Purpose of an advance report

An advance report is a financial document intended for proper accounting and tax accounting. It displays the organization's expenses, including travel expenses and primary documents confirming these expenses.

Before sending an employee on a business trip, the employer must give him an advance to pay for travel, housing, food and other travel expenses. If possible, you can pay in advance part of the expenses from the organization’s current account, for example, railway and air tickets, accommodation bills. Funds are issued in an accountable amount and issued at the cash desk or by transfer to a card.

After returning from a business trip, the employee must prove that the money was spent for its intended purpose. According to clause 26 of the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749; hereinafter referred to as the Regulations on Business Travel), the employee fills out an advance report, where he indicates all expenses and attaches supporting documents (checks, tickets, control coupons, etc.).

This procedure applies to all types of travel expenses, except for daily allowances (in this case, it is enough to transfer the money to the employee without registering it for reporting). Accordingly, they are not required to be reflected in the advance report. But you can also reflect the amount of daily allowance in the advance report as a separate line.

General rules

There is no single, legally regulated formal type. The accountant has the right to draw up an advance report using the unified form No. AO-1 or develop a personal form, approving it by order.

Documentation is maintained both in paper and electronic form. If the institution provides for completion in electronic form, then the JSC is signed electronically by each of the participants in the accountable process.

There are a number of generally accepted rules for filling out (Decree of the State Statistics Committee No. 55 of 01.08.2001):

- The report is generated within a three-day period from the expiration of the period for which accountable funds were issued (it must be determined by order or regulation), the employee’s return from a business trip or the employee’s departure from sick leave, provided that the specified day of return of the accountable account fell during the period of incapacity for work.

- If the deadline for returning the advance money is violated, the employer applies sanctions to the employee, including financial ones.

- The accountant provides full assistance to the accountable person in filling out.

- The document, completed and executed in accordance with all rules, is signed by the head of the organization.

- The reporting is accompanied by primary documentation confirming the expenses incurred (receipts, tickets, statements, invoices).

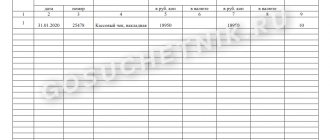

Form of advance travel report and rules for filling it out

Most organizations and individual entrepreneurs use a unified advance report form in form No. AO-1 (approved by Resolution of the State Statistics Committee dated 01.08.2001 No. 55) ().

However, organizations can independently develop an advance report form that will differ from the unified one, and consolidate it in their accounting policies. Let's say you can delete columns indicating accounting accounts.

When filling out form No. AO-1, you must take into account that:

- OKPO code must consist of 8 digits

- in the “Report in amount” field, you must indicate the amount of money actually spent, if it differs from the amount of the advance

- if the company does not have structural divisions, you do not need to indicate the name and code of the division

- in the empty line of the table on the left you can write “Advance received on a bank card” (in the standard version of the form only withdrawal from the cash register is provided)

- the “Spent” figure in the table must coincide with the figure in the “Report in total” field (a difference from the “Total received” figure is allowed)

- the “Balance” field is filled in if the “Total received” figure exceeds the “Spent” figure

- the “Overexpenditure” field is filled in if the “Total received” figure is less than the “Spent” figure

Please note: the advance report is prepared in 1 copy . The storage period is at least 5 years , and in case of disputes or disagreements, until a decision is made on the case (Article 277 of the list of standard management documents, approved by order of the Federal Archive of December 20, 2019 No. 236).

Who is the accountable person

Accountable funds are issued by the manager to the employee of the enterprise for general production or general business expenses. The employee reports for the amounts disbursed on time through an advance report. An employee, having received funds for the needs of the enterprise, is an accountable person.

IMPORTANT!

Advances are issued not only to employees of the enterprise, but also to freelance employees who have entered into civil law contracts with the employer (clause 5 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014).

Accountable funds are transferred to responsible employees not only in cash, but also to a bank card by wire transfer (letter of the Ministry of Finance of the Russian Federation No. 03-11-11/42288 dated 08/25/2014).

The employer determines the circle of accountable employees in a special order. Employees agree with the appointment. The management order approves the list of responsible employees who receive accountable funds.

All accountable persons are required to report on expenses incurred, attaching supporting documentation, and provide advance reports to the accounting department on time.

