Forms P13001 and P14001 are no longer relevant!

On November 25, 2020, new rules for making changes to information about LLCs came into force.

This article describes the legacy rules. We have prepared a new article with up-to-date information. Go to new article

If your LLC changes its legal address in 2022, you need to submit an application to the inspectorate. This can be done using form P13001 or P14001 - it all depends on whether you need to make changes to the charter of the LLC when moving the company.

Whether to make changes to the charter of a limited liability company when changing its legal address depends on two factors:

- How the current address is written in the charter

- Does any part of the address written in the charter change?

If there is no need to make changes to the charter, the application to the inspectorate is submitted using form P14001, but if the address in the charter changes, use form P13001.

Selecting an application form

An application on form P14001 must be submitted if the address changes, but there is no need to make changes to the charter. This is possible in the following cases:

- The charter of the LLC specifies only the city, which does not change when moving

- The charter specifies the exact address down to the building, but without an office number; you are moving within the same building

- And so on.

An application in form P13001 is submitted if, when changing the address, it is necessary to make changes to the charter. For example:

- The charter specifies the exact address, which does not coincide with the new address

- The charter specifies the exact address up to the office, you are moving to another office

- Only the city is specified in the charter, but you are moving to another locality

How to report moving to another location

Changing your legal address when moving to another locality is completed in two stages. This procedure was introduced in 2016 to limit the unreasonable migration of taxpayers between different Federal Tax Service Inspectors.

At the first stage, the organization must notify the tax office of the decision to change the address. Based on this, the Federal Tax Service within 5 working days makes an entry in the Unified State Register of Legal Entities stating that the LLC is in the process of changing its location. The second stage begins 20 calendar days after the entry is made in the register. The manager must submit the application again, after which changes are recorded in the charter.

There is an exception to this order. If an LLC moves to another locality according to the registration of a director or participant of the company with a share of at least 50%, then the change of address is carried out in one stage. Let's consider both situations, starting with the two-stage one.

Changing the location of an LLC in two stages

Previously, at the first stage, application P14001 was submitted, and at the second - P13001. Now this is a single form P13014, which is submitted twice, but filled out differently.

First stage (notification of change of location)

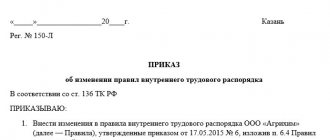

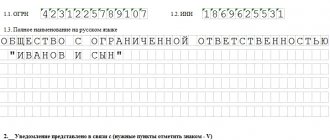

- First page . In paragraph 1, indicate the OGRN and TIN codes of the organization. In paragraph 2, enter the value “2”, because changes are made only to the Unified State Register of Legal Entities.

- Second page . In paragraph 6, put “1”, this means that the LLC has decided to change its location.

- Sheet B. Only item 1 is filled in, that is, the name of the locality to which the company is moving (page 2 of sheet B is not submitted, because it is not filled out).

- Sheet P. Enter information about the applicant.

Sample of filling out P13014 when changing location (first stage)

Second stage (registration of a change of address of a legal entity)

- First page . In paragraph 1, indicate the OGRN and TIN codes of the organization. If the LLC has its own charter, in paragraph 2, enter the value “1”, because the Federal Tax Service will register changes to the charter. Below, indicate in what form the new charter is presented: “1” if this is a new edition of the entire charter or “2” if this is a sheet of changes to the charter.

- If the LLC uses a standard charter, in paragraph 2, enter the value “2”, because the standard charter does not change when changes are made to the address.

Sample of filling out P13014 when changing location (second stage)

Changing the location of an LLC in one step

Form P13014 in case of relocation of a company with the registration of a manager or participant with a share of 50% or more, is submitted once.

To be filled in:

- First page. In paragraph 1, indicate the OGRN and TIN codes of the organization. If you use your own charter , in paragraph 2, enter the value “1”, because changes are immediately made to the charter. Next, note in what form the new charter is presented: “1” if this is a new edition of the entire charter or “2” if this is a sheet of changes to the charter.

- If a standard charter , in paragraph 2, enter the value “2”, because the standard charter does not contain the address of the LLC and changes will only be made to the Unified State Register of Legal Entities.

Sample of filling out P13014 when changing location in one stage (registration of a director or participant with a share of at least 50%)

Sample application P13001

- PDF, 12.5 MB

- XLS, 531 KB KB

In an application for any of these forms when changing address, you need to fill out only sheet B, sheet 001 and page for the applicant. After completing the application, it must be certified by a notary. The notary will need the following documents:

- Completed application

- Company Charter

- Letter of guarantee for the provision of an address (for non-residential premises) or consent of the owners of the premises (if the registered address of the founder or director is indicated in the company charter)

- TIN

- OGRN

- In some cases - an extract from the Unified State Register of Legal Entities

Does a change in the legal address of a LLP entail its state re-registration?

In accordance with paragraph 6 of Article 42 of the Civil Code of the Republic of Kazakhstan, a legal entity is subject to state re-registration in the following cases:

- reducing the size of the authorized capital;

- name changes;

- changes in the composition of participants.

Accordingly, if the legal address changes, the LLP is not subject to re-registration .

At the same time, a change of address requires notification of the registration authority (NOA SC "Government for Citizens") in order to make changes and additions to the registration data of the partnership.

Article 14-2 of the Law of the Republic of Kazakhstan “On state registration of legal entities and accounting registration of branches and representative offices”:

Changes and additions to the registration data of a legal entity, branch (representative office) are made when:

1) changing the location of a legal entity belonging to a private business entity , branch (representative office), with the exception of a joint-stock company, branch (representative office);

…………………

When changing the location of a legal entity belonging to a private business entity , branch (representative office), with the exception of a joint-stock company, branch (representative office), in addition to the notification, a document confirming the location of the legal entity, branch (representative office) is attached .

