Personal accounting account to reflect shortages

To record shortages in accounting, account 94 “Shortages and losses from damage to valuables” is intended (Chart of Accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

Basic information about account 94 is presented in the figure below:

What amounts are reflected in the debit and credit of this account, see below:

What needs to be taken into account when calculating the residual value of a fixed asset (FPE), see the article “How to determine the residual value of fixed assets” .

Let's figure out how account 94 is used in business activities.

Registration of shortage upon acceptance of goods

Update: October 6, 2016

What documents does the buyer need to fill out if he identifies a shortage upon acceptance of the goods?

If upon acceptance the buyer reveals a smaller quantity of goods than indicated in the delivery note, then he can contact the supplier with a request to make corrections to the delivery note. The corrections must be certified by an employee of the supplier who has a power of attorney for the release of material assets, part 7 of Art. 9 of the Law of December 6, 2011 No. 402-FZ.

You can do without correcting the invoice. To do this, in case of a shortage, the buyer draws up a quantity discrepancy report in four copies, for example, in form No. TORG-2. The act is drawn up by a commission appointed by order of the head. In addition, a representative of the supplier must be invited to draw up the report. If the supplier has not sent a representative, then the act is drawn up without him.

When drawing up an act in any form, it is necessary to note how much of the goods is indicated in the transport documents and the consignment note, how much was actually accepted and how much was the shortage. Those goods for which no discrepancies have been identified do not need to be listed in the act. The act is signed by members of the commission, a representative of the supplier (carrier) and an expert (if involved), and then the head of the purchasing organization approves the act. It is advisable to make a note in the delivery note that discrepancies in quantity were identified upon acceptance, and also indicate the number and date of the report.

At the next stage, you need to issue a letter of claim (claim) to the supplier. In it you need to indicate your requirements: either deliver the goods additionally, or return the money if there was an advance payment in clause 1 of Art. 466, paragraph 3 of Art. 487, paragraph 1, art. 511 of the Civil Code of the Russian Federation.

The buyer attaches one copy of the discrepancy report to the claim. The second copy of the act remains with the buyer, the third is transferred to the representative of the supplier (or other organization) who was present at acceptance, and the fourth is taken by the carrier who delivered the goods (if there was a transportation contract).

Register the existing invoice in the purchase book only for the cost of the goods actually received. If the supplier issues an adjustment invoice with a decrease in the quantity of goods, then it is no longer necessary to register it in the purchase book. Letter of the Ministry of Finance dated May 12, 2012 No. 03-07-09/48.

A claim letter might look like this.

LLC "April"

107370, Moscow, st. Boytsovaya, 6

To the head of Mart LLC, A.E. Podsnezhkin. 142500, Moscow region, Pavlovsky Posad, 7

Requirement (claim) due to shortage of the quantity of goods transferred

On July 5, 2016, upon acceptance of the goods shipped by your organization to our address under contract dated March 29, 2016 No. 58/r (delivery note dated July 5, 2016 No. 98), it was discovered that 3 (Three) boxes of ceramic tiles were delivered opened. A piece count of the contents of boxes with damaged packaging revealed a shortage of 20 (Twenty) pieces of ceramic tiles (article 10558965), which is confirmed by the mark in the delivery note and act dated 07/05/2016 No. 2.

In accordance with paragraph 1 of Art. 466 of the Civil Code of the Russian Federation we demand that the prepayment for undelivered goods in the amount of 7080 rubles, including VAT (300 rubles x 20 pcs. + 300 rubles x 20 pcs. x 18%) be returned to our bank account within 10 working days from the date of receipt claims. Bank details for transfer are specified in the agreement.

If these requirements are not met, we will be forced to go to court.

