization as a whole, reflected in subsections 1.1 and 1.3 of Appendix No. 1 to section 1 of the calculation; the amount of contributions to the compulsory pension insurance (based on a base not exceeding the maximum value)

How to change data in your Sberbank personal account?

Author of the question: Nesterov M. Created: 02/24/22

Also update your personal data

you can do it yourself in your

SberBank Online

.

In the main menu, click “Profile” → “Documents”. change

your mobile phone number, email, passport, INN, SNILS, STS and driver's license.

Answered by: Orlov E. 02/24/22

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

How to make an updated VAT return in 2022 - 2019?

> > > Tax-tax February 5, 2022 An updated VAT return must be submitted when errors are identified that lead to an understatement of the tax or an overstatement of its amount accrued for reimbursement.

Filing an updated VAT return in other cases is the right of the taxpayer, and not his obligation. We'll tell you how to make and submit a clarification.

Submitting an updated or corrective VAT return to the Federal Tax Service allows the taxpayer to correct errors made in the previously submitted version of this document. At the tax office when conducting

How to fill out an updated declaration

How to correct a VAT return? How to make an adjustment VAT return? If the question arises of how to make a VAT declaration that clarifies the values already filed, then the answer is simple: you need to draw up a new declaration with the correct amounts. How to fill out an updated VAT return? It is necessary to enter all the values into it completely, and not display only the difference between the erroneously submitted and correct ones. Thus, a sample of an updated VAT declaration is a regular declaration, only containing the correct (updated in comparison with the previously submitted document) numbers.

Note! The updated declaration is filled out in the form that was in force during the period for which changes are made (clause 5 of Article 81 of the Tax Code of the Russian Federation). From the 3rd quarter of 2022, a new VAT declaration form is in force as amended by Order No. ED-7-3 dated March 26, 2021/ [email protected]

For step-by-step instructions on how to fill out an updated VAT return, starting with the reporting campaign for the 3rd quarter of 2022, see ConsultantPlus, having received trial demo access to the K+ system. It's free.

As for tax agents, in the clarification they display information only for those taxpayers for whom errors were discovered.

A sign of an updated document is a special code (adjustment number), which must be indicated on the title page in a separate field in the VAT return. The correction number corresponds to the serial number of the clarification submitted for the tax period in which the errors were discovered.

Another point that distinguishes the updated VAT return is the indication of relevance in sections 8 and 9. The relevance code in the updated VAT return has 2 meanings (clauses 46.2, 48.2 of the Filling Out Procedure, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ):

- 0 - if in the original version of the declaration sections 8, 9 were not filled out or changes are made to them;

- 1 - if these sections do not require data correction.

Making changes requires filling out appendices to sections 8, 9. The design features of these sections and appendices to them are described in the letter of the Federal Tax Service of Russia dated March 21, 2016 No. SD-4-3/ [email protected]

Read about common errors in filling out returns in the article “Tax officers summarize errors: check your VAT return .

IMPORTANT! It should be taken into account when submitting a clarification, by which it will be possible to judge the overpayment of tax, that the tax office reimburses the overpaid amount of tax (or makes a credit) only if three years have not yet passed from the date of payment of the “excess” tax (clause 7 of Art. 78 Tax Code of the Russian Federation).

You can submit an update to receive a VAT deduction within 3 years after goods (work, services, property rights) are registered or imported into the territory of Russia (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

If clarifications are submitted for the period in which a single (simplified) declaration form was submitted, you should submit the usual (full) declaration form, but indicate on it that this is a clarification. This is done if taxable transactions are indicated for which information about their absence was previously provided (in the reporting period). This norm was clarified by the Russian Ministry of Finance in its letter dated October 8, 2012 No. 03-02-07-1-243.

If the taxpayer has changed the registration address and switched to service in another Federal Tax Service, then the clarification is submitted to the new tax office, but the form itself indicates the OKTMO (OKATO) code of the previous territorial tax service (letter of the Federal Tax Service of the Russian Federation for Moscow dated October 30, 2008 No. 20-12 /101962).

