Benefits for small businesses are advantages that the state provides to certain categories of entrepreneurs, which puts them in a more advantageous position compared to other business entities. The preferential regime for the activities of individual entrepreneurs, micro-enterprises and small businesses reduces the receipt of taxes and contributions to the budget, but it solves other issues of national importance:

- Ensuring self-employment and further pension provision for entrepreneurs without employees (freelancers, artisans, persons providing various types of services);

- Creating new jobs and removing the burden from the state to support the unemployed;

- Reducing social tension in society due to increased well-being of the population;

- The development of new types of activities and the organization of small innovative productions, which, although they do not guarantee large profits, do not require large financial investments.

Read about additional benefits due to the coronavirus pandemic in our new article.

Create documents for registering a business for free

Now in Russia there are more than 20 million people of working age who do not officially work anywhere and are not registered with the tax authorities as entrepreneurs. The state is interested in bringing this category out of the shadows as much as possible, so that at least these citizens take on the issues of self-sufficiency. To do this, it is necessary to make running a legal small business simple, convenient and profitable, which means:

- Minimize the tax burden for this category of taxpayers;

- Reduce administrative barriers to state registration of small businesses;

- Simplify the reporting of small businesses to government agencies;

- Soften administrative and tax controls and reduce the amount of penalties for violation of the law;

- Provide special conditions for small businesses to receive orders for the production of goods and sales of services, in particular, within the framework of government procurement.

But before we find out what benefits the state provides to small businesses in 2022, let’s figure out what small businesses are and who belongs to them.

Tax holidays on simplified taxation system and patent

Each region has preferential tax conditions for certain types of businesses, which local authorities consider priority.

The most popular is the reduced rate under the simplified tax system: for example, in Komi on “Income” it is 3% instead of 6%, in St. Petersburg on “Income minus expenses” it is 7% instead of 15%. Tax holidays are a complete tax exemption for new individual entrepreneurs. In other words, this is the simplified tax system or patent rate of 0%. You can find out about holidays in the “Features of regional legislation” section on the tax website.

If you are included in the local list, it is important that the income from the specified type of activity is at least 70%. If the condition is met, there is no need to notify the tax office. You simply do not pay tax for the first two years and, in the case of the simplified tax system, submit zero returns.

Tax holidays do not exempt from insurance premiums for individual entrepreneurs and mandatory payments for employees.

Reimbursement of commissions in the Fast Payment System (FPS)

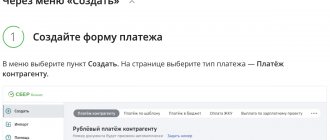

The state has decided to actively develop and support a system of fast payments. For this purpose, funds are allocated to reimburse small and medium-sized businesses for the use of SBP for settlements with clients.

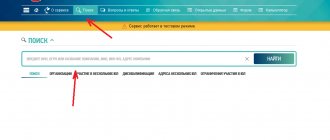

The commission for settlements through SBP is no more than 0.7%, while for acquiring it is 1.5-2.5%. And in 2022, entrepreneurs can receive a refund of the commission for transfers from individuals for the period from 07/01/21 to 12/31/21.

To accept payments, it is recommended to purchase an online cash register, which already has a built-in payment function via SBP. MTS Kassa provides cash registers on favorable terms both for rent and in installments.

Get a free consultation

VAT exemption

Entrepreneurs using the simplified tax system and a patent are exempt from paying VAT. There are few exceptions, for example, import of goods. In other cases, you decide for yourself whether to pay VAT or not. If the counterparty asks to issue an invoice and pay, you are not prohibited from agreeing. But then you will have to report VAT.

It will be most convenient to submit VAT reports in Elbe.

Under the general system, entrepreneurs usually pay VAT. But small businesses are also exempt: if the income for the last quarter is less than 2 million rubles, the entrepreneur applies to the tax office and receives a benefit.

Grants to support entrepreneurs

An entrepreneur can receive co-financing in the form of a non-refundable payment from the state. For 2022, grant amounts are set from 60,000 rubles to 25,000,000 rubles. Beginning and long-established entrepreneurs can count on such support. The rules for receiving grants are established in each individual region; you can find them on the official website of the local administration or the website of the Ministry of Economic Development of the Russian Federation.

To receive grants, you must submit an application for participation in a competitive selection, describe in detail your business plan and what you plan to use the amount of money for. The selection criteria most often are:

- field of activity of the entrepreneur;

- volume of revenue from activities;

- number of workplaces.

In 2022, active assistance will be provided to production, agriculture, farmers, and tourism.