Appendix: act on identifying discrepancies in the quantity of goods upon their acceptance dated 07/05/2016 No. 2 on 1 sheet.

| General Director of April LLC | A.A. Molodtsov |

The culprits have been identified: how to write off shortages identified during inventory

Regular monitoring of the availability and condition of property, carried out through an inventory, helps the company’s management:

- promptly identify shortages and damage to property;

- deal with the culprits;

- take measures to recover shortfalls from those responsible;

- write off damaged and missing material assets from accounting accounts and generate reliable information in reporting on company property;

- take measures to strengthen control over the safety of assets, increase the level of responsibility of financially responsible persons, etc.

The following articles talk about the nuances of inventory:

- “Inventory of inventories: order and nuances”;

- “Procedure for conducting an inventory of fixed assets”;

- “The procedure for carrying out a BSO inventory (nuances).”

To understand the postings for writing off shortages during inventory, we will use the conditions of the example.

After conducting an inventory at warehouse No. 3 (the financially responsible person is storekeeper N. G. Zavyalov), a shortage of goods and materials in the amount of 8,630 rubles was revealed:

| Name | Quantity | price, rub. | Cost, rub. | ||

| Cement PC-500 | 5 bags | 290,00 | 1 450,00 | ||

| Shovel with wooden handle (rail steel) | 4 pieces | 525,00 | 2 100,00 | ||

| Rack jack | 1 piece | 5 080,00 | 5 080,00 | ||

| Total amount: | 8 630,00 | ||||

Storekeeper Zavyalov N.G. agreed to voluntarily compensate for the shortage.

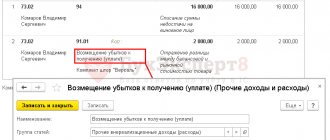

In the company's accounting, entries were made to write off the shortage to the guilty party:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 94 | 10 | 8 630,00 | The cost of missing valuables is transferred to the shortage account |

| 73 | 94 | 8 630,00 | The shortage is attributed to the person at fault |

| 70 | 73 | 8 630,00 | The shortage is withheld from the salary of the financially responsible person at his request |

How the presence of natural loss norms affects the procedure for writing off shortages is described here .

Important to consider! Recommendation from ConsultantPlus: Evaluate written-off inventory items in the manner established by the accounting policy. In the debit of account 94, also write off the amount of deviations, including transport... (read more).

Product traceability: how to deal with discrepancies, returns and errors in documents

Discrepancies in quantity of goods

Let's assume that upon delivery a shortage of goods was discovered and surpluses were discovered.

What to do if the product is subject to traceability? We will proceed from the fact that initially the shipping documents and invoices (UPD) were issued in accordance with the terms of the transaction.

Situation No. 1. A shortage was identified upon receipt of goods

If a shortfall is detected before the transfer of rights to the goods, if such a shortage is not made up, the parties should document this fact (for example, the buyer acknowledges the shortage upon acceptance of the goods). Then the supplier must generate an adjustment invoice (ACI), which will reflect the decrease in the quantity of goods shipped.

The basis for issuing an adjustment invoice is a document confirming the parties’ agreement on the change in the cost of shipped goods due to a change in their quantity (clause 10 of Article 172 of the Tax Code of the Russian Federation). Next, the usual accounting actions are carried out with the adjustment invoice, which ultimately leads to the reflection of correct data in the tax returns of the parties for VAT, including the details of the traceability of goods.

If the shortfall is not simply due to a shipping error, but rather to a shortage of goods from the supplier, he must stop traceability of such goods by recording the shortage with an inventory document and reflecting it in the report on transactions with goods subject to traceability for the corresponding quarter.

Situation No. 2. The shortage was identified after the buyer accepted the goods

If a shortage of goods is identified by the buyer after he has accepted the goods for accounting, the further development of the situation will depend on whether the buyer sets himself the task of proving the shortfall.

Once ownership of the goods has passed to the buyer and acceptance documents have been signed without complaint, the supplier has every reason to believe that he has passed the traceability baton to his buyer.

A shortage subsequently identified by the buyer can be considered as having already occurred to him. It is then the buyer who will remove the goods from traceability by taking an inventory, documenting shortages and recording them in their Traceable Goods Transaction Report.

