In current realities, conducting an on-site audit as a form of tax control is a real scourge of small businesses. After all, such a measure on the part of the Federal Tax Service in 80% of cases threatens with serious fines. And monetary compensation is not the worst thing that can happen to a company.

And the reason for such a high percentage of sanctions lies in the fact that managers simply do not know how to properly prepare for it. And the fact is that most people simply do not have a clear idea of what this event entails and what algorithms it uses. The powers of the inspection staff and the procedure for carrying out the procedure are unclear. And in some cases, even the purpose of the event remains very vague for the entrepreneur. Although it would seem that it is simpler. The object should always be potential evasion of payments, distortion of documents and concealment of unspecified inventory items. But, as practice shows, the moment is not always correct.

In this review we will look at all aspects of the process.

What it is

So, on-site tax audits can be carried out in relation to completely different legal entities. But if you look at the statistics, simplified individual entrepreneurs are the most realistic candidates. Why is this happening? Yes, first of all, the fact is that there are simply more such companies than full-fledged LLCs, OJSCs or CJSCs. And every entrepreneur, given the conditions, will always try to switch to the simplified tax system, because it is simply profitable. And even if not all requirements are met, the manager often strives for this system. This is the second aspect, checking the legality of this peculiar transition.

As for the concept itself, there is no clear definition recorded in the Tax Code of the Russian Federation. But it can be removed without any problems. Such formats, unlike their office counterpart, are always of a special nature. That is, this is not an ordinary process that takes place at the end of each reporting period, month or year. No, such research has not been systematically carried out since 2022, not counting some enterprises operating in the healthcare or social sphere.

Therefore, since this is not a typical case, it requires adequate and compelling reasons. That’s right, an on-site tax audit is carried out on the basis of already identified violations or suspicions of their presence. If you have received increased attention from the Federal Tax Service, you receive a kind of tick in the personal file of the enterprise. And if enough of them accumulate, then the arrival of the tax authorities will not take long. It is also worth understanding that even one major violation is quite capable of triggering the arrival of employees. Usually suspicions arise during a desk procedure. If there are obvious errors, then the reporting is simply returned to the taxpayer. And he must correct it in a timely manner. The period is only 5 days. But if suspicions arise that potential evasion is taking place, but this cannot be directly tracked in the declaration, a departure is scheduled. Circumstantial evidence is sufficient for this.

Accordingly, we understand what the appointment procedure and regulations for conducting an on-site tax audit are. This is a specific algorithm for collecting evidence, assessing their quantity and weight. Unfortunately, exact data on the indicated points is unknown. Everything depends on the decision of the head of the department of the Federal Tax Service at the place of registration of the organization. In some cases, one package of evidence may be considered sufficient, but in another it may not. Therefore, you should not strictly focus on this. It is better to always keep in mind that “guests” can knock on the door literally at any moment. At least, this is relevant after submitting reports for the period. Its study takes up to three calendar months. And at this time it is best to be especially vigilant.

As for the definition, the procedure is characterized by the following aspects:

- Conducted on site.

- Lasts from 1 day to 2 months.

- Employees have special powers and will have to provide any primary documents upon request, as well as property owned by the enterprise, if available. And free passage through any premises, including warehouses, archives, laboratories and other areas.

- The basis for the decision to conduct an on-site tax audit is an order from the head of the department of the Federal Tax Service.

- According to Art. 89 of the Tax Code, the total duration of the event cannot be later than 3 years after the order. Standard limitation period.

Procedure for reviewing materials

The procedure for studying materials is divided into three stages.

First stage

First, preparatory actions are carried out (clause 3, article 101 of the Tax Code of the Russian Federation):

- Disclosure of the list of materials that will be analyzed.

- Checking the attendance of persons summoned to the meeting.

- Checking the credentials of the persons who have appeared.

- Disclosure of the rights and obligations of participants.

After this, the main stage of reviewing materials begins.

Second phase

The materials are analyzed on the basis of Article 101 of the Tax Code of the Russian Federation. The tax representative, based on paragraph 5 of Article 101 of the Tax Code of the Russian Federation, must establish the following points:

- Presence of violations of tax laws.

- Availability of grounds for prosecution.

- The presence of aggravating and mitigating circumstances related to the detected violation.

First, representatives announce the inspection report, and then their objections to it. At the meeting, a kind of debate takes place.

Third stage

The head of the tax office makes a decision based on the results of consideration of the materials. The taxpayer is either liable or not. The decision will not be announced immediately. It is prepared in writing and then handed to the taxpayer.