Documents to confirm expenses in the advance travel report

Each amount spent by the accountable person must be confirmed by the relevant document (one or more). All supporting documents must be attached to the expense report and kept with it.

If the business trip is abroad, it is necessary to translate the source documents line by line. You don't have to turn to professionals for this. Translation of the employee himself, who has sufficient knowledge of a foreign language, is allowed (letter of the Ministry of Finance dated April 20, 2012 No. 03-03-06/1/202).

Expenses for train, plane

Previously, employees handed over railway and air tickets to the accounting department (along with a boarding pass with an inspection stamp).

Since in 2022 most travel documents are issued electronically, the composition of the documents has changed.

Supporting documents for purchasing electronic tickets :

- On the plane:

- route or receipt (extract from the automated information system for registration of air transportation according to clause 2 of Order of the Ministry of Transport dated November 8, 2006 No. 134)

- a paper boarding pass with an inspection stamp or a certificate from the carrier (letter of the Ministry of Finance dated February 28, 2019 No. 03-03-05/12957)

- For the train: control coupon (extract from the automated control system for passenger transportation on railway transport according to clause 2 of Order of the Ministry of Transport dated August 21, 2012 No. 322)

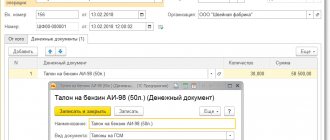

Document 1C: Advance report on business trip

When sent on a business trip, the employee is reimbursed (Article 168 of the Labor Code of the Russian Federation):

- travel expenses;

- expenses for renting premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

The employee must document the amount of expenses other than per diem.

Employee Ivanov A.P. goes on a business trip for 5 days. Ivanov was given funds in the amount of 33,000 rubles.

Upon return, the employee reported on the amounts received and attached supporting documents. There is no flight registration stamp on the boarding pass for the return ticket.

Bank and cash desk – Cash desk – Advance reports – Create button:

So that the postings indicate the Cost Item Travel

, you need to make the settings: Directories – Income and expenses – Cost items.

The received invoice is created automatically: Purchases – Purchases – Invoices received.

Deadline for submitting advance report

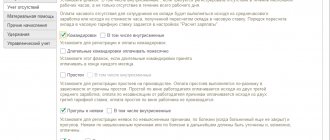

According to the law, the head of the organization independently sets the deadline for submitting an advance report and supporting documents to the accounting department. Therefore, it can be anything (clause 6.3 of the Central Bank instruction dated March 11, 2014 No. 5587-U).

However, for business trips there is an exception that applies to all employers: the employee is required to provide an advance report on the business trip within 3 working days after returning (clause 26 of the Business Travel Regulations).

Below is an example of filling out an advance report for a business trip.

Why do you need an advance report?

An advance report is a prerequisite for the procedure for issuing money. The employee reports on expenses made within the prescribed period using a special reporting form. Its main goal is complete control over financial expenses in a budget organization. With the help of this document, the movement of spent funds issued to fulfill the needs of the institution is checked and the expenses incurred are written off.

How long are advance reports of accountable persons kept?

After the expense report has been checked, approved, postings have been made on it and the remaining amounts have been closed (overspending has been issued or the balance has been received), the document is sent for storage. Organizations ensure the storage of documents within the periods established by federal laws and other regulatory legal acts (Clause 1, Article 17 of the Law “On Archiving in the Russian Federation” dated October 22, 2004 No. 125-FZ).

The storage periods for documents are given in several regulatory documents:

- According to sub. 1 clause 8 art. 23 of the Tax Code of the Russian Federation, documents related to accounting or tax accounting, on the basis of which the tax base for calculating taxes to the budget is formed, must be stored for 4 years. These documents also include advance reports.

- In accordance with paragraph 4 of Art. 283 of the Tax Code of the Russian Federation, documents confirming the loss incurred are stored for the entire period during which the resulting loss is carried forward to future periods and reduces the tax base of the current tax period.

- In Art. 29 of Law No. 402-FZ for primary accounting documentation, which includes, in particular, advance reports, a storage period established by the rules of state archiving is provided, but not less than 5 years.