In the event that the buyer decides to pursue a claim, until the conflict with the supplier is resolved in one way or another, the buyer should record the shortage and reflect it in the report on transactions with goods subject to traceability.

In the future, if the supplier acknowledges the fact of short delivery, he must generate an adjustment invoice (ACI) and register it in his purchase book in the period in which it was issued. This will lead to the reflection of the relevant data in the VAT return for the current tax period; the supplier does not need to submit an updated declaration (clause 1 of Article 169, clause 13 of Article 171, clause 10 of Article 172 of the Tax Code of the Russian Federation, clause 2, 12 Rules for maintaining a purchase book).

The buyer, having received an adjustment invoice, registers it in the sales book in the tax period in which the earliest of the following dates falls (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation, clause 14 of the Rules for maintaining the sales book):

—

receipt by the buyer of primary documents for changes in the direction of reducing the cost of purchased goods. In this case, this is a certain document following a dispute with the supplier, in which he admitted the fact of short delivery, or a court decision;

—

receipt by the buyer of an adjustment invoice.

During the same period, correct traceability data will be included in the buyer’s tax return. However, at the same time, he also needs to submit an adjustment report on transactions with goods subject to traceability. Then there will be no discrepancies in the system.

Situation No. 3. During acceptance, surplus goods were identified

If the buyer does not mind accepting them, then the seller, in agreement with the buyer, increases the quantity of goods shipped by issuing an adjustment invoice. The parties record it in their VAT registers in the general manner, i.e. for the period in which the documents that are the basis for issuing adjustment invoices were drawn up (clause 10 of Article 154, clause 13 of Article 171, clause 10, Article 172 of the Tax Code of the Russian Federation). This ensures that the traceability system reflects the correct data without the parties submitting updated tax returns, as well as special notifications and reports.

If the buyer refuses the excess goods, he returns it to the supplier. Based on the assumption that the documents were initially drawn up in accordance with the terms of the contract, there is no need to adjust them or the parties’ VAT and traceability reporting in this case, since the status quo has been restored.

In the event that the buyer identifies surplus goods, but cannot associate them with a specific supplier, batch of goods, RNPT, he receives such goods on the basis of inventory documents and, if this product is traceable, submits a notification about the balance in order to receive RNPT and be able put the product into circulation. The report on transactions with goods subject to traceability does not include data from such goods. The traceability details of this item will be reflected in the system in the usual way as it moves further.

Situation No. 4. A shortage or surplus is identified during an export or import operation

If the parties encounter discrepancies in connection with the import of goods or in connection with export to the EAEU country, the following must be taken into account:

1.

If the import was made from a country outside the EAEU, to change the quantity of goods reflected in the goods declaration, you should contact the customs authority. If the customs decision is positive, the number of goods with the corresponding RNPT will change. If the buyer records a shortage or surplus of imported goods in his warehouse during inventory, he fills out:

—

in case of shortage - a report on transactions with goods subject to traceability,

—

when surpluses are identified - notification of the remaining balances of goods subject to traceability (for the purpose of obtaining RNPT);

2.

When importing goods from an EAEU country, the buyer submits an import notification to the tax authority within five working days from the date of acceptance of these goods for registration. If by this time a discrepancy has already been identified and agreed upon with the supplier, the notification must reflect the actual quantity of goods. The Federal Tax Service of Russia will assign RNPT to this batch by sending the corresponding receipt in response to the notification. If a discrepancy recognized by the supplier is identified at a later date, it is necessary to submit an adjustment notice (no later than the next business day from the date of discovery of the fact of non-reflection or incomplete reflection of information).

