From the fourth quarter of 2022, all companies must use the new form Calculation of insurance premiums (DAM) , KND 1151111 . In the article we will tell you when you need to submit the calculation, show a sample of filling it out and give detailed instructions on how to fill it out correctly.

The frequency of presentation is quarterly . All companies and individual entrepreneurs must report using the DAM form if they are insurers of pension, medical and social insurance for hired personnel. The RSV form for 2022 was approved by Federal Tax Service order No. ММВ-7-11/470 dated September 18, 2022, as amended by Federal Tax Service order No. ED-7-11/751 dated October 15, 2022.

Deadline for submitting the report according to the DAM form

The quarterly calculation of insurance premiums is submitted to the tax authorities no later than the 30th day of the month following the reporting period. If the established day for submitting the report falls on a weekend, then in accordance with the law it is postponed to the first working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

For 2022, the following deadlines for providing quarterly calculations have been established:

- for 2022 until January 31, 2022 (the 30th is a day off)

- for the first quarter until May 4, 2022 (April 30 is a day off)

- half a year before August 1, 2022 (July 30th and 31st are weekends)

- 9 months before October 31, 2022

Entrepreneurs running peasant farms do not submit quarterly reports; the deadline for submitting the annual report is set, as for other organizations, no later than January 30 of the following year. But since the 30th falls on a Sunday, the deadline is moved to the next working day, January 31, 2022.

New reporting - unified calculation of insurance premiums

Starting from reporting for 2022, policyholders submit a unified calculation of insurance premiums to the Federal Tax Service using a new form, which was approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] The name of the document - calculation of insurance premiums - does not have an abbreviation, although accountants reduced it to DAM or ERSV (unified calculation of insurance premiums).

The number of the unified calculation form for insurance premiums 2022 is KND 1151111. You can download the current ERSV form for 2021 on our website using the link below: Please note that starting with reporting for the 1st quarter of 2022, the new ERSV form will be used.

The calculation is submitted 4 times a year: based on the results of the 1st quarter, half year, 9 months and year. The exception is peasant/farm enterprises (peasant farms), they submit calculations only at the end of the year.

The deadline for submitting the calculation is the 30th day of the month following the reporting period. If it coincides with a weekend, this period is moved forward to the next weekday. For example, for 2021 you need to report until 01/31/2022 inclusive, because 01/30/2022 - Sunday.

Insureds submit the calculation to the Federal Tax Service at the place of registration of the individual entrepreneur (letter of the Federal Tax Service dated March 1, 2017 No. BS-4-11 / [email protected] ) or the location of the legal entity.

Ask questions on our forum! For example, in this thread you can clarify which points in filling out the ERSV most often lead to the need to submit an updated report or write explanatory letters .

Method of submitting the report - on paper or via the Internet

Since 2022, the rules by which the possibility of submitting a declaration in electronic or paper form have been determined have changed. From the 1st quarter of 2022 in accordance with clause 4 of article 80, clause 10 of art. 431 of the Tax Code of the Russian Federation establishes a new limit on the number of employees :

- companies with more than 10 employees are required to provide a report in electronic form, previously this parameter was 25 people

- companies created during the reporting period, including through reorganization, are required to report electronically if the number of employees exceeds 10 people, and not 25, as was previously the case

Legal entities and individual entrepreneurs with fewer than 10 employees can choose the method of submitting the report independently: submit the calculation on paper in person, send it by registered mail with a list of attachments by mail, or submit it via electronic communication channels.

What to check in Appendices 1 and 2 to Section 1

Please check Appendices 1 and 2 in the DAM for the year separately, after a control check of the database and insurance premiums according to special reports in 1C.

Check the calculation of the taxable base by type of accrual. Check whether your program has the correct division into taxable and non-taxable parts. It is possible that in the fourth quarter there were new types of payments to employees, and for them the base for contributions was formed incorrectly. This needs to be checked in the program.