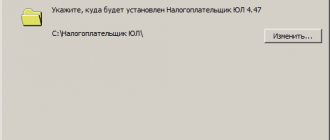

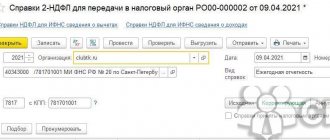

Taxpayer legal entity version 4.62 dated April 11, 2022

18948 Taxpayer of Legal Entities is a program that helps entrepreneurs, businessmen, and individuals in preparing reports to the tax authorities.

Bookmark this page to always have the latest updates! Launch the program by double-clicking on the downloaded installation file. Windows will most likely ask you if you agree to open the executable file, click yes or OK.

Next, a window with a license agreement will open in front of you:

Section 3 is subject to inclusion in relation to those FLs in which changes (additions) are made. Thus, the updated Calculation of the SV payer making payments must necessarily contain: - Section 1. Mandatory. The information must be updated to replace the previously submitted information - Appendix 1 to Section 1.

Required. When is it necessary to submit an updated

Important nuances associated with submitting clarifications

When submitting an amendment in which the amount of tax payable has increased compared to the previously submitted declaration, the payer must keep in mind that he faces a fine (clause 1 of Article 122 of the Tax Code of the Russian Federation). However, it can be avoided:

- if the clarification was submitted after the deadline established for submitting the declaration, but before the payment deadline (for example, the clarified VAT declaration for the first quarter of 2022 was submitted on May 10, 2017), and before the payer submitted the clarification, an on-site audit or tax authorities were not assigned to him they themselves identified an understatement of the base, but the payer did not yet know about it (clause 3 of Article 81 of the Tax Code of the Russian Federation);

- if the corrective tax return is submitted after the deadline for tax payment, but before submitting the update, the payer paid the tax and penalties (clause 1, clause 4, article 81 of the Tax Code of the Russian Federation);

- if the payer, after an on-site inspection, submits an update for the period covered by this inspection, but the inspectors during the inspection did not find an understatement of the base (clause 2, paragraph 4, article 81 of the Tax Code of the Russian Federation).

How to make an adjustment in a taxpayer's legal entity for insurance premiums

The Tax Code of the Russian Federation does not have exact deadlines for its submission.

- If an error is identified by tax officials, the policyholder is given 5 days to submit an adjustment. If this deadline is violated, a fine of 5,000 rubles is imposed.

- In order not to pay a fine of 20% of the amount of underpaid contributions (clause 1 of Article 122 of the Tax Code of the Russian Federation), before submitting the adjustment, you must pay the arrears on insurance premiums and accrued penalties (clause 4 of Article 81 of the Tax Code).

The adjustment is submitted in the same way as the initial DAM report.

- If the number of employees is more than 25 people, then the report is transmitted electronically.

- If the staff is less than 25 people, then it is allowed to submit the calculation in paper form.

Calculations of the amounts of accrued and paid contributions are transferred to the tax office at the place of registration of the enterprise based on the results of each quarter by the 30th day of the month following the reporting period.

How to submit a VAT adjustment: three pitfalls

The VAT return for the first quarter has been submitted, and we will soon report for the second quarter. For many, this “shift change” is the time to submit updates for past periods. Dmitry Shapovalov, Extern technical support expert, analyzed the most common reasons for failures to make adjustments, and prepared a manual that will help you do everything right the first time.

A VAT adjustment must be submitted in the following cases:

- If you discovered that you made mistakes in the primary VAT return, did not include all the data in it, or reduced the amount of tax payable. If there is a tax arrear, it must be repaid along with the payment of penalties until the updated return is submitted.

- If a request has been received from the tax office to provide an explanation of the submitted declaration (clause 3 of Article 88 of the Tax Code of the Russian Federation). The explanations must include the rationale for the changes made to the revised VAT return. Explanations must be provided within 5 days after receiving the request.