If a surplus was subsequently identified as a result of the buyer's inventory and it is difficult to associate the goods with a specific delivery and with a specific RNPT, it is necessary to reflect its identification in the notification of the remaining goods subject to traceability. The shortage of the specified goods, which cannot be documented specifically with short delivery, is reflected in the report on transactions with goods subject to traceability, based on inventory documents;

3.

if the goods were exported to the EAEU country, the supplier submits a notification of the movement of goods subject to traceability within five working days from the date of shipment of this product. If it subsequently turns out that the notice indicated an incorrect quantity of goods due to a shortfall or surplus that the buyer agreed to accept, a corrective notice must be submitted no later than the next business day from the date the incorrect information was discovered. If the buyer refuses the excess goods, the seller retains ownership of them. Despite the fact that the goods have left for the EAEU country, their return is not related to a foreign economic transaction: the Russian seller simply brings back his own goods. There is no need to accompany such an operation with an adjustment notification about the movement of goods subject to traceability, since in the initial notification the data was indicated correctly and then the actual state of affairs was brought into line with the documents.

Purchase returns

The buyer’s refusal of the goods in whole or in part can be formalized, depending on the situation and the will of the parties, by terminating the transaction, declaring it invalid, adjusting the shipment, or a new purchase and sale agreement (the so-called “repurchase”).

When a transaction is terminated or recognized as not concluded, the previously issued invoice (UPD) is registered in the purchase book (sales book, additional sheet of the purchase book or sales book) of the party with negative values. Thanks to such corrections, the VAT declarations of the parties ultimately reflect the correct information about traceability details.

If the return is decided to be formalized by a new agreement in which the parties have swapped roles, the former buyer issues an invoice (UPD) with traceability details and the return route of the goods is traced in the system by reflecting the shipment in the tax returns of the parties.

If it is decided to issue a refund using an adjustment invoice (UCI), it is reflected in the VAT registers and tax returns of both the buyer and the seller in the usual manner for taxpayers, which ultimately also allows for the correct reflection of traceability details in the system. No additional reports or notifications are required here unless we are talking about a transaction with partners from the EAEU.

The situation is more complicated with the return to the supplier of goods that were imported by a Russian buyer from an EAEU country or, conversely, goods that a Russian supplier shipped to the territory of another EAEU country. The fact is that in the language of the Protocol on the Payment of Indirect Taxes to the Treaty on the EAEU (Appendix No. 18), only the return of goods of inadequate quality is considered a return. If the imported product is of high quality, but the buyer still refuses it, the return is formalized as the goods being exported by him (clause 23 of the Protocol, Letter of the Ministry of Finance dated March 31, 2020 No. 03-07-13/1/25489). There is no clarification on this issue yet. But taking into account the provisions of the Treaty on the EAEU, it would be correct to do this:

—

when returning low-quality goods from the territory of the EAEU back to Russia, issue a corrective notification about the movement of goods subject to traceability from the territory of the Russian Federation to the territory of another state - a member of the Eurasian Economic Union;

—

When a buyer returns a quality product from the territory of the EAEU to Russia, import to the Russian Federation and a notification of the import of goods subject to traceability from the territory of another state - a member of the Eurasian Economic Union to the territory of the Russian Federation and other territories under its jurisdiction are issued. This will be the initial notification and, despite the fact that the goods were previously in the system and had a RNPT, the batch will be assigned a new RNPT by the tax authority in response to this Notification. The procedure for filling out the Import Notice (clause 3), given in the Letter of the Federal Tax Service of Russia dated April 14, 2021 No. EA-4-15 / [email protected] , assumes that in this document line 12 (RNPT) is not filled out upon initial submission;

—

when a Russian buyer returns a low-quality product to a supplier in an EAEU country, a corrective import notification is issued;

—

When a Russian buyer returns a good quality product to a supplier in an EAEU country, an export and notification of the movement of goods subject to traceability from the territory of the Russian Federation to the territory of another member state of the Eurasian Economic Union is issued.

Error in invoice (UPD)

Let's assume that upon acceptance of the goods (or later) it turned out that there were significant errors in the accompanying documents and invoices that required correction. For example, the quantity of goods, RNPT, cost, etc. are incorrectly indicated.

What should the parties do?