The maximum value of the base for insurance premiums for 2021

| Type of compulsory insurance | Limit value |

| Pension | RUB 1,465,000 |

| Social | RUB 966,000 |

| Medical | — |

When checking the annual DAM, check the general base for calculating contributions and only after that – the DAM, which generates “1C: Salaries and Personnel Management 8” ed. 3. Check the database using the report Taxes and contributions – Reports on taxes and contributions (Section Insurance premiums) – Analysis of contributions to funds

(Fig. 1). The value for calculating contributions must be equal to the total amount of payments minus non-taxable amounts, taking into account the maximum values for calculating contributions for compulsory pension and social insurance.

Rice. 1. Analysis of contributions to funds

Report Analysis of Fund Contributions

can be configured in “1C: Salaries and HR Management 8” edition 3 specifically for your company and save several report options for specific legal entities in the program.

Report Analysis of Fund Contributions

additionally configure:

- by type of accrual;

- employee breakdown;

- in terms of employee status (selection for temporary residents, temporarily staying employees);

- by neighborhood.

To make additional settings in the Fund Contribution Analysis

Contact your company's service partner.

In “1C: Salaries and Personnel Management 8” edition 3 there is another additional calculation for monitoring contributions - Checking the calculation of contributions

, but it is formed with a breakdown for each employee and month.

Checking the calculation of contributions

is located in the same section with

the Analysis of contributions to funds: Taxes and contributions – Reports on taxes and contributions (Section Insurance contributions) – Checking the calculation of contributions

(Fig. 2).

Rice. 2. Checking the calculation of contributions

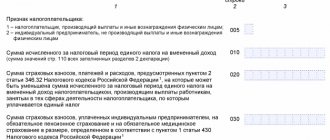

Appendix 1 to Section 1

In the first appendix, two subsections are required to be completed: subsection 1.1 reflects the amount of contributions for compulsory pension insurance, subsection 1.2 contains information about payments for compulsory health insurance.

Both subsections contain the same fields to fill out, but if in subsection 1.1 the contribution amounts are divided into deductions before and after exceeding the limit on contributions to compulsory health insurance, then in subsection 1.2 there is no such division, since there are no limits on contributions to compulsory medical insurance.

Next, check the completion of the payer tariff code. The full list is given in Appendix 5 to the order of the Federal Tax Service No. ММВ-7-11/470. A frequently used code is 01, when the policyholder pays premiums at the basic insurance premium rates.

Check the taxable base: in subsection 1.1 of Appendix 1 to Section 1 the control ratio must be met:

Columns 1 (2,3,4) lines 050 = Columns 1 (2,3,4) lines 030 - Columns 1 (2,3,4) lines 040

All calculated contributions must be equal to the amount of contributions from payments within and above the limit. For reconciliation, use the ratio of indicators in subsection 1.1 of Appendix 1 to Section 1 (see below):

Columns 1 (2,3,4) lines 060 = Columns 1 (2,3,4) lines 061 + Columns 1 (2,3,4) lines 062

Also control the amounts payable by fund in section 1. Pension contributions payable must be equal to the total amount of contributions calculated for all tariffs. Apply the ratio:

Lines 030 (031,032,033) of section 1 = Amount of column 1 (2,3,4) of line 060 of subsection 1.1 of Appendix 1 for all tariffs

If equality is not met, check the indicators. There may be an error in the total amount of insurance premiums payable (lines 030–033 of section 1), or the amounts for individual tariffs have been calculated incorrectly.

The amount of contributions for health insurance must be equal to the amount of calculated contributions for all tariffs, that is:

Lines 050 (051,052,053) of section 1 = Amount of column 1 (2,3,4) of line 060 of subsection 1.2 of Appendix 1 for all tariffs

If equality is not met, check whether there may be errors in the total amount of insurance premiums payable (lines 050–053 of section 1) or in the indicators for individual tariffs.

Control ratios when checking calculations

The Tax Service has changed the rules for checking control ratios (CR) of accrued amounts in the calculation of insurance premiums. Now the actions of the inspection bodies are regulated by letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 02/07/2020. In the document, all changes are presented in the form of a detailed table. The new CS make it possible to better compare the amounts of payments accrued under employment contracts to employees not only with the minimum wage established by the region, but also with the average wages in certain industries for the previous period. This technique will make it possible to more effectively identify “black” salaries. In total, the list of control ratios has been reduced, but at the same time it has become more effective.

