Examples of transactions on account 76

Account 76 stores information about transactions with debtors and creditors, which cannot be posted to accounts 60-75. This includes the following calculations:

- for property and personal insurance;

- on claims to suppliers, contractors, transport companies, banks and so on;

- on deductions from employees' wages in favor of third parties in enforcement proceedings;

- on deposited amounts;

- on dividends and other income due;

- for VAT on advances issued and received;

- on received bank guarantees;

- on issued collateral;

- for leasing;

- for the sale and purchase of services and inventory items not related to core activities, and so on.

All calculations on account 76 are usually unsystematic. Organizations carry out such operations much less often than they carry out settlements with buyers, suppliers, banks and the tax office.

Analysis of account 76

Analytical accounting is maintained separately for transactions. Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors. On account 76, subaccounts have many meanings, the most used among them are the following:

- 76.01 - calculations for property and personal insurance. This takes into account operations on life and health insurance of employees and contracts on insurance of enterprise property. Voluntary (within permissible limits permitted by law) and compulsory insurance are taken into account.

- Account 76.02 is used to generate cash flows for claims that have arisen, including the accrual of fines, penalties, and penalties for unfulfilled obligations. Account 76 of subaccount 02 can be applied both in relation to agreements with counterparties and in the event of an outstanding tax debt.

- Using subaccount 76.03, accrued and paid dividends to the founders of the organization are recorded based on the results of the financial year.

- Subaccount 76.04 shows reserved funds for unpaid salaries.

- Account 76.5 in accounting assumes the reflection of other settlements with suppliers and contractors that are not related to the main activities of the enterprise. Account 76.5 includes amounts such as settlements with a notary and the accrual of duty payments. Analytical accounting of account 76.5 is formed separately for each case.

- Account 76.09 in accounting is other settlements with various debtors and creditors, also not related to the main activities of the company. Account 76.09 forms transactions for settlements with auditors, third-party law firms, and reflects the amounts of sponsorship and charitable payments.

- Calculations for third-party debts of employees based on writs of execution, for example, alimony payments, are made using subaccount 76 41.

- Account 76.49 is intended for settlements with the employee for other deductions in accordance with the rules of the organization. Provided that these deductions do not apply to the main ones. Such amounts may include costs for mobile communications and assets purchased within the enterprise.

- Subaccounts 76.AB and 76.VA contain VAT amounts on advances issued and received, respectively. The used account 76 VAT allocates separately from the amounts of advance payment received or on the transferred advances against future deliveries.

The list of presented subaccounts can be supplemented, depending on the nature of the activity and operating conditions of the enterprise, not limited to the movement of funds through subaccount 76.09.

Standard entries to account 76 are used to record transactions that are not involved in the main activities of the enterprise and are of an irregular nature. On the contrary, the balance sheet for account 76 gives an idea of the status of settlements under individual contracts. To simplify the analysis of mutual settlements with other counterparties, the use of various sub-accounts is allowed, including account 76.05 or 76.09 (account for mutual settlements with other counterparties).

Subaccounts to account 76

The instructions for the Chart of Accounts list four subaccounts that an organization can open for this account:

- 76. Calculations for property and personal insurance - to account for calculations for insurance of property and personnel not related to contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund (I take them into account in account 69);

- 76.Calculations for claims - to account for claims against suppliers, contractors, credit institutions, buyers, and so on;

- 76.Calculations for dividends due and other income - to account for dividends and other income due to the organization;

- 76. Calculations for deposited amounts - to account for accrued but not paid wages due to the employee’s absence.

This is not a closed list; the organization has the right to open additional sub-accounts. The main thing is to record their use in the working chart of accounts. For example, VAT payers open the following subaccounts:

- 76.AB - here they record VAT on the amounts of advance payment received from customers;

- 76.VA - here they record VAT on the amounts of advances transferred to suppliers.

You can also allocate a separate sub-account to account for leasing transactions, received bank guarantees, issued collateral, and so on.

Account 76.AB

The used accounting account 76 is a reflection of other calculations of a legal entity. In cases of receipt of prepayments from counterparties or transfer of advances to suppliers, account 76.AB or account 76.VA is intended for accounting for VAT amounts.

