Accounting for income tax calculations

The procedure for accounting for income tax calculations, as well as identifying the difference between the accounting profit tax recognized in accounting and the tax reflected in the income tax return, is established by the Accounting Regulations (PBU) 18/02, approved.

by order of the Ministry of Finance of the Russian Federation dated November 19, 2001 No. 114n. The Ministry of Finance has made a number of amendments to PBU 18/02, which must be applied starting with the reporting campaign for 2022. Find out exactly what amendments were made to the regulations and how to apply them in practice in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

PBU 18/02 introduced indicators into accounting practice, each of which increases or decreases taxable profit. Next we will look at these indicators.

Impact on the content of notes to financial statements

In accordance with the new edition of PBU 18/02, the explanations to the balance sheet and the income statement must disclose the information necessary for users of the statements to understand the nature of the indicators related to the organization’s income tax.

Note that until 2022, the relevant indicators were subject to disclosure in the explanations only in the presence of permanent tax liabilities (assets), changes in deferred tax assets/liabilities that adjust the indicator of conditional income tax expense (income).

In the new edition of PBU 18/02, the content of such explanations has been clarified. Thus, deferred income tax due to:

- the occurrence (settlement) of temporary differences in the reporting period;

- changes in tax rules (including rates);

- recognition (write-off) of deferred tax assets due to a change in the probability that the organization will receive taxable profit in subsequent reporting periods.

In addition, the explanations should contain values that explain the relationship between income tax expense (income) and the profit (loss) indicator before tax. For example this:

| Formulation from 2022 | Formulation until 2022 |

| Applicable tax rates | Reasons for changes in applied tax rates compared to the previous reporting period |

| Conditional expense (conditional income) for income tax | Conditional expense (conditional income) for income tax Permanent and temporary differences that arose in the reporting period and resulted in the adjustment of the conditional expense (conditional income) for income tax in order to determine the current income tax Permanent and temporary differences that arose in previous reporting periods, but resulted in an adjustment of the conditional expense (conditional income) for income tax of the reporting period due to changes in the requirements for the recognition of current income tax |

| Fixed tax expense (income) | Amounts of a permanent tax liability (asset), a deferred tax asset and a deferred tax liability Amounts of a deferred tax asset and a deferred tax liability written off in connection with the disposal of an asset (sale, transfer on a gratuitous basis or liquidation) or type of liability |

The Ministry of Finance especially notes that the new list of indicators disclosed in the explanations given in PBU 18/02 is not exhaustive (information message dated December 28, 2018 No. IS-accounting-13). The organization must include in the explanations other information necessary for users of the statements to understand the nature of the indicators related to the organization’s income tax.

Temporary differences as a basis for deferred income taxes

If income (expenses) are recognized both for accounting and tax accounting purposes, and the difference arises only in the time of their recognition, such a difference is called a temporary difference.

The resulting temporary differences result in deferred income taxes.

Deferred income tax is the amount of tax calculated by multiplying temporary differences by the tax rate. This tax is “deferred” into the future, that is, it will affect (either decreasing or increasing) the amount of tax payable in future reporting periods.

Accounting distinguishes between deductible temporary differences and taxable temporary differences. The former influence the deferred tax in the direction of increase, the latter – in the direction of decrease.

Deductible differences arise when expenses are recognized later for tax accounting purposes, and income earlier than for accounting purposes.

Examples of deductible differences:

- the amount of fixed assets depreciation in accounting is greater than in tax accounting;

- tax loss that will be carried forward;

- income (expenses) arising from the difference in exchange rates based on calculations in conventional units.

Taxable differences are income and expenses that increase accounting profit in the current reporting period and taxable profit in subsequent reporting periods.

Examples of taxable differences:

- the amount of bonus depreciation with fixed assets is taken into account for tax accounting purposes and is not included in the accounting records;

- customs duties are included in direct expenses for tax accounting purposes and are written off in proportion to the goods sold in accounting;

- brokerage services are included in direct expenses for tax accounting purposes and are written off in proportion to the goods sold in accounting.

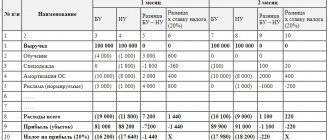

Temporary differences

Temporary differences (TD) are income and expenses that form accounting profit (loss) in one reporting period, and the tax base for TP in another or other reporting periods.

In the reporting period, when BP arises between accounting and accounting data, deferred tax assets (DTA) and deferred tax liabilities (DTL) are formed.

Temporary differences are divided into deductible (TVR) and taxable (TVR).

Deductible temporary differences are formed if any expenses in accounting reduce accounting profit in the reporting period, and will be accepted in accounting only in the following reporting (tax) periods.

Example.