In Kontur.Externe, checks for new control ratios are already built in: if an error is detected, the system will not allow you to send the calculation.

Most of the report's benchmark ratios are evaluated according to the rate code. If an error is detected, the inspector sends a notice of non-compliance, which must be corrected within a specified time frame.

Unified calculation of insurance contributions to the Pension Fund - personalized information of employees

Section 3 of the unified calculation is devoted to personalized information about insured persons - both within the framework of an employment contract and within the framework of a civil law contract. The accountant indicates here the personal data of the insured person - TIN, SNILS, full name, date of birth, citizenship, gender, code of the type of identification document, its series and number.

Filling out personal data of employees in a single calculation for insurance premiums 2022 should be treated with the utmost attention. If there is an error in F.I.O., INN or SNILS, the Federal Tax Service will not accept the report (letter of the Federal Tax Service of Russia dated January 19, 2017 No. BS-4-11 / [email protected] ). Other information about employees must also be reliable.

See also: “The employee’s TIN is unknown: how to submit the ERSV?” .

The accountant must also indicate whether the employee has mandatory pension, medical and social insurance.

Subsection 3.2.1 of personalized information includes data on payments in favor of the employee for the last 3 calendar months, the code of the insured person, and the basis for calculating insurance premiums. If there are additional tariff fees, reflect them in the fields of subsection 3.2.2.

Find out whether to include data on workers laid off in the previous reporting period in the calculation of contributions here .

The difference between Section 3 of the unified calculation of insurance premiums and the similar section of the RSV-1 form is that the new reporting does not need to reflect information about the period of work, working conditions and insurance coverage of the employee. Separate reporting is intended for this data (form SZV-STAZH), which is submitted to the Pension Fund of the Russian Federation at the end of the calendar year.

Important! ConsultantPlus warns Section 3 of the calculation is important to check. The calculation will not be considered submitted and will have to be resubmitted if it contains: For a list of defects in which the tax authorities will return the calculation for clarification, see K+. This can be done for free as part of demo access.

You can view a sample of filling out a single calculation of insurance premiums to the Federal Tax Service for 2022 in ConsultantPlus, having received free trial access to the system.

Separate divisions and branches

Separate divisions and branches that have a separate current account must provide calculations of insurance premiums to the local tax authority (clause 11 of Article 431 of the Tax Code of the Russian Federation). Since 2022, having a bank account has become a determining condition . Thanks to this modification, compliance of the Tax Code of the Russian Federation with the law on pension insurance was achieved, in which registration of a unit as an insurer is possible only if it has a separate current account.

For companies with separate divisions without a current account, which in the period 2017-2019. had the right to submit reports on insurance premiums to the local tax office, there were two options for action:

- Open a current account and continue reporting according to the old scheme.

- Submit to the tax authorities an application for deprivation of the division's authority to provide consolidated reporting, which includes information on the branch's accruals at its location.

Thus, in accordance with paragraphs. “a”, “c” clause 85 art. 2, part 3 art. 3 of Law No. 325-FZ, from January 1, 2022, only those separate divisions that make payments in favor of employees and have a separate current account can transfer insurance premiums and provide a declaration on them.

Who is required to submit the ERSV at the end of the third quarter of 2022 and within what time frame

The unified calculation of insurance premiums (ERSV) is submitted by entrepreneurs who use hired labor in their activities to the tax office at the place of residence and by organizations without any exceptions at the place of registration.

NOTE! The legislation does not oblige individual entrepreneurs who do not employ hired workers to submit a specified report to the tax authorities. Legal entities, even in the absence of employees, are required to report on insurance premiums. In this case, the calculation can be submitted with zero indicators - this is relevant for those situations where no payments were made in favor of individuals and, accordingly, insurance premiums were not charged.

Read more about this calculation here.

All reporting entities whose average number of employees for the previous year did not exceed 10 people have the right to choose: they can submit the ERSV electronically or on paper. Those who have exceeded this indicator do not have such a choice - they are required to send the ERSV to the tax authorities electronically, and if they submit a report on paper, they face a fine for violating the delivery format.

