How to correct errors in SZV-STAZH

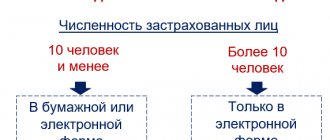

There are three types of correction forms:

- corrective (KORR);

- canceling (OTMN);

- special (OSOB).

The choice of form depends on what error was made in the original report. When filling out the form, abbreviations are indicated.

The correction form is submitted if it is necessary to correct an error in the registered data. The list of such situations is limited:

- it is necessary to correct the amount of payments to the employee or the period of service;

- It is necessary to supplement the information on the amounts of contributions.

The second type is used to cancel information - for example, if the report contains information about an employee who no longer works in the organization. A special form is submitted if you forgot to add data about an employee to the original report.

How to make an RSV adjustment

Question: The employee works under a GPC agreement, the agreement with him was signed on December 25, 2018, and payment was made on January 10, 2019.

Insurance payments were accrued in December, the DAM report was completed for the year, and 6-NDFL appears in the report for the first quarter. How to adjust the RSV? Answer: No adjustment is required. The payment date is the day the employee is accrued. If remuneration and contributions from it are accrued in the 2018 calculation period, then they must be reflected in the DAM for 2022. The situation is different with the calculation of personal income tax. The date of receipt of income is the day of payment or transfer to the taxpayer’s account. Therefore, for remuneration accrued in December but paid in January, tax must be withheld on the day of payment and transferred no later than the next day. Since these actions were carried out in the 2019 tax period, they are reflected in the calculation of 6-personal income tax for the first quarter of 2022.

Question: We passed the zero RSV. The founder and general director of the enterprise are the same person; he did not enter into an employment contract with himself, so he was not paid a salary. The Federal Tax Service inspector said that it is necessary to submit the RSV adjustment. Will it be correct to reflect the director as an insured person in the DAM?

Answer: Labor relations arise as a result of appointment to a position or confirmation in a position - in your case they arose due to the fact that the founder appointed himself as a director (Article of the Labor Code of the Russian Federation). In accordance with the laws on compulsory insurance, the general director is insured. Therefore, in lines 160, 170 and 180 of subsection 3.1 of section 3, the attribute “1” should be indicated. The number of insured persons in line 010 in Appendices 1 and 2 to Section 1 must be equal to one. If there are no payments, subsection 3.2 of section 3 is not completed.

Question: It is necessary to submit the DAM adjustment for 2018, since accruals under the GPC agreement for five employees were taxed not at 10%, but at 22%. What sections need to be adjusted when correcting the amount of the base and contributions for employees so that there is no doubling of accruals for employees with the adjustment in the Federal Tax Service base?

Answer: In the updated calculation in Section 3 for these employees, it is necessary to reduce the amount of the base (columns 220 and 230) and the amount of contributions (column 240). Payments that exceed the maximum base amount and contributions calculated from them are not reflected in the personalized information. In subsection 1.1 of Appendix 1 to Section 1, amounts that exceed the maximum base value must be indicated in line 051, and contributions from these amounts at a rate of 10% - in line 062. Contributions in line 061, accrued at a rate of 22%, must be reduced by the corresponding amount and adjust the values in lines 030–033 of section 1 in accordance with line 060 of subsection 1.1. In order for the updated calculation to be correctly loaded into the Federal Tax Service database, you need to change the adjustment number in line 010 of section 3 from “0” to “1”, and in line 040 leave the number that was in the primary calculation.

Question: In the first quarter the company was on the simplified tax system, so they passed the DAM with tariff code “02”, and in the second quarter the company switched to OSNO. Do I need to make an adjustment to the DAM for the first quarter with code “01” and recalculate contributions?

Answer: Tariff codes “02” and “01” are used by insurance premium payers who apply the basic tariff established by Art. 425 Tax Code of the Russian Federation. Since the tariff rates for these codes are the same, and the amounts of the base and calculated contributions were not underestimated, there is no need to recalculate the contributions. But it is better to submit an updated calculation with tariff code “01” without section 3, since nothing changes in the personalized information. This will avoid misunderstandings if the Federal Tax Service checks calculations on a cumulative basis from the beginning of the year by tariff code.

Question: Is it necessary to submit an adjustment according to the DAM if an employee from Armenia has been assigned the status “Equal to citizens of the Russian Federation”, but the VPNR code was mistakenly entered in the IS?

Answer: The category codes of the insured person NR (hired employee) and VPNR (temporarily staying in the territory of the Russian Federation) refer to the same tariff for calculating pension contributions. An error in specifying the code does not lead to an underestimation of the calculated contributions to the compulsory pension insurance, so you can do without adjustments. But please note that if you use a program to fill out the calculation, which is configured to auto-calculate indicators of other subsections depending on the category, then the VPNR code may lead to distortion of the amounts:

- payments in subsection 1.2 (temporarily staying foreigners are not insured in the compulsory medical insurance system);

- social insurance contributions for temporary disability and in connection with maternity in Appendix 2 (temporarily staying foreigners contributions are calculated at a rate of 1.8%, not 2.9%).

