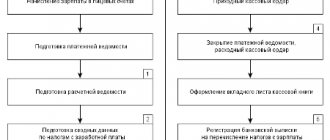

Most employees receive their earnings based on a salary project. At the bank, salary cards are opened for each employee, to which the accounting department of the enterprise (organization) transfers the money earned on a monthly basis.

But regardless of such cooperation with a specific bank, each employee has the right to receive a salary on the bank card of another person, for example, a relative - husband or wife. This norm is enshrined in the Labor Code of the Russian Federation, but there are some nuances that both employees and employers should be aware of.

What is the procedure for transferring wages to a bank card?

In accordance with the provisions of Art. 136 of the Labor Code of the Russian Federation, the employer has the right to pay wages in 2 ways:

- In cash by issuing through the cash register.

- By cashless transfer to a bank card.

In this case, the bank to which the employee’s salary will be transferred can be selected:

- Employer. In this case, the entire staff of the company centrally receives wages in one bank (this is reflected in the collective or labor contract, and when hiring new employees, they fill out an application for a bank card).

Example

Ivanov S.V. was hired by Rassvet LLC, which entered into an agreement with the credit institution PJSC BANK for servicing employee salary cards. Ivanov S.V. should fill out an application to open an account with PJSC BANK, after which he will begin to receive his salary on the card.

- An employee. In order for wages to be paid to an employee’s personal card, it is necessary to fill out an application indicating bank and account details.

Example

Petrova A.N. got a job at Lily of the Valley LLC. The employee wants to receive her salary on her card, which she had even before joining Landysh LLC. To do this, she fills out an application in which she asks for the salary to be paid to a personal card and provides its details.

Read about the document that establishes the procedure for paying wages here.

NOTE! You cannot prevent an employee from receiving payments to the card of any bank he chooses. In this case, the employee must notify you in writing of his desire to receive a salary from another credit institution, indicating new details no less than 15 calendar days before the salary is paid (Article 136 of the Labor Code of the Russian Federation).

Nuances

When paying wages to an employee using this method, you need to remember important nuances:

- Payment to the account of a third party does not fall under the concept of deductions from wages (Articles 137, 138 of the Labor Code of the Russian Federation), therefore the amount of payments cannot be limited within the limits of wages.

- If the application specifies a certain transfer amount, but in fact, after paying personal income tax, the employee has less money to pay, the actual amount is transferred. The company is not required to make additional payments.

- In the text of the purpose of payment “payments” it is advisable to focus on the fact that the salary is being transferred, and not other, additional, income of the employee.

Briefly

- Transferring salary to another person's card is permitted by law. Such an agreement between the administration and the employee must be enshrined in the employment agreement, in the additional agreement to the document. A statement is also required indicating: to whom, how much, for what period, from what payments the transfer should be made; and detailed details for transfer.

- The payment order also indicates to whom the money was sent, from whose salary, for what period, and details of the basis document.

- The accountant keeps track of payments using account 76 and opening sub-accounts corresponding to the analytical data.

Is it legal to transfer wages to someone else’s card?

In practice, the question often arises about the possibility of transferring salaries to someone else’s card. The Labor Code of the Russian Federation states that wages are paid directly to the employee himself, with the exception of situations where a different procedure is regulated by federal laws or an employment contract (paragraph 5 of Article 136 of the Labor Code of the Russian Federation).

International law (International Labor Organization Convention No. 95 of July 1, 1949 regarding the protection of wages) provides for such exceptions as:

- the court's decision;

- desire of the employee (Article 5 of the Convention).

Thus, the very fact of transferring an employee’s salary to someone else’s bank account is permitted by the current legislation. For example, alimony, which is part of an employee’s salary, is unconditionally sent to the alimony recipient’s card on the basis of a writ of execution. Consequently, this once again indicates that there is no prohibition on transferring an employee’s salary to someone else’s card.

ATTENTION! The condition for a different procedure for paying wages must be fixed in an additional agreement to the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation).

