Normative base

The main document that regulates synthetic and analytical accounting of calculations is the chart of accounts, approved by Order of the Ministry of Finance No. 94n.

On its basis, a working chart of accounts is formed, taking into account the specifics of the organization’s activities. To understand the difference between these concepts, let's look at the table.

| Name | Description | Normative base |

| Synthetic accounting | Recording of data in a generalized form (carried out in accounts and accounting registers) about property, liabilities and business transactions. | Instructions for the use of the chart of accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, Art. 10 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. |

| Analytical accounting | Recording of data on sub-accounts and in accounting registers in the context of individual types of property, liabilities and business transactions (details synthetic accounting data). |

Legal basis for payroll

The company is obliged to pay every employee with whom an employment contract is concluded. It reflects the salary, work schedule and other features of the performance of job duties. The level of wages depends on qualifications, complexity and volume of work performed, and working conditions.

Each enterprise is obliged to organize synthetic and analytical accounting of wages, which makes it possible to analyze in an understandable form:

- accruals individually for each employee;

- by type of accrual;

- on the amounts of accruals, deductions, payments and debts.

An employee’s salary, if he has worked for a full month, is paid not lower than the established minimum wage (Articles 133, 133.1 of the Labor Code of the Russian Federation).

Synthetic and analytical accounting of payroll calculations

Accounting for payroll settlements is kept on account 70 “Settlements with personnel for wages”. It summarizes information on settlements with employees – both those on the payroll of an agricultural organization and those not. On the credit side, the accounts reflect the amounts of accrued basic and additional wages, bonuses, benefits, pensions for working pensioners and other payments, as well as income on shares and other securities of the organization.

The debit of account 70 reflects the paid amounts of wages, bonuses, temporary disability benefits, pensions, income from participation in the enterprise, deposited amounts, as well as the amounts of accrued taxes, payments under writs of execution and other deductions established by law.

In an organization, the issuance of grain, potatoes and other products to certain categories of workers as payment for labor is reflected in the debit of account 70, and its accrual is reflected in the credit. Products issued as payment for labor are assessed at average selling prices at the time of sale.

In relation to the balance, account 70 is passive. There may be an expanded balance on it. The credit balance shows the organization's debt to pay staff, and the debit balance shows the organization's personnel debt. A debit balance arises only in cases where employees are paid more than was due for time worked or for the amount of work performed. This circumstance means that the organization of settlements with personnel is not at the proper level. The debit balance should be eliminated in the next month, withholding from the employee's wages due and paying it in cash to the cash register.

The analytical accounting register for account No. 70 is the payroll statement (Appendix No. 9), which is a general register that reflects settlements with personnel for wages for each employee. This document is used to calculate all types of wages for the month and make deductions; this document serves as the basis for issuing wages due to employees.

The payroll statement is drawn up highlighting subtotals for structural divisions; it indicates the worker’s full name, personnel number, position, category, rank. The balance for the employee or organization is transferred from the payroll for the previous month. The “Accrued” section shows all types of wages accrued at piece rates, tariff rates, salaries, allowances, bonuses, etc. entries are made only on the basis of primary documents (time sheets, work orders, foreman’s book, sick leave certificate). Then the “Accrued” total is calculated, after which the amount due is determined, and the balance at the beginning of the month is added or subtracted to the “Accrued” total. The “Retained” section reflects mandatory and optional deductions, i.e. income tax, pension fund, trade unions, advance payment for the first half of the month, other deductions.

The payroll statement is signed by the chief accountant and the head of the organization. After this, the statement is transferred to the cash desk for payment of wages.

The register of synthetic accounting for account 70 in this organization is the summary statement for account 10 (Appendix No. 10).

When calculating wages, account 70 No. “Settlements with personnel for wages” corresponds with the debit of the following accounts [3 p.443]:

| Debit | Credit | Content |

| 07,10,11, 43 | Calculation of wages to employees for the delivery of material assets and products | |

| Payroll for construction team workers for the purchase of fixed assets, planting and growing perennial plantings | ||

| 23,20/2,25/1,28,29 90,44, 69 | Payroll for employees | |

| Accrual of bonuses from the reserve fund | ||

| Vacation pay is accrued from the reserve, if it is created in the organization |

CONCLUSION

In modern economic conditions, wages are one of the fundamental factors in the development of the national economy.