Question: The employee’s last name in SNILS was entered with an error. He changed the documents and reported this to the Federal Tax Service, but recently it turned out that in the DAM report it goes through twice: once with the correct data, the second time with incorrect data. We sent an adjustment to include this employee in Section 3 twice: with the wrong last name (zero amounts) and with the correct last name. Now the accruals for the “wrong” employee have been reset to zero, but he is still listed in the Federal Tax Service database, so the number of insured persons between the company and the tax office does not agree. How to submit an RSV adjustment?

Answer: In order for an individual’s data to be permanently deleted from the Federal Tax Service database, it is necessary to indicate the sign “2” in adjustment section 3 (with an adjustment number other than zero) with zero amounts in lines 160, 170, 180 - not insured.

Question: An individual employee worked unofficially for an individual entrepreneur from 11/01/2006 to 06/01/2018. Now he is retiring, and he needs to include this period in his length of service. The contributions have been calculated, paid to the MRI, and now you need to submit a report with adjustments for 2022. How to fill out the DAM adjustment for previous years, where to indicate this employee and how to assign his length of service?

Answer: For each reporting period from 2006 to 2016, you need to submit information about the employee using the SZV-KORR form with the “OSOB” type, where you indicate the amounts of payments, accrued contributions and periods of service. In the adjusting RSV-1 for 2016, additional accrued contributions must be reflected in line 120 of section 1 and in section 4 (section 6 should not be included in the adjusted calculation). For 2022 and 2022, information about periods of work must be submitted for the employee using the SZV-STAZH form with the “Additional” type. And information about the amounts of payments and contributions must be reflected in the updated calculations for insurance premiums (submitted to the Federal Tax Service for each reporting period in 2022 and for the first quarter and half of 2022) in section 3 of the employee.

Reporting on employees: mass operations and filters.

To learn more

How to pass the supplementary SZV-STAZH

If an employee was not included in the reports for 2022 and later periods, then such an error is corrected using the SZV-STAZH form with the “Additional” type. There is no data on such employees in the Pension Fund yet, so there is nothing to correct there with the help of SZV-KORR.

Also, SZV-STAZH with the “Additional” type is submitted if errors were made in the original form, due to which the report was partially accepted. If the Pension Fund rejected information about some employees, then information about them did not go to the individual personal account. This is possible due to errors with status “30”.

Why do we need to correct mistakes?

SZV-STAZH - a form of personalized reporting to the Pension Fund of the Russian Federation, containing information about the employee’s length of service, both general and preferential. This data directly affects the correctness and timeliness of calculating pensions to employees, so try to avoid any inaccuracies in them.

Errors made and discovered in the SZV-STAZH report must be corrected in order to:

- avoid claims from employees;

- protect yourself from fines from regulatory authorities.

How to quickly make clarifications? If inaccuracies are discovered by the policyholder himself, there is no specific deadline for correcting them, but we recommend doing this immediately upon discovery of the defects. If the Pension Fund notices the error and sends a corresponding notification, then the organization has 5 days to make changes.

ConsultantPlus experts discussed how to correctly fill out the SZV-KORR. Use these instructions for free.

How to pass SZV-KORR with the “Special” type

The SZV-KORR “OSOB” form is submitted to provide information for periods before 01/01/2017 for the insured person, information for which was not included in the previously submitted reports. The form must fill out sections 1-3 and at least one of sections 4-6. It depends on what information needs to be supplemented: periods of work, accruals at the regular or additional rate.

The type “SPECIAL” is indicated in the header of the form. The report is submitted in the general order.

Important: this form is not used to correct SZV-STAZH.

Add or remove an employee

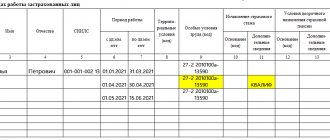

Let's consider how to make an adjustment to SZV-STAZH for 2022 for one employee if information about him was not indicated or was indicated incorrectly.

Option 1. Exclude an employee:

- Fill out the SZV-KORR form indicating in the “type of information” section - “OTMN”.

- The first and second sections are filled in, the rest are empty.

- Together with the corrective one, EDV-1 is sent.

We offer a sample of how to fill out the SZV-STAZH adjustment for 2021 in order to cancel previously sent information.

Option 2. Add an employee:

- Fill out the form as for primary information.

- The “Additional” code is used before submitting the SZV-STAZH adjustment for 2022 or for another past period: put a tick in the “Additional” field.

- Provide accurate information.

- EFA-1 is attached to the revised report.

How to pass SZV-STAZH with the KORR type

If the report contained erroneous information, which the Pension Fund accepted and entered into the employee’s HUD, they can be corrected using the SZV-KORR “CORR” report.

For example, if the SZV-STAZH does not indicate some periods of work or working conditions for early retirement.

With the same report, you can correct data on income, accrued and paid insurance premiums, and the employee’s insurance record.

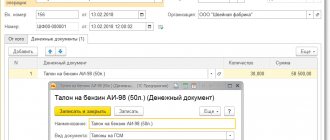

Location of the SZV-STAZH and SZV-KORR forms in 1C:ZUP

SZV-STAZH and SZV-KORR reports :

- in the section Reporting, references - 1C: Reporting with the switch set to By category , in the report group Reporting by individuals :

- in the section Reporting, certificates - Pension Fund. Packs, registers, inventories.

create an EFA-1 :

- in the section Reporting, references - 1C: Reporting with the switch set to By category , in the report group Reporting to funds

- in the section Reporting, certificates - Pension Fund. Packs, registers, inventories.

SZV-M due date

In a situation where the data in the original report is subject to adjustment, the employer has a number of questions about the supplementary form SZV-M about the deadline for submission and penalties, as well as about the rules for its execution.

Find out whether there will be a fine for supplementing the SZV-M form from the article “You missed an employee in the SZV-M - how to fix it.”

There are no special rules regarding the timing of submission of the supplementary SZV-M: specific calendar dates are not established in the legislation for this report.

At the same time, in paragraph 40 of the Instructions, approved. By order of the Ministry of Labor dated April 22, 2020 No. 211n, the period during which the employer can correct errors discovered by Pension Fund specialists in the original SZV-M without sanctions is established. It is five working days from the date of receipt from the fund of notification of errors in the report.

The Pension Fund has the right to give notice to the employer in one of the following ways:

- hand over in person against signature;

- send by registered mail;

- send via TKS electronically.

Let us recall the rules by which the date of receipt of the notification is determined:

- when sent by mail - the sixth day from the date of sending a registered letter (Article 17 of Law No. 27-FZ dated 04/01/1996);

- when sent electronically - the date specified in the confirmation of receipt of the employer’s information system (clause 38 of the Instructions, approved by order of the Ministry of Labor dated April 22, 2020 No. 211n).

It is important to remember these subtleties, since an incorrectly calculated date of receipt of the notification will not allow the five-day period for completing and submitting the report to the Pension Fund to be correctly calculated. It is possible to submit a supplementary SZV-M without a fine only if the specified deadline is met.

Find out in ConsultantPlus what is the deadline for submitting a supplementary SZV-M if you independently discover an error. Trial access to the system can be obtained for free.

The Pension Fund of Russia issued a fine for supplementary SZV-M - do not rush to pay

The Pension Fund issues two types of fines for supplementing SZV-M in 2022 (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation, Part 3, Article 17 of Law No. 27-FZ dated April 1, 1996):

- per company - 500 rubles. for each forgotten employee;

- per manager - from 300 to 500 rubles.

For controllers from the Pension Fund of the Russian Federation, it does not matter that the employer himself discovered the missing information in the original report and corrected them by submitting a supplementary SZV-M (letter of the Pension Fund of the Russian Federation dated March 28, 2018 No. 19-19/5602). In their opinion, information on forgotten employees was submitted late, and a fine is provided for this.

If the employer himself has discovered incomplete data in the original report, there is a good chance of a judicial cancellation of one of the fines, the amount of which is determined based on the number of employees reflected in the supplementary SZV-M (determination of the RF Armed Forces dated December 20, 2019 No. 306-ES19-23114, resolution AS of the Far Eastern District dated December 13, 2019 in case No. A37-1648/2019, of the Ural District dated December 19, 2019 in case No. A07-9848/2019, etc.).

The fine can be successfully challenged in court even in the case where the error was found by the PFR inspectors, and the employer managed to submit the supplementary SZV-M within five days after receiving the notification from them (determination of the RF Armed Forces dated July 5, 2019 No. 308-ES19-975).

The penalty in the form of an administrative fine for supplementing the SZV-M form imposed on the director cannot be canceled, even if the company is exempted from the fine (Resolutions of the Armed Forces of the Russian Federation dated August 13, 2019 No. 80-AD19-8, dated December 20, 2019 No. 1-AD19- 5).

But there is also good news. Individual entrepreneurs are subject to administrative liability under Art. 15.33.2 of the Code of Administrative Offenses of the Russian Federation is not currently applied (law dated December 16, 2019 No. 444-FZ). Such amendments to the Code of Administrative Offenses appeared thanks to the Constitutional Court of the Russian Federation, which recognized the situation as inconsistent with the Constitution when an entrepreneur is held liable for SZV-M twice: as an insurer (under the law on personalized accounting) and as an official (under the Code of Administrative Offenses of the Russian Federation).