Methods of collecting taxes, fees, penalties

If a taxpayer does not fulfill his tax obligations voluntarily, tax authorities have the right to force him to pay the budget. To do this, they begin the collection procedure. The following ways to replenish the treasury are provided to them:

- at the expense of money in taxpayer accounts in banks and electronic DS (Article 46 of the Tax Code of the Russian Federation);

- at the expense of his property (Article 47 of the Tax Code of the Russian Federation).

A transition from one stage to another is possible only when the previous method did not work (with minor exceptions).

ConsultantPlus experts explained in detail what to do if you independently discover tax arrears. Study the material by getting trial access to the K+ system for free.

Next, we will look at how the very first and most common stage of recovery in practice takes place - at the expense of funds. We will talk about collecting taxes from business entities. The forced collection of taxes from ordinary “physicists” is prescribed separately in the Tax Code of the Russian Federation and has its own rules (Article 48 of the Tax Code of the Russian Federation).

Legislative framework of the Russian Federation

not valid Edition from 02.11.2013

detailed information

| Name of document | “TAX CODE OF THE RUSSIAN FEDERATION (PART ONE)” dated 07.31.98 N 146-FZ (as amended on 02.11.2013 with amendments that came into force on 03.12.2013) |

| Document type | tax code, code |

| Receiving authority | President of the Russian Federation, State Duma of the Russian Federation, Siberian Federation of the Russian Federation |

| Document Number | 146-FZ |

| Acceptance date | 17.08.1998 |

| Revision date | 02.11.2013 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

“TAX CODE OF THE RUSSIAN FEDERATION (PART ONE)” dated 07.31.98 N 146-FZ (as amended on 02.11.2013 with amendments that came into force on 03.12.2013)

Article 46 Collection of tax collection and fines from funds in the accounts of the taxpayer (payer of fees) - an organization of an individual entrepreneur or a tax agent - an organization of an individual entrepreneur in banks and also from his electronic funds

(as amended by Federal Laws dated July 27, 2006 N 137-FZ, dated June 27, 2011 N 162-FZ)

1. In case of non-payment or incomplete payment of the tax on time, the obligation to pay the tax is compulsorily fulfilled by foreclosure on the funds in the accounts of the taxpayer (tax agent) - organization or individual entrepreneur in banks and his electronic funds.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

1.1. In case of non-payment or incomplete payment on time of the tax payable by the participant in the investment partnership agreement - the managing partner responsible for maintaining tax records (hereinafter in this article - the managing partner responsible for maintaining tax records), in connection with the implementation of the investment partnership agreement ( with the exception of corporate income tax arising in connection with the participation of a given partner in an investment partnership agreement), the obligation to pay this tax is compulsorily fulfilled by foreclosure on funds in the accounts of the investment partnership.

(as amended by Federal Law dated November 28, 2011 N 336-FZ)

If there are no or insufficient funds in the accounts of the investment partnership, recovery is made from the funds in the accounts of the managing partners. In this case, first of all, the recovery is applied to the funds in the accounts of the managing partner responsible for maintaining tax records.

(as amended by Federal Law dated November 28, 2011 N 336-FZ)

In the absence or insufficiency of funds in the accounts of the managing partners, the penalty is applied to the funds in the accounts of the partners in proportion to the share of each of them in the common property of the partners, determined as of the date the debt arose.

(as amended by Federal Law dated November 28, 2011 N 336-FZ)

2. Tax collection is carried out by decision of the tax authority (hereinafter in this article - the decision on collection) by sending on paper or in electronic form to the bank in which the accounts of the taxpayer (tax agent) - organization or individual entrepreneur - are opened, instructions from the tax authority to write-off and transfer to the budget system of the Russian Federation of the necessary funds from the accounts of the taxpayer (tax agent) - an organization or an individual entrepreneur.

(as amended by Federal Laws dated July 27, 2010 N 229-FZ, dated June 29, 2012 N 97-FZ)

The form and procedure for sending to the bank an order from the tax authority to write off and transfer funds from the accounts of a taxpayer (tax agent) - organization or individual entrepreneur, as well as instructions from the tax authority to transfer electronic funds of a taxpayer (tax agent) - organization or individual entrepreneur to the budgetary The system of the Russian Federation on paper is established by the federal executive body authorized for control and supervision in the field of taxes and fees. The formats of these instructions are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, in agreement with the Central Bank of the Russian Federation.

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

The procedure for sending to the bank an order from the tax authority to write off and transfer to the budget system of the Russian Federation funds from the accounts of a taxpayer (tax agent) - an organization or an individual entrepreneur, as well as an order from the tax authority to transfer electronic funds of a taxpayer (tax agent) - an organization or an individual entrepreneur in electronic form is established by the Central Bank of the Russian Federation in agreement with the federal executive body authorized for control and supervision in the field of taxes and fees.

