Filling out the title page 6-NDFL

To create in the program “1C: Salary and HR Management 8”, ed. 3, regulated report 6-NDFL, we need to go to the section “Reporting, certificates” - “1C-Reporting” - “Create” - “Types of reports” and select in the section “Reporting for individuals” - “6-NDFL”.

Let's start with the title section of this report. Here fields with a prohibition on editing are filled in, such as: “TIN”, “KPP”, “Submission period (code)”, “Tax period (year)”, and fields with the ability to edit, they are highlighted in yellow: “Adjustment number” Provided to the tax authority (code)”, “at the location (accounting) (code)”, “Code according to OKTMO”.

The data for this section is taken by the program from the “Organizations” directory (section “Settings” - “Enterprise” - “Organizations”).

If cells with any information about the tax agent are not filled in and cannot be filled in manually (cells not highlighted in yellow), this means that the corresponding data has not been entered into the database. Then you should add the necessary information to the directories, and in the report in the upper right corner, click on the “More” - “Update” button.

Separately, it is worth highlighting the “Signature Date” field, which indicates the date the report was signed (by default, this is the current date of the computer).

If on the date of filling out the report there is still unwithheld tax, then the program will add this amount to line 080 of section 1 6-NDFL.

How 6-NDFL data is generated in 1C 8.3 ZUP

Personal income tax accounting in 1C 8.3 ZUP is carried out according to the following registers:

In 1C 8.3 ZUP, the documents used to accrue income ( Vacation , Sick leave , Bonus , Calculation of salaries and contributions , etc.) record income and the personal income tax calculated from it. In this case, the information enters the registers as follows:

When conducting the Sheets... in the personal income tax to be transferred , the amount of withheld personal income tax is recorded.

When posting a document, this data goes into the following registers:

Filling out section 1 of form 6-NDFL

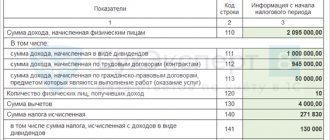

This section indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate.

If we have payments to individuals during the tax period, taxed at different rates, then section 1 will be filled out by the program for each tax rate.

Section 1 states:

- Line 010 shows the tax rate. By clicking on the cell, we can select the bet we need;

- In line 020 - accrued income is reflected on a cumulative basis

If wages or travel allowances were accrued in March, but paid in April, then such employee income will be included in the report for the first quarter, because according to these types of payments, the date of actual receipt of income is the date of accrual (Letter of the Federal Tax Service of the Russian Federation dated 08/01/2016 No. BS-4-11 / [email protected] ).

The situation is different with sick leave, vacation pay and other payments. For their types of payments, the date of actual receipt of income is the date of payment. For this reason, if they were accrued at the end of March, but paid in April, they will not be included in the report for the first quarter, but will be reflected in the 6-NDFL for the six months. Registers of entries will help you analyze personal income tax amounts. What it is? In essence, accounting in 1C is the recording of documents. Each document has a result, for example, records accrual amounts. These results can be viewed using reports that can summarize the results across documents and show the user the total. However, there are usually a lot of documents, so the documents record their results (“movements”) in special tables - 1C registers, which themselves summarize the results so that the report simply displays the pre-calculated totals.

The “1C” register is a table, the same as in Excel, each document writes one or several lines of its movements (results) with some sign - plus or minus - into the "1C" register. This means that the total of the “1C” register has changed to the corresponding number.

To open the registers of records responsible for reflecting personal income tax amounts, we will need:

The first option: go to “Payroll and contributions” - “More” - “Document movement”. In the “Output only” field, select two registers: “Calculations of taxpayers with the budget for personal income tax” and “Accounting for income for calculating personal income tax”.

Second option: “All functions - “Accumulation registers” - select one by one “Calculations of taxpayers with the budget for personal income tax” and “Accounting for income for calculating personal income tax”.

- In section 1, the amount of deductions for income from line 020 is reflected in line 030 . For example, professional, standard, property, social.

To find out what deductions were applied in a particular month and what income they relate to, we will need the “Personal Income Tax Analysis by Month” report. It clearly demonstrates the deductions applied. The report is located in the section “Taxes and contributions” - “Tax and contribution reports” - “Personal income tax analysis by month”.

?

- Line 040 indicates the total amount of calculated personal income tax on income, which is reflected in line 020, minus deductions.

- Line 050 indicates the total amount of fixed advance payments by which the calculated tax amounts were reduced.

In section 1, you can manually add or delete a block of lines 010-050.

To add another block, you need to click on the link “Add lines 010-050”; to delete this block, click on the red cross located near line 010. In addition to lines 020 - 050, the first section also contains lines 070 - 090 . They are not filled out based on the date of receipt of income.

Report 6-NDFL: general concepts

The sixth income form contains a summary of data on all individuals who earned money from their tax agent, on tax deductions, the amount of taxes withheld and everything else that may affect the calculation of tax transfers to the treasury.

The deadline for submitting the annual form is the beginning of April, the next year after the reporting year. The information in the form is accumulated and submitted to the regulator on an accrual basis for each quarter. More information about the dates for filing 6-NDFL in 2022 is in the infographic below:

The report form itself is unified and approved by the regulator. The report includes two parts:

- General indicators.

- Dates and amounts of actual income received and income withheld.

Below we consider the basic requirements for filling out the form:

- General information. The report is based on information about recorded income paid to individuals from a tax agent, all required deductions, taxes paid according to tax registers

- Income. The 1C user must include in the report all income received by an individual during the reporting period.

