Hello, dear readers!

Maintaining accounting records is a rather complex process that many people cannot do. In order to correctly reflect all cash receipts and expenses, as well as other business transactions of the company, you need to know the basics and principles of accounting. Only a specialist can cope with this task. This is why many business owners resort to the help of professional accountants or outsourcing firms.

As they say, you put matters in the hands of knowledgeable people - and you don’t worry.

Accounting involves many activities, including:

- maintaining cash discipline,

- preparation of primary documentation,

- calculation and payroll of employees,

- preparation of a balance sheet,

- accounting of fixed assets,

- and much more.

If you are just planning to open your own business, then you are probably faced with the question of the need to maintain accounting records. Should I lead it or not? Limited liability companies are required to do this under any taxation regime. But whether an individual entrepreneur should keep accounting - this question is much more interesting. Let's look at this topic based on current legislation.

Who is required to keep accounting records in the Russian Federation?

The answer to this question is given by Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Those required to maintain accounting in the Russian Federation include:

- organizations engaged in commercial and non-profit activities;

- government agencies, local governments, management bodies of extra-budgetary state funds (including territorial ones);

- Bank of Russia;

- Individual entrepreneurs, private practitioners;

- Representative offices and divisions of foreign and international organizations located in the Russian Federation.

Thus, formally, individual entrepreneurs are classified as economic entities that are required by the state to keep accounting records.

However, in paragraph 2 of Art. 6 of Law No. 402-FZ IP are mentioned among those who may not do this. In this case, a mandatory condition must be met: the entrepreneur keeps records of income and expenses and other taxable items and physical indicators related to his activities.

So what is meant by keeping records mentioned by the legislator in paragraph 2 of Art. 6 of Law No. 402-FZ, and which entrepreneurs are required to keep accounting, and which individual entrepreneurs can rightfully not bother themselves with accounting?

How to independently organize accounting for an individual entrepreneur - step-by-step instructions for beginners

In order for the business to succeed from the very moment of formation of the individual entrepreneur, I recommend starting with the organization of accounting.

My step-by-step instructions will tell you how to do this correctly.

Step 1. We make a preliminary calculation of the estimated income and expenses of the business

First, you need to make a list of all the expected income and expenses of your company. This is necessary to calculate how expensive your business is, what share of expenses in the income of your individual entrepreneur.

The amount of expenses, as well as income, will play an important role when choosing a taxation system.

Example

My friend Larisa from Kazan decided to open her own business - a taxi service. To choose the right tax system, she made a preliminary calculation (I heard from friends that this helps a lot) of her future income and expenses.

That's what came out of it:

- estimated income for the year will be 12 million rubles;

- total expenses - 4140.6 thousand rubles, including: annual expenses for labor costs 2.28 million rubles. (6 employees), deductions from the wage fund 20.2% 460.6 thousand rubles, other expenses 1.4 million rubles. (car rental, office rental, communication services, etc.).

Having made the calculation, Larisa began choosing the most suitable taxation system.

Advice! Try to plan all your income and expenses as completely as possible. When calculating expenses, think about whether all of them can be confirmed by a correct primary document. This is important because tax authorities pay special attention to the expenses of organizations.

Step 2. Choose a tax system

An individual entrepreneur can choose almost any of the taxation systems adopted in the Russian Federation.

However, the most popular are general (OSNO), simplified (USN), imputation (UTII) and patent.

It is from these five types that we will choose. Ask why out of five, when four are written in black and white? Yes, because there are 2 types of simplification: “Income” and “Income - expenses”.

Having analyzed all the systems, I have collected their main pros and cons in a table, after reviewing which you can begin to choose the tax system that is suitable for your company.

Example

So, as we remember, Larisa calculated the expected income and expenses of her future company.

They made up:

- Revenues 12 million rubles;

- Expenses 4140.6 thousand rubles.

In the Republic of Tatarstan, taxi services can be provided on all systems, including imputation and patent, and, therefore, Larisa will also select a system for all types.

Larisa calculated all the main taxes that she would have to pay on different systems and, for greater clarity, collected them in this table.

Data for choosing a tax system:

| № | General system | STS "Income" 6% | STS “Income - Expenses” 10% | UTII | Patent | |

| 1 | Income tax 20% | 1 571 880 | 720 000 | 785 940 | 233 020 | 120 000 |

| 2 | VAT 18% | 1 830 508 | ||||

| 3 | Total | 3 402 388 | 720 000 | 785 940 | 233 020 | 120 000 |

Calculations have shown that for Larisa’s taxi service it is more profitable to choose a patent system, which is much cheaper, and in addition, this system does not require tax reporting.