The buyer does not need to refuse to accept the goods. It should be capitalized on the basis of existing correctly executed documents (perhaps on the basis of internal primary accounting documents, say, an acceptance certificate) and initially taken into account as an uninvoiced supply.

The buyer notifies the supplier of an error in the documents. The latter is faced with the task of reworking the documents so that their details, including those related to traceability, acquire the proper meaning.

Purchased inventories can be released for processing, objects can be put into operation as fixed assets and used in any way that implies the cessation of traceability. In particular, nothing prevents the product from being put on sale at retail, since traceability ceases in the case of sale of the product to individuals for use for personal, family, household and other purposes not related to business activities, as well as in the case of sale of the product to taxpayers tax on professional income.

If purchased goods are intended to be resold to another organization or individual entrepreneur, please note the following. The invoice (UPD) contains traceability details:

—

registration number of the batch of goods subject to traceability (RNPT);

—

quantitative unit of measurement of a product used for traceability purposes;

—

the quantity of a product subject to traceability, in the quantitative unit of measurement of the product used for traceability purposes.

If the buyer is sure that the flaws in the documents received from the supplier are not related to traceability details, it is not prohibited to ship the goods. Don't forget: traceability is based on documents. If we were talking about goods subject to mandatory marking by means of identification, they could neither be accepted, nor stored, nor transported, nor sold if they did not have a marking code (Article 4 of the Agreement on the Labeling of Goods with Means of Identification in the Eurasian Economic Union ). This is the fundamental difference between the two control systems.

If errors are made specifically or presumably in the traceability details, there is also no direct prohibition on shipping the goods to the next buyer in the chain of goods circulation, but due to obvious problems when issuing an invoice to him, it is advisable to postpone the shipment until the receipt of correctly completed incoming documents. After all, the invoice, like the UPD, must be generated within 5 calendar days from the date of shipment, which means that shipment at your own risk in the absence of correct traceability details will occur under severe time pressure.

What does the seller do while the buyer decides on further actions with the product?

He must make corrections to the invoice (if necessary) and issue a corrected invoice (UPD). According to clause 7 of the rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, in a new copy of the invoice, changes in line 1 of the number and date of the original invoice drawn up before the corrections were made are not allowed. And in line 1a the serial number of the correction and the date of correction are indicated. The remaining indicators of the new copy of the invoice, including new (initially not filled out) or updated (changed), are indicated with the correct values. This is also true for indicators columns 11 – 13, where traceability details are provided.

After issuing/receiving a new invoice:

—

the seller, if the quarter has not yet been closed, cancels the previously made entry in the sales book, registering the original document with negative values, and the new one with positive values. If changes are made for the previous tax period, entries are made in an additional sheet of the sales book for the tax period in which the invoice (UPD) is registered before corrections are made to it (clauses 3, 11 of the Rules for filling out the sales book, clauses 3, 4 Rules for filling out an additional sheet to the sales book);

—

the buyer, if the quarter has not yet been closed, cancels the entry on the original invoice (UPD) in the purchase book, entering its data with negative values, and then registers the data of the corrected document with positive values. If corrections are made for an earlier tax period, then entries are made in an additional sheet to the purchase book (clauses 4, 9 of the Rules for filling out the purchase book, clauses 3, 5 of the Rules for filling out an additional sheet to the purchase book).

The VAT returns of the parties reflect correct data. If corrections were made after submitting the declaration for the period, then an updated tax return is submitted, which, among other things, corrects the traceability details of the goods. This must also be done if the party to the transaction did not increase the amount of tax payable as a result of correcting the error, since otherwise incorrect data will remain in the traceability system.

Prepare in advance for handling traceable goods

The Taxcom company will help with this. We will select electronic document management solutions for you, thanks to which you can easily issue invoices according to the new rules, as well as exchange other electronic documents with counterparties and submit reports to government agencies via the Internet.

traceability traceability of goods

Send

Stammer

Tweet

Share

Share

There is no one to blame for the shortage: we are sorting out the wiring

Situations when there is no one to blame for a shortage often arise. Company assets can be lost as a result of force majeure (flood, drought, earthquake) or stolen by thieves who cleverly cover their tracks.