(as amended by Federal Laws dated July 27, 2010 N 229-FZ, dated June 27, 2011 N 162-FZ, dated June 29, 2012 N 97-FZ)

3. The decision on collection is made after the expiration of the period established in the requirement to pay the tax, but no later than two months after the expiration of the specified period. A decision on collection made after the expiration of the specified period is considered invalid and cannot be executed. In this case, the tax authority may apply to the court to collect from the taxpayer (tax agent) - an organization or individual entrepreneur - the amount of tax due for payment. The application may be filed with the court within six months after the expiration of the deadline for fulfilling the requirement to pay the tax. A deadline for filing an application missed for a valid reason may be reinstated by the court.

(as amended by Federal Law dated November 29, 2010 N 324-FZ)

The decision on collection is brought to the attention of the taxpayer (tax agent) - organization or individual entrepreneur - within six days after the decision is made.

If it is impossible to deliver the decision on collection to the taxpayer (tax agent) against receipt or transfer in another way indicating the date of its receipt, the decision on collection is sent by registered mail and is considered received after six days from the date of sending the registered letter.

4. The order of the tax authority to transfer tax amounts to the budget system of the Russian Federation is sent to the bank in which the accounts of the taxpayer (tax agent) - an organization or individual entrepreneur - are opened, and is subject to unconditional execution by the bank in the order established by the civil legislation of the Russian Federation.

(as amended by Federal Law dated July 27, 2010 N 229-FZ)

4.1. The effect of the tax authority's order to write off and transfer funds from the accounts of a taxpayer (tax agent) - organization or individual entrepreneur, as well as the tax authority's order to transfer electronic funds of a taxpayer (tax agent) - organization or individual entrepreneur to the budget system of the Russian Federation is suspended:

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

by decision of the tax authority to suspend the validity of the corresponding order when the tax authority makes a decision in accordance with paragraph 6 of Article 64 of this Code;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

upon receipt from a bailiff of a resolution to seize funds (electronic funds) of a taxpayer (tax agent) - an organization or individual entrepreneur, located in banks;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

by decision of a higher tax authority in cases provided for by this Code.

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

The validity of the tax authority's order to write off and transfer funds from the accounts of a taxpayer (tax agent) - organization or individual entrepreneur, as well as the tax authority's order to transfer electronic funds of a taxpayer (tax agent) - organization or individual entrepreneur to the budget system of the Russian Federation is renewed by decision of the tax authority to cancel the suspension of the relevant order.

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

Tax authorities make a decision to revoke unfulfilled (in whole or in part) orders to write off and transfer funds from the accounts of taxpayers (tax agents) - organizations or individual entrepreneurs or orders to transfer electronic funds of taxpayers (tax agents) - organizations or individual entrepreneurs to budget system of the Russian Federation in the following cases:

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

changing the deadline for paying taxes and fees, as well as penalties and fines in accordance with Chapter 9 of this Code;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

fulfillment of the obligation to pay taxes, fees, penalties, fines, interest provided for by this Code, including in connection with the offset made to repay arrears and debt on penalties and fines in accordance with Article 78 of this Code;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

write-off of arrears, debts on penalties and fines, interest provided for in Chapter 9, as well as Article 176.1 of this Code, recognized as uncollectible in accordance with Article 59 of this Code;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

reducing the amount of tax, fee, penalty on an updated tax return submitted in accordance with Article 81 of this Code;

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

receipt by the tax authority from the bank of information about cash balances on other accounts (electronic money balances) of the taxpayer in accordance with paragraphs and Article 76 and paragraph 2 of Article 86 of this Code for the purpose of collection according to the decision on recovery made in accordance with paragraph 3 of this article .

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

The forms and procedure for sending to the bank the decisions of the tax authority specified in this paragraph on paper are established by the federal executive body authorized for control and supervision in the field of taxes and fees. The formats of these decisions are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, in agreement with the Central Bank of the Russian Federation.

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

The procedure for sending to the bank the decisions of the tax authority specified in this paragraph in electronic form is approved by the Central Bank of the Russian Federation in agreement with the federal executive body authorized for control and supervision in the field of taxes and fees.

(as amended by Federal Law dated July 23, 2013 N 248-FZ)

5. The order of the tax authority to transfer the tax must contain an indication of those accounts of the taxpayer (tax agent) - organization or individual entrepreneur from which the tax should be transferred, and the amount to be transferred.