- In paragraph 277 of the List of standard management archival documents indicating storage periods, approved. Rosarkhiv sets a storage period of 5 years for advance reports.

Thus, the minimum storage period for advance reports is 5 years, the maximum is determined by the duration of the transfer of the loss (if received) to the future.

Accountable person's advance report approved: posting

If, according to the advance report, more than the advance received has been spent, the employee is given an overspend. If not all accountable money has been spent, the remainder must be returned to the enterprise's cash desk (the accountant will issue a receipt order for it, the counterfoil will be given to the accountant).

An employee can also spend personal money to purchase something necessary for the company, for example, fuel and lubricants for a company car. In this case, a report is first submitted, and then the funds are reimbursed. Such an action must also be permitted by internal regulations.

If the accountable person does not meet the deadline established by the enterprise for submitting the advance report and does not return the balance of the accountable amounts, the employer has the right to reimburse the debt from his salary (Article 137 of the Labor Code of the Russian Federation).

At the time of checking the advance report, the money issued is reflected in Dt 71 “Settlements with accountable persons”. After approval by his manager, the accountant needs to make entries according to Kt 71 in correspondence with the accounts of expenses incurred:

| Debit | Credit | Contents of operation |

| 71 | 50, 51 | Accountable money issued |

| 20 (23, 25, 26, 29, 44) | 71 | Expenses reflected in the advance report |

| 08, 10, 41 | 71 | Reflects the costs of purchasing fixed assets, materials, goods recorded in the advance report |

| 19 | 71 | VAT allocated according to the received invoice |

| 68 | 19 | VAT credited |

| 60 | 71 | Payment made to supplier |

| 50 | 71 | The balance of accountable amounts was handed over to the cashier |

| 70 | 71 | Debt withheld from wages |

| 71 | 50 | Overspending issued from cash register |

Checking advance reports of accountable persons

In order to report for funds received and spent, the accountant needs to draw up an advance report and attach to it documents that will serve as the basis for accepting the expenses incurred - checks, BSO, invoices, travel tickets, slips (for payments by bank card), etc. .

If the advance was issued by transfer to the employee’s salary or accountable card, then the payment order must indicate that the money transferred is accountable. To receive accountable amounts on a bank card, the employee is recommended to write an application requesting the issuance of money for a certain time and indicating the card details - this is stated in the letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288. In the same letter, officials report that it is advisable to develop and consolidate the procedure for issuing an advance for household needs by non-cash means and drawing up an advance report and establishing it in the accounting policy of the enterprise.

The form for the advance report can be form AO-1, approved by the State Statistics Committee of Russia dated August 1, 2001 No. 55. It is not mandatory, therefore it is allowed to develop your own report form for the advance received, taking into account the specifics of the enterprise and compliance with all the requirements for filling out the necessary details in accordance with paragraph. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The report form must have space reserved for completion by the employee and the accountant. The document has a front and back side. First, the employee fills out the part intended for him on the front side, in which he indicates information about himself and the purpose of the advance received. Then, on the reverse side, he lists all supporting documents indicating their names, numbers, dates, amounts (for each separately). The total is calculated and indicated. Documents are attached to the report. For ease of use, they can be numbered in accordance with the serial number assigned in the expense report.

The employee passes the completed form with attached originals about expenses to the accountant, who checks the received document:

- according to the form - the correctness of filling out all the necessary lines, the presence of the specified documents, the usefulness of their execution, the correct transfer of data from the originals to the report, the correspondence of the amounts, the presence of signatures;

- in terms of content - the intended purpose of the expenses incurred, the reliability of the documents, the correspondence of the specified dates to the time for which the advance was issued;

- by arithmetic calculation - the total amount in the report is checked, which must be repaid in this sub-report.

After receiving the advance report from the accountant, the accountant must give him a receipt stating that he accepted the report with the attached documents for verification.

The report, verified and signed by the accountant and chief accountant, is submitted to the manager or authorized person for approval. By signing, the director agrees to consider the costs incurred to be justified.

The deadline for submitting the advance report to the accounting department for verification and approval of the report for the advance for the needs of business activities is established by the manager at his discretion. It is recommended to consolidate them in the accounting policies. Based on the approved report in the accounting department, accountable amounts are written off in accordance with the procedure established by law.