First, the property owner must understand the true reasons for the shortage and take measures to find the perpetrators, as well as evidence of their involvement in the loss of valuables. To do this, the company can conduct an internal investigation itself or file a complaint with the police.

Let's look at an example to see what kind of postings are used when writing off a shortage if the culprit is not identified.

Construction materials worth RUB 2,654,399 disappeared from the construction site. 38 kopecks In the “Construction City” accounting, after conducting an inventory and completing the necessary documents, the following entry was made:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 94 | 10 | 2 654 399,38 | There is a shortage of building materials |

The company's management contacted the police to report the theft. As a result of the investigation, the culprits of the theft were not identified. After receiving from the internal affairs bodies a document on the suspension of the case of theft of valuables due to the absence of perpetrators, the following entries were made in the accounting records of Stroyka-Gorod LLC:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 91.2 | 94 | 2 654 399,38 | The loss from the shortage was written off as other expenses due to the absence of the perpetrators |

The same entry is made in accounting if the guilt of the financially responsible person in damage or loss of valuables is not proven. The basis may be an acquittal by the court (clause 5.2 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

Learn about the nuances of using account 91 from this material.

Rules for document preparation

On the first page, fill in information about the consignee:

- Name;

- OKPO code;

- OKDP code;

- location.

After this, fill in the place of acceptance of the goods (for example, the address where the warehouse is located) and the details of the accompanying document (for example, a delivery note). Please indicate below:

- names and addresses of the shipper, consignee and supplier;

- details of the contract and invoice (if any);

- delivery method (for example, by road);

- date, time and place of departure of the cargo.

The second page contains information about discrepancies. The first table indicates the shipper's data (information about the condition of the transport, presence of sealing marks, name of the goods, quantity and gross weight.

The second table is filled in if there are discrepancies in weight and number of seats. The third table contains a list of goods indicating place numbers, prices and amounts.

On the third page of the form, you should fill in information about storage conditions, temperature conditions and packaging condition. In the table, fill in the data about the cargo, including damage, defects, surpluses and shortages.

On the last page, fill in information about the product inspection (on what scales the goods were weighed, how the quantity was checked (counting places, measurements, etc.). After this, describe in detail what defects were found. For example, some of the packages are damaged, some items arrived defective ( indicate the nature of the damage). This is followed by the conclusion of the commission, which is formulated briefly. For example, present a claim to the supplier for such and such an amount.

Then the signatures of the chairman and members of the commission, the representative of the shipper and the chief accountant are signed. At the end, the decision of the head of the company is written, which usually coincides with the conclusion of the commission.

There is no space for printing in TORG-2. A seal is not required. If desired, printing is allowed on the last page, where there are signatures of the chairman and members of the commission, or on the first page, where the stamp “APPROVED” is located.

How to write off the shortage at the expense of net profit

Net profit is the final financial result of the company's activities for the reporting period. Its indicator is formed on account 99 “Profit and losses” and with the final turnover at the end of the year is written off to the credit of account 84 “Retained earnings (uncovered loss)”. Retained earnings can be used to cover losses (for example, when a shortage is discovered). However, only the owners of the company can decide on this form of using profits.

This publication talks about where the company’s net profit can be directed.

If the owners make such a decision, the entries when writing off the shortfall at the expense of net profit will not affect accounts 99 and 84. The operation to write off the shortfall in accounting will be reflected in the correspondence of accounts Dt 91.2 Kt 94. Such writing off of the shortfall leads to discrepancies between accounting and tax accounting , since this amount will not participate in calculating the taxable base for income tax. As a result, a permanent tax liability must be reflected in the accounting accounts.

Attention! Hint from ConsultantPlus: There is a position of the Russian Ministry of Finance, according to which if the perpetrators have not been identified, then a document confirming the right to include losses from theft in expenses is... (read more).