Tax collection can be made from ruble settlement (current) accounts, and if there are insufficient funds in ruble accounts, from the foreign currency accounts of the taxpayer (tax agent) - an organization or an individual entrepreneur.

Tax collection from foreign currency accounts of a taxpayer (tax agent) - an organization or individual entrepreneur - is made in an amount equivalent to the payment amount in rubles at the exchange rate of the Central Bank of the Russian Federation established on the date of sale of the currency. When collecting funds held in foreign currency accounts, the head (deputy head) of the tax authority, simultaneously with the tax authority’s order to transfer the tax, sends an order to the bank to sell, no later than the next day, the currency of the taxpayer (tax agent) - organization or individual entrepreneur. Expenses associated with the sale of foreign currency are borne by the taxpayer (tax agent).

Tax is not collected from the deposit account of the taxpayer (tax agent) if the validity period of the deposit agreement has not expired. If there is the specified agreement, the tax authority has the right to give the bank an order to transfer, upon expiration of the deposit agreement, funds from the deposit account to the settlement (current) account of the taxpayer (tax agent), if by this time the order of the tax authority sent to this bank to tax transfer.

6. The order of the tax authority to transfer the tax is executed by the bank no later than one business day following the day it receives the specified order if the tax is collected from ruble accounts, and no later than two business days if the tax is collected from foreign currency accounts, unless this violates the order of priority of payments established by the civil legislation of the Russian Federation.

If there is insufficient or no funds in the accounts of the taxpayer (tax agent) - organization or individual entrepreneur on the day the bank receives an order from the tax authority to transfer tax, such order is executed as funds are received in these accounts no later than one business day following the day of each such receipts to ruble accounts, and no later than two business days following the day of each such receipt to foreign currency accounts, if this does not violate the order of priority of payments established by the civil legislation of the Russian Federation.

6.1. If there is insufficiency or absence of funds in the accounts of the taxpayer (tax agent) - organization or individual entrepreneur, the tax authority has the right to collect tax using electronic funds.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

Collection of tax at the expense of electronic funds of a taxpayer (tax agent) - organization or individual entrepreneur is carried out by sending to the bank in which the electronic funds are located, an order from the tax authority to transfer electronic funds to the account of the taxpayer (tax agent) - organization or individual entrepreneur in the bank.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

The order of the tax authority for the transfer of electronic funds must contain an indication of the details of the corporate electronic means of payment of the taxpayer (tax agent) - an organization or individual entrepreneur, using which the transfer of electronic funds should be carried out, an indication of the amount to be transferred, as well as details of the account of the taxpayer (tax agent) agent) - an organization or an individual entrepreneur.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

The tax can be collected from the balances of electronic funds in rubles, and if they are insufficient, from the balances of electronic funds in foreign currency. When collecting tax from the balances of electronic funds in foreign currency and indicating in the order of the tax authority to transfer electronic funds the foreign currency account of the taxpayer (tax agent) - an organization or individual entrepreneur, the bank transfers electronic funds to this account.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

When collecting tax from the balances of electronic money in foreign currency and indicating in the order of the tax authority for the transfer of electronic money the ruble account of the taxpayer (tax agent) - an organization or individual entrepreneur, the head (deputy head) of the tax authority simultaneously with the order of the tax authority for the transfer of electronic funds sends an order to the bank to sell, no later than the next day, foreign currency of the taxpayer (tax agent) - an organization or an individual entrepreneur. Expenses associated with the sale of foreign currency are borne by the taxpayer (tax agent). The bank transfers electronic funds to the ruble account of the taxpayer (tax agent) - an organization or individual entrepreneur in an amount equivalent to the payment amount in rubles at the exchange rate of the Central Bank of the Russian Federation established on the date of transfer of electronic funds.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

If the electronic funds of a taxpayer (tax agent) - organization or individual entrepreneur are insufficient or absent on the day the bank receives an order from the tax authority to transfer electronic funds, such order is executed as electronic funds are received.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

The order of the tax authority for the transfer of electronic funds is executed by the bank no later than one business day following the day it receives the specified order, if the tax is collected from the balances of electronic funds in rubles, and no later than two business days, if the tax is collected from balances of electronic funds in foreign currency.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

7. If there is insufficient or absence of funds in the accounts of the taxpayer (tax agent) - organization or individual entrepreneur or his electronic funds or in the absence of information about the accounts of the taxpayer (tax agent) - organization or individual entrepreneur or information about the details of his corporate electronic means of payment used for electronic money transfers, the tax authority has the right to collect tax at the expense of other property of the taxpayer (tax agent) - an organization or individual entrepreneur in accordance with Article 47 of this Code.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

In relation to the corporate income tax for a consolidated group of taxpayers, the tax authority has the right to collect tax at the expense of other property of one or more members of this group if there is insufficient or no funds in the bank accounts of all participants of the specified consolidated group of taxpayers or if there is no information about their accounts.