- Deductions. The report must reflect the right to tax deductions of all possible options, as well as their actual provision.

- Personal income tax amount. The report contains the calculation and amount of income transferred to treasury accounts.

General introductions

Let me clarify that the report form itself assumes that it reflects information on the calculation of income, as well as the withholding of amounts by the tax agent. This is a kind of consolidated file of all those individuals who earned their income from the tax agent, about the detailed tax amounts, the right to receive tax deductions and all such information necessary for calculating the tax.

The report also has a strictly limited deadline for its submission. All entities are required to submit a quarterly cumulative report to the tax office at the place of registration no later than the last day of the month after the reporting period. The deadline for submitting the annual report is April 1 of the following reporting year.

The form itself has two parts:

- Title page.

- The first section is “Generalized indicators”.

- The second section “Dates and amounts of income actually received and withheld personal income tax.”

The amounts to be calculated are taken from the accounting data of earned values from the tax agent, and all tax deductions that occur according to the tax registers are also taken into account.

How to create a calculation?

Next, we will talk with you about how to create 6-NDFL in 1C ZUP 3.0. The very good news is that this form is issued to the user automatically, but subject to a number of conditions. So, what are these conditions, I decided to indicate to you in the table.

| No. | Name |

| Condition 1 | You have indicated a person’s right to apply to him a tax deduction of the type for which he has a confirmed right |

| Condition 2 | You have calculated and accounted for the amount of tax withheld |

| Condition 3 | The software displays the entire person’s earnings for the tax period |

The machine contains a prescribed algorithm for generating a report, and for this you should open the reporting form, then the 1C certificate.

Filling examples

See the current version of the article Review of the new form 6-NDFL, used from 2022

Let's move on to consider filling out the 6-NDFL in 1C 8.3 ZUP in a number of situations.

Example 1. Salary in 6-NDFL

For December 2022, salaries were accrued in the amount of 25,000 rubles. and it is paid on January 10, 2022 by statement to the cashier . Personal income tax was calculated and withheld from her in the amount of 3,250 rubles:

The date when salary income is actually received is the last day of the month of its accrual. Therefore, salary income is 25,000 rubles. and personal income tax from it - 3,250 rubles. will appear as annual 6-personal income tax in Section 1 in lines 020 and 040 , respectively.

Due to the fact that the December salary will be issued in 2022 (01/10/2020), then the personal income tax will be withheld already in 2022. Therefore, line 070 in Section 1 for 2019 will not include the personal income tax withheld from the salary:

Section 2 completed as indicated in the table:

Due to the fact that the planned transfer date ( line 120 ) falls on the 1st quarter of 2022, the block of December salaries and personal income tax from it will be reflected in Section 2 the 6-NDFL report for the 1st quarter. 2022

Example 2. Vacation pay in 6-NDFL

In June 2022, Vacation calculated vacation pay in the amount of RUB 4,778.20. and personal income tax from them - 621 rubles:

Payment of the accrued amount occurs on June 20, 2019 in a separate statement to the cashier :

The date on which vacation pay income is received corresponds to the date of their payment. Therefore, vacation pay (4,778.20 rubles) and the personal income tax calculated from them (621 rubles) will appear in the semi-annual 6-NDFL in Section 1 in lines 020 and 040 , respectively.

Due to the fact that personal income tax withholding from vacation pay occurs at the time of payment (06/20/2019), this amount will also be reflected in the semi-annual report 6-NDFL in line 070 of Section 1 .

Filling out Section 2 on vacation pay and personal income tax on them will be done as indicated in the table:

Due to the fact that the planned date of transfer ( line 120 ) falls on the 3rd quarter of 2022, the block with vacation pay and personal income tax withheld from them will fall into Section 2 6-NDFL report for 9 months of 2022.

Example 3. One-time bonus in 6-NDFL

In November 2022, for the same month, the document Bonus was awarded to employee D.M. Yolkin. The one-time bonus is calculated in the amount of 1,000 rubles. and personal income tax from it - 130 rubles:

On December 10, 2019, along with the salary for November 2022, the following bonus was paid:

and personal income tax is withheld from her - 130 rubles:

For subsequent correct registration of the date of receipt of income for a one-time Bonus, before accruing it, you should check that in its parameters on the Taxes, contributions, accounting tab, 2002 is selected as personal income tax Income Category field is set to Other income from work :

In the personal income tax code 2002 (Taxes and contributions - Types of personal income tax), the checkbox must be checked Corresponds to wages :

Only in this case, the date of its payment will be recorded as the date of receipt of income for a one-time Award .

Due to the fact that the date on which income in the form of a one-time Bonus is the date of its payment (December 10, 2019), the bonus amount is 1,000 rubles. and personal income tax from it - 130 rubles. will appear in the annual report 6-NDFL in Section 1 in lines 020 and 040, respectively.

Personal income tax on the premium will be withheld at the time of its payment (12/10/2019). Consequently, this amount will also be reflected in the annual report 6-NDFL in line 070 of Section 1 .

In Section 2, bonus blocks are filled in according to the rules described below:

Due to the fact that the planned deadline for the transfer of personal income tax ( line 120 ) falls on the last quarter of 2019, the block with the one-time Premium and the personal income tax withheld from it will be included in the annual report 6-NDFL in Section 2 .

See the current version of the article Review of the new form 6-NDFL, used from 2022

See also video: The procedure for filling out Section 2 in 6-NDFL and the deadline for paying personal income tax on additional accrued vacations and sick leave