What is the document confirming the location of the LLP?

In accordance with the State Standard, documents confirming the location of a legal entity are a lease agreement and another document provided for by civil law.

If the owner of the premises is an individual, then the notarized consent of the individual to provide the premises as the location of the legal entity is provided.

Only the city is specified in the charter

If the LLC charter specifies only a city as the company's address, then when moving within the same locality, there is no need to make changes to the charter. In this case, submit an application to the inspectorate using form P14001; you do not need to pay a state fee.

When the company moves to another city, amend the charter of the LLC and submit an application to the inspectorate in form P13001. Additionally, the tax office may require the current charter, a letter of guarantee or consent of the owners of the residential premises, a decision or minutes of the meeting of founders on a change of address. The state duty will be 800 rubles.

Reasons for writing a notice

In the process of changing the address of the organization's location, these changes must be recorded in the constituent documentation. They must be registered with government agencies. The adjustments made become legally significant only after their state registration.

The notification must be sent to the banking institution servicing the enterprise, as well as to partners with whom the company interacts. In addition, changes should be reflected in concluded contracts and work books of employees. Agreements with counterparties usually stipulate how and within what time period notification of changes that have occurred should be sent.

A sample notification of counterparties about a change of legal address can be found on the Internet at various resources.

The charter contains the full address

If the LLC’s address is indicated in full in the charter, then when moving you need to make changes to the charter and submit an application to the inspectorate in form P13001. In the application, page 001, sheet B and sheets for the applicant are filled out. Don't forget to have it certified by a notary and pay the state fee. The inspection may additionally request the following documents:

- Charter of the LLC in two copies

- Minutes of the founders’ meeting or the founder’s decision to change the address

- Letter of guarantee or consent of the owners of the premises

- Receipt for payment of duty

Letter about clarification of legal address from the Federal Tax Service, what should I reply?

Currently, tax inspectorates send two types of letters to the legal address of companies:

Letter confirming legal address. This is when the Federal Tax Service asks you to provide documents confirming the accuracy of the legal address of your company. (You can sample a response to a letter confirming a legal address) As we wrote earlier, if this letter is ignored, your company receives a record of unreliability in the Unified State Register of Legal Entities, which has many negative consequences for the activities of the Company.

Letter to clarify (detail) legal address . This is when the Federal Tax Service Inspectorate asks you to clarify (detail) the legal address in the Unified State Register of Legal Entities. This letter is significantly different from the first one, and your actions to respond to it are also different. What should you do if you receive a letter about address details?

Step-by-step instructions when receiving a letter to clarify your legal address!

1) First, you need to look at how your address is registered in the Unified State Register of Legal Entities. To do this, you can go to the tax.ru website yourself and order an electronic statement. ( link here ). This service is provided by the Federal Tax Service free of charge and will take you a few minutes of time. Typically, the tax office sends out such letters of clarification if only the number of the house and building (building) is indicated in your Unified State Register of Legal Entities. Of course, if this is an office building and your legal address is the number of the house and building, it will be extremely difficult for the Federal Tax Service employees to find you. We would like to remind you that at present it is the task of employees of the territorial Federal Tax Service to check the location at the legal address entered in the Unified State Register of Legal Entities. They have the right to go to the specified address and check if the company is located there. Therefore, no one will be looking for you throughout the building! And your office number is not indicated.

2) If you really have indicated the house number and building, we begin to proceed further. You need to contact the landlord from whom you rent the premises (or acquired a legal address) and ask him to provide you with documents clarifying your legal address. You need a document that will indicate the floor, room number, room, office, etc. Your address should be as detailed and understandable as possible for tax officials. We would like to immediately note that if you do everything correctly and prepare the correct response to the letter about clarification of the legal address, the chance that an employee of the Federal Tax Service will come to you is minimal.

3) After the landlord has given you documents - this could be a new lease agreement with an updated legal address or an additional agreement to the lease agreement, you proceed to the third stage. We say right away that submitting these documents to the Federal Tax Service with a covering letter is useless! In this case, this option is not suitable here; you will only waste time, and your legal address will not be clarified. You need to make changes to the Unified State Register of Legal Entities in the information about your legal address! Yes, it is to make changes according to the forms provided for by law (13001 or 14001). Now you need to figure out what form to submit? To do this, open your charter and look on the first page to see how the legal address of the Company is indicated:

- indicated Moscow - preparing form 14001 (Sample of filling out form 14001 here)

- the address is indicated in full with the street, house number - we are preparing form 13001. (Sample of filling out form 13001 here)

4) After you have prepared the form required in your case, the General Director of the Company goes to the notary office to certify the signature. You must take the Company's constituent documents and seal with you. After certification, a set of documents is collected and submitted to the Federal Tax Service. After 7 calendar days you should receive a registration sheet with the updated address. This concludes the actions in your response to the letter about clarification of the legal address.

If you have any questions, you can write to us by e-mail: or call +7 (499) 3910477 (consultation is free).

Legal staff provide services for preparing documents when clarifying the legal address; we will take on this entire complex process. Only for our clients a notary without a queue!

Sample notice of relocation of an organization

General Director of Ingosras LLC Mikhail Ivanovich Mikhailov

Notification of change of actual address

We inform you that our organization LLC “Zavod” from December 15, 2021 will be located in the office at the address: 109397, St. Petersburg, st. Stavropolskaya, 16. Office hours remain the same: from 10-00 to 22-00 daily. The decision to move to a new office was made in connection with the expansion of the staff. Please note that the telephone number and legal address of our organization remain the same. The move will not affect the intensity of our work; our obligations to you will be fulfilled on time.

If you have any questions, we are ready to answer them by phone or by mail

Ivanov Oleg Ivanovich

Stamp/signature