In this example, I gave you an algorithm for choosing a tax system. Of course, the result of your calculations will be different and the system that suits your business may also be different.

When choosing a tax system, I advise you to pay attention to my general recommendations:

- if your individual entrepreneur’s expenses in relation to income are less than 60%, i.e. low-cost business, for example, provision of services, then the simplified tax system of 6% is suitable for you;

- if the expenses of your business in the income structure occupy 60% or more (remember how my friend Larisa planned her income and expenses) and all of them can be confirmed by correct primary documents, then the simplified tax system of 15% is what you need;

- if even the thought of tax reporting and accounting is a burden to you, and your type of activity is eligible for a patent, then don’t hesitate to choose this system;

- if your business is in the retail sector, then imputation is your everything:

- The general system is appropriate for large enterprises, for example, those involved in manufacturing.

Step 3. We understand the tax reporting of the selected system

Having decided on the system, you should understand tax reporting. The largest number of taxes, and therefore tax reporting, is on the general system.

Here the following are paid: property and profit tax, VAT, personal income tax, land and transport taxes. And these are just the main types. Add here your calculations as an employer with the Funds, it turns out quite a lot. Each tax and contribution has its own requirements, its own list of reports and deadlines for its submission.

With simplified tax reporting, everything is simple: the declaration is submitted once after the end of the tax period. In addition to the declaration, simplifiers submit reports on transport and land taxes, of course, if there are objects of taxation.

If the individual entrepreneur is an employer, then the following is additionally drawn up:

- personal income tax reporting;

- reports to the Pension Fund and the Social Insurance Fund;

- information on the average number of employees.

Impostors submit a UTII declaration quarterly. If there are employees, land or transport, then it is also necessary to submit reports on these grounds, similar to the simplified ones.

An individual entrepreneur who has acquired a patent does not submit a declaration.

Step 4. Determine the need to attract employees

At the initial stage, you should decide whether your individual entrepreneur needs to attract hired employees.

This is necessary in order to:

- calculate estimated personnel costs;

- decide whether you can independently carry out payroll calculations and do the necessary reporting on this section of accounting;

- organize workplaces for employees.

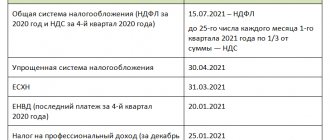

Step 5. Study the tax calendar of the selected system

In order not to get confused in numerous reports on taxes and contributions, you need to create a tax calendar.

This is not difficult to do because:

- firstly, the tax calendar can be downloaded from specialized accounting websites;

- secondly, the calendar can be found on the tax service website;

- thirdly, it will not be difficult to do it yourself, having first thoroughly understood this issue.

I offer an example of a tax calendar for your reference.

After you have selected or created your tax calendar, carefully study the dates, reports and information you will need to submit. Keep it at hand at all times, this will help you avoid missing important dates.

If you plan to organize accounting for individual entrepreneurs in a special online service, then there is no need for a calendar, since you will receive automatic reminders from the service about reporting deadlines.

Step 6. Organize a system for preparing documents for reporting

Before reporting, a number of activities must be carried out.

Preparatory activities:

- reconciliation of primary documents with accounting data - reconciliation can be continuous or selective, it reveals possible inconsistencies and errors;

- correction of all identified errors.

After the control measures have been completed, we begin filling out the reporting forms.

The completed reporting must be forwarded to the tax office. For individual entrepreneurs, reporting can still be submitted in 2 ways: on paper and electronically.

If everything is clear with the submission of paper reports, then with the submission of electronic reports there are nuances.

Tax reports can be sent via electronic communication channels in 2 ways:

- Independently , through specialized online services. To do this, you need to pay and obtain an electronic digital signature. How to get it is described in great detail in the service instructions.

- With the help of accounting firms offering such a service. Of course, the service is paid. With this method, the individual entrepreneur provides the company with all the necessary information for drawing up reports and their subsequent sending.

Step 7. Save all documents related to the business

The activities of even the smallest individual entrepreneur involve the creation and processing of various documentation, including accounting and tax documentation. All documents have certain storage periods.