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

7.1. Foreclosure of the property of participants in an investment partnership agreement in accordance with Article 47 of this Code is permitted only in the event of the absence or insufficiency of funds in the accounts of the investment partnership, managing partners and associates.

(as amended by Federal Law dated November 28, 2011 N 336-FZ)

8. When collecting tax, the tax authority may, in the manner and under the conditions established by Article 76 of this Code, suspend transactions on the accounts of a taxpayer (tax agent) - an organization or individual entrepreneur in banks or suspend electronic money transfers.

(as amended by Federal Law dated June 27, 2011 N 162-FZ)

8.1. From the date of revocation of a credit organization’s license to carry out banking operations, tax collection from funds in accounts in such a credit organization is carried out taking into account the provisions of the Federal Law “On Banks and Banking Activities” and the Federal Law “On the Insolvency (Bankruptcy) of Credit Institutions.”

(as amended by Federal Law dated July 28, 2012 N 144-FZ)

9. The provisions of this article also apply when collecting penalties for late payment of tax.

10. The provisions of this article also apply when collecting fees and fines in cases provided for by this Code.

11. The provisions of this article are applied when collecting corporate income tax for a consolidated group of taxpayers, corresponding penalties and fines from funds in the bank accounts of participants in this group, taking into account the following features:

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

1) collection of tax from funds in bank accounts is primarily carried out at the expense of funds from the responsible participant in the consolidated group of taxpayers;

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

2) if there are insufficient (absent) funds in the bank accounts of the responsible participant of the consolidated group of taxpayers to collect the entire amount of tax, the remaining uncollected amount of tax is collected from funds in banks sequentially from all other participants in this group, while the tax authority independently determines the sequence of such collection based on the information he has about taxpayers. The basis for collecting tax in this case is the demand sent to the responsible participant of the consolidated group of taxpayers. In the event of insufficiency (absence) of funds in the bank accounts of a member of a consolidated group of taxpayers when collecting tax in the manner provided for by this subparagraph, the remaining uncollected amount is collected from funds in banks from any other participant in this group;

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

3) when the tax is paid, including partially, by one of the participants in the consolidated group of taxpayers, the collection procedure for the part paid is terminated;

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

4) a participant in a consolidated group of taxpayers, in respect of whom a decision has been made to collect corporate income tax for a consolidated group of taxpayers, is subject to the rights and guarantees provided for by this article for taxpayers;

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

5) the decision on collection is made in the manner established by this article after the expiration of the period established in the request for payment of tax sent to the responsible participant of the consolidated group of taxpayers, but no later than six months after the expiration of the specified period. A decision on collection made after the expiration of the specified period is considered invalid and cannot be executed. In this case, the tax authority may apply to the court at the place where the responsible member of the consolidated group of taxpayers is registered with the tax authority with an application to collect the tax simultaneously from all participants of the consolidated group of taxpayers. Such an application may be filed with the court within six months after the expiration of the period for collecting the tax established by this article. A deadline for filing an application missed for a valid reason may be reinstated by the court;

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

6) a decision on collection made in relation to a responsible participant or another participant in a consolidated group of taxpayers, actions or inactions of tax authorities and their officials during the collection procedure may be challenged by such participants on grounds related to violation of the procedure for carrying out the collection procedure.

(as amended by Federal Law dated November 16, 2011 N 321-FZ)

Request for payment of tax

If a taxpayer is found to have a tax arrears, the inspectorate sends him a request to pay the debt. The procedure for filing and serving a demand is described in Art. 69 Tax Code of the Russian Federation. And its form was approved by order of the Federal Tax Service dated August 14, 2020 No. ED-7-8/ [email protected]

The taxpayer must pay the request within 8 business days after receiving it, unless a longer period is specified in the request itself. If the debt is not repaid within the prescribed period, the Federal Tax Service begins the collection procedure.

IMPORTANT! If the demand was not made, the tax authorities do not have the right to write off taxes for collection.

Decision to collect tax

To collect tax debts, the inspectorate makes a decision on collection. She must do this within two months after the expiration of the deadline for voluntary payment of the claim by the taxpayer. If he is late, he will be able to collect the debt only through the court. The Federal Tax Service has 6 months to go to court after the deadline for fulfilling the requirement has expired.

IMPORTANT! A decision on collection made outside the specified two-month period is invalid and cannot be enforced. Check that controllers are meeting deadlines. If the deadline is violated, you can appeal the decision to a higher tax authority and to court.