Accounting and reporting on wages is carried out in accordance with the uniform methodological framework and procedure established by the Labor Code of the Republic of Belarus, as well as regulations and resolutions.

Wages are remuneration for work depending on the qualifications of the employee, complexity, quality, quantity and conditions of the work performed, as well as compensation and incentive payments to employees for their work.

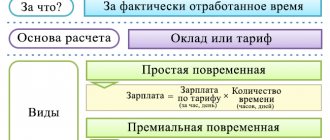

Wages are divided into forms and systems. By form it can be natural and monetary, by type of system - time-based, piece-rate and collective. Along with the basic salary, the employee may be paid a bonus, allowances for quality work, as well as for exceeding the plan. Salaries are paid in monetary units of the Republic of Belarus.

The wage fund is the sum of remunerations provided in accordance with the quantity and quality of labor, as well as compensation related to working conditions. Payroll accounting is carried out in accordance with the Instructions for filling out forms of state statistical reporting on labor. Section IV. Salary fund.

The wage fund includes:

- wage payments calculated on the basis of piece rates, tariff rates and official salaries established depending on the results of work, its quantity and quality, incentive and compensatory payments, including compensation for wages in connection with increases and indexation of prices, systems bonuses to workers, managers, specialists and other employees for production results, other conditions of remuneration in accordance with the forms and systems of remuneration used at the enterprise;

- the cost of products issued as payment in kind;

- incentive payments according to system provisions: bonuses for production results, including remunerations based on the results of work for the year;

-additions to tariff rates and salaries for professional excellence, high achievements in work;

-prizes for saving raw materials and materials, creation, development and implementation of new equipment, based on the results of competitions, shows, competitions aimed at identifying and using production reserves and increasing production efficiency, one-time incentives for individual employees for completing particularly important production tasks;

- incentive payments related to working hours and working conditions, including: bonuses and additional payments to tariff rates, salaries, for night work, multi-shift work, for combining professions, expansion of service areas, for work in difficult, harmful, especially harmful working conditions, etc.;

Agricultural organizations use various unified forms of primary documents to record time worked, volumes of work performed and payroll calculations. Such primary documents include: a foreman’s book for recording labor and work performed, a tractor driver’s record sheet, a timesheet for recording working hours and accrual of earnings , accounting sheet for piece work, time sheet and calculation of earnings for time-based wages

In accordance with Article 73 of the TCRB, wages are paid regularly on the days specified in the collective agreement, agreement or employment contract, but at least 2 times a month. Responsibility for violation by the employer or an authorized official of the employer of the procedure and terms for payment of wages is provided for in part one of Article 9.19 of the Code of the Republic of Belarus on Administrative Offenses.

Synthetic accounting is kept on account 70 “Settlements with personnel for wages”. This summarizes information on settlements with personnel, both on and off the payroll of the organization, regarding wages (for all types of wages, bonuses, benefits and other payments), as well as on the payment of income on shares and other securities of this organization. Summarization of data on account 70 “Settlements with personnel for wages” is carried out in the order journal f. 10-APK based on the summary statement of settlements with employees (f. 59-APK). It preliminarily summarizes the data from payroll statements compiled for each structural unit. The debit turnover on account 70 “Settlements with personnel for wages” is reflected in the order journals f. 1-APK, f. 2-APK, f. 7-APK, f. 8-APK, f. 9-APK and other analytical accounting registers. At the end of the month, the credit turnover of account 70 and the amounts composing it are from the order journal f. 10-APK is transferred to the General Ledger.

Primary documentation reflects all transactions performed in accounting and is the basis for systematization and accumulation of information in accounting registers. Therefore, the study and verification of primary documentation was an integral part of the study.

According to the accounting policy, an automated form of accounting is used when maintaining accounting records. Internal rules for documenting operations, organizing document flow, and maintaining accounting registers are determined by the accounting department of the enterprise.

Synthetic accounting registers are designed to summarize information in the context of synthetic accounts. The main ones in the organization are the journal order for account 70 “Settlements with personnel for wages” and the General Ledger.

The order journal reflects transactions that relate to the credit of this account in correspondence with the debit of the corresponding accounts. Entries in the order journal are made on the basis of data from the summary tables and payroll statements. The statement to the journal order for account 70 “Settlements with personnel for remuneration” reflects the debit entries of account 70 “Settlements with personnel for remuneration” in correspondence with the credit of the corresponding accounts. The total amounts of the order journal are transferred to the General Ledger.