There are several regulatory documents regulating this issue. For example, Federal Law No. 402 “On Accounting” states that accounting records and primary records must be stored for at least 5 years.

Tax registers and reports in accordance with the Tax Code of the Russian Federation are stored for at least 4 years. Information on settlements with the Pension Fund of Russia and the Social Insurance Fund must be stored for 6 years. Documents on settlements with personnel and personnel documentation for employees are stored for 75 years.

The individual entrepreneur must organize proper storage of documents in a specially designated room or in a specialized organization in compliance with the rules of archiving.

What is meant by accounting for income and expenses?

The concept of “accounting for income and expenses” is used in the Tax Code of the Russian Federation, which obliges taxpayers, in cases established by law, to account for income, expenses and their taxable items (subclause 3, clause 1, article 23 of the Tax Code of the Russian Federation). Thus, individual entrepreneurs may not maintain accounting records if they maintain tax records.

Let us remind you that entrepreneurs can apply the following tax regimes in their activities:

- simplified tax system;

- OSNO;

- Unified Agricultural Sciences;

- PSN.

Find out what taxes an individual entrepreneur must pay and what reports he must submit in ConsultantPlus.

Let's consider which of these regimes provide for accounting for income, expenses and other objects of taxation. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

How to choose a good accountant to run an individual entrepreneur - 4 simple tips

A good accountant is the cure for the headaches of any business owner.

As promised, I’ll give you some tips on choosing it.

Tip 1. Select candidates with higher specialized education

When choosing an accountant for your individual entrepreneur, pay attention to the candidates’ education. Give preference to specialists with specialized higher education.

I know many will say that experience is important, not education. But experience is a gain. Moreover, as practice shows, novice accountants most often undertake accounting for individual entrepreneurs, since it is believed that accounting here is simpler than, for example, accounting for an LLC.

Of course, there is no need to talk about any experience in this case.

However, it has been noticed that specialists who have a specialized higher education, even in the absence of work experience in their specialty, quickly and easily understand the tasks assigned to them, since they already have basic knowledge in the main specialized disciplines, are able to work with information, make the necessary calculations, compile accounting entries.

Tip 2. Pay attention to the candidate’s professional knowledge and skills

I recommend that you check the candidate’s professional skills. To make your task easier, I have prepared a list of questions, after receiving answers to which you will be able to form an initial opinion about the professionalism of the hired accountant.

Key questions for the candidate during the interview:

- What kind of work experience do you have in the field of our company?

- How many and what companies did you service?

- What taxation systems can an individual entrepreneur use?

- What kind of reporting needs to be prepared for each taxation system?

- Does an individual entrepreneur need to keep any registers?

- what programs can you use and at what level?

- What reporting methods do you use in your activities?

- What methods of legal tax optimization do you know?

- How often do you need to reconcile with the tax office?

- What is the procedure and timing for reconciliation with counterparties?

- If records are kept electronically, do I need to print out primary records and paper reports?

- What is an inventory and what are the basic requirements for carrying it out?

- What is the procedure and terms for storing accounting documents?

Tip 3: Read reviews from other customers

When choosing an accountant, do not be lazy to read reviews about him. In this case, the source becomes, for example, specialized forums on the Internet.

If you are planning to transfer the accounting of individual entrepreneurs to a specialist from your city, then ask your friends, perhaps one of them has already been a client of this specialist.

Tip 4. Don't try to save money

When outsourcing accounting to individual entrepreneurs or selecting an accountant for your business, do not save money. Remember: the miser pays twice.

Professional accountant services for individual entrepreneurs cannot be cheap. An experienced specialist not only processes primary data in a high-quality manner and prepares reports, he completely takes upon himself all the client’s problems in the field of accounting and tax accounting.

How to make accounting easier for individual entrepreneurs, watch the video.

Should individual entrepreneurs keep accounting records using the simplified tax system?

Let us turn to the clarifications of the Russian Ministry of Finance (letter dated July 26, 2012 No. 03-11-11/221), whose specialists interpret this situation as follows.

According to Art. 346.24 of the Tax Code of the Russian Federation, simplified persons are required to record their income and expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified taxation system. Its form and procedure for registration were approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

Consequently, the obligatory condition for accounting income and expenses by simplifiers, established by paragraph 2 of Art. 6 of Law No. 402-FZ will be observed, which means that they may not keep accounting.