Small enterprises have the right to depreciate a fixed asset (fixed asset) at a time, which relates to business inventory, and in NU, if such a fixed asset meets the conditions of depreciable property, it will be depreciated over its useful life. Thus, the VVR will be formed.

And in the reporting period when IRR arises, a deferred tax asset is formed, which is also calculated as the product of this difference by the current income tax rate.

ONA is accrued on the debit of account 09, and is repaid on the credit of account 09 in correspondence with account 68.04.2.

Taxable IR are formed if in the reporting period the tax base for IR is reduced, and accounting profit will be reduced by this amount in the following reporting (tax) periods.

Example.

If an asset is purchased, the cost of which is 60,000 rubles, then in the accounting book it will not be depreciated, and its cost will be immediately taken into account in the expenses of the current period, and in the accounting book the cost will be repaid through depreciation during its useful life.

In the reporting period when the non-current tax arises, deferred tax liabilities are recognized.

The change in the value of IT is calculated as the product of NVR and the income tax rate in effect at the reporting date. IT is accrued on the debit of account 77, and is repaid by a reverse entry to the credit of account 77 in correspondence with account 68.04.2.

SHE and IT as parts of deferred income tax

Deferred tax asset (DTA) is that part of deferred income tax that should reduce income tax in subsequent reporting periods. The amount of the deferred tax asset is determined by multiplying the deductible temporary differences by the income tax rate.

Deferred tax liabilities (DTL) are that part of deferred income taxes that lead to an increase in taxes in subsequent reporting periods. The amount of deferred tax liability is determined by multiplying taxable temporary differences by the income tax rate.

EXAMPLE from ConsultantPyus: At the beginning of the month there is an account balance of 77 - 300 rubles. At the end of the month, the total balance of IT for all objects is 1,560 rubles, the total balance of IT is 160 rubles…. Read the continuation of the example by learning a trial demo access to the K+ system. It's free.

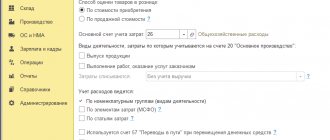

Balance sheet method of deferred tax accounting

The balance sheet method of accounting for deferred taxes does not require accounting for differences.

When performing the routine operation “Calculation of income tax”, the amount of the current income tax is calculated based on tax accounting data.

When performing the regulatory operation “Calculation of deferred tax according to PBU 18/02”, temporary differences are determined for each type of asset and liability - as the difference between the book value and tax value of the asset (liability) at the reporting date.

Current and deferred taxes correspond to the indicators disclosing the amount of income tax in the income statement as amended by Order No. 61n:

- “Current income tax” - line (2411).

- “Deferred income tax” - line (2412).

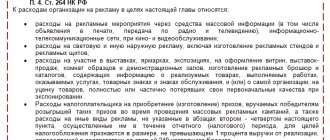

Permanent differences, PNR and PND

Permanent differences are income and expenses that are taken into account in accounting, but are not taken into account in tax accounting. These include:

- the amount of excess of actual expenses reflected in accounting records over expenses according to the norms adopted for tax purposes;

- expenses for the gratuitous transfer of property;

- a loss that is carried forward but which, after the lapse of time, cannot be accepted for tax purposes.

When permanent differences arise, a permanent tax expense (PTR) or permanent tax income (PTI) arises.

PNR, like PND, is calculated by multiplying the constant difference by the income tax rate.

PPR leads to an increase in income tax in the reporting period.

IPA leads to a reduction in income tax in the reporting period.

PNR and PND are recognized in the reporting period in which the permanent difference arises.

New indicator

Amendments to PBU 18/02 also changed the very logic of calculating net profit or loss. Since 2022, an indicator has been introduced that characterizes the change in the economic benefits of an organization in connection with taxation of profits.

Thus, in order to describe the change in the volume of economic benefits for the reporting period in connection with the taxation of profits, PBU 18/02 introduced a new indicator “Profit tax expense (income)”, which was absent until 2022.

Income tax expense (income) is the amount of income tax recognized in the income statement as an amount that reduces (increases) profit (loss) before tax when calculating net profit (loss) for the reporting period.

Profit tax expense (income) is determined as follows:

| CURRENT INCOME TAX + DEFERRED INCOME TAX |

In this case, deferred tax for the reporting period is determined as follows (excluding transactions not included in accounting profit/loss):

| DEFERRED TAX ASSETS + DEFERRED TAX LIABILITIES |

By the way, the edition of PBU 18/02 from 2022 provides a practical example of determining income tax expense and related indicators. For clarity, it also calculates the amount of net profit for the reporting period. Moreover, the calculation is performed in two ways:

| Balance method | Postponement method |

| Reduction of profit before tax by income tax expense | Reduction in pre-tax profit by contingent expense adjusted for:

|

KEEP IN MIND

PBU 18/02 allows you to use any of these methods of your choice. There are no restrictions.