Learn about the types of discrepancies between accounting and tax accounting from this material.

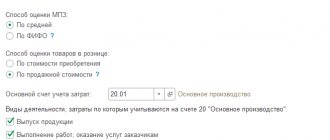

BASIC: income tax

Losses from shortages (spoilage), identified when receiving inventory items within the limits of natural loss norms, are included in material costs under a separate item (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation). If losses are not classified as direct expenses, take them into account in the period when the shortage (damage) was identified (paragraph 1, paragraph 2, article 318 of the Tax Code of the Russian Federation). If the organization takes them into account as direct expenses, then the profit tax can be reduced only after the products in the cost of which they are taken into account are sold (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). The organization independently establishes the list of direct expenses in its accounting policy for tax purposes (paragraph 10, paragraph 1, article 318 of the Tax Code of the Russian Federation).

When calculating income tax, use the same norms of natural loss that are used in accounting (Article 7 of Law No. 58-FZ of June 6, 2005). Do not take into account shortages (damage) in excess of natural loss norms when calculating income tax. Submit a claim to the supplier (carrier) for this amount. If the supplier (carrier) acknowledged the claim and returned the excess amount received to the organization (buyer), do not increase the tax base. This amount is not income (Article 41 of the Tax Code of the Russian Federation). It only reduces the receivables that the organization has incurred due to shortages (damage).

Results

Identified amounts of shortfalls, regardless of the presence or absence of perpetrators, are reflected in the debit of account 94 “Shortages and losses from damage to valuables.”

The amounts reflected in this account are written off to account 73 “Settlements with personnel for other transactions” - if the culprit is identified, or is recognized as another expense and written off to account 91 “Other income and expenses” - if the culprits are not found or their involvement in the shortage is not proven. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Customer Reviews

Gratitude to Konstantin Vasilievich Solovyov I am very glad that I was accepted for a consultation with Konstantin Vasilievich Solovyov. An excellent, very competent lawyer. Please accept my gratitude for your excellent service. Thank you!

Valadze G.G. 08/17/2018

Gratitude from Marina Kuleshova I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal work and professionalism, as well as to his assistant Elena Vladimirovna for the qualified assistance provided. I wish you prosperity and achievement of professional heights.

Sincerely, Marina Kuleshova. 08/15/2018

Gratitude from Potapova T.I. I express my gratitude to Denis Yuryevich Stepanov for the work done, high qualifications, as well as for very clear, accessible help in solving my problem (protection of consumer rights). Excellent, very competent lawyer. Thank you very much!

Sincerely, Potapova Tamara Ivanovna, 07/09/2019

Thanks from Radhuan M.R. Dear Kavaliauskas Vasily Anatolievich. Let me express my sincere gratitude for the qualified legal assistance provided. Thanks to your professionalism, I was able to achieve a decision in my favor. I wish you further prosperity and professionalism.

Radhuan M.R. 06/08/2018

Gratitude from Elena and Alexander I sincerely thank lawyer Vasily Anatolyevich for his qualified and polite service. We will always contact you and tell our friends. Thank you.

Elena

Alexander 998-98-59

Gratitude from Balitskaya A.S. I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his efficiency and professionalism in resolving controversial issues. The pre-trial settlement was completed as quickly as possible.

Balitskaya A.S., 05/15/2019

Gratitude from Piskunov I.B. I just don’t have words to express my gratitude to Sergei Vyacheslavovich. Thank you for having such a lawyer. Thank you for your help regarding the issue regarding the employment contract.

Piskunov I.B. 12/12/2018

Gratitude from N.A. Tomashpolskaya I would like to express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal advice and sensitive, attentive attitude towards me, who found myself in a difficult situation.

Sincerely, Tomashpolskaya N.A. 07/01/18

Review by Minina M.V. I would like to express my deep gratitude to Yuri Vladimirovich Sukhovarov for his competent advice and qualified assistance on my issue.

With gratitude, Minina Margarita Vladimirovna.

Letter of thanks