The following articles will help you fill out the specified tax register correctly:

- “How to keep a book of income and expenses under the simplified tax system (sample)?”;

- “Book of accounting for income and expenses under the simplified tax system in 2020–2021.”

An individual entrepreneur has the right to combine the simplified tax system with the PSN.

Find out how to properly keep track of income and expenses in this case in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Accounting for an individual entrepreneur

Accounting for individual entrepreneurs on OSNO

Many entrepreneurs simply have no alternatives when choosing a tax regime; only the general tax regime (OSNO) is suitable for them. For example, if the activities of an individual entrepreneur are mainly related to the performance of work or provision of services for large companies that apply the general taxation regime. Its peculiarity is the presence of value added tax (VAT), the standard rate of which today is 20%.

If organizations on OSNO order, for example, spare parts from individual entrepreneurs on the simplified tax system, then they will not be able to receive VAT deduction, which means their expenses will increase. This, of course, is not beneficial to anyone - why pay more taxes if you can cooperate with those who work with VAT and reduce the amount of VAT payable to the budget?

There is even a popular joke among accountants on this topic:

Two experienced accountants are trying to balance the annual balance sheet. Both were very tired. Suddenly the first one asks the second one: “Listen, I forgot, how many months are there in a year?” The other quickly answers, without taking his eyes off the calculations: “Ten.” without VAT.

Let's return to how to keep an individual entrepreneur's accounting on OSNO. Here you cannot use half-measures and approximate figures, since then it will not be possible to correctly calculate VAT, which is determined separately for accrual and deduction.

Example: Individual entrepreneur Anton Ivanovich Vasiliev produces countertops for furniture. Let's assume that Anton Ivanovich sells them in large quantities, which makes kitchen sets and sells them wholesale to different stores. The company operates on OSNO and pays VAT to the budget. Let's say she sells headsets worth 600,000 rubles per month including VAT.

Value added tax: 600,000 / 1.2 = 100,000 rubles.

The countertops for these kitchens were purchased for 120,000 rubles including VAT (tax amount 20,000 rubles). Then “Dream Kitchen” will have to pay 0 = 80,000 rubles to the budget.

If Anton Ivanovich had worked for the simplified tax system without VAT, it is not a fact that he would have found partners in the form of large companies, since it is not profitable for the latter to cooperate with the “simplistic” ones.

Individual entrepreneurs will also need accounting for OSNO in the following cases:

- for comprehensive control and subsequent analysis of the results of economic activity - you can calculate liquidity ratios, turnover ratios and others, and then draw a conclusion about the state of affairs and identify hypothetical growth points;

- to be able to search for work on tender services - often financial statements are a mandatory item in the list of documents that need to be submitted to the competition site;

- to attract investors or obtain a bank loan - reporting will help prove that the individual entrepreneur has prospects.

Thus, entrepreneurs most likely cannot do without transparent accounting on OSNO. And this will not be a whim or an excess - the presence of financial statements will help you get a loan if necessary, attract investors, and win a tender.

Accounting (financial) statements for individual entrepreneurs using the simplified tax system

Keeping accounting records for individual entrepreneurs using the simplified tax system, as mentioned above, is not mandatory - it is legal not to keep records at all or organize simplified ones. Tax accounting cannot be neglected, otherwise penalties will follow. A simplified tax return is submitted once a year, but in order to create it, you need to know how things are going in the business. This is what financial accounting is for.

This is interesting: How to raise money for a project on the Internet

To determine the tax base, a “Book of Income and Expenses” is usually kept. Of course, you don’t need to hand it over anywhere, but you can present it in case of a tax audit. Individual entrepreneurs using the simplified tax system “Income minus expenses” record in the book all business transactions related to income and expenses. Under the “Income” tax regime, the book indicates all income, as well as insurance premiums (you can use them to reduce the amount of tax payable).

Fragment of the form “Income and Expense Accounting Book”

Do individual entrepreneurs keep accounting records on OSNO?

This situation is similar to the previous one (letter of the Ministry of Finance of Russia dated July 26, 2012 No. 03-11-11/221).

According to paragraph 2 of Art. 54 of the Tax Code of the Russian Federation, entrepreneurs working for OSNO take into account income and expenses for their commercial activities in the book of income and expenses and business operations of individual entrepreneurs, approved by order of the Ministry of Finance of Russia No. 86n dated August 13, 2002 and the Ministry of Taxes of Russia No. BG-3-04/430.

