What is gratuitous receipt? The considered method of acquiring a fixed asset relieves the recipient from paying the cost

How long does parental leave last in 2022 according to the Labor Code of the Russian Federation? Vacation

Regulatory framework Postings on wages in a budgetary institution are regulated by several legislative acts, including

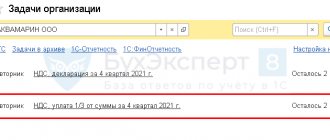

Have the deadlines for submitting reports for the 3rd quarter changed? The Government of the Russian Federation issued a Decree dated April 2, 2020.

Where to obtain a certificate of a professional accountant To obtain a certificate of a professional accountant, you need to undergo training in

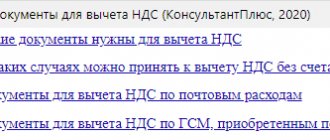

How to deduct VAT Each taxpayer-buyer has the right to reduce the accrued value added tax

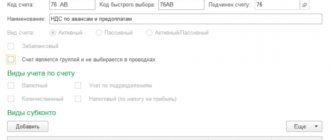

Examples of transactions on account 76 Account 76 stores information about transactions with debtors

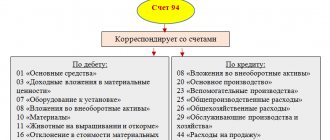

Personal accounting account for reflecting shortages To record shortages in accounting, it is intended

The contents of line 130 in form 6-NDFL Line 130 causes confusion even for an experienced accountant.

Home / Taxes / What is VAT and when does it increase to 20 percent?