The Tax Code defines the deadline for submitting the ERSV as the 30th day of the month following the end of the reporting period. The reporting periods are the first quarter, half a year, 9 months and a year. The end of the third quarter is the end of the nine-month reporting period. You must report for this period in 2022 no later than November 8, 2021, because The deadline is shifted due to non-working days.

IMPORTANT! If the submission of the ERSV is delayed by 20 days or more, the tax authorities have the right to block the bank account. In addition, a payment submitted on time will be considered not submitted if there are errors, which will also lead to the blocking of accounts (clause 7 of Article 431 of the Tax Code of the Russian Federation). See details here.

Calculation form and procedure for filling out the DAM form

In order to report on social contributions for the fourth quarter of 2021, you will have to use a new form approved by Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 N ED-7-11/ [email protected]

Read more New form of the RSV 2022

The form of calculation has become simpler, but the new changes cannot be called drastic. It is most convenient to fill out the document in the following order: first, fill out the title page, then Section 3 and the rest of the appendices, and only at the very end proceed to filling out the first section.

Title page

The main innovation of the title page is the appearance of a field to reflect information about the average number of personnel. This innovation freed companies and individual entrepreneurs from submitting an independent report on their headcount to the Federal Tax Service.

Let's look at line-by-line filling.

TIN - 10-digit taxpayer number (12-digit for individual entrepreneurs)

Checkpoint - a 9-digit code assigned by the inspection where the declaration is submitted

The correction number is “0—” for the initial submission of the report, and the serial number of the correction for the updated report. Billing period - indicate the period code (see table)

| Taxable period | For legal entities and individual entrepreneurs | In case of reorganization (liquidation) |

| I quarter | 21 | 51 |

| half year | 31 | 52 |

| 9 months | 33 | 53 |

| year | 34 | 90 |

By location (accounting) (code) - the full list is given in Appendix No. 4 to the Filling Out Procedure, the most common are “120” for individual entrepreneurs and “214” for organizations.

The name of the organization is the full name of the taxpayer from the constituent documents.

Average headcount - indicates the number of personnel, which is calculated in accordance with clauses 76-79.11 of Rosstat Order No. 711 dated November 27, 2022.

OKVED2 code is a value from the OKVED2 classifier corresponding to the type of activity being carried out.

The following is a block to be filled in in case of reorganization (liquidation) of an organization .

The contact phone number is displayed with the country and city code. All numbers are written in a row without spaces or other symbols.

The number of sheets of the declaration is reflected , and, if available, the number of sheets of supporting documents.

Finally, the full name of the person certifying the accuracy and completeness of the information provided .

Signature

and

date .

Title page

Section 1

If the company made payments to its employees during the reporting period, then number 1 is indicated on line 001 “Payer type (code)”; for those who did not make payments, code 2 is provided. Accordingly, in the first case, the corresponding accruals should be indicated in lines 031-033 , in the second – zero values are entered.

for lines 111-113 . This was done to be able to reflect reimbursement of expenses in connection with temporary disability of employees in the calculation, even in cases where wages were not accrued.

Zero reporting should consist of a title page, Section 1 without appendices, which will indicate code 2, and Section 3 without table 3.2.

Section 1 consists of 9 appendices.

If during the reporting period the company applied several tariffs, then Appendix 1 to Section 1, as before, is filled out in several copies. The tariff code is indicated in accordance with the changes made in the classifier. Please note that the new form excludes codes 02 and 03. For those who apply the basic tariff for calculating insurance payments, code 01 is provided, which is indicated regardless of the chosen taxation system. Also, codes 04 and 05, which were entered in the case of using reduced tariff rates, have been removed from the register. Due to changes made to the legislation, such benefits have been terminated.