How to make an adjustment to your VAT return

To avoid common mistakes when preparing adjustments, use this guide:

Adjustment section How to adjust correctly

| Correction number | The adjustment number in the declaration and annexes must match. If you are an Extern subscriber, click on the “Proceed to Send” button and the numbers in the attachments will be entered from the declaration automatically. |

| Field "Relevance indicator" | Fill out this field only in applications. Put “0” if the clarification contains a new version of the purchase book, sales book and other applications. Set "1" if you do not need to send a new version of the application. Please note: the composition of the adjustment must be the same as the composition of the primary declaration. For example, you filed a VAT return, consisting of: a declaration, a purchase book and a sales book. And you only need to update the sales ledger.

At the same time, for the sales book you need to put the relevance indicator “0” in order to update the data on it in the Federal Tax Service database, and for the purchase book you need to put the relevance indicator “1”, since nothing needs to be updated in it. |

| Additional sheets of the purchase book (section 8.1) and sales book (section 9.1) | If changes are made to the appendix to the purchase book, for example, to section 8.1, then the information from the purchase book as part of the adjustment comes with the sign “1” - the information is relevant, and the appendix - section 8.1 with the sign of relevance “0” - the information is not relevant. Similarly, you can adjust the sales book. There is no need to attach additional sheets if an error appeared when transferring data from the primary purchase/sales book to section 8 or 9. In this case, correct the books themselves (section 8 or 9):

|

Use Extern to report the first time. 3 months free.

Send a request

Sending adjustments to Externa

To prepare an adjustment in the system:

- Open the VAT report; it will save the data you submitted during the initial submission.

- Click “Edit” and make the necessary changes to the declaration.

If you upload ready-made files from another program to Extern:

- Remove existing declaration and attachment files from the draft.

- Click on “Upload Declaration”, select one or more files and click “Open”.

Procedure for submitting an update in 2022

Updated declarations are submitted electronically (letter of the Federal Tax Service of Russia dated March 20, 2015 No. ГД-4-3/ [email protected] ). How exactly to send VAT clarifications is described in paragraph 2 of the Filling Out Procedure (Federal Tax Service Order No. ММВ-7-3/ [email protected] ).

The updated VAT consists of previously submitted attachments or other sections with changes made, as well as the declaration itself (even if nothing has changed in it).

Data input

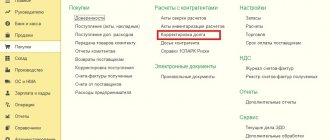

Entering a VAT return in the program from the Federal Tax Service is divided into separate entry sections.

Entering Sections 1-7 involves regular entry of a declaration, and entering Sections 8-12 and appendices Sections 8 and 9 involves tabular entry.

To enter the appropriate section, use the button related to this section.

Entering summary information for Sections 8 and 9 and their annexes also involves entering using the corresponding buttons (total data can also be entered when entering information in sections). If there is entered information for a section, then its quantity will be shown in the name of the button in brackets.

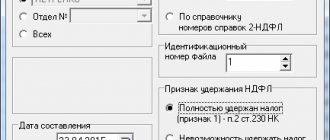

How to fill out the adjustment code in the 3-NDFL declaration

Updated reporting is generated on the same form as the amended declaration, and according to the same rules.

NOTE! The declaration for 2022 must be submitted using the new form from the order of the Federal Tax Service dated October 15, 2021 No. ED-7-11 / [email protected] you can below by clicking on the picture.

When filling out this form, you should format it as if the report was being made for the first time, but only with the correct data. That is, the only difference between the adjusting statements will be an indication that it is not the first one filed for the same period.

This indication is made by indicating the correction number on the title page in a specially designated field consisting of 3 cells. When submitting the first (initial) report, the number is also placed there, but is indicated by the number 0 in the first of the cells. The remaining cells are filled with dashes.

If an updated report is submitted, then instead of zero, numbers corresponding to the serial number of the adjustment begin to be entered, starting from 1.