Read about the tax burden of individual entrepreneurs on the OSN here.

Thus, the condition for accounting for income and expenses (clause 2 of Article 6 of Law No. 402-FZ) is also met here. Consequently, individual entrepreneurs on OSNO, like simplifiers, are free to refuse accounting.

For a comparison of popular tax regimes for small businesses, read the article “What is the difference between the simplified tax system and the OSNO? What is more profitable?

Hired employees

The emergence of hired employees complicates the accounting process. From this moment on, the individual entrepreneur acquires the status of a tax agent. His responsibilities include calculating and withholding income taxes from employees' wages, as well as paying their contributions to the social insurance fund and pension fund.

ATTENTION!

Having hired employees requires submitting 7 types of reports and maintaining personnel documentation. This is not easy to do. In this case, it is recommended to seek the services of a specialist.

Do I need accounting for individual entrepreneurs on the Unified Agricultural Tax?

The answer to this question can also be found in the explanations of the financial department (letter of the Ministry of Finance of Russia dated August 27, 2012 No. 03-11-11/257).

According to paragraph 8 of Art. 346.5 of the Tax Code of the Russian Federation, in order to determine the tax base for the Unified Agricultural Tax, entrepreneurs are required to take into account income and expenses in the book of income and expenses of individual entrepreneurs applying the taxation system for agricultural producers. Its form and design rules are enshrined in the order of the Ministry of Finance of the Russian Federation dated December 11, 2006 No. 169n. In addition, entrepreneurs on the unified agricultural tax system are required to pay VAT from January 2022. To account for VAT transactions, individual entrepreneurs must maintain a purchase book and a sales book, as well as issue invoices.

An individual agricultural producer has the right to apply the exemption and not pay VAT. Read more about the procedure for applying for benefits here .

And again we come to a similar conclusion: individual entrepreneurs on the Unified Agricultural Tax can refuse to do accounting.

The article “Rules for maintaining a book of income and expenses under the Unified Agricultural Tax” will help you correctly draw up an accounting book for individual entrepreneurs on the Unified Agricultural Tax.

How an individual entrepreneur can do accounting on his own: step-by-step instructions

Today there are many programs and online services for accounting. Why not try to cope on your own? This is especially true for beginning entrepreneurs who do not have the opportunity to hire an accountant or outsource accounting.

What do you need to do your own accounting? Of course, the nuances depend on the chosen tax regime, but a general algorithm of actions can be formulated:

- Select tax regime. To do this, you need to roughly estimate possible income and expenses, and also think about hypothetical partners. If these are large companies working with VAT, choose OSNO. Otherwise, you can stop at the simplified tax system. Here everything usually depends on the markup on goods and services - if the profit from the transaction is minimal, it is usually more profitable to use the “Income minus expenses” mode. However, the simplified tax system “Income” is more convenient for many - there is less paperwork, since expenses do not need to be confirmed.

- Study the legislation. Pay attention to the deadlines and forms for submitting reports, the procedure for paying taxes and contributions. Answers to questions can be found in the free online version of ConsultantPlus.

- Write your accounting policy. Usually the following is indicated there: what kind of accounting will be used (traditional or simplified), tax accounting methods, the procedure for drawing up and processing documents and similar things. It is best to supplement the accounting policy with applications - for example, a working chart of accounts (if necessary), standard forms of primary documents, etc. It is logical that when carrying out activities it will be necessary to be guided by the chosen policy.

- Resolve the issue with the employees. Decide if you plan to hire anyone. It is worth understanding that financial and tax accounting is much simpler in the absence of employees. With the advent of employer status, the need for personnel records will arise.

- Keep track of document flow. Don’t put off completing paperwork until tomorrow—reflect business transactions as they occur. How? Use special programs and services. And remember that no documents - no deal. When checking, the tax office will not take your word for it, no matter how honest your eyes are. Any transaction in classical accounting is reflected according to the principle of double entry - the debit of one account and the credit of another.

- Conclude agreements with partners. It is convenient when there are contractual obligations - often then the paperwork is significantly simplified. Sign contracts with telecom operators, transport companies, post office... Make a digital signature and submit reports electronically.