The following codes were entered into the register during the year:

| New code | Who points |

| 17 | Organizations from the unified register of residents of the Special Economic Zone in the Kaliningrad Region (Federal Law dated January 10, 2006 No. 16-FZ) |

| 18 | Russian companies that produce and sell their animated audiovisual products, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products |

| 19 | Payers of contributions with the status of a participant in a special administrative region (Federal Law of August 3, 2018 No. 291-FZ), who pay ship crew members for the performance of labor duties. Vessels must be registered in the Russian Open Register of Ships |

In Subsection 1.1 and 1.2 of Appendix 1 there is line 045, which is intended to form the amount of expenses accepted for deduction that are related to the receipt of income under the contracts listed in clause 8 of Art. 421 Tax Code of the Russian Federation. This line reflects expenses that have documentary evidence, as well as those that are accepted for deduction in the established amounts, regardless of the presence of documentary evidence.

In the new form of Calculation of insurance premiums in Appendix 2, a new line “Payer's tariff code” has appeared. Now, when using different tariffs simultaneously, this section will need to be filled out on several sheets, similar to Appendix 1. A new line 015 to reflect the number of people from whose payments insurance payments are accrued.

block 001-006 is intended to indicate charges for each individual tariff. Lines 070-090 indicate the total amounts for all applicable tariffs. Line 055 is intended to indicate the tax base from which contributions are calculated to stateless persons at a rate of 1.8%.

Appendix 5 has been developed to calculate compliance with the conditions for the use of reduced tariffs by IT companies in accordance with paragraphs. 3 p. 1 art. 427 Tax Code of the Russian Federation. When filling out a section in the new DAM, you must use new tariff codes. row 060 has also been added to the table to reflect information about company registration in the special zone resident form.

Added Appendix No. 5.1, which is filled out in case of applying a reduced tariff.

Appendix 6 is also intended to determine the legality of applying a reduced tariff for non-profit organizations using the simplified tax system and tariffs established by paragraphs. 3 p. 2 art. 427 Tax Code of the Russian Federation.

Appendix 7 is filled out by organizations that are engaged in the production of animation and audiovisual products using the reduced tariff established by paragraphs. 6 paragraph 2 art. 427 Tax Code of the Russian Federation. The new edition has expanded the list of codes (see Appendix No. 7 of the RSV)

Appendix 8 is intended for information on temporarily staying foreign citizens who pay contributions at a rate of 1.8%. Previously, such information was reflected in Appendix 9.

Appendix 9 is filled out by insurers who have employees who are undergoing training or working in student groups. Pension contributions are not calculated from these payments. In the previous edition, Appendix 10 was allocated for such policyholders.

Section 2

This section of the Insurance Premium Calculation form is entirely intended for peasant and farm households. The new changes affected only Appendix 1, where when indicating the personal data of members of the household, it will now be necessary to enter passport data, gender and date of birth in full. Completing this section is not particularly difficult.

Section 3

The form in question is intended to reflect personalized information. For subsection 3.2.2, a new coding has been developed that establishes the basis for calculating contributions at an additional tariff and in accordance with working conditions.

New codes of insured persons in subsection 3.2.2

| Code | Name |

| 110 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 1 of Article 428 of the Tax Code of the Russian Federation) |

| 120 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 2 of Article 428 of the Tax Code of the Russian Federation) |

| 131 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 132 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 133 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 134 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 140 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

| 231 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 232 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 233 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 234 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 240 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

Section 3

New form of DAM from the report for 2022

The calculation form for insurance premiums in 2022 was updated by order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11 / [email protected] The form has a KND number - 1151111. Detailed instructions for filling out the DAM are in Appendix No. 2 to the order. Filling out the form will require accuracy and attention, since errors in the calculation can lead to fines and the need to re-submit the DAM.

The main changes in the calculation affected the design of the form. It has become simpler and reduced by almost 1/3. Let's look at the innovations in more detail:

- Title page. A new field “Average headcount” has appeared; this data will need to be provided in the DAM for each reporting and billing period. A separate report on the average number of employees was deleted.

- Tariff codes and category codes of insured persons . Tariff codes that were introduced in the first half of 2022 were added to the order. For SMEs that pay contributions from payments above the minimum wage at reduced rates, the payer tariff code “20” and the insured person category codes “MS”, “VZhMS”, “VPMS” have been approved. For policyholders who have a zero premium rate, the payer tariff code “21” and the insured person category codes “KV”, “VZhKV”, “VPKV” were approved.