The general ledger is a general register of synthetic accounting. It is designed to keep records throughout the year. All synthetic accounting accounts used by the organization are opened in it. For each account, the balance as of January 1 is recorded and the total data of the order journals is recorded monthly, the turnover for the month and the balance at the end of the reporting month are displayed. The amounts of debit and credit turnover for all accounts must be equal. In the General Ledger, a separate sheet is provided for each synthetic account.

Analytical accounting registers are intended to summarize information in the context of analytical accounts, detailing the content of the indicators of the synthetic account to which they are opened. These include an account card and an employee’s personal account.

Payments to personnel for wages and salaries are one of the most labor-intensive parts of the accounting process, but at the same time the most suitable for automation. This is explained by the large number of primary documents, the need to perform calculations and group data according to various analytical criteria. Automated accounting forms are based on different principles. The use of appropriate computers ensures obtaining results of different degrees without rewriting data from one register to another. Operations based on homogeneous characteristics are grouped in the process of machine information processing. As a result, it is possible to obtain final information directly based on processing the initial data. This is a fundamental difference between automated forms of accounting and manual ones. Properly organized accounting of labor and wages is designed to help increase labor productivity, improve the use of working time, and reduce production costs.

List of used literature

1. Magazine “Belarusian Agriculture” for March

2. https://www.glavbukh.ru/

3. Accounting in agriculture: textbook / A. P. Mikhalkevich, P. Ya. Papkovskaya, S. K. Matalytskaya [etc.]; under general editorship A. P. Mikhalkevich. – 4th ed., with amendments. - Mn. : BSEU, 2006. – 688 p.

4. State program for the revival and development of rural areas for 2005-2010.

5. Law of the Republic of Belarus “On Accounting and Reporting”

6. Instructions for using the chart of accounts

7. Resolution of the Council of Ministers of the Republic of Belarus “On establishing the tariff rate”;

8. Resolution of the Council of Ministers of the Republic of Belarus “On state regulation of accounting and reporting in the Republic of Belarus”;

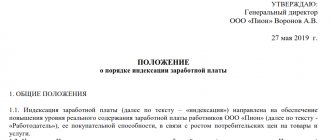

9. Regulations on remuneration of labor “Impuls-Agro” CJSC “AHEKA”;

10. Resolution of the Ministry of Agriculture and Food of the Republic of Belarus;

11. Economics and organization of agricultural production: Textbook. Benefit. – Mn.: Urajai, 1999. – 198 p.: ill. – (Textbooks for vocational schools).

12. Economics of enterprises and industries of the agro-industrial complex: Textbook. Benefit /V. S. Tonkovich, E. I. Kiveisha, L. F. Dogil and others; Under the general editorship. V. S. Tonkovich, L. F. Dogil. – Mn.: BSEU, 1996. – 264 p.

13. Accounting in agriculture A. S. Cheche Accounting in agriculture: a textbook for students of non-economic specialties of agricultural universities: 2nd ed., additional. and processed/ A.S. Chechetkin. – Mn.: Information Computing Center of the Ministry of Finance, 2007

14. Accounting: Textbook. allowance. 2nd ed., revised. / O.A. Levkovich, I.N. Burtseva; Under general ed. O.A. Levkovich.- Mn.: Amalthea, 2004

15. Magazine “Chief Accountant”

16. Guidelines for accounting of agricultural products and inventories for agricultural and other organizations engaged in the production of agricultural products - Mn.: LLC "Informpress", - 2007. - 152 p.

17. Accounting and auditing in the agro-industrial complex: a textbook for students of economic specialties in agriculture. universities / L.I. Steshits.-Mn.: “ICTs of the Ministry of Finance”, 2005

18. Novikova, Z.T. Economic theory: textbook for universities, e.g. “Economics” and other economics. specialist. / Z.T. Novikova. – M.: academic project, 2005.

19. Accountant consultant").

How to take into account your salary

The chart of accounts for organizing synthetic accounting of wages is account 70 “Settlements with personnel for wages”.

The loan reflects accruals payable to the employee in connection with the performance of work duties:

- salary, bonuses, allowances (in correspondence with cost accounts: 20, 23, 25, 26);

- vacation pay (in correspondence either with account 96 (when creating a reserve) or similar to the reflection of salary);

- disability payment (in correspondence with account 69).