- Analyze financial statements. The result of accounting can be seen in the balance sheet and income statement. For starting individual entrepreneurs, it is especially important to pay attention to accounts payable and receivable. If the first significantly exceeds the second, summed up with cash, there is reason to start worrying. But the complete absence of a creditor does not guarantee that things are going well. Perhaps the chances to scale the business by attracting credit funds are not being taken advantage of.

Article on the topic: What is crowdfunding + 10 platforms for raising funds for business development

Important! If you plan to do accounting yourself, but are not confident in your abilities, take a little training. It is not necessary to go into the weeds and master the institute program; it is enough to understand the principles of accounting: what are active and passive accounts, double entry, how to reflect transactions and draw up a balance sheet. Modern programs, of course, will do a lot for you, but to avoid mistakes you need to be in the know and keep your finger on the pulse.

Today there are all opportunities for teaching accounting - books, online services, courses

Accounting for individual entrepreneurs on a patent

Entrepreneurs who have chosen PSN for their activities, just like all other individual entrepreneurs, may not keep accounting, since they carry out tax (clause 1 of Article 346.53 of the Tax Code of the Russian Federation) in accordance with the procedure approved by order of the Ministry of Finance of Russia dated December 22, 2012 No. 135n .

For information on individual entrepreneur reporting on PSN, see the article “Individual entrepreneur reporting on PSN - pros and cons.”

IMPORTANT! The absence of the need for accounting for entrepreneurs entails that they do not have to submit financial statements.

Transition of individual entrepreneurs to a simplified taxation system

The individual entrepreneur makes such a transition on a voluntary basis. However, there are conditions under which you cannot switch to the simplified tax system . According to clause 3 of Article 346.12 of the Tax Code of the Russian Federation, individual entrepreneurs cannot switch to and apply the simplified tax system:

- engaged in the production of excisable goods;

- engaged in the extraction and sale of non-common minerals;

- switched to paying the unified agricultural tax (USAT);

- whose average number of employees exceeds 100 people;

- who failed to notify the tax authority of the transition to the simplified tax system within the prescribed period.

Read more about the application of the simplified tax system in the article - Simplified taxation system, as well as in Chapter 26.2 of the Tax Code of the Russian Federation.

How to keep books of income and expenses

There are a number of criteria that entrepreneurs (and other persons filling out the relevant registers) must comply with when maintaining books of income and expenses:

- books must be kept in Russian;

- each tax period must have its own accounting book;

- all completed business transactions are reflected in the register in full;

- entries in the book must meet the principle of reliability and be recorded continuously and in chronological order;

- as the basis for each business operation, the individual entrepreneur must have a supporting source document;

- it is allowed to keep registers on both paper and electronic media (at the same time, at the end of the tax period, the electronic version of the books must be printed, bound and numbered);

- The rules for correcting erroneous entries in the book must be followed: corrections must be documented, confirmed by the signature of the entrepreneur with the obligatory indication of the date of the correction.

Transfer of accounting responsibilities

A full-time accountant will cost an entrepreneur 20,000 - 50,000 rubles per month. This is the average for Russia, and it largely depends on the region. Like any other employee, an accountant works under an employment contract, when the document flow of an individual entrepreneur is small, the accountant can get a part-time job.

The services of an outsourcing company will cost less if there is little paperwork involved. For example, 10 documents for the simplified tax system cost approximately 1,500 rubles, and 100 documents already cost 5,400 rubles.

Only the wealthiest individual entrepreneurs can completely entrust their accounting to a specialized company - such a pleasure can cost up to 100,000 rubles per month.

An individual entrepreneur who transfers accounting management under an agreement to third parties ultimately receives:

- Additional financial costs;

- Distraction from certain processes within the company (which sometimes leads to a misunderstanding of the situation);

- Additional free time that can be devoted to other important work.

Possible accounting objects for entrepreneurs

It is worth understanding that the accounting registers that entrepreneurs should maintain are not limited to books of income and expenses. Thus, an individual entrepreneur is not exempt (if he has a corresponding obligation, circumstances or objects) from accounting for:

- personnel;

- cash transactions;

- fixed assets;

- NMA, etc.

Individual entrepreneurs may also be subject to the payment of certain taxes (VAT, transport, property tax, personal income tax), contributions to extra-budgetary funds, etc. In this case, he will have to not only maintain the appropriate accounting registers, but also generate reports based on them and submit them to regulatory authorities.

To learn how an entrepreneur can switch to electronic reporting, read the article “How to connect electronic reporting for individual entrepreneurs (nuances)?”