It is important to note that the employer has the right to refuse to carry out such operations due to the fact that the norms of paragraph 1 of Art. 421 of the Civil Code of the Russian Federation speaks of freedom of contract: forced registration of any relations between subjects of civil law is not allowed. In addition, such a refusal may be due to the presence in the employment contract or other internal document of the employer of conditions regarding the impossibility of performing these actions.

You can find out the officials’ opinion on the legality of an employer’s refusal to pay wages to someone else’s card in the K+ system by receiving a free trial access.

If the employer is not against such a transfer, then in order to make it, the employee needs to draw up an application indicating the details of the card that he chose for the salary transfer. The application must be submitted no later than 15 days before the payday.

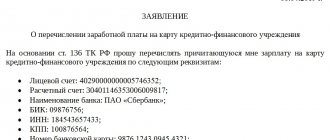

You can download a sample of such a statement for free by clicking on the image below.

NOTE! Wages transferred to a third party are not withheld, since they do not fit the criteria of withholding established by Art. 137 Labor Code of the Russian Federation. This means that the employee can indicate in the application any percentage of the payment amount that he wants to receive on a card that does not belong to him.

The presence of an employee’s statement will help to justify the ownership of income received by another person, if we consider the possibility of tax risks arising from such transfers.

For information on paying personal income tax on wages, see the article “When to transfer income tax from wages?” .

conclusions

Rostrud has issued a special clarification regarding receiving wages under salary projects. An employee should not be “tied” to a specific bank. Everyone has the right to choose: use their own card or find a more suitable option. The employer does not have the right to refuse or impose a card from the bank with which he cooperates.

When applying for a job, you must carefully read the employment contract, which provides for an alternative option for receiving wages, planning in advance the possibility of receiving wages on another person’s card.

Common Questions

Is it possible, at the request of an employee, to transfer his wages to the account of another person if the employee’s account is seized by bailiffs?

The employer has the right to transfer the employee’s wages to the accounts of third parties at his request, provided that this clause is specified in the employment agreement. The employer’s actions in question are not prohibited by law, and liability for them is not provided. That is, in this case we are not talking about withholding, but about the employee’s will to dispose of accrued wages. An employee can dispose of his wages at his own discretion by submitting a corresponding application to the accounting department.

It’s another matter if the bailiffs sent a writ of execution against this employee to the employer, and the employee asks to transfer his income to the accounts of third parties in order not to pay obligations. In this case, the employer’s actions may be regarded as failure to comply with the legal requirements of the bailiff, as well as the provision of false information about the debtor’s property status. This offense entails the imposition of an administrative fine under Art. 17.14 Code of Administrative Offenses on:

- citizens in the amount of 2,000 to 2,500 rubles;

- officials - from 15,000 to 20,000 rubles;

- for legal entities - from 50,000 to 100,000 rubles.

How to formalize a condition for transferring income to third party accounts in additional. agreement to the employment contract?

If the employment contract itself does not contain a provision for transferring the employee’s income to third party accounts, draw up an additional agreement, indicating the following wording:

Amend clause 3.4 of the employment contract as follows: “3.4. The salary is transferred to the account in the credit institution specified in the Employee’s application, including to the account of a third party.”

Is it possible to transfer the salary of a deceased employee to third party accounts?

Within 4 months from the date of death of an employee, the employer has the right to pay the remainder of the deceased employee’s salary to any member of his family. The basis for payment will be:

- an application from a family member to transfer amounts due to the deceased employee to his account;

- a document confirming the relationship with the deceased employee (marriage certificate, birth certificate, etc.);

- employee's death certificate.

The deadline for transferring wages, compensation for unused vacation days, and sick leave benefits is no later than a week from the date of receipt of the relevant papers (Article 141 of the Labor Code of the Russian Federation).

ATTENTION! Payments accrued after the death of an employee are not subject to personal income tax and insurance contributions (Letter of the Ministry of Finance dated January 22, 2020 N 03-04-05/3420).

