What is the order of payment in a payment order?

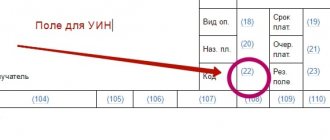

One of the fields that the payer must fill out when drawing up a payment order is called “payment order” and has the number 21. As follows from the explanations for the procedure for filling out payment orders (Appendix 1 to the Bank of Russia regulation dated June 19, 2012 No. 383-P), in the props “Och.

payment." The number indicates the order of payment in accordance with federal law. The general sequence of writing off funds from the account is established in paragraph 2 of Article 855 of the Civil Code of the Russian Federation (note that part two of the Civil Code of the Russian Federation was put into effect by Federal Law No. 14-FZ of January 26, 1996).

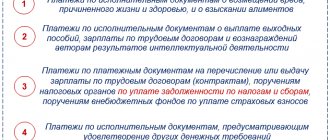

According to this norm, payments are made first of all on the basis of writs of execution, which order the withholding (collection) of alimony or funds for compensation for harm to life and health.

The second stage of payments are transfers within the framework of executive documents for the transfer of wages, severance pay or royalties.

“Ordinary” wages (including debts paid voluntarily, and not under a writ of execution) are transferred from the account in third place. Also, in the third place, money will be written off based on collection orders from the Federal Tax Service, Pension Fund and Social Insurance Fund.

Calculate your salary and benefits taking into account the annual increase in the minimum wage Calculate for free

The fourth priority consists of payments under enforcement documents providing for any other penalties (debt under contracts, fines, penalties, etc.).

All other payments are transferred in fifth place.

Important

Within one queue, payment orders are executed in the order they are received by the bank.

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

Commentary to Art. 855 Civil Code of the Russian Federation

1. The procedure for debiting funds from the client’s account depends on whether there are enough funds in the account to satisfy incoming requests.

If there are funds on the account, they are debited from the account in calendar order - in the order in which the client's orders and other documents for debiting are received.

A different procedure for writing off funds from an account may be provided for by law. Currently there is no such law.

The parties by their agreement cannot provide for a different procedure for debiting funds from the account. Such an agreement is not acceptable either between the bank and the client, or between the bank’s client and its counterparty under the agreement.

2. If the funds in the account are not enough to satisfy all the requirements presented to it, the write-off is carried out in the order of priority provided for in paragraph 2 of Art. 855, which establishes six queues of claims for which write-offs can be made. Nevertheless, in fact, there were five queues, which is associated with the recognition of non-compliance with Art. 19 of the Constitution of the Russian Federation, paragraph. 4 p. 2 comments. Art., establishing the third priority of requirements. In this regard, it is proposed to introduce appropriate amendments to Art. 855. Before such changes are adopted, paragraph. 4 is not subject to application as it has no legal force. From 1998 to the present, the third and fourth stages of payments provided for in paragraph 2 of Art. 855, are combined into one line by the annual law on the federal budget for the next year.

Write-off of funds for the requirements of one queue is carried out in the calendar order of receipt of documents. Execution of settlement documents is carried out only for claims for which the payment deadline has already arrived. If the client has several accounts of the same type in the bank, the order of debiting is determined separately according to the requirements presented to each account.

The division of claims into queues depends not only on the legal nature of the claims themselves, but also on the document presented to the bank. Thus, similar requirements can be placed in different queues depending on the document under which they are submitted. Payments under executive documents, a closed list of which is contained in Art. 12 of the Law on Enforcement Proceedings have priority over payments under other payment documents. On this basis, for example, the requirements assigned to the second and third stages, as well as to the fifth and sixth, differ.

The claims of pledgeholders are not allocated in a separate queue, since funds held in a bank account cannot be the subject of pledge (clause 3 of the information letter of the Supreme Arbitration Court dated January 15, 1998 No. 26 “Review of the practice of considering disputes related to the application of rules by arbitration courts Civil Code of the Russian Federation on Pledge” // Bulletin of the Supreme Arbitration Court. 1998. No. 3).

3. The first priority includes demands for enforcement documents for compensation for harm to life and health, as well as for the collection of alimony. Similar requirements for documents other than executive documents cannot be included in the first priority. Thus, the payer’s application for voluntary payment of alimony is not an executive document, therefore, transfer on its basis is made according to the fifth group of priority of payments (letter of the Central Bank of the Russian Federation dated May 7, 1996 N 17-2-13/318 “On the priority of payments from settlement, current , budget accounts of legal entities" // The document was not published).

Secondly, write-offs are made according to executive documents on the payment of severance pay and wages with persons working under an employment contract, including a contract for the payment of remuneration to the authors of the results of intellectual activity.