ATTENTION! Sometimes the tax office requires additional evidence to impose liability. In this case, auxiliary measures are carried out. Based on their results, a second meeting is held on the basis of Resolution of the Presidium of the Supreme Arbitration Court No. 391/09 of June 16, 2009.

Species diversity

Despite the fact that there is no clear concept in the Tax Code of the Russian Federation, this study is still divided into several types. Let's look at each of them.

- Specific. Only one transaction is affected. And this is the safest option for the organization itself. Tax officers will not be interested in all taxable activities, but only in the selected agreement. It is here, according to employees, that the violations are hidden. And in any case, even if it really exists, it’s not so scary. The most unpleasant thing, besides the standard fine, is the potential cancellation. But what’s interesting is that usually the attention of the Federal Tax Service in this case is not the organization itself being inspected, but the counterparty. Simply uploading information through the second party is easier, safer and faster. How to work with the potential accused himself.

- Selective. This is already more unpleasant. Such an on-site tax audit can cover entire verticals and layers of activity. Usually one is selected. Relevant for companies that operate in several areas at once. Conveniently, other industries are not suffering at all at the time of the event and are not suspending their activities. But the research will be very meticulous in any case. And despite the fact that the request will concern one vertical, be prepared to provide tax authorities with access to any location. Even to warehouses that are practically not connected with this area.

- General. The most unpleasant, protracted and painful option for the company. And what’s most annoying is that it is prescribed with considerable frequency. After all, for a selective analogue you need to at least have clear suspicions about a specific industry. But they are not always there. So you have to go through the entire company as a whole to catch where exactly the violation is hidden. And as often happens, instead of the one that was suspected, there are dozens of new ones. Considering how an on-site audit takes place, what the tax inspectorate checks during an on-site audit, they will be able to get to the bottom of all the “gray” points of the enterprise. All primary documentation is reviewed and supply agreements are fully analyzed. Even accounting entries, cash registers and accounting journals are considered. They can easily check the warehouse for compliance with the real component of the inventory and their documentary reflection.

In connection with the latter, it is always worth having high-quality software that allows you to carry out this kind of reconciliation in a timely manner.

can help with this. Thanks to special software, inventory is carried out by just one employee. And for this you don’t need any additional equipment, just a smartphone. Software from Cleverence is:

- Simplifying the daily responsibilities of employees.

- Program developed to meet modern requirements of Russian legislation.

- Utilities customized for enterprises.

- Professional packaged offers for businesses of any size.

Sending the act by mail

If an organization (its representative) avoids receiving an on-site inspection report, the inspection reflects this fact in the report and sends it by registered mail to the location of the organization (separate unit). In this case, the date of receipt of the act is considered to be the sixth working day from the date of sending the registered letter. This follows from the provisions of paragraph 2 of paragraph 5 of Article 100 and paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Moreover, the countdown of the six-day period begins from the day following the day of sending the act (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

Situation: does the inspection have the right to transfer a tax audit report (desk, field) by registered mail (by mail), if the organization does not evade receiving it?

The inspectorate may send a tax audit report by registered mail. But the date of its receipt will be considered the sixth working day from the date of sending the registered letter only if the organization evaded receiving the act. If the organization did not evade receiving the act, then the day of its delivery should be considered the day the organization actually received the registered letter.

This conclusion follows based on the totality of the following norms.

Tax legislation indicates that the inspectorate has the right to transfer a tax audit report in person against a signature or in other ways indicating the date of receipt of the report by the organization. This is stated in paragraph 1 of paragraph 5 of Article 100 of the Tax Code of the Russian Federation. Consequently, sending the act by registered mail is not a violation of the law on the part of the inspectorate, since this method of transmission allows one to reliably determine the date of actual receipt of the act by the organization.

At the same time, the legislation specifies that the inspectorate has the right to send a tax audit report by registered mail only if the organization avoids receiving it. In this case, the date of receipt of the act by the organization is considered to be the sixth working day from the date of sending the registered letter. This follows from the provisions of paragraph 2 of paragraph 5 of Article 100 and paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Moreover, the countdown of the six-day period begins from the day following the day of sending the act (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

The regulatory agencies did not express an official point of view on this matter. But in arbitration practice there are court decisions that confirm the legitimacy of this conclusion (see, for example, Resolution of the FAS of the Volga District dated December 17, 2009 No. A55-5813/2009).

Situation: to what address of the organization - legal or actual - should the inspection send a registered letter with a tax audit report (office, on-site)?

The inspectorate must send a registered letter with a tax audit report to the location of the organization, that is, to its legal address, which is indicated in the Unified State Register of Legal Entities (clause 5 of Article 31, clause 5 of Article 100 of the Tax Code of the Russian Federation). Similar explanations are contained in paragraph 1 of the letter of the Federal Tax Service of Russia dated September 20, 2013 No. AS-4-2/16981.

