Expenses subject to mandatory accounting by suppliers

Suppliers in government tenders are required to keep records of expenses:

- payment of commission fees for winning an electronic trading platform

- monetary security for a government contract

- payment of a commission to the bank that issued the guarantee

For suppliers in commercial bidding, these costs can be added to:

Registration in ERUZ EIS

From January 1, 2020 , in order to participate in tenders under 44-FZ, 223-FZ and 615-PP, registration in the ERUZ register (Unified Register of Procurement Participants) on the EIS (Unified Information System) portal in the field of procurement zakupki.gov.ru is required.

We provide a service for registration in the ERUZ in the EIS:

Order registration in the EIS

- payment for the right of access to documentation

- expenses for paying the subscription fee for participation in electronic trading for a specific period

It should be borne in mind that in some situations it is also possible to receive income, for example, receiving interest on funds stored in a special account.

The need to tax the amount of the security deposit

Important!

If the text of the agreement between the parties states that the amount of the security payment can be used by the recipient in settlements of the main obligation upon termination of the agreement, the security payment is considered as an advance. Accordingly, the need arises to pay personal income tax and VAT (and the company generates income using the simplified tax system).

If the agreement does not provide for settlements under the main obligation upon termination of the agreement using a security payment, then this payment cannot be regarded as income of the recipient of the funds. A security payment is not income until some event occurs, upon the occurrence of which the obligations will be secured by the amount of the security payment. If nothing like this happens, the money is returned to the payer. It turns out that the party to the contract who received the payment is its temporary holder who has no commercial benefit.

Rules for accounting for winning commissions

Money spent as commission fees for winning electronic auctions can be considered an expense item for telecommunications services (clause 25, clause 1, article 264 of the Tax Code of the Russian Federation) or recorded as other expenses (clause 49, clause 1, art. 264 of the Tax Code of the Russian Federation). It should be remembered that expenses must be economically justified and must have documentary evidence (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Documentary confirmation is carried out using closing documents - an act of provision of services and an invoice from the ETP, and a universal transfer document can also be a closing document. Documentation can be presented both on paper and in electronic form with certification by the operator’s electronic signature.

Definition and purpose of security payment

Important!

A security payment is not similar to a deposit or advance payment.

A security payment is a certain amount of money that is paid by one of the parties to the contract in favor of the other party as a penalty or a guarantee of the absence of probable losses in the event of violation of the terms of the contract. This is not the same as a deposit and an advance. Money cannot be the subject of collateral, if only because foreclosure on the pledged property presupposes its sale, and money cannot be sold.

The deposit is paid to the second party to the agreement against the payments due from the first party, which are stated in the agreement between them. An advance, in turn, differs from a deposit in that:

- If the provision of the agreement is violated by the party to the agreement who paid the deposit to the other party, then this amount will not be returned to the payer.

- If the agreement is violated due to the fault of one of the parties to the contract who received a deposit from the other party, the culprit will return the deposit and pay the same amount as a penalty on top.

Procedure for accounting for contract security

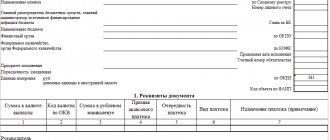

Reflection of security payments in accounting is carried out on account 76 , to which it is advisable to open a sub-account “Purchases” or “Settlements for issued security”.

Contract security cannot be included as expenses . Firstly, there is no such option in the Tax Code of the Russian Federation, Article 346.17. “The procedure for recognizing income and expenses.” Secondly, expenses are recognized as expenses only after they are actually paid.

An exception is the situation when a security payment is credited to repay the debt to the customer (letter of the Ministry of Finance dated 04/03/2020 No. 03-03-06/1/27033).

Accounting for received and issued security for obligations under contracts

According to paragraph 1 of Article 329 of the Civil Code of the Russian Federation, fulfillment of obligations under the contract can be ensured:

- penalty;

- collateral;

- retention of the debtor's property;

- surety;

- independent guarantee;

- deposit;

- security deposit;

- in other ways provided by law or contract.

Starting from version 3.0.70, 1C:Accounting 8 supports accounting for collateral for obligations (payments) under contracts. For the new feature to become available to the user, he will need to enable the corresponding functionality (section Main - Settings - Functionality). On the Calculations tab, you must set the Accounting for collateral for obligations and payments flag.

After enabling the specified setting in the contract card (section Directories - Purchases and sales - Contracts), a collapsible group Collateral for obligations appears, where, if the flag is checked, the Contract provides for security for obligations and payments, the user can specify the type of security under the contract and list the parties to the transaction (Fig. 1) .