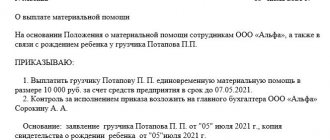

The Federal Tax Service must deliver or send the decision on collection to the taxpayer within 6 working days from the date of its issuance. Simultaneously with the decision to collect tax debt, tax authorities may decide to suspend transactions on the account, and if there is no money in the accounts, then seize the taxpayer’s property.

Collection of tax debts at the expense of the taxpayer’s property

If the tax authority was unable to collect the debt for taxes, insurance premiums, penalties and fines at the expense of the taxpayer’s funds in full, then the balance of such debt is subject to collection at the expense of the taxpayer’s property (clause 7 of Article 46, clause 1 of Article 47 of the Tax Code of the Russian Federation) .

For this purpose, the tax authority adopts two documents: a decision and a decree on collection. The decision of the tax authority on collection by virtue of Art. 12 of the Federal Law “On Enforcement Proceedings” refers to enforcement documents, which is also confirmed in paragraph 64 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 57 of July 31, 2013, which states that courts must take into account that, within the meaning of Article 47 of the Tax Code of the Russian Federation and paragraph 5 of Part 1 of Article 12 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings”, the resolution of the tax authority on the collection of tax at the expense of the taxpayer’s property is an enforcement document.

Accordingly, based on the decision of the tax authority, bailiffs will carry out collection, applying it to the property of the taxpayer.

As stated above, the tax authority accepts two documents regarding the foreclosure of a taxpayer’s property: a decision and a resolution. The decision is made within one year from the date of expiration of the deadline for fulfilling the requirement to pay the tax.

As in certain previous cases, the Government of the Russian Federation has increased the deadline for the tax authority to make a decision on collection by six months (clause 7 of the Resolution of the Government of the Russian Federation dated 04/02/2020 N 409).

Thus, the decision to recover from the property can be made within one and a half years after the expiration of the deadline for fulfilling the requirement for payment.

If the deadline for making a decision is missed, the tax authority can only collect the debt by going to court. A decision made after missing the deadline is invalid and cannot be executed (Clause 1, Article 47 of the Tax Code of the Russian Federation). In this case, the tax authority does not send a decision on recovery to the taxpayer.

How does a bailiff enforce a tax authority's decision?

All actions to recover property are carried out by a bailiff in accordance with the Federal Law “On Enforcement Proceedings”.

To do this, the bailiff performs the legal actions necessary for collection, in the following order, and within the following deadlines.

- The bailiff issues a resolution to initiate enforcement proceedings within 3 days from the moment he receives the enforcement document (Clause 8, Article 30 of the Federal Law “On Enforcement Proceedings”).

- The bailiff sends a copy of the resolution to the debtor and the tax authority on the initiation of enforcement proceedings or a resolution in electronic form, signed with an enhanced qualified electronic signature, no later than the next working day from the date of its issuance (Clause 17, Article 30 of the Federal Law “On Enforcement Proceedings”).

- The bailiff carries out collection if, within 5 days from the date of receipt of the resolution, the debtor does not repay the debt (clause 12 of article 30 of the Federal Law “On Enforcement Proceedings”).

- The bailiff will seize and sell the property of the debtor-taxpayer at an auction, and using the proceeds from such a sale, he will pay off the taxpayer’s debts to the budget, the costs of enforcement proceedings and the enforcement fee (Article 69 of the Federal Law “On Enforcement Proceedings”).

It should be borne in mind that the seizure and sale of the property of a debtor-taxpayer is no different from the seizure and sale of the property of other debtors who are in arrears in payment for goods (work, services) delivered to them.

The order of seizure of property by a bailiff

The bailiff will seize property for sale in the order established by clause 5 of Art. 47 Tax Code of the Russian Federation:

- cash and non-cash funds and precious metals;

- property that the debtor does not use directly in production (paintings and design objects, gold jewelry);

- finished products and other material assets not intended for participation in production;

- raw materials, supplies, equipment and other assets used in production;

- property that the taxpayer transferred to other persons (for rent, for storage, etc.);

- other property.

The period for performing these actions is two months from the date when the bailiff received the tax authority’s decision on collection (Clause 4 of Article 47 of the Tax Code of the Russian Federation). This period does not include the time during which enforcement actions were not actually performed.

As practice shows, the specified two-month period is almost never met, since the collection procedure is a complex multi-stage mechanism associated with the identification, seizure and sale of the debtor’s property, in order to maintain a balance of interests of both creditors and the debtor.