If the payment received precedes the fact of shipment of the goods, then an advance invoice must be generated for the buyer within the next 5 days. In accounting, the use of posting 76.AB will mean reflecting the amount of allocated VAT:

- Dt 51 - Kt 62 - advance amounts received from buyers

- Dt 76.AV - Kt 68 - allocated VAT on prepayment

How to write off 76.AB? After shipment of the goods, it is possible to apply a deduction for the previously accrued advance tax. Accordingly, the entry in the purchase book will look like:

- Dt 68 ― Kt 76.AV

By analogy, correspondence from account 76.VA is used for advance payments transferred to the suppliers’ account:

- Dt 60 - Kt 51 - prepayment is made to the supplier;

- Dt 68 - Kt 76.VA - claimed VAT deduction on the advance invoice;

- Dt 76.VA - Kt 68 - reflection of the tax amount after offset of the prepayment in the sales book.

Receiving an advance payment obliges the seller to calculate tax on the amounts received to the budget with subsequent offset upon shipment.

Accounting for the allocated amount of tax in the advance invoice by the buyer is his right. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Analytics on account 76

Account 76 records many different transactions, so analytics depends on the subaccount. For example:

- when accounting for insurance calculations, analytics are built by insurance types and insurance companies;

- when accounting for claims, analytics are built on debtors and claims received;

- when accounting for dividends and income, analytics are built for each source of income;

- when accounting for deposited salaries, analytics are carried out for each employee who did not receive their salary on time;

- when accounting for settlements based on writs of execution, analytics are also carried out for each employee for whom there is a writ of execution;

- when accounting for leasing, analytics are carried out for leasing companies and contracts;

- when taking into account received bank guarantees, analytics are built for each bank and the issued guarantee;

- When accounting for contributed collateral, analytics is carried out by recipients, and so on.

How to reflect VAT on advances in the balance sheet

It is unlikely that any organization can manage its activities without an advance payment system. Remember the famous phrase: “money in the morning, chairs in the evening”? Accounting has long adapted to this situation, and accountants operate with separate subaccounts for advance VAT quite confidently.

But there is one issue that has not yet been resolved, and today they continue to break spears about it - how to reflect VAT on advances in the balance sheet? Before we talk about which line of the balance sheet should reflect the amount of VAT on advances, let's remember how this VAT appears and on what accounts it exists.

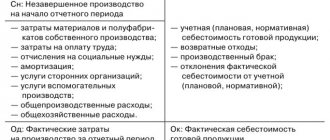

How does “advance” VAT arise?

Let's start with an example. LLC "Style" is engaged in tailoring women's clothing and is located on OSNO. The organization has just opened. Wherein:

— an advance payment was made to the supplier Tweed LLC for fabrics in the amount of 59,000 rubles, including VAT 18%;

— an advance payment was received from the clothing store Moda LLC in the amount of 141,600 rubles, including VAT 18%.

First, let's deal with the prepayment received from the store. According to the rules of the Tax Code, an organization on OSNO that is not exempt from VAT, when receiving an advance on account of upcoming deliveries of products, works, services upon receipt of them, must calculate VAT (clause 2, clause 1, Article 167 of the Tax Code). Let's do this:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

At the moment when the clothes are sewn and shipped to Fashion LLC, VAT must be charged again - already on the cost of the shipped products:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

And VAT accrued earlier on the advance payment is accepted for deduction (clause 1, clause 1 and clause 14 of Article 167, clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code).

A deduction is made if, after receiving an advance payment, the terms of the contract are changed or terminated and the corresponding amounts of advance payments are returned (clause 5 of Art.