Rice. 1. Information about securing obligations in the agreement card

The type of security is selected from the list preset by the program in accordance with the Civil Code of the Russian Federation:

- Aval;

- Pledge;

- Guarantee;

- Surety;

- Other.

The parties to the transaction are selected from the Counterparties directory and indicated in the fields:

- Who provided;

- In whose favor;

- For whom.

To record received security for obligations and payments, off-balance sheet account 008 “Securities for obligations and payments received” is intended. To record issued security for obligations and payments, off-balance sheet account 009 “Collateral for obligations and payments issued” is intended.

Starting with version 3.0.70 of 1C:Accounting 8, subaccounts have been added to off-balance sheet accounts 008 and 009:

- 008.01 “Securities for obligations and payments received” and 009.01 “Securities for obligations and payments issued” - for accounting for collateral in rubles;

- 008.21 “Collateral for obligations and payments received (in foreign currency)” and 009.21 “Collateral for obligations and payments issued (in foreign currency)” - for accounting for collateral in foreign currency.

Information about the collateral received for a transaction with a counterparty is reflected in the Transaction document (section Transactions - Accounting - Transactions entered manually). Click the Add button to enter a debit entry for account 008.01, indicate the name of the counterparty, the name of the agreement securing the obligation and the amount of the security received. For transactions with collateral in foreign currency, you must use account 008.21, additionally indicating the currency and the value of the transaction in foreign currency. The write-off of the amount of collateral received for a fulfilled obligation should be reflected as an entry in the credit of account 008.01 (008.21).

The security issued for a transaction with a counterparty is reflected in the document Transaction on the debit of account 009.01 indicating the counterparty and the agreement with the counterparty providing for the security of the obligation. For transactions with collateral in foreign currency, you must use account 009.21, additionally indicating the currency and the value of the transaction in foreign currency. The write-off of the amount of collateral issued for a fulfilled obligation is reflected by an entry in the credit of account 009.01 (009.21).

Using standard program reports (for example, the Analysis subconto Agreements report), you can analyze not only the status of settlements with counterparties, but also collateral under contracts - received and issued.

Security payment for a posting in accounting (using an example)

Important!

When a security payment is transferred, the entries must be reflected in a separate sub-account in which settlements are made for the main obligation provided for in the agreement.

A lease agreement has been signed for the workshop. For late transfer of rent to the owner, the tenant will be charged a penalty interest at the rate of 30% per annum. The lessor who has received the security deposit has the right to use it to pay off interest on late rent payments. VAT is not paid on the amount of the security deposit. The workshop owner's accountant will make the following entries:

| DEBIT | CREDIT | A comment |

| 51 | 60 sec. "Security payment" | The security deposit has been credited (excluding VAT) |

| 51 | 60 sec. "Rent" | The rent has been credited (the terms specified in the agreement have been violated). Including VAT. |

| 76 s/sch. "Calculations for claims" | 91 | Interest accrued for late payment of rent (30% per annum). VAT is not charged. |

| 60 sec. "Security payment" | 76 s/sch. "Calculations for claims" | The security deposit is written off to pay off a claim for late payment of rent. |

Postings for a security deposit and a deposit: comparison

The main practical differences between a deposit and a security deposit:

- The possibility of withholding the amount of the deposit by the supplier who did not deliver anything in fact.

If such withholding occurs, the supplier reflects this fact with postings (let’s agree that the supplier pays VAT):

- Dt 51 Kt 62/Z - deposit received;

- Dt 62/Z Kt 91 - the deposit is included in other income;

- Dt 91 Kt 68 - VAT is charged on the amount of the deposit.

Thus, the postings do not contain the subject of payment (goods) and the fact that VAT has been charged on it: the amount of the deposit is included in other income, and not in revenue (as with a security deposit). Otherwise, the postings are used with the same synthetic accounts as when reflecting the application of the security deposit in accounting.

- Possibility for the buyer to receive double the amount of the deposit.

In such a situation, the buyer will use the following entries:

- Dt 60(76) Kt 51 - the deposit is transferred to the supplier;

- Dt 51 Kt 60(76) - the deposit was received back with a “penalty” amount;

- Dt 60(76) Kt 91.1 - “penalty” excess over the initial deposit is included in other income.

Here again we are talking about the appearance of the amount included in other income, separated from the one that corresponds to the original amount of the deposit that is returned. It is noteworthy that, as in the case of an unused security deposit, VAT is not reflected in the transactions, since the additional income of the buyer in this case is represented by a penalty that is not related to payment for goods (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05.02.2008 No. 11144/07 on case No. A55-3867/2006-22).

Another noteworthy nuance is the use of supporting documents as part of the accounting of the payment in question.

