The main provisions for the formation of personal income tax declaration 6 were approved by order of the Federal Tax Service dated October 14, 2015 No. MMV 7-11-450. The report reflects information about the profit received, calculated and withheld tax. Part 1 of the report is completed on a cumulative basis from the beginning of the year. If there are few problems in determining the total indicators, difficult moments arise when filling out line 060 of the 6 personal income tax declaration. In the article, we will identify the nuances that employers face when generating headcount information, explain what is included, and provide examples of filling out the declaration.

Basic provisions

Quarterly personal income tax reporting is submitted to the fiscal authorities within the time limits approved by law. To fill out the section, use analytical information from personal income tax registers. This norm is defined in Article 230, paragraph 1 of the Tax Code.

- Title design is done line by line, from left to right. Dashes are placed in empty cells. The declaration is signed by the manager or the person filling out the information who is entrusted with such right;

- Part 1 is completed on a cumulative basis from the beginning of the reporting year. At the same time, a separate block is formed for each personal income tax rate in the tax return in columns 10-50 with a summary of the results on 1 page. Information in cells 60-90 is reflected in a cumulative total only on the first page;

- in the second part of the report, indicators collected only in the reporting quarter are formed. Field blocks 100 – 140 are filled in for each date and amount of income actually received and tax paid.

Number of individuals who received income in 6 personal income tax: how to count for a six-month, year, quarter

It is important to remember that the date in line 120 will be no later than the day following the day the income is paid to the taxpayer.

The obligation to maintain tax registers is regulated by the Tax Code. In the absence of registers, tax authorities hold the business entity accountable (TK Article 120, letter AS 4-2-22690 dated February 29, 2012).

6 Personal income tax 1 section

General approach to the formation of section 2 6-NDFL

From the 1st quarter of 2022, the 6-NDFL reporting form and the procedure regulating the process of its preparation were approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] In accordance with this procedure and clarifications of the Federal Tax Service:

- Section 2 of the report is formed based on summary information, based on data for the 1st quarter, 1st half of the year, 9 months and a year on a cumulative basis.

- Information for inclusion in the report must be taken from tax registers for personal income tax (clause 1 of article 230 of the Tax Code of the Russian Federation).

For more information about registers, see the material “How is the personal income tax register maintained?”

The absence of personal income tax registers at an enterprise falls into the category of gross violations of tax accounting rules. ConsultantPlus experts spoke about the consequences of such violations. Get trial access to the K+ system and upgrade to the Ready Solution for free.

- If individuals were paid income taxed at different personal income tax rates, section 2 is filled out separately for each rate (letter of the Federal Tax Service dated December 1, 2020 No. BS-4-11 / [email protected] (clause 2).

The annual calculation was also adjusted by order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected] We talked in more detail in our material.

Generating information about the number of individuals. persons in field 060

Information on the number of employees who have made a profit since the beginning of the year is reflected in 6 personal income taxes on line 060.

When forming 6 personal income taxes on an accrual basis, we are guided by the main rules:

- Line 60 indicates the number of individuals. persons to whom earnings were transferred during the reporting period from the beginning of the year. The list of income is given in the table;

- if an employee received income at the parent enterprise and at a branch, the income is included in the reporting at each enterprise;

- if the profit was received at one enterprise in different contracts, 1 person must be indicated on line 60;

- if the income is received in one organization at different personal income tax interest rates, consider 1 individual. face;

- if during the reporting period a person is fired and then rehired, the calculations are not summed up and 1 person must be reflected.

Procedure for calculating income:

Line by line filling out 6 personal income tax: title page and calculation

Report 6 personal income tax, when and how to submit

Personal income tax is a tax on personal income, which is withheld from such income as::

- When selling your property if it was owned for less than the required period

- When renting out your own property

- Winnings from the lottery or various competitions

- From salary

No tax is paid on:

- If a close relative gave or inherited any property

Even if a company is an intermediary, for example, it hires employees to work in another company, it will be considered a tax agent and is obliged to remit personal income tax on wages.