What can the received grant be spent on:

- purchase of raw materials, supplies, etc., but not more than 20% of the amount issued;

- rental or renovation of premises necessary for business development. Also no more than 20% of the amount;

- acquisition of business-needed software, licenses, patents, etc.

You will have to account for the money received, so you cannot spend it at your own discretion.

Quota for participation in government procurement

Government customers are required to purchase goods and services from small and medium-sized businesses in an amount of at least 15% of the annual procurement volume. From January 1, 2022, the minimum volume increases to 25, and the deadline for payment under government contracts is reduced from 15 to 7 days. Under other agreements, payment terms will be reduced from 30 to 15 working days.

For small businesses, auctions are held without representatives of large businesses. At such auctions, the amount of bid security and the contract payment period are less than in regular procurements.

Moratorium on scheduled inspections

In March 2022, the Federal Tax Service issued Order No. ED-7-2/181 dated March 20, 2020, which states the suspension of all scheduled inspections of small and medium-sized businesses. There was also no requirement to renew licenses and business permits that were expiring.

According to the order of the Federal Tax Service, the following were suspended:

- on-site inspections initiated;

- on-site inspections;

- checks of retail equipment and online cash registers.

On November 30, 2022, Prime Minister Mikhail Mishustin signed Resolution No. 1969 extending the moratorium on scheduled inspections until December 2022.

Organizations whose activities involve risks of harm to the environment or human health are not subject to the moratorium.

However, in 2022, the Federal Tax Service resumed checking the availability of online cash registers and rules for compliance with cash discipline. Read our article about what may cause a visit from the tax service and what it checks.

Subsidies for business development

There are three popular types:

- For already working young entrepreneurs. Issued on a competitive basis for business expansion in the amount of 300 to 500 thousand rubles. You must provide a business plan describing the current state of the business and planned changes. The state is ready to pay up to 50% of the expected costs, but only if the entrepreneur has his own money to invest in the project.

- To reimburse interest rates on loans. The state compensates for the costs of paying interest on loans received to support and develop activities.

- For equipment leasing. The state will pay up to 70% of the down payment when concluding an equipment leasing agreement. You can get it through competitive selection.

Terms and conditions can be found on the My Business website.

Rental holidays

The Government of the Russian Federation signed a Resolution on deferment of payment of rental obligations for all industries affected by the pandemic. This applies even to those who are not on the SME register.

Rental holidays were valid from April to October 2022. During this period, entrepreneurs could not make payments under lease agreements, and after October they could pay 50% of the agreement amount. You will still have to pay for the period from April to October, but it is allowed to repay the debt in installments from January 2022. Moreover, the payment schedule must be monthly, but the amount should not exceed 50% of the regular rental cost. The landlord cannot demand the full amount of the debt, or half of it, at once.

It was possible to obtain a deferment in rent payments only if the contract was concluded before the start of the pandemic. Landlords are prohibited from charging penalties, fines and evicting entrepreneurs from premises. The holidays do not affect utilities; they must be paid in full.

In 2022, entrepreneurs can count on a rent deferment only by agreement of both parties. To obtain a deferment, it is enough to conclude an additional agreement with the lessor, which spells out new lease conditions and a debt repayment schedule.

Benefits for participants in special zones

Residents of special economic zones

Companies operating in special – technology-innovation and tourist-recreational – economic zones, which are united into a cluster by decision of the Government of the Russian Federation, can take advantage of income tax benefits. We are talking about applying a 0% rate to the tax base when calculating that part of the tax that is payable to the federal budget (clause 1.2 of Article 284 of the Tax Code of the Russian Federation).

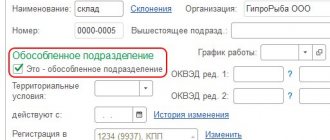

An important condition for receiving tax preferences is maintaining separate records of income (expenses) from activities directly eligible for benefits, i.e., carried out in the territory of a special economic zone. Loss of resident status in a technology-innovative or tourist-recreational special economic zone means loss of the right to use tax preferences (clause 1.2 of Article 284 of the Tax Code of the Russian Federation).

For technology-innovation activities, the possibility of applying such a benefit ends with the end of 2022, and in terms of tourism and recreational activities it will be valid until 2023 (clause 5, article 10 of the law “On Amendments...” dated November 30, 2011 No. 365-FZ ).