After 4 months from the date of death of the employee, the employer will be able to pay the money due to him only to his heir on the basis of a certificate of inheritance (clause 3 of Article 1183 of the Civil Code of the Russian Federation).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Filling out an application to transfer salary to another person

Transfers to a third party card are of a declarative nature. The application must be in writing; its form is not formalized and is not fixed by law. Each company creates its own template and its own requirements for writing applications. The application must reflect the following information:

- In the back right corner: in the dative case: position of the manager, name of the organization, full name of the manager, position, structural unit

- in the genitive case: full name of the employee applying for financial assistance

Thus, it falls on management to satisfy the employee's request.

Salary payment error

The salary must be paid directly to the employee, except in situations where the payment is provided for in the employment contract.

If there is a condition in the employment contract that the employee chooses the person in whose favor the payment will be made, the organization can transfer the employee’s salary to the account or card of another person based on an application where you need to indicate: the payment period (for example, wages for August 2022) , amount of payment (full salary or part thereof), recipient details.

How to transfer salary to a card of another bank

Initially, you need to decide on a credit institution. This must be a Russian bank. The card does not have to be a salary card - this is a symbol for mainly debit cards to which organizations transfer wages to their employees. If a full-fledged salary project is drawn up, then a legal entity or individual entrepreneur within its framework receives a number of additional preferences.

You can make any card a salary card: the date it was issued does not matter. An employee may have a card in his hands long before he decides to make it a salary card. This is a fairly common practice. You can change the bank to receive your salary as follows:

- Fill out an application addressed to the employer.

- Submit your application to your employer and wait for it to be reviewed.

An application to change a salary card is submitted to the employer, and not to the accounting department. The reason for this is that in most organizations accountants are not authorized to deal with such issues. Moreover, changing the salary card of even a single employee means an increase in the amount of work for the accountant. Disagreements arise precisely on this basis.

How to write an application to change your salary details

There is no unified form for such a statement. In fact, it is compiled in free form. After the “header” (to whom, from whom, for what reason), the following document structure is used:

- Recipient - full name of the applicant.

- The account number for crediting wages can be checked in the Internet bank, through an ATM, or by calling the hotline.

- Name of the credit institution.

- Correspondent account.

- BIC.

To clarify the purpose of the payment, indicate “salary transfer”. On the websites of most major credit institutions, you can download such an application form and submit it to your employer or accounting department.

What needs to be agreed upon with the bank

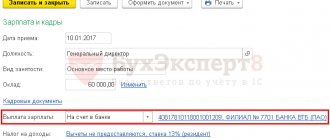

Using Sberbank as an example, a salary project is opened without additional contracts and approvals. After issuing a Mastercard card, the client, through Sberbank Online, performs the following actions:

- Log in to Sberbank Online and select a card.

- In the card settings, select the “Make a salary card” option.

- Create and download an application.

- Submit your application to your place of work.

- Wait for your salary to be transferred.

After the first salary transfer, the Sberbank salary project is activated automatically. The client receives a corresponding SMS message and push notification. From this moment on, the client enjoys all the benefits of the salary project.

An employee does not agree to a salary project

When concluding an employment contract with an employee, the employer indicated that the salary would be transferred to the employee’s bank account, which was opened as part of a “salary” project in a certain bank.

A similar provision is enshrined in the collective agreement. Can an employer refuse to transfer wages to the account designated in the employee’s written application? The employer cannot refuse to transfer wages to the employee’s bank account specified by him in a written application.

We have instructions on what to do if an employee does not want to agree to your salary project.

Rationale. Article 136 of the Labor Code of the Russian Federation states that wages are paid to the employee, as a rule, at the place where he performs the work or is transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective or labor agreement.

In this case, the employee has the right to change the credit institution to which his wages should be transferred, informing the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment of wages. Thus, it follows from labor legislation that an employee can, in writing, replace the credit institution, that is, the bank from which he wants to receive wages.