Why is it needed?

Every person from the working-age population of the country has at least once been faced with the need to obtain this document. And I wondered where to get the 2nd personal income tax certificate? Most often, it is needed to be submitted to credit organizations and banks in order to confirm the fact that a given citizen is able to fully pay off his obligations in the future. Moreover, the interest rate on the loan can significantly depend on the borrower’s provision of 2-NDFL. You will also need to receive it for:

- registration of tax deductions;

- sometimes - upon receipt of a visa;

- for getting a new job and in some other cases.

Why do you need a 2-NDFL certificate?

The certificate may be needed by tax agents, individuals, individual entrepreneurs, as well as pensioners.

A tax agent is an entity that pays citizens a certain amount with taxation. Agents are required to submit information about paid taxes to the tax service using Form 2-NDFL.

REFERENCE!

Tax agents are all employers operating in the country. Their responsibilities include calculating, withholding and paying taxes to all employees with reporting.

For individuals, the paper is a reflection of income; accordingly, it is needed in all cases when it needs to be confirmed. These include applying for a loan, paying for vacations, sick leave, days off, calculating pension accruals and processing various benefits.

In the same cases, individual entrepreneurs need a certificate. If the individual entrepreneur is also employed, a certificate can be requested from the employer.

Pensioners require 2-NDFL to apply for a loan or various subsidies. Only those persons who receive payments from the NPF can request a certificate.

Basically, a 2-NDFL certificate is needed in the following cases:

- Registration of loans and mortgages. Most often, banks require proof of income.

- Dismissal. When applying for a new job, the employer may require a declaration from the previous one.

- For deduction. It may be necessary to provide a certificate to the tax office in order to confirm the correctness of the accruals and obtain specific deductions.

- Apparatus employed. 2-NDFL is required by the accounting department so that it can see what deductions the employee had in his previous place. This will affect future deductions from income.

- To social protection. The document is needed to receive various benefits.

- To kindergarten and school. In this case, a certificate is needed so that, with a low income, the child is provided with some benefits, for example, free food.

- To obtain citizenship and visa. The certificate confirms that the applicant will be able to provide for himself and his family members.

- To court. Required for proceedings regarding labor disputes.

- Decree. Before going on maternity leave, a woman is required to provide a certificate for the last two years in order to process and pay benefits.

Who issues

How to get a 2-NDFL certificate? You can request this important document at your place of work or study. The employer, de facto and de jure acting as a tax agent, is obliged to issue a certificate upon the written request of the employee within three days (Article 62 of the Labor Code). The request is written in free form in the form of a request. It should contain the following data:

- FULL NAME. employee and his passport details;

- address – registration and actual;

- personal account;

- a valid telephone number for contact.

At the bottom of the page, the date is placed in the left corner, and the signature and transcript are in the right corner.

Attention! The employer's refusal to issue this document is illegal. If you are officially employed, then you don’t have to worry about whether you can get a personal income tax certificate-2. Contact the accounting department at your place of work.

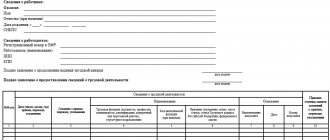

What kind of certificate is this anyway?

The 2-NDFL certificate form is approved at the legislative level. This document contains all the necessary information regarding the taxpayer and tax agent, the amount of income and the tax withheld. It includes the following sections:

- information about the tax agent;

- information about the individual who receives the income;

- income that is subject to taxation at the tax rate;

- data on standard, social, property tax deductions;

- total profit and tax.

The certificate may be required both for personal purposes and as a form of reporting to tax authorities.

Receipt from previous place of work

According to the Labor Code of the Russian Federation, if an employee who previously worked in a company applies for this certificate, the accounting department does not have the right to refuse the request. The document can be obtained both for the current period and for the previous year. But, as a general rule, no more than for the last 4 years.