The bailiff completes the enforcement proceedings and issues a resolution, copies of which are sent to the debtor and to the tax authority no later than the next working day from the date of its issuance (clause 6 of Article 47 of the Federal Law “On Enforcement Proceedings”).

The end of enforcement proceedings occurs when, for example:

- the debtor's debt has been fully repaid;

- the claimant revoked the writ of execution;

- The debtor organization is liquidated or declared insolvent (bankrupt).

The decision has been made - get your money ready

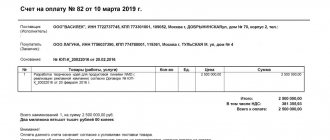

After making a decision on collection, the inspectorate issues an order to write off and transfer the debt to the budget and sends it to the bank. Orders can be issued to several accounts, but within the limits of the amount of the arrears collected (clause 54 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Collections are made sequentially: from ruble accounts, from foreign currency accounts, from accounts in precious metals, through electronic funds. Each subsequent type of account is connected if there are insufficient funds on the previous one. It is prohibited to collect taxes from special election accounts and special referendum fund accounts.

The Tax Code of the Russian Federation does not establish the deadline within which the instruction must be sent. But the Presidium of the Supreme Arbitration Court of the Russian Federation explained that the tax authorities must meet both the decision and the order within the two-month period allotted for making a decision (resolution No. 13114/13 dated 04.02.2014). So here too you need to keep an eye on the deadlines. The bank must write off the money within the following terms:

- from ruble accounts - no later than the next business day after receiving the order;

- from currency and precious metals accounts - no later than two business days.

If there is not enough money, the order will go to the card index, and the bank will write off the money as it is credited to the account, observing the sequence established by civil legislation (clause 2 of Article 855 of the Civil Code of the Russian Federation). The write-off will continue until the order is fully executed or until it is suspended or withdrawn by the tax authorities.

Collection of tax debt by the tax authority in court

The legislation on taxes and fees, which is, in fact, an administrative branch of law, is structured in such a way that the collection of the corresponding tax debts from legal entities is carried out in an indisputable manner. If the taxpayer does not agree with such a penalty, he has the right to challenge the non-normative acts of the tax authority, actions or inaction of their officials (Clause 12 of Article 21 of the Tax Code of the Russian Federation).

At the same time, in accordance with Art. 79 of the Tax Code of the Russian Federation, funds excessively collected by the tax authority from the taxpayer are subject to return with interest, which is compensation for the taxpayer’s losses.

However, there are exceptions to this rule on the indisputable collection of tax debts from the taxpayer. The tax authority collects such debt through the court in the following cases:

- from personal accounts of organizations, if the amount collected exceeds 5,000,000 rubles;

- from the accounts of interdependent companies in the cases provided for in paragraphs. 2 p. 2 art. 45 Tax Code of the Russian Federation;

- if the tax debt arose as a result of recharacterization of the transaction;

- when the debt arose as a result of an audit conducted by the Federal Tax Service of Russia;

- if the debt is collected from an individual who is not an individual entrepreneur.

- when the tax authority missed the deadline for collecting the debt at the expense of the taxpayer’s funds (clause 3 of Article 46 of the Tax Code of the Russian Federation);

- if the tax authority missed the deadline for collecting the debt at the expense of the taxpayer’s property (clause 1 of Article 47 of the Tax Code of the Russian Federation).

Request for payment of tax

Before going to court, the tax authority must send the taxpayer a demand to pay the tax (Article 69 of the Tax Code of the Russian Federation).

According to Art. 69 of the Tax Code of the Russian Federation, the requirement to pay a tax is sent by the tax authority to the taxpayer, regardless of whether he is held accountable for violating the legislation on taxes and fees.

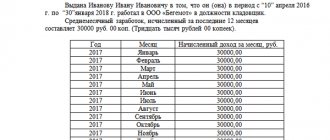

Thus, the tax authority informs the taxpayer about the amounts of arrears, fines and penalties available to him.

The demand for payment of tax must contain information about the amount of tax debt, the amount of penalties accrued at the time of sending the demand, the deadline for fulfilling the demand, as well as measures to collect the tax and ensure the fulfillment of the obligation to pay the tax, which are applied in the event of failure to fulfill the demand by the taxpayer.

Changing transaction qualifications

The most frequently used case in practice is the situation related to the recovery of funds from the taxpayer, provided for under. 3 p. 2 art. 45 of the Tax Code of the Russian Federation, namely: from an organization or individual entrepreneur, if their obligation to pay tax is based on a change by the tax authority in the legal qualification of the transaction made by such a taxpayer, or the status and nature of the activity of this taxpayer.