In 2022, a benefit appeared in the form of a 0% tax rate (clause 1.11 of Article 284 of the Tax Code of the Russian Federation) for legal entities working in tourism and recreational sphere in the Far Eastern District. Its use is limited to the periods 2018-2022 and requires the organization to fulfill a number of conditions (Article 284.6 of the Tax Code of the Russian Federation). The occurrence of non-compliance with these conditions will require the restoration of the amount of unpaid tax and payment of penalties (clause 5 of Article 284.6 of the Tax Code of the Russian Federation).

For application from the beginning of 2022, a benefit for legal entities operating in special zones, but in areas different from those specified in paragraph. 1.2 art. 284 Tax Code of the Russian Federation. It lies in the fact that the tax rate intended for the federal budget is 2% (clause 1.2-1 of Article 284 of the Tax Code of the Russian Federation), and not 3%, at which most companies must pay tax to this budget in 2017-2024 .

Free economic zone participants

Companies operating in a SEZ (free economic zone) enjoy a preferential rate (0%) when paying income tax to the federal budget. The benefit is provided for 10 tax periods from the moment of receipt of income from the sale of goods under an agreement on activities in the FEZ (clause 1.7 of Article 284 of the Tax Code of the Russian Federation).

In addition, the constituent entities of the Federation may establish a reduced rate for such enterprises to pay tax to the local budget (not lower than 13.5%).

It is mandatory to maintain separate records of income (expenses) by types of activities carried out in the FEZ and outside it. Moreover, taxation of other types of activities is carried out in accordance with the general procedure (letter of the Ministry of Finance dated March 20, 2015 No. 03-03-10/15503).

For information on the requirements for registers in which tax accounting is organized, read the article “How to maintain tax accounting registers (sample)?”

TASED participants

For companies that are residents of TASED (territories with rapid socio-economic development) preferences are also provided - this is an income tax (2014 benefit) at a rate of 0% when paying income tax to the federal budget (clause 1.8 of Article 284 of the Tax Code of the Russian Federation).

Mandatory conditions for the application of benefits are (Article 284.4 of the Tax Code of the Russian Federation):

- State registration of a legal entity for TASED.

- Absence of separate divisions outside the TASED zone.

- Non-use of special tax regimes by the taxpayer.

- Non-inclusion of a TASED resident into consolidated groups of taxpayers.

- Lack of activity as an insurer, bank, non-profit organization, clearing company, non-state pension fund or professional participant in the securities market.

- Lack of status as a participant in SEZs and/or regional investment projects.

- Providing at least 90% of your income through activities carried out within the framework of the agreement on work in the TASED.

- Ensuring separate accounting of income by type of activity when executing an agreement on work in TASED and others.

Benefits for paying tax to the federal budget (0% rate) are maintained for 5 years from the date of receipt of the first profit under the agreement to work in a TASED. There is also a benefit for paying tax to the budget of a constituent entity of the federation: for the first 5 years - a maximum of 5%, and for the next 5 years - a minimum of 10%. Moreover, the right to apply the benefit does not disappear in the event of a lack of profit for 3 consecutive tax periods (from 2022, their number under certain conditions can reach 9, Article 1 of the Law “On Amendments...” dated November 27, 2017 No. 339-FZ) and will be used after these periods (clause 5 of Article 284.4 of the Tax Code of the Russian Federation).

Preferential tax regime for individual entrepreneurs

NPA is a tax on professional income, which was previously developed specifically for the “Self-employed” status. Recently, individual entrepreneurs can also switch to it.

Advantages of individual entrepreneurs when switching to NPD:

- Lack of reports and declarations.

- Generating a receipt in a mobile application, not at the cash register.

- No obligation to pay fixed insurance premiums.

- Automatic calculation of tax due.

- Attractive tax rates (4-6%).

You can switch to a preferential tax regime if you comply with the requirements of Part 3 of Art. 15 of Federal Law No. 422-FZ of November 27, 2018:

- sale of goods of own production or independent provision of services;

- no employees;

- the annual income of an individual entrepreneur does not exceed 2.4 million rubles.

Subsidies for start-up entrepreneurs from the employment center

If you are registered as unemployed at the employment center and decide to open your own business, you can count on payments for small and medium-sized businesses under the Ministry of Economic Development program.

Regional payment and amount is determined depending on the region. For example, in Moscow the minimum amount is set at 10,200 rubles, but in the Moscow region it is already 145,560 rubles.

The subsidy is allocated for paperwork, organizational issues during opening and payment of state fees. It will be necessary to report on the intended use of the amount for its intended purpose. Up-to-date information on the amount of the financial benefit can be obtained from your local employment center.