Report 6 Personal Income Tax is submitted by legal entities and individual entrepreneurs who have employees who receive wages. This report form is compiled quarterly on an accrual basis and submitted electronically in the month following the reporting month no later than the last day.

Important! If the report submission date falls on a weekend, it is submitted on the first working day.

The report itself consists of a title page and two sections.

- The first section reflects the amounts as a cumulative total of generalized indicators

- The second section contains the dates and amounts when the income was actually received and transferred, as well as the tax itself was paid

It is worth remembering that if an enterprise has separate divisions that have their own checkpoint, this type of report is submitted for each separate division separately, each to its own district where the structural division is registered.

Example of filling line 060

Based on the results of the 3rd quarter, the accounting department fills out the 6th personal income tax report.

Employee information for 9 months is as follows:

- 13 employees work in the organization on a permanent basis;

- 3 employees were laid off in May;

- In September, 4 employees got jobs, and one of them already worked in the company in the first half of the year.

When filling out field 060, an employee who is rehired is counted as 1 person.

Sample of filling out line 060 of personal income tax for 9 months.

Correct filling of line 090 in report 6 personal income tax

Composition of the new 6-NDFL

6-NDFL report in 2022 includes:

- Title page

- Section 1 “Data on tax agent obligations” (similar to the data contained in Section 2 of the current version of 6-NDFL ). At the same time, when indicating the amounts of withheld tax, the date of receipt of the income and the amount of income from which it was withheld are no longer indicated. For a tax refund transaction, each refund amount and date are indicated.

- Section 2 “Calculation of calculated, withheld and transferred amounts of personal income tax” (similar to the data contained in Section 1 of the current version of 6-NDFL ).

- Appendix No. 1 . Certificate of income and tax amounts of an individual (coincides with the current version of 2-NDFL ) - this application will only need to be filled out in the annual 6-NDFL .

Let's take a closer look at the new rules for filling out 6-NDFL .

Example of accounting for employees of the parent organization and branch

Let's consider an example of filling out for a new structural organization and the parent company.

What information is indicated in line 060 of declaration 6 for the parent and structural organization?

- During January – March, 22 people received income and paid personal income tax;

- in the second quarter, the structural division “Firm 1” was organized, where 5 employees were transferred in April;

- In addition, 5 more individuals were admitted to the branch in June. persons;

- The branch calculates wages independently;

- in month 06, 3 employees left the branch;

- 2 people from those laid off went back to work at the parent company “Firm”;

- in June, 4 more people were hired into the staff of the parent organization “Firm”.

Both organizations “submit two personal income tax declarations according to OKTMO.

The calculation of 6 personal income taxes for the six months for the organization “Firm” will be as follows:

- line 060 = 22 + 4 = 26 people.

The calculation is not affected by 2 people who were transferred to the branch and then returned to the parent organization.

Calculation of employees for the structural unit “Firm 1”:

- line 060 = 5 + 5 = 10 people (5 employees were hired due to transfer from the parent organization, 5 were hired in June).

Fill out correctly: personal income tax 6 on an accrual basis

Filling rules

Before describing the rules by which it is prescribed to fill out line 030, we note one important nuance ─ entering a non-zero tax amount on line 030 of section 1 of the 6-NDFL calculation automatically generates the obligation of the tax agent to simultaneously fill out lines 031 “Tax refund date” and 032 “Tax amount”.

In this regard, let us dwell on the rules for filling out all of these interconnected lines:

In a situation where the tax agent has nothing to reflect on lines 030 ─ 032 (he did not return tax to individuals for the last three months of the reporting period), the rule applies: in the absence of total indicators, “0” is entered in lines 030, 032, and in the remaining blank fields of this block ─ dashes.

Check whether you filled out Form 6-NDFL correctly with the help of explanations from ConsultantPlus experts. If you do not have access to the K+ system, get a trial demo access and switch to the Ready-made solution for free.

Example of filling out a report for the 1st quarter

In the company's staff, in January, employment contracts were concluded with 18 people. At the same time, 1 person did not start work, and no profit was accrued for January. Salaries were paid to 17 employees.