By debit we take into account the accrual of deductions from employees' salaries (alimony, deductions for excessive vacation time upon dismissal, other deductions by decisions of executive bodies, the employer or the employee's application). The wiring is as follows:

Dt 70 Kt 73, 76.

The balance reflects either the amount of debt of the enterprise for salary transfers, or the amount of excess income transferred to the employee. Synthetic and analytical accounting of wages involves the formation of the following entries:

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 44 | 70 | Salaries accrued to employees |

| 96 | 70 | Accrual of vacation pay reflected |

| 69 | 70 | The accrual of benefits for VNIM is reflected |

| 70 | 68 | Personal income tax withheld |

| 70 | 73, 76 | Other deductions were made from employee salaries |

| 70 | 50, 51 | Salaries paid to employees of the organization |

Synthetic accounting and its features

Synthetic accounting represents generalized indicators. Its main difference is that there is no division into certain characteristics of funds to be accounted for. Within the framework of synthetic accounting, funds are used only in monetary terms. This form is used mainly on accounts 01, 04 (Intangible assets), 10 (Materials). Sub-accounts can also be opened. For example, the following subaccounts can be opened for account 08:

- 08-1 “Purchase of land.”

- 08-2 “Purchasing resources.”

The synthetic accounting method is used exclusively by professional accountants, while the analytical method can be used by other employees. Information from the MS is used in the preparation of reporting, that is, the balance sheet.

Question: How to reflect in accounting the wages overpaid upon dismissal of an employee and the corresponding amounts of personal income tax and insurance contributions? View answer

Synthetic accounting accounts

The MS contains information on general characteristics of property, its sources, and various processes of economic importance. The main account is synthetic, as well as the second one, called the subaccount. Subsequent accounts will be called analytical. Not all synthetic accounts contain subaccounts. Sometimes the specification of an operation is performed using analytical tools.

It must be said that SU and AU are inextricably linked. This is explained by the following factors:

- Operations are performed on the basis of the same primary documents.

- In accounts we are talking about the same objects, but in analytical accounting they are detailed.

- Both SU and AC have credit, debit and balance indicators.

- The analytical accounting balance is similar to the synthetic accounting balance.

But there are also differences. CS allows you to quickly obtain the required general information. AU helps to detail them. That is, both methods complement each other.

The synthetic method is used to reflect data on passive account 70. Let us recall that it records information on settlements with employees. The following information is reflected in the account credit:

- Salary to employees.

- Accrual of vacation pay and various incentives to employees.

- Calculation of pensions, social contributions.

- Auctioneers' income.

The debit displays the company's expenses in similar areas: payment of salaries, pensions and other deductions.

Typical wiring

Let's look at typical control system wiring:

- DT 20, 44, 69 CT 70 – accruals based on sick leave.

- DT 84 CT 70 – issuance of dividends.

- DT 70 CT 68 – personal income tax deduction from salaries.

- DT 70 CT 50 and 51 – payment of wages.

- DT 70 CT 76 – salary deposition.

These postings are used most often.

Why do you need analytics when reflecting wages?

The ability to quickly obtain information about the status of payroll settlements with employees should provide analytical accounting of payroll settlements. It is advisable to organize analytics separately for each employee, opening a personal account for each.

The form in which the necessary data is entered is developed and approved by the organization independently. It is also permissible to use form T-54, approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004.

Individual registers must be stored for 75 years (clause 413 of Order No. 558 of the Ministry of Culture of August 25, 2010).

In any case, maintaining an employee’s personal account should ensure that information about accruals, deductions and amounts to be paid is received at any time. Data from analytical individual registers are used to compile consolidated accounting registers and to generate pay slips.

Read more: How to fill out a pay slip

Features of settlements with personnel for wages

All actions here are indicated on account 70, on which all calculations directly for the payment of wages are reflected in debit, but also various payments on a corporate loan and deductions on a loan. The company's cost accounts serve as a source of funds for payroll. In general, wages include hours worked and time not worked. The first category includes:

- remuneration for labor (salary, tariff rate, percentage of profit or sales);

- incentives and compensation payments, including bonuses.

The second includes funds, the amount of which is calculated on the basis of average earnings or certain state regulatory standards:

- educational or annual leave;

- downtime due to the fault of the employer;

- business trips and so on.