The inclusion of this norm in the Tax Code of the Russian Federation is aimed at protecting the property rights of taxpayers - legal entities and entrepreneurs from unlawful claims of tax authorities related to the arbitrary qualification of transactions at the discretion of the tax authorities.

In other words, the tax authorities, when conducting tax audits, having changed the qualifications of transactions made by the taxpayer, do not have the right to collect from the taxpayer tax arrears, fines and penalties in an indisputable manner.

The legislator, while providing the taxpayer with additional protection when the tax authority carries out such re-qualification, considered that the grounds for such re-qualification of transactions and additional assessment of taxes to the taxpayer, accrual of penalties and prosecution are subject to special verification, carried out exclusively in court, since when the tax authority issues a non-normative act between the parties There is already a dispute related to the determination by the tax authority of the actual essence of the business transaction performed by the taxpayer.

These relations can be considered as some additional form of control over the legality of the actions of the tax authority when conducting a tax audit of legal entities, along with the administrative procedure for appealing non-normative acts of tax authorities.

The Tax Code of the Russian Federation does not contain the concepts of “legal qualification of a transaction” and “legal requalification of a transaction.” The legislator decided not to constrain himself in this case by any legal framework.

Based on Art. 431 of the Civil Code of the Russian Federation, we can conclude that the qualification of a transaction is the determination of its subject and essential conditions and, based on this, the determination of the type of obligation. The Constitutional Court of the Russian Federation, in Ruling No. 282-O dated December 16, 2002, explained that the legal qualification of transactions means clarifying the real relationship between the parties to the transaction (whether a purchase and sale, exchange, etc. was made). In this case, the type of transaction is established based on the subject of the agreement, its essential conditions and the consequences to which it will lead.

The Civil Code of the Russian Federation provides for the possibility of re-qualifying transactions, for example in Art. 170 of the Civil Code of the Russian Federation establishes the right to re-qualify a feigned or imaginary transaction.

A sham transaction is one that is made to cover up another transaction. An imaginary transaction is a transaction carried out only for show, without the intention of creating corresponding legal consequences.

In a sham transaction situation, one transaction is passed off as another. In the case where there is an imaginary transaction, the completed transaction is unreal for tax purposes (Clause 1, Article 54.1 of the Tax Code of the Russian Federation).

When recharacterizing a transaction, the tax authority independently, at its discretion, selects the type of obligation that, as it seems to it, most corresponds to the given legal relationship, replacing the will of the parties with its own will.

The tax authority, reclassifying the transaction, determines which transaction should be completed instead of the one entered into by the parties.

In paragraph 3 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53 “ON ASSESSMENT BY ARBITRATION COURTS OF THE VALIDITY OF RECEIVING A TAX BENEFIT BY A TAXPAYER” it is stated that a tax benefit may be recognized as unjustified, in particular, in cases where for tax purposes transactions not taken into account in accordance with their actual economic meaning, or transactions not caused by reasonable economic or other reasons (business purposes) are taken into account.

Paragraph 4 of the Resolution also stipulates that a tax benefit cannot be recognized as justified if received by the taxpayer outside of connection with the implementation of real business or other economic activity.

According to paragraph 7 of the Resolution, if the court, based on an assessment of the evidence presented by the tax authority and the taxpayer, comes to the conclusion that the taxpayer for tax purposes took into account transactions not in accordance with their actual economic meaning, the court determines the scope of the rights and obligations of the taxpayer based on the true economic content of the relevant operation.

Thus, if the tax authority, during an audit, comes to the conclusion that the taxpayer has concluded and executed, for example, a supply agreement, and the taxpayer himself considers the transaction he has completed to be a commission agreement, then the tax authority changes the legal qualification of the transaction, i.e. e. it reclassifies the commission agreement as a supply agreement.

In this case, the tax authority has the right to assess additional taxes to the taxpayer, impose penalties and hold the taxpayer liable, based on the terms of the supply agreement.

Applying to the court

But he can collect the specified tax accruals only by filing a corresponding application with the court, since there is a re-qualification by the tax authority of the agreement in comparison with how this agreement was concluded and executed by the taxpayer himself.

To collect the arrears that arose as a result of recharacterization of the transaction, the tax authority must go to court (Letter of the Ministry of Finance of Russia dated 02/08/2013 N 03-02-07/1/3089). It is the court that will determine the validity of the recharacterization of the transaction and the legality of additional tax charges. The same is stated in the Resolutions of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57, and the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 6, 2012 N 8728/12.