In February:

- 1 employee was dismissed without accrual of income on 01.02;

- 1 woman went on maternity leave on 02/01;

- 1 person was contracted for a “maternity” place on 02/02.

For February, the amount of earnings of 18 individuals must be transferred. persons.

In March, earnings were accrued to 18 employees.

Explanations for filling out the report in this situation.

Line 060 indicates the number of individuals to whom profit has been accrued since the beginning of the reporting year. In this case, the average payroll or payroll number is not calculated. Calculation of labor relations does not play a role in filling out the line - an employment contract, a civil contract or a combination agreement has been drawn up.

It is important to observe the control ratios when filling out line 060: the number on line 060 coincides with the number of submitted annual reports on Form 2.

Line 060 6 Personal income tax is filled in with an accrual total. Here indicate the number of physical. persons to whom the profit is accrued. Therefore, for January, profit is not taken into account in the calculation if 1 worker’s income was not accrued. Thus, the headcount for January in this example is 17 people.

Another employee was hired in February. This means that another employee is added to the report in line 060 for February. Headcount for month 02 – 18 people.

The situation did not change in March. When filling out line 060 of the first section, 1 person to whom income was not paid for January is not taken into account. You need to specify 18 employees.

About the new form 6-NDFL in 2022

The new form 6-NDFL was approved by Order of the Federal Tax Service dated September 28, 2021 N ED-7-11/ [email protected] It will be valid starting with reporting for 2021. The deadline for submitting the report has not changed; for the annual 6-NDFL - no later than March 1 of the next year. Therefore, we will report for the first time using the new form no later than March 1, 2022.

The new form 6-NDFL is implemented in ZUP 3.1.20.71 / 3.1.18.305. To create 6-NDFL for 2022 using the new form, the computer/server date must be 01/01/2022 or later. Then a field for selecting a form edition will appear in the report creation window.

You can distinguish the new form 6-NDFL by the presence of new lines in the report, as well as by the version of the form on the title page.

The main differences in the new form are related to the appearance of new fields:

- for accounting of income and personal income tax of highly qualified specialists (HQS)

- to account for income tax offset when calculating personal income tax on dividends

The procedure for filling out 6-NDFL was also clarified. Let's take a closer look at what fields have appeared in the report and what innovations have been introduced in the filling order.

General rules for filling out Section 2

Section 2 is filled out for the reporting period with a cumulative total:

- Lines 110 – 150 - according to the date of receipt of income (this data at the end of the year should coincide with Appendix No. 1 ).

- Lines 160 , 190 - by date of tax withholding/refund.

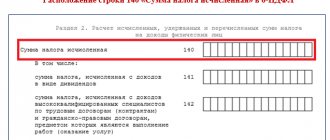

Calculated personal income tax ( line 140 ) and withheld personal income tax ( line 160 ) will not converge in 6-personal income tax (from 2022) , because They have different filling rules.

About line-by-line completion of Section 2 of the report (from 2022) :

- Section 2 of report 6-NDFL - procedure for filling out 110-113 and control ratios

- Section 2 of report 6-NDFL - procedure for filling out lines 120-180

For more details, see the excerpt from the seminar dated April 14, 2021 “6-NDFL for the 1st quarter of 2022 in 1C”

See also:

- In what period will 6-NDFL include wages paid on March 31, 2021?

- In 6-NDFL for what period will sick leave accrued in March and paid in April 2022 be included?

- In 6-NDFL for what period will sick leave paid along with an advance payment in March 2022 be included?

- In what period will vacation pay for April paid in March 2022 be included in 6-NDFL?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Algorithm for filling out the financial results report in a simplified form...

- Algorithm for filling out the financial results report in the usual form...

- Algorithm for filling out a cash flow statement...

- Settings in ZUP 3, under which income falls into lines 112 and 113 of section 2 of the 6-NDFL report (from 2022) In ZUP 3, income falls into lines 112 and 113...