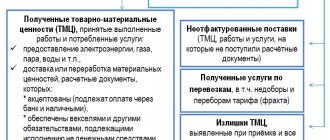

Main transactions for account 76

Because of its versatility, account 76 corresponds with almost all accounting accounts in debit and credit. In the table we have collected the main transactions that most organizations face.

| Debit | Credit | Description |

| 20 / 23 / 25 | 76 | Insurance costs are allocated to production. |

| 50 / 51 / 52 | 76 | Insurance compensation received. The supplier has paid the penalty or fine due to the claim. The due dividends have been received. |

| 68.02 | 76.VA | Accepted for deduction of VAT on advance payments to the supplier. |

| 70 | 76 | Salary deposited. |

| 76 | 10 / 41 | Materials were written off due to an insured event. There was a shortage of materials from the supplier, identified after acceptance. |

| 76 | 28 | The supplier admitted a fine for a manufacturing defect that was his fault. |

| 76 | 50 | Deposited wages were issued from the cash register. |

| 76 | 50 / 51 / 52 | The amount presented for payment has been repaid. |

| 76 | 60 | The supplier has been assessed a penalty or fine for a claim for violation of the terms of the contract. |

| 76.AB | 68.02 | VAT is charged on the advance payment from the buyer. |

| 76 | 73 | The amount of insurance compensation payable to the employee has been accrued. |

| 76 | 91 | The amount of the penalty for the claim against the supplier is included in other income. Insurance compensation has been calculated. Income received in the form of dividends from another organization. |

To record settlements with other debtors and creditors, we recommend the cloud service Kontur.Accounting. Calculate penalties, take into account insurance and leasing payments, deposit wages. We give all newcomers a trial period of 14 days.

Account 76.AB in 1C

Content:

1. What is account 76.AB

2. Wiring 76.AB

3. Account 76.AB in 1C

4. Using account 76.AB in 1C

What is account 76.AB

This article will provide general information about what account 76.AB is, after which its operation in the 1C system will be analyzed, as well as an example of working with account 76.AB in accounting.

Account 76.AB is used for VAT for advances and prepayments. It is subordinate to the account “Settlements with various debtors and creditors”. On account 76.AB, VAT is separated from the total amount of the initial payment, which will be transferred from the buyer, due to payment for goods and services that were not provided at the time of settlement.

This account operates on subaccounts on the basis of a special invoice that must be issued to the customer, as well as an agreement within which the obligation to pay an advance payment is stated. All transactions that relate to VAT are regulated by account 76.AB during the accrual of funds that were issued by the customer, the basis in this case is a bank statement.

Postings 76.AB

Let's look at wiring 76.AB.

· For debit:

1. 76.AB000 is posting 76.AB, which is used to enter initial balances, which are VAT on prepayments and advance payments allocated by buyers and customers. In this case, the basis is the document “Entering balances”.

2. 76.АВ68.02 is entry 76.АВ, which charges VAT based on the buyer's initial payment. The basis for this posting is the invoice.

· For credit:

1. 68.02 76.AB is an entry 76.AB which deducts VAT from the original payment originally given by the buyer. The basis is a document on the formation of entries in the purchase book;

2. 91.02 76.AB - this entry 76.AB writes off the amount of VAT from the total amount of the advance that was received, provided that the debt from creditors is written off. The basis for the posting is the document “Write-off of VAT”.

Account 76.AB in 1C

In the 1C system, account 76.AB “VAT on advances and prepayments” is used in a similar way: to summarize all data about the amounts of VAT that were credited for payments from the budget, from advances that have already been issued, as well as from prepayments issued, at the expense of future deliveries of products or performance of work, services, and so on.

Account 76.AB of accounting refers to active accounts, so it can only use a balance that is a debit.

If the records of account 76.AB in the 1C system for debit have the prefix 68.02, then this means that the total amount of tax that must be paid to the budget will be displayed, based on those advances, as well as prepayments issued that have already been issued and received.

If the entries in account 76.AB in the 1C system for a loan have the prefix 68.02, this means that a deduction of the total tax amounts that were credited during the use of products, works or services will be reflected. However, they must be paid initially.

4. Using account 76.AB in 1C

To carry out accounting in account 76.AB in the 1C system, you must rely on:

· Invoices that have been distributed into amounts to receive advance payments as well as prepayments. In this case, the subconto will be “Invoices issued”;

· Customers and buyers who have made an advance payment. In this case, the subconto will be “Counterparties”.

The above-described sections for determining the account 76.AB in the 1C system are demonstrated in the screenshot below:

Accounting 76.AV in 1C

Specialist

Aidar Farkhutdinov