In accordance with paragraph 1 of Art. 5 Federal Law “On the federal budget for 2009 and for the planning period of 2010 and 2011” (SZ RF. 2008. N 48. Art. 5499) until amendments are made to paragraph 2 of Art. 855 if there are insufficient funds in the taxpayer’s account to satisfy all the requirements presented to him, the write-off of funds according to settlement documents providing for payments to the budgets of the budget system of the Russian Federation, as well as the transfer or issuance of funds for settlements of wages with persons working under an employment contract , are made in the calendar order of receipt of the specified documents after the transfer of payments referred to in clause 2 of Art. 855 for the first and second stages.

Thus, in fact, the third line of claims consisted of payments to budgets and payments for wages under any payment document, except for executive documents.

Within this queue, the bank may receive different requirements for one payment document (wages, payments to the Pension Fund of the Russian Federation, Social Insurance Fund, etc.), therefore, if there are insufficient funds in the account to satisfy all requirements, the calendar queue cannot be applied to them . In accordance with Part 6, Clause 31 of State Tax Service Instruction No. 35 “On the application of the Law of the Russian Federation “On Personal Income Tax” (Russian News, 1995. No. 169, 174, 179) if there are insufficient funds in the account of the employing organization to pay wages in full and transfer to the budget of the withheld amounts of income tax, then the tax is transferred to the budget from the amounts actually paid to individuals.

In the order provided for writing off the main payment, settlement documents are also executed for writing off amounts of fines, penalties and other financial sanctions received by budget revenues of all levels and extra-budgetary funds (letter of the Central Bank of the Russian Federation dated December 2, 1996 N 144-96 “On the priority writing off penalties and other sanctions" // Bulletin of the Bank of Russia. 1996. N 67).

In the fourth place, funds are written off according to the requirements referred to in paragraph 2 of Art. 855 to the fifth stage, - for other monetary claims on the basis of executive documents.

Finally, in the fifth place, funds are written off according to the requirements referred to in paragraph 2 of Art. 855 for the sixth stage, - according to other payment documents.

4. Payments assigned to one queue are made after payment of the claims of the previous queue.

If, at the end of the operating day, payment documents presented to the bank cannot be paid due to the lack of funds in the client’s account, the funds are debited from the payer’s account and reflected in the balance sheet account of funds written off from clients’ accounts, but not posted to the correspondent account (subaccount ) a credit organization due to insufficient funds in the account (clause 4.3 of the Regulations of the Central Bank of the Russian Federation No. 2-P).

Unexecuted settlement documents are placed in the corresponding file cabinet of unpaid settlement documents for the correspondent account: settlement documents for executive documents - in a file cabinet in a division of the Bank of Russia settlement network, and settlement documents for other payments - in a file cabinet maintained by the bank (clause 4.4 of Regulations of the Central Bank of the Russian Federation N 2-P). In the file cabinet, settlement documents are distributed in the order of priority provided for in paragraph 2 of Art. 855.

5. The order of write-off of funds provided for in paragraph 2 of Art. 855, imperatively establishes the procedure for write-off. A different priority cannot be established by any other law or agreement.

Why indicate the order of payment in a payment order?

Paragraph 1 of Article 855 of the Civil Code of the Russian Federation states: if there is enough money in the account to fulfill all the requirements presented to the account, funds are written off in the order in which payments are received. A similar rule is contained in paragraph 2.10 of Regulation No. 383-P. It says that if there are sufficient funds in the payer’s bank account, orders (payment orders) are subject to execution in the sequence of their receipt by the bank.

Accordingly, establishing the order of payments is necessary, first of all, in case the account at some point does not have funds to execute all payments. Then the bank will transfer money not in calendar sequence, but taking into account the sequence indicated in field 21.

In addition, recording the order of payment in the payment order is necessary in case of arrest or blocking of the account. In such situations, the bank has the right to make payments that occupy a higher step in the queue than those for which the account was arrested (blocked). For example, a decision by tax authorities to suspend operations due to non-payment of taxes (Article of the Tax Code of the Russian Federation) will not prevent the bank from transferring alimony and wages according to executive documents.

Results

The “Payment order” detail is always filled in, since this is required by regulation No. 762-P.

It is especially necessary to pay attention to this field when the financial position of the organization is lame and Art. 855 of the Civil Code of the Russian Federation. You should study the order in which payments are made and, depending on this, indicate the correct order. To reflect the order of payment in the payment order - 2021-2022, symbol 5 is given for taxes, and symbol 3 for payment of wages. No changes were made to the order of payments in 2022-2022. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What order of payment should I indicate in 2022?

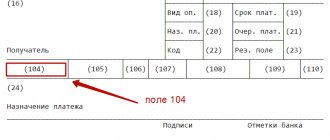

When filling out field 21 of payment orders in 2022, you must adhere to the following order.

To transfer payments for taxes, fees, and contributions, you should enter 5 (letter of the Ministry of Finance dated January 20, 2014 No. 02-03-11/1603). The same figure must be indicated in field 21 of the payment slip for the transfer of state duty, since it is a federal fee. This code also indicates penalties and fines that the payer pays based on the requirements of the tax authorities.

When transferring wages, you must enter the number 3. This code is also indicated in the case