One of the most difficult problems can arise if you need to obtain a 2-NDFL certificate for your previous place of work, but by that time this legal entity no longer exists. Then you can request the necessary document from the tax office.

When is it possible to receive 2-NDFL from the tax office?

Providing 2-NDFL certificates to individuals is not the responsibility of tax employees, as stated in Art. 32 of the Tax Code of the Russian Federation. However, if you need a certificate of income that you received at your previous job in a company that no longer exists, then only tax officials can provide this data.

To do this, an individual must submit a written request to the tax authority in accordance with the place of registration of the former employer. Tax officials must provide information about income based on information that was previously received from the former employer, because he is obliged to annually provide 2-NFDL certificates for each employee no later than April 1 of the year following the current one (clause 2 of Article 230 of the Tax Code of the Russian Federation) . For situations where a company is liquidated, in particular during transformation, the timing may differ, but liquidated organizations are required to submit 2-NDFL before complete closure.

Probability of refusal

As a rule, working citizens do not have problems with the question of where to get a 2-NDFL certificate. A hitch is possible if the company acting as the citizen’s employer maintains “gray” or even “black” accounting and does not deduct the required payments for the employee. This situation can be fraught with various unpleasant consequences for both parties.

If they do not accept the application or verbally refuse to issue a certificate, you can send a request by registered mail with notification and a list of the attachment. They have no right to refuse. An employee who is desperate to get the document he needs can complain to the labor inspectorate. What may entail the subsequent detection of more serious violations at the enterprise and the imposition of fines on its management.

Keep in mind: the current employer is always required to legally issue 2-NDFL. For example, individual entrepreneurs act as tax agents for their employees, so they also issue certificates using this form.

Where can I order and get a 2-NDFL certificate for a working person?

Article 62 of the Labor Code of the Russian Federation states that the employer is obliged to issue information about the income of employees, in particular, 2-NDFL certificates. The obligation to issue certificates rests with the employer, since in accordance with Art. 116 of the Tax Code of the Russian Federation, he is a tax agent.

In view of this, obtaining a certificate for an employed person is very simple. All you have to do is contact your employer. He is obliged to issue a certificate within three days, without specifying why the employee needs it.

IMPORTANT!

If the employer fails to fulfill its obligations regarding the certificate, sanctions may be imposed upon the employee upon complaint. For officials, the fine is up to 5 thousand rubles, for an enterprise – up to 50 thousand. It is even possible to suspend the organization's work.

If there are errors in the document, you need to quickly correct them. Changes must be made both to the certificate of the employee who issued it at his request, and to the certificate that is sent to the tax authority. If a tax error is discovered before correction, the employer may be fined.

For the unemployed

If you are unofficially employed, perhaps sooner or later the question will arise of where to get the necessary 2-NDFL certificate if you do not work. Private entrepreneurs may face the same dilemma for themselves. The latter have the opportunity to obtain the required document from the tax office at the place of registration.

Students are given certificates from the place of study.

For those who are left without work, but are registered at the labor exchange, 2-NDFL will be issued upon request from the employment service.

How to obtain a 2-NDFL certificate from an employer?

To obtain a certificate of employment, you need to visit the organization’s accounting department and write a free-form application addressed to the director. By law, the employer is required to issue a certificate within three days. If this does not happen, the person has the right to file a complaint with the labor inspectorate, and if this does not help, then with the prosecutor’s office.

IMPORTANT!

Tax documentation must be kept by the company for four years. At the end of this period, the employer may refuse to issue a certificate.

How and where to get a 2NDFL certificate?

When leaving a job, personal income tax certificate 2 automatically falls into the list of papers that are issued to the person who quits. If this does not happen, the employee has the right to demand it. Based on the fact that the certificate is signed (ideally) by the head of the organization/enterprise, the employer, either former or current, should apply for it.

At the place of work

Purely theoretically, it is easiest to obtain personal income tax at your place of work. An application is drawn up addressed to the director/manager with a request to provide a certificate (TC Article 62, TC Article 230, paragraph 3).

