The activities of any enterprise are impossible without the presence of official administrative documents. Typically these are orders

Running a business is a complex process that involves solving many different problems. Including in

Most employees receive their earnings based on a salary project. In the bank for each employee

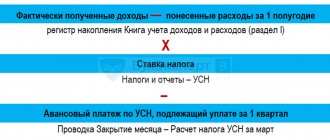

How to calculate the simplified tax system “income” To calculate the simplified tax system tax, the taxpayer who has selected the object “income” should

Home / Labor Law Back Published: 06/16/2020 Reading time: 11 min 0 745

Methods for collecting taxes, fees, penalties If the taxpayer does not fulfill his tax obligations voluntarily, tax authorities

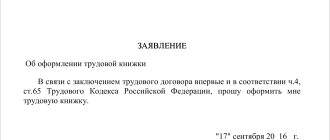

We'll tell you whether you need a paper work book when applying for a job in 2022, and

How to correct errors in SZV-STAZH There are three types of correction forms: corrective (KORR); canceling (OTMN);

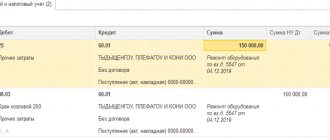

Accounting for income tax calculations The procedure for accounting for income tax calculations, and

In the current realities, conducting an on-site audit as a form of tax control is a real scourge