Options for maintaining individual entrepreneur records

A beginning individual entrepreneur can conduct accounting in one of the following ways:

- On one's own. Accounting for individual entrepreneurs using special modes (for example, the simplified tax system) has a fairly simple scheme, which allows a businessman to conduct accounting independently.

Online accounting services (for example, “My Business”) and specialized programs (for example, 1C) provide great support in this direction, which describe and guide the entire process in detail.

- With the help of a hired accountant . This option will cost less than a contract with an accounting firm, but the risks also increase. It is very important and at the same time difficult to find an honest, experienced specialist. It is advisable to hire a private accountant based on recommendations from friends or trusted persons. In other situations, it is worth once again weighing all the risks and benefits and only then deciding whether to resort to this option.

- Under an agreement with an outsourcing company . A striking example of the principle “the more expensive, the simpler.” The services of an accounting firm are the most expensive method, but it relieves the individual entrepreneur from the need to delve into accounting matters. Specialists are busy with accounting, and the entrepreneur himself can calmly devote himself to the rest of the work.

Can an individual entrepreneur, at his own discretion, keep accounting records and submit financial statements?

Despite the right granted to entrepreneurs by Law No. 402-FZ not to conduct accounting or prepare financial statements, many individual entrepreneurs do not refuse accounting. And there are objective reasons for this.

The ultimate goal of accounting is the preparation of reports that reliably reflect the financial condition of the entity. The information contained in these reports is used not only by the state, but also by internal corporate consumers of information (owners, managers, employees) and third-party stakeholders (investors, creditors, counterparties, auditors). These users make certain important economic and strategic decisions based on such reporting.

An individual entrepreneur who does not conduct accounting and does not prepare financial statements may face a number of objective difficulties:

- refusal to receive a loan, investment, leased property;

- refusal of partners to cooperate;

- the problematic nature of control over accounts receivable and payable;

- inability to qualitatively analyze current performance indicators and make important management decisions;

- inability to organize effective financial internal control, etc.

In addition, there may be situations when an entrepreneur will not be able to refuse to maintain accounting records and prepare financial statements for internal corporate reasons. For example, if the individual entrepreneur is part of a holding company that prepares consolidated statements and exercises strict internal control over the activities of its members.

Note that external users (usually for lending and investment purposes) may need accounting statements (forms 1, 2), certified not only by the signature of the entrepreneur, but also by the mark of the tax authority.

IMPORTANT! If an entrepreneur has decided to conduct accounting and prepare financial statements, he can submit them to the Federal Tax Service in the general manner. Tax officials do not have the right to refuse to accept an individual entrepreneur’s financial statements and put a mark on their acceptance on them.

You will find a sample of form 1 in the article “Procedure for drawing up a balance sheet (example)”.

What is accounting

Accounting is a system of comprehensive collection and synthesis of information, as well as careful recording of facts about the economic activities of an economic entity. Simply put, it is a record of every transaction performed .

For example, an entrepreneur shipped goods - issued a delivery note and an invoice (if working with VAT), received money for them by bank transfer - recorded the receipt of funds to the current account.

Accounting is necessary to know exactly how things are going for a businessman: using the balance sheet, you can see the presence of real estate and equipment in the property, what is the amount of credit obligations, and whether there are receivables. Accounting statements as a whole allow for a sober assessment of the financial position of an individual entrepreneur as of a certain date.

Accountants account for every transaction, even the purchase of pens and erasers

Many people think that accounting and tax are identical concepts, synonyms. However, this idea is fundamentally wrong; these are completely different things, which even have different goals:

- accounting's main goal is informational (providing data on the financial condition of an economic entity);

- for tax accounting - fiscal (to enable the state to monitor the correctness of calculation and payment of taxes).

Thus, accounting is necessary so that an entrepreneur can soberly assess the financial situation, see prospects and formulate a strategy for further development. And the tax office is intended to systematize information about the subject and formalize it in accordance with the primary documentation. For what? To correctly and timely calculate taxes, guided by the rules prescribed in the Tax Code of the Russian Federation.

It is important to understand well the difference between accounting and tax accounting, since only then will it be possible to establish their proper management.

Calculation and payment of tax simplified tax system

The tax amount is equal to the product of the taxable base for a certain period and the tax rate.