How to reflect the guarantee of fulfillment of obligations in tax accounting

Security payment

Security payment (pledge or deposit), guarantee or bank guarantee: accounting, income tax, value added tax.

Let's consider how receiving a security payment, guarantee or bank guarantee will affect the calculation of value added tax and income tax.

Security payment: pledge or deposit.

In fact, this security payment has the same legal nature as the usual deposit or pledge (see Article 334 and paragraph 1 of Article 380 of the Civil Code of the Russian Federation). This is a way to ensure the fulfillment of obligations (clause 1 of Article 329 of the Civil Code of the Russian Federation). The method is introduced by one party to the contract in favor of the partner and is intended to ensure the fulfillment of the obligation under the contract (Article 381.1 of the Civil Code of the Russian Federation). And if the debtor does not fulfill the contractual terms, the creditor will count the amount of the security payment against the obligation not fulfilled by the partner.

In accordance with paragraph 32 of Art. 270 of the Tax Code of the Russian Federation, when transferring property or property rights as a deposit or collateral, the organization does not incur expenses taken into account for tax purposes. This also applies to the security payment. The security payment is not recognized as an expense in tax accounting.

The return of the security deposit is not income. There is no need to take into account the amount of the returned security deposit in your income. Because when determining the tax base, revenues in the form of property and property rights that the company received in the form of a security payment are not taken into account (clause 2, clause 1, article 251 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 28, 2015 N 03- 03-06/2/61826).

VAT on security deposit

With value added tax the situation is more complicated. VAT on the security deposit will be paid depending on how the clause on this is spelled out in the contract.

If the contract stipulates that the recipient has the right to withhold the pledge or deposit as payment for subsequent goods or services, then it will have to be clearly included in the VAT tax base. According to paragraphs. 2 clause 1 and clause 2 art. 162 of the Tax Code of the Russian Federation, the tax base for value added tax includes funds received as payment for goods (work, services) sold by the taxpayer.

Therefore, if, when an organization receives funds as a security payment for future payments for goods, works or services sold by it, subject to value added tax, the amount of the security payment is included in the tax base for value added tax (Letter of the Ministry of Finance of Russia dated November 3, 2015 . N 03-03-06/2/63360).

To avoid this, write in the contract that the security deposit is not withheld as payment and is subject to return at the time of termination of the contract or fulfillment of the obligation for which it was received. Or specify a special period for writing off the security deposit upon termination of the contract. Otherwise, a claim may be filed for non-return of the security deposit.

Surety or bank guarantee.

The guarantee or bank guarantee itself does not lead to income or expenses. After all, a guarantee is an obligation under which the guarantor is obliged to fulfill obligations to the creditor for a third party in whole or in part (clause 1 of Article 361 of the Civil Code of the Russian Federation). This is some action that may or may not happen in the future. And before this event occurs, neither income nor expenses arise, and therefore no tax base for value added tax and profit tax.

But the fee itself for providing a guarantee will be taken into account as an expense for the person for whom they are guaranteeing or for the person to whom the bank guarantee was issued. These expenses will be taken into account evenly during the period for which they were issued (letters from the Ministry of Finance of Russia dated December 1, 2014 No. 03-03-06/1/61180, dated July 19, 2012 No. 03-03-06/4/75 and dated 11.01.11 No. 03-03-06/1/4, dated 27.07.12 No. 03-03-06/1/365).

Let us separately dwell on the accounting of collateral and deposit from the “simplified”.

The position of the Federal Tax Service regarding the simplified tax system and security deposit is simple. For a taxpayer using the simplified taxation system, the receipt and issuance of a pledge or deposit will not cause any tax consequences. This follows from (clause 1, clause 1.1, article 346.15, clause 2, clause 1, article 251 of the Tax Code of the Russian Federation, clause 1, article 346.16 of the Tax Code of the Russian Federation).

It is also impossible to accept as expense the amount of valuation and insurance of property pledged as collateral, since such expenses are not specified in clause 1 of Art. 346.16 of the Tax Code of the Russian Federation.

The same is true when returning the amount of the pledge or deposit, since the economic benefit of the mortgagor within the meaning of clause 1 of Art. 41 of the Tax Code of the Russian Federation is missing.

At what point is a security deposit recognized as income?

For a simplified taxpayer, the amount of the security payment is recognized as income at the moment when the amounts securing the obligation are accepted as payment for goods supplied (work performed, services provided) (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation). They are included in the income of the “simplified” person on the date of conclusion of the corresponding agreement (letters of the Ministry of Finance of Russia dated October 28, 2013 No. 03-11-06/2/45451, dated April 8, 2013 No. 03-11-06/2/11372 and dated October 24. 12 No. 03-11-06/2/135).