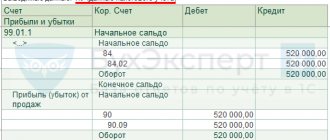

How is the current income tax formed?

Current income tax is the income tax payable to the budget in the reporting period. It is calculated based on the amount of conditional income (expense), adjusted for the amounts of deferred tax assets and liabilities, permanent tax assets and liabilities of the reporting period.

Using the indicators discussed in this article, introduced by PBU 18/02, we will draw up a rule for calculating the current income tax (current tax loss):

Tnnp (Tu) = UD (UR) + NONA – PONA – NONO + PONR + PNR – PND

Where:

Тнп (Ту) – current income tax (current tax loss).

UD (UR) – conditional income (expense) for income tax.

NONA – accrued NONA, which represent deferred tax assets that arose in a given tax period.

PONA – repaid ONA, which represent deferred tax assets generated when calculating income tax in previous tax periods, for which in a given tax period there is no longer a difference between accounting and tax accounting. For example, accounting and tax depreciation for some accounting object are equal.

NONO is the accrued deferred tax liability that arose in a given tax period.

PONR are repaid deferred tax expenses generated when calculating income tax in previous tax periods, for which in a given tax period there is no longer a difference between accounting and tax accounting. For example, customs duties were included in direct expenses for tax accounting purposes, and in accounting they were written off in proportion to the goods sold, and finally, in accounting they were completely written off, since all the goods were sold.

PPR is a constant tax expense, which leads to an increase in income tax in the reporting period.

IPA is a constant tax income, which leads to a reduction in income tax in the reporting period.

SHE and IT in the above formula for calculating the current income tax are deferred income taxes, formed on the basis of deductible and taxable temporary differences.

In the absence of permanent differences, deductible and taxable temporary differences that give rise to deferred tax liabilities and assets, the contingent income tax expense will be equal to the current income tax.

We take the tax return as a basis

From January 1, 2008, the current income tax can be determined on the basis of the tax return for corporate income tax (clause 22 of PBU 18/02). With this method, the basis is the tax calculated according to tax accounting data, that is, in exact accordance with the data of the tax return. It is reflected in accounting as the debit of account 99, subaccount “Conditional income tax expense” and the credit of account 68, subaccount “Calculations for income taxes.” That is, the current income tax in the accounting accounts is determined by this single entry. Then the question arises: how to form permanent, deferred tax liabilities (assets) in accounting and how to apply the mandatory PBU 18/02? The answer is provided by paragraph 3 of PBU 18/02, which establishes that information on permanent and temporary differences can be generated on the basis of primary accounting documents in the accounting accounts or in another manner determined by the organization independently. That is, in the case of determining the current income tax on the basis of a tax return, it is necessary to consolidate this method in the accounting policy and create permanent and temporary differences not in accounting accounts, but in primary documents, including independently developed ones. Accordingly, the correspondence debit to account 99, subaccount “Conditional income tax expense” and credit to account 68, subaccount “Calculations for income tax” will become the only entry in accounting and reflect the income tax according to the tax return. And the indicators in the financial statements will be formed without the use of permanent and temporary differences.

| It is important! |

| Information about permanent and temporary differences can be generated on the basis of primary accounting documents in the accounting accounts or in another manner determined by the organization independently. |

For small businesses and non-profit organizations that are exempt from the obligation to apply PBU 18/02, but are required to fill out the “current income tax” line, there is no need to conduct additional calculations of permanent and temporary differences. But we repeat once again: if the named organizations are payers of income tax, they are required to fill out line 150 of the profit and loss report (clause 2 of PBU 18/02). As you can see, the second way to determine the current income tax is, at first glance, much simpler. Organizations required to apply PBU 18/02 simply need to keep records and reflect permanent and temporary differences (clauses 3, 7, 14, 15 PBU 18/02) in the manner prescribed by the accounting policy, that is, in those developed independently and approved by the accounting policy primary accounting documents. It must be said that many accountants prefer not to use this opportunity, believing that by not reflecting permanent and temporary differences directly on the accounting accounts, the organization violates the requirement of mandatory application of PBU 18/02. We hope that this article will help re-evaluate this belief. Yu. Pimenova, expert editor Material provided by the magazine “Practical Accounting

”

Results

A simple rule will help an accountant recognize permanent tax differences: if any expense or income is recognized in accounting, but is not accepted at all or at least partially in tax accounting (neither in the current, nor in subsequent, nor in previous periods), then a constant arises a tax difference that results in a permanent tax expense or permanent tax income.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.