The request must be satisfied within 3 days (TC Article 62 as amended 2006/30/06 and 2014/21/07).

Refusal serves as a reason to contact the labor inspectorate and demand compensation for moral damage (Labor Code Art. 237).

The refusal is usually due to the fact that the employee was not officially hired, and therefore there is no information. Another reason is accounting irregularities. If the enterprise is “clean” in all respects, then there is no reason to refuse to issue a document. You can request personal income tax as many times as you like; there is no fee for issuing the document.

In the case of obtaining a certificate from a former employer, the algorithm of actions is the same.

If the organization is liquidated

If a company is liquidated, then there is no organization - no leader, even an ex. The information covered in the certificate is available to only two entities - the employer (accounting) and the tax authority (Tax Code Art. 230). But the duties of the tax authorities are not the issuance of personal income tax (NC Art. 32). Vicious circle?

Explanations are given in Letter of the Federal Tax Service No. BS-3-11/ [email protected] 2015/05/03.

To obtain a certificate in this case, you should contact the Federal Tax Service at the place of registration of the enterprise that was liquidated.

In an application requesting the necessary information, it must be indicated that the company has been liquidated and there are no other options for obtaining 2NDFL.

Copies of the employment record with the mark and seal of the disappeared office and passport are attached to the application. If the details of the company and the manager’s TIN are attached (check the seal in the work book), the situation will be significantly simplified. You should keep a copy of the application to the tax office for yourself.

Unemployed and unemployed

Where can I get a personal income tax certificate 2 for an unemployed person? An unemployed person due to circumstances, registered in the Employment Employment Center, makes a request to the accounting department of the employment center.

A temporarily unemployed person (due to dismissal) and not registered in the SZ can receive 2NFDL from an ex-employer or from the tax office (if the office is liquidated).

Anyone who has never worked or has never officially applied for a job has no chance to receive a certificate at all. The reason is obvious: due to the lack of a tax agent, no deductions were made (Tax Code Art. 208).

A non-working student must be issued a personal income tax upon his request at the dean's office of the educational institution.

For an individual entrepreneur

An individual entrepreneur himself is a tax agent, and therefore cannot issue himself a personal income tax of the 2nd form (Tax Code Ch. 23; Tax Code Art. 346.11).

For individual entrepreneurs, instead of 2NDFL, 3NDFL is used, which must certainly be endorsed by the tax office. Without marks from the Federal Tax Service, a declaration in Form 3 cannot replace 2 personal income taxes.

The second document, comparable in importance to 2 personal income taxes, for an individual can be a declaration form according to the simplified tax system. Marks on the acceptance of the “simplified” tax inspection must be made without fail.

The individual entrepreneur must take care of copies of these two documents in advance (when submitting) and ask the inspector to put tax authority marks on them.

Where can I get a certificate of income for a pensioner?

Of course, one of the options for a situation where a person needs a certificate of income, but does not work anywhere and is not registered with the labor exchange, is the situation of a retired person.

Such a certificate can be obtained from a branch of the Russian Pension Fund. The only thing worth remembering in this situation is that a certificate for a pensioner cannot be issued in Form 2-NDFL, since personal income tax is not levied on pensions. The document that is issued for pensioners differs in form and does not serve as a full replacement for 2-NDFL. Although the bank will accept it for a loan.

Where can I get an income certificate if I haven’t worked recently?

A person may not work and not be on the labor exchange even in such a basic situation as changing jobs and looking for a new place to work. If a person can afford to sit at home for a while, relax and find a good job, then why not.

A certificate of income, and in form 2-NDFL, in such cases you can get a job at your old place. Of course, provided that official employment was registered there.

The only thing you need to remember is the period that interests the bank or any government agency that asks you for a certificate. It is clear that no one is interested in your income that you received from the job you quit two or three years ago. But if very little time has passed since your dismissal, it is likely that such a certificate will suit you.