- Appendix 5.1 . It is relevant for payers from the IT sector, who, as part of the tax maneuver, have received reduced insurance premium rates from January 1, 2022. The application is completed to confirm your compliance with the conditions for applying the reduced tariff. This applies to electronics, software and database developers.

- New payer rate codes and category codes of insured persons for the IT sector . Developers of electronics, programs and databases who meet the conditions for applying reduced tariffs will enter the tariff code “22”. The codes for the categories of insured persons are as follows: “EKB” - individuals; “VZhEK” - persons from among foreign citizens or stateless persons temporarily residing in the Russian Federation, as well as temporarily staying refugees; "VPEC" - foreigners or stateless persons temporarily staying in the Russian Federation.

Submit RSV and other reports in the Kontur.Accounting web service. The service itself will fill out the forms based on accounting data. Sending via the Internet.

Rules for providing corrective information

If an error is discovered in a previously provided calculation or if contributions are underpaid, an updated calculation must be submitted. It must consist of the same applications that were previously submitted. The clarification document must indicate the correction number.

If you need to cancel previously provided information, then in line 010 of Section 3 you must put the cancellation sign “1”, and lines 130-170 , 190-210 blank.

If in the previously submitted calculation an error is found in the personal data of the insured person, then the procedure for filling out the correction report will be as follows:

- The policyholder fills out Section 3 with erroneous information and indicates the cancellation indicator “1” in it; dashes are placed in subsection 3.2.1.

- Section 3 is filled out again, corrected data is entered into it, and subsection 3.2.1 is filled in. In this case, the cancellation sign is no longer indicated.

As a result, the updated calculation will include two sheets: one with erroneous information, and the second correct. To clarify other inaccuracies in Section 3, you simply need to submit the document again with the correct information. At the same time, the personalized section must be filled in completely, and not just the corrected lines.

Form of a single calculation for insurance premiums to the Federal Tax Service

The unified calculation of insurance premiums 2022 consists of a title page and three sections. There are 21 sheets in total. But you don't have to fill them all out.

| Section/application number | Section name | Compulsory completion for all policyholders | Notes |

| Title page | v | The policyholder indicates the TIN, KPP, adjustment number, the period for which the report is submitted, OKVED2, information about the tax authority receiving the report, the total number of sheets in the calculation | |

| Section 1 | Summary data on the obligations of the insurance premium payer | v | Here the OKTMO, BCC of the contribution, the amount of the contribution for the billing period and contributions for the last 3 months of the billing period are indicated - and so on for each type of contribution |

| Annex 1 | Calculation of insurance premiums for compulsory pension and health insurance | — | Consists of subsections 1.1, 1.2, 1.3, 1.3.1, 1.3.2 - filled in if appropriate payments are available |

| Appendix 1.1 | Calculation of the amounts of insurance premiums for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations | — | Filled out by payers making payments to individuals specified in Art. 429 Tax Code of the Russian Federation. |

| Appendix 2 | Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (VNiM) | — | The policyholder specifies whether sick leave or benefits are paid directly to the employee or whether an offset system is in place. The number of insured persons in total and for each of the last 3 months is filled in, and the insurance base is provided. The amount of reimbursement of expenses to the policyholder and the amount of contributions payable to the budget are also indicated. |

| Appendix 3 | Expenses for compulsory social insurance in case of VNIM and expenses incurred in accordance with the laws of the Russian Federation | — | Here you can see cumulative payments to employees by type of insured event and the total amount of payments. Accrued but not paid benefits are recorded for reference. |

| Appendix 4 | Payments made from the federal budget | — | Payments to Chernobyl victims, as well as victims at the Mayak production association, the Semipalatinsk test site and other radioactive zones are indicated |

| Appendix 5 | Calculation of compliance with the conditions for the application of a reduced tariff of insurance premiums by payers from sub-clause. 3 p. 1 art. 427 Tax Code of the Russian Federation | — | Filled by IT companies |