Without the court's interference in these relations, the tax authority collects the corresponding additional tax charges only for imaginary transactions, i.e. those that actually did not exist (clause 2 of Article 170 of the Civil Code of the Russian Federation). For example, in the case considered by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 16064/09 dated June 1, 2010, the tax authority established that the documents used to document the transaction were unreliable and contradictory, and concluded that in fact this transaction did not actually take place . The tax authority refused to refund the VAT to the taxpayer and excluded the costs of this transaction from income tax expenses, and collected the additional accrued taxes in an indisputable manner, without going to court with a corresponding application. The Supreme Arbitration Court of the Russian Federation recognized the decision of the tax authority as legal and justified.

The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 16, 2013 N 3372/13 states that the judicial procedure for collecting taxes accrued as a result of re-qualification of a transaction made by such a taxpayer, or the status and nature of its activities, is intended to ensure judicial control, primarily over the legality of additional accrual such taxes.

Meanwhile, such control can be ensured both by challenging the decision to prosecute or the decision to refuse to prosecute, and by applying to the arbitration court with an application to collect the tax additionally assessed by such a decision.

In this regard, in itself, non-compliance with the judicial procedure for collecting tax, despite the fact that the decision of the inspectorate to prosecute, on the basis of which the decision was made to collect tax from funds in the accounts of the taxpayer - an organization or an individual entrepreneur, was the subject of judicial control and recognized as legal, does not indicate a violation of the rights and legitimate interests of the taxpayer.

It seems that this approach is justified, since it leads to procedural economy in an issue that has already been considered in court, which completely excludes its re-examination.

The simplest example of recharacterization of a transaction is a commission agreement. In one of the cases, the tax authority declared the commission agreement concluded by the taxpayer to be a supply agreement (Resolution of the ASVSO dated May 29, 2019 N F02-1926/2019 in case N A19-18267/2018).

When considering the dispute, the courts supported the taxpayer, emphasizing that the tax authority should not express an opinion on the nature of the transaction carried out by the person being inspected, but provide evidence that the commission agent actually sold the goods independently, and not on behalf of the principal. However, the tax authority did not provide such evidence in the present case.

Kozlov S.Yu., lawyer at MCA “Yulova and Partners”

Tax Code 2022: The Ministry of Finance has prepared large-scale changes

The State Duma proposed abolishing the transport tax

Limitation period for collecting tax sanctions

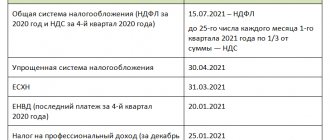

Collection of tax sanctions (fines) and penalties is carried out according to the same rules that we discussed above, and within the same time frame:

- 8 working days to pay the claim;

- 2 months for the tax authorities to make a decision on collection and send a collection order to the bank (or 6 months to go to court if they are late with the decision);

- 1-2 business days for the bank to execute the order.

Upon expiration of the established deadlines, controllers lose the right to collect taxes.

Find out how the statute of limitations for imposing a fine is calculated here.

Before collection

At the same time, preparatory work for collection begins much earlier than its actual identification and reflection in the inspection report. So, for example, currently, within no more than one month from the start of the on-site inspection, the debt settlement department of the inspectorate conducting the inspection must monitor the company’s solvency. This is done by obtaining information about the property on the company’s balance sheet, as well as obtaining a challenge to the registration authorities. Moreover, such information is collected not only in relation to the company itself, but also in relation to owners, managers and even affiliated companies.

The purpose of these actions is to ensure the most effective collection (including at the expense of property) when a tax debt is actually identified by the enterprise. The first step of inspectors in this direction is to apply interim measures based on the results of the audit, and their adoption does not even require the tax audit decision to enter into legal force.

Results

Tax authorities have a way of influencing those who do not pay taxes voluntarily - forced collection. But the Tax Code of the Russian Federation not only grants them such a right, but also requires them to comply with a certain procedure and deadlines. Monitor their actions, because if they deviate from the rules, the penalty can be challenged.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Property foreclosure

The next stage - collection of debt from property - can only be applied if it is established that it is impossible to collect from funds in current accounts. It is important to note that even if there is no money in the bank, auditors will be able to proceed to the next stage - debt collection from the organization’s property - only after the end of the two-month period allotted for debt collection from funds.

This is due to the fact that during the specified period, the taxpayer’s account may receive the money necessary to pay the debt amount. At this stage, a decision is made on recovery at the expense of the organization’s property, as well as a resolution on recovery, which is sent to the bailiffs for execution. As an interim measure, the inspection may make a decision to seize real estate that is on the balance sheet of the organization that is subject to foreclosure.

Unlike the preliminary security discussed above, in this case the organization loses the opportunity not only to dispose of property, but also to own it (that is, to use it in current activities).