But before you count, individual entrepreneurs need to check the simplified tax system tax rate with their tax office. The fact is that a specific rate of the simplified tax system is established by a subject of the Federation, which is given the right by federal legislation to reduce the rate (and even set it to zero) for a certain period or for certain categories of tax payers.

“The tax levied on taxpayers who have chosen income as an object of taxation” (as it is called in the table of budget classification codes - KBK) is equal to the product of the tax base (amount of income, revenue) and the tax rate equal to 6%.

The amount of the simplified tax system can be reduced to 50% if you deduct the amount of insurance contributions paid for a specific reporting period for compulsory and voluntary pension, compulsory medical, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory social insurance against accidents for production and occupational diseases, as well as the amount of the trade tax (if applicable).

“The tax levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation” is equal to the product of the taxable base (i.e., the difference between the amount of income and the amount of expenses (determined in accordance with Article 346.16 of the Tax Code of the Russian Federation) and the tax rate, equal to 15%.

Next, you need to compare the resulting tax amount with the amount of the so-called minimum tax (it is equal to 1% of revenue).

If the calculated tax amount is less than the minimum, then the minimum tax must be paid. That is, when comparing two amounts, we choose to pay the larger one.

The simplified tax system must be calculated and paid for the tax period (year). But in the middle of the year, three advance payments must be calculated and paid quarterly, which are then taken into account when calculating the tax for the year.

The calculation of advances is the same as the tax in general, but the amounts of income and expenses are taken on an accrual basis for a specific reporting period - first for the first quarter, then for six months, then for 9 months.

Advance payments of the simplified tax system must be paid by the 25th day of the month following the reporting period (quarter, half-year, 9 months):

- for the first quarter of the year (from January to March) – until April 25;

- for six months (from January to June) – until July 25;

- for 9 months (from January to September) – until October 25.

Tax for the year is paid by individual entrepreneurs no later than April 30 of the following year.

The following BCCs must be indicated in payment orders (receipts):

income - 18210501011011000110

income minus expenses - 18210501021011000110

What does switching to the simplified tax system give to individual entrepreneurs?

First of all, the use of the simplified tax system replaces three with one tax. In accordance with paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, individual entrepreneurs are exempt from the obligation to pay:

- personal income tax (on income from activities as an individual entrepreneur, but excluding dividends);

- tax on property of individuals (but except for property not used by individual entrepreneurs for business activities, as well as except for property, the tax base for which is determined from the cadastral value);

- value added tax (VAT) (but excluding VAT on import transactions).

How can an individual entrepreneur switch to the simplified tax system?

In order for an individual entrepreneur to use the simplified tax system, you need to submit a notification to the tax authority in the form “26.2-1” :

notifications about the transition to a simplified taxation system.

If the individual entrepreneur has just been registered (newly), then the notification of the transition to the simplified tax system is submitted no later than 30 calendar days from the date of registration of the individual entrepreneur for tax registration. In this case, it is considered that the individual entrepreneur has switched to the simplified tax system from the date of tax registration (this day often coincides with the day of state registration of the individual entrepreneur).

If the individual entrepreneur is already operating and uses other taxation systems, then a notification of the transition to the simplified tax system from the beginning of the next year must be submitted to the tax authority no later than December 31 of the current year . That is, such an individual entrepreneur will not be able to switch to the simplified tax system before next year.

With one exception.

An individual entrepreneur who has ceased to be a payer of the single imputed tax (UTI) has the right to switch to the simplified tax system from the month in which his obligation to pay UTII ceased. To do this, he must submit a notification about the transition to the simplified tax system no later than 30 days after the termination of his obligation to pay UTII.

An individual entrepreneur who pays UTII for certain types of activities simultaneously apply the simplified tax system, but in relation to other types of activities.

In the notification, the individual entrepreneur must indicate his chosen option for the object of taxation on the simplified tax system - “income” or “income reduced by the amount of expenses.”

An individual entrepreneur who has switched to the simplified tax system does not have the right to switch to a different taxation regime until the end of the year (as well as to change the variant of the object of taxation of the simplified tax system), but has the right to simultaneously apply the patent taxation system and, as noted above, UTII.

If an individual entrepreneur has ceased the type of activity in respect of which he applied the simplified tax system, he is obliged to notify the tax authority of the date of such termination no later than 15 days.

Read more about the transition to the simplified tax system in the article - Notification of the transition to the simplified tax system.