| Appendix 6 | Calculation of compliance with the conditions for the application of a reduced tariff of insurance premiums by payers from sub-clause. 7 clause 1 art. 427 Tax Code of the Russian Federation | — | Filled out by NPOs on the simplified tax system engaged in the social, scientific, educational, healthcare and mass sports spheres |

| Appendix 7 | Calculation of compliance with the conditions for the application of a reduced tariff of insurance premiums by payers specified in subparagraph. 15 clause 1 art. 427 Tax Code of the Russian Federation | — | Filled out by Russian organizations engaged in the production and sale of animated audiovisual products produced by them, applying the contribution rates established by sub-clause. 6 paragraph 2 art. 427 Tax Code of the Russian Federation. |

| Appendix 8 | Information necessary for applying the insurance premium rate established in paragraph. 2 subp. 2 p. 2 art. 425 Tax Code of the Russian Federation | — | Fill in regarding payments in favor of foreigners and stateless persons temporarily staying in the Russian Federation |

| Appendix 9 | Information necessary for applying the provisions of sub-clause. 1 clause 3 art. 422 Tax Code of the Russian Federation | — | Filled out in relation to remuneration in favor of university students (full-time study) for activities in student teams (included in the register of associations with state support) under a contract or employment contract |

| Section 2 | Summary data on the obligations of insurance premium payers - heads of peasant farms | — | Fill in regarding insurance premiums accrued for the head and members of the peasant farm |

| Annex 1 | Calculation of the amounts of insurance premiums payable for the head and members of the peasant farm | – | |

| Section 3 | Personalized information about insured persons | v | Includes subsections: 3.2.1 - completed by all policyholders; 3.2.2 - filled out in accordance with the provisions of Art. 428 of the Tax Code of the Russian Federation regarding payments subject to additional tariff contributions |

The calculation indicates only the accrued amounts of contributions and insurance payments. Amounts paid and payment order numbers are no longer included in reporting. Also, the calculation does not reflect the balance of the company's debt on insurance premiums at the beginning and end of the reporting period.

You will find a line-by-line algorithm for filling out all sections of the DAM from experts in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Regulatory framework

- Order of the Federal Tax Service dated September 18, 2022 No. ММВ-7-11/470 “On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form”

- Order of the Federal Tax Service dated October 15, 2022 No. ED-7-11/751 “On amendments to the appendices to the order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/470”

- letter of the Federal Tax Service dated February 7, 2022 No. BS-4-11/2002 “On the control ratios of the form for calculating insurance premiums, approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. MMV-7-11/470”

- clause 4 art. 80, clause 10 art. 431 of the Tax Code of the Russian Federation - criteria for the number of personnel, allowing you to submit a DAM report on paper

RSV form

IMPORTANT!

For the 4th quarter of 2022, we report on the current ERSV form from the Federal Tax Service order No. ММВ-7-11/ [email protected] (as amended on 10/15/2020). And from the reporting for the 1st quarter of 2022, we submit an updated form for calculating insurance premiums from the Federal Tax Service order No. ED-7-11 / [email protected] dated 10/06/2021.

Let's see what the form for calculating insurance premiums for the 4th quarter of 2022 consists of, supplemented by information on the number of employees. The form contains 11 sheets (including attachments) and consists of:

- title page;

- Section 1 “Summary data on the obligations of the payer of insurance premiums”;

- Section 2 “Summary data on the obligations of insurance premium payers - heads of peasant (farm) farms”;

- Section 3 “Personalized information about insured persons.”

Which section needs to be completed and to what extent depends on the status of the policyholder and the type of activity he carries out. The table shows the categories of employers and the subsections of the calculation that they must fill out.

| Insured category | What to fill in the calculation |

| All policyholders are payers of insurance premiums (legal entities and individual entrepreneurs, except heads of peasant farms) |

|

| In addition, you must fill out: | In addition to the above: |

| Insurers who have the right to apply reduced or additional rates of social payments |

|

| Insurers who, during the reporting period, had expenses associated with the payment of compulsory social insurance to individuals in the event of temporary disability and in connection with maternity |

|