Also, if the security payment is not returned within three years from the end of the agreement, it will become income and income tax will be charged on it. After all, after three years, the payer will no longer have the right to return the security payment and the latter will become the property of the recipient.

Offsetting the security of an obligation against another agreement.

The taxpayer has the right to offset the security payment against another agreement. To do this, draw up a letter regarding the offset of the security payment under a new agreement or an additional agreement and provide that it contains wording about the offset of the security payment against the previous agreement, or other terms of offset. Remember that if a deposit or collateral is used as an advance on a future contract, it will have to be subject to VAT (Letters dated 09.09.2011 N 03-07-11/245 and dated 21.09.2009 N 03-07-11/238) .

Accounting entries for security deposit

Using an example, let us consider what accounting entries are made by the parties to an agreement providing for security of an obligation.

Thus, the seller reflects the following transactions:

| Debit | Credit | Contents of operation |

| 50 (51) | 62-1 (76-1) | Security payment received |

| 62 (76) | 68 | VAT is charged on the amount of the security deposit |

| 008 | The amount of the security deposit is reflected in the off-balance sheet account | |

| 62 (76) | 90 | Revenue under the contract is reflected |

| 90.3 | 68 | VAT charged on sales |

| 008 | The amount of the security deposit has been removed from off-balance sheet accounting | |

| 62-1 (76-1) | 62-2 (76-2) | The amount of the security deposit is offset against payment under the agreement |

| 68 | 62 (76) | Accepted for deduction of VAT from the amount of the security deposit |

| or | ||

| 62 (76) | 91 | The security payment is reflected as other income (if the obligations are not fulfilled due to the fault of the buyer) |

| 68 | 62 (76) | Accepted for deduction of VAT from the amount of the security deposit |

| or | ||

| 76 | 50 (51) | The security deposit was returned at the end of the contract term |

| or | ||

| 91 | 62 (76) | Other expenses are reflected in the form of a fine (if obligations are not fulfilled due to the fault of the seller) |

| 09 | 68 | IT is reflected (if the seller uses the cash method of accounting for income and expenses) |

| 62 (76) | 50 (51) | The security payment was returned to the counterparty |

| 68 | 09 | OTA has been repaid (if the seller uses the cash method of accounting for income and expenses) |

| 68 | 62 (76) | Accepted for deduction of VAT from the amount of the security deposit |

Accounting for a security payment by the obligated party under the simplified tax system: entries

Leasing-Banking LLC, within the framework of the agreement on the application of a security deposit, will select the following entries in the accounting registers:

- Dt 60/OP (subaccount again for the counterparty) Kt 51 - payment transferred to the counterparty;

- Dt 51 Kt 60/OP - the counterparty returned the payment.

Vending-Lending LLC will record the following entries in its registers:

- Dt 60/OP Kt 51 - payment transferred to the counterparty;

- Dt 41 Kt 60 - goods supplied by the counterparty are accepted onto the balance sheet;

- Dt 60 Kt 60/OP - payment is credited as payment for supplies.

IMPORTANT! As an alternative to accounts 60 (when accounting for transactions with a supplier) and 62 (when accounting for transactions with a buyer), account 76 can be used for OP. In this case, it also makes sense to open a subaccount for the counterparty.

Postings are used according to a different scheme if the parties work on OSN. This is mainly due to the fact that they become VAT payers.

Leasing accounting in ERP 2.4 in regulated accounting

In regulated accounting, the ability to keep records of fixed assets received under leasing is determined by the functional option “Master data and Administration-Regulated accounting-Management of parameters of regulated accounting-Leasing”.

Setting up rules for displaying transactions is specified by the parameters of leasing agreements. This allows you to support various display schemes for such contracts in accounting. To display the amounts of business transactions, you can use standard subaccounts of mutual settlements and obligations (postings to subaccounts 60.02, 76.05, etc.) or independently supplement the working chart of accounts with dedicated subaccounts on account 76 “Settlements with various debtors and creditors.”

It is recommended to use different subaccounts for accounting accounts under the agreement for:

- Security payment;

- Lease obligations (the account is used only for the “On Balance Sheet” accounting option);

- Leasing services;

- Redemption of the leased asset.

You can analyze the status of mutual settlements under leasing agreements using the “Register of leasing agreements” report. There are 2 options for accounting for leasing from the lessee - on the balance sheet and off the balance sheet.

Implementation of 1C:ERP 2

Comprehensive automation of enterprise resource management.

Free audit from a leading 1C partner! To learn more

Let's set up leasing accounting in 1C:ERP

We will competently set up your 1C and adapt the functionality to your accounting processes.

1 year warranty! To learn more