Situation: is the inspection obliged to attach to the report handed over to the organization evidence of violations that were identified during a tax audit (on-site, office)?

If documents received from the organization being inspected serve as evidence of a violation, then the inspectorate is not obliged to attach such evidence to the inspection report.

In this case, the following features must be taken into account.

If evidence of a violation is provided by documents received from other sources (for example, documents from counterparties, protocols for interviewing witnesses), then the inspectorate must attach such evidence to the tax audit report. This obligation remains even if information received from third parties:

- constitute a banking, tax or other secret protected by law (for example, commercial);

- contain personal data of citizens.

In these cases, not complete copies of documents, but extracts from them certified by the inspectorate should be attached to the tax audit report.

This procedure is established by paragraph 3.1 of Article 100 of the Tax Code of the Russian Federation, paragraph 1.13 of Appendix 6 to the order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Grounds for conducting an on-site tax audit

As we have already noted, there is always a reason. The procedure is not systematic. This means that there are a number of legitimate claims with the help of which the decision to order this study is made. VPN is often prescribed if there are suspicions of corrections or inaccuracies in the data reflected in the declaration. This is the most common case. Plus, the timing of the transfer also plays a role. If the reporting arrived significantly late, this is also a kind of alarm bell.

If before this the company already had difficulties with paying contributions to the budget of the Russian Federation, certain sanctions from the Federal Tax Service have already accumulated - this is an additional point in favor of the VPN. No less important is the organizational status of the company. If the taxpayer's system has recently been changed to one of the simplified forms, there will also be close attention. Moreover, employees may simply want to check whether the transition conditions have actually been met.

But, considering what documents the tax authorities check during an on-site tax audit, they still need permitting documentation signed personally by the head of the department. Therefore, a fictitious and vague reason will not work. If the arriving Federal Tax Service employees do not support their requests with warrants, then you can ignore them. And you will definitely know the reason indicated, recorded, signed and stamped.

How is the check carried out?

Standards for conducting audit activities are prescribed in the legislation of the Russian Federation. In addition, some rules may be contained in the accounting policies of the organization.

During the verification process, many parameters are taken into account:

- direction of the company's activities;

- personnel qualifications;

- rates of growth;

- financial condition, etc.

Next, the provided documents are reviewed and analyzed, as well as the actions performed by the company’s employees.

Often audit activities take several days, or even weeks - the specific period is negotiated individually and depends on many factors, including the size of the organization, the presence of structural divisions and branches, the duration of the period for which the audit is carried out, etc.

In any case, the audit is not carried out more than once a year.

Procedure

Again, there are no strict regulations. Yes, there are some elements that apply in one situation or another. But which ones will be involved in your case depends on the suspicion and severity of potential violations, the scope of their occurrence and many other factors.

Nevertheless, the procedure for conducting an on-site tax audit is formalized only by legal means. Therefore, after each action, a report will be drawn up. And they can be as follows:

- Visual inspection of premises. And you should not interfere with gaining access to any rooms or buildings. Even if it's the director's office. Nevertheless, from this perspective, the Federal Tax Service has legal requirements for unhindered movement throughout the territory.

- Inventory. That's why we emphasized the importance of this point in the preliminary stage and the need for software that simplifies this process. Tax officials will be as closely as possible during their work. Therefore, if the commission conducting the inventory before this took a careless approach to the work, at this stage the whole truth will be revealed.

- Request and seizure of documents. That is, documentation may be required to be presented on the spot. And take it with you for further study, if right now it is not possible to identify the presence or absence of errors and falsification.

- Expertise. For this task, independent experts from various fields and levels are involved. Remember that you do not pay for their activities, even if it turns out that violations actually took place. And you are completely free to watch them work. It is your right to be present during an on-site tax audit.

- Interrogation. Persons who are employees of the company, as well as third parties with information, give testimony. According to the law, you cannot be forced to do this. But remember that refusal to provide information may become a reason for going to court. And during the legal proceedings it will no longer be possible to refuse.

The procedure for processing the results of a tax audit

The procedure for processing the results of a tax audit depends on 2 factors:

- type of inspection: desk or field;

- the actual result of the check: whether there are violations or not.

The entire resulting procedure is clearly stated in Art. 100 Tax Code of the Russian Federation.

Find the full text of the article, as well as comments on the main issues raised by its provisions, here.

Now let's briefly look at the main aspects.

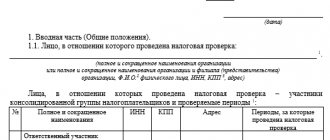

Results of the procedure, final acts

Upon completion of the collection of information and evidence, identification and analysis of all accompanying documentation, epilogues become a special act. Its form is KND 1165010. In fact, it is a kind of confirmation that the procedure was successfully completed. It is transferred to the manager or owner of the company. And it also indicates the subject of the research. And this is very important. According to the law, it is impossible to make a claim in any industry or transaction if the VPN has already passed through it. This is a kind of shield, unless, of course, violations are revealed.

After transmitting the document, all information received will be carefully analyzed. And the result will be another act - KND 1160098. It will tell you whether mistakes were made, whether there are deviations from the norms, whether sanctions will be applied. Its preparation takes time, but no more than 2 months.

Drawing up an act, features of the document

There is no unified sample audit report, so it can be written in any form. However, when compiling it, it is important to take into account some features common to all such documents.

In particular, it is necessary to divide the act into sections. There must be at least three of them:

- beginning (the so-called “head”),

- main part,

- conclusion.

The details of the organization in which the inspection is being carried out, as well as information about the person checking, are entered at the beginning, the methods and progress of the inspection are included in the main block, and the conclusions of the experts are included in the conclusion.

The act must be signed by the person or group of persons who carried out the inspection - thus, they indicate that all the information entered into it is correct and they bear full responsibility for it. The act must also contain the auditor's seal.

The document is drawn up in two identical copies . One of them remains with the auditor, the second is transferred to the customer company. A note about the act should be entered in the enterprise's documentation journal - it is usually kept by the secretary.

Appeal

If you do not agree with the result, no one cancels the right to file a complaint against the actions of employees. To do this, you need to contact the higher authority of the Federal Tax Service directly. The form is free, but do not forget to attach the document you receive.

It is also of interest how often on-site tax audits can be carried out. And wouldn’t it be a violation on the part of the service to have too systematic a VPN? Actually the answer is simple. The frequency depends only on the presence of legal reasons on the basis of which the head of the department makes a decision. That is, at least every reporting period. Or basically never.

By the way, if your complaint is not successful, this is not a reason to despair. You still have the right to protect your legitimate interests through legal proceedings. Therefore, feel free to go to court if you are sure that the Federal Tax Service has exceeded its powers or made a mistake.

Results of materials review

The decision of the meeting is drawn up in the form approved by Order of the Federal Tax Service No. MM-3-06 / [email protected] dated May 31, 2007. The document specifies the circumstances of the violation established during the inspection (clause 8 of Article 101 of the Tax Code of the Russian Federation). The decision must contain the following information:

- Links to papers confirming the circumstances of the violation.

- Arguments given by the payer in defense of its interests.

- The results of consideration of these arguments.

The next point is the decision to hold the company liable. It is accompanied by information such as:

- Indication of the offenses committed.

- Provisions of articles of the Tax Code of the Russian Federation that were violated.

- Imputed penalties.

- The size of the detected arrears.

- Amount of accrued penalties.

- Fine.

IMPORTANT! The decision must be accompanied by indications of the violated legislative acts. Otherwise, the decision is canceled on the basis of paragraph 10 of the Information Letter of the Presidium of the Supreme Arbitration Court No. 71 dated March 17, 2003.

If the payer is not held liable, a decision is also drawn up. It contains this information:

- The amount of arrears, if any were discovered.

- Amount of penalties accrued.

- Deadline for appeal.

- Name and address of the tax authority considering appeal cases.

- Other necessary information.

The decision to refuse to impose liability does not exclude the financial liability of the payer for offenses. As a rule, this is a penalty.

Responsibility for violation

Depending on the severity of the offense, various consequences may occur. First of all, the tax office, the usual fines, sanctions; in case of delay, a penalty is also charged. For violations that are related to specific decisions of officials - administrative. But in fact, it also represents fines. But not to the enterprise as a whole, but to the individual. Remember that an on-site tax audit may be carried out to look for criminal offenses. And this is the most unpleasant case. If crimes are detected, the accused faces a real prison sentence.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Preparation and passing of VPN

Remember a few tips to minimize your risk:

- Always prepare and send reports to the Federal Tax Service on time.

- Don't raise your bid above the market average.

- Try to keep all accounting documents in order.

- Do not interfere with the activities of the Federal Tax Service.

- Do not try to switch to the simplified tax system if the conditions are not met.

- Report income and expenses in a timely manner.

And most importantly, study and understand what the methodology for conducting an on-site audit by the tax inspectorate is.

Then you will know exactly what actions from the tax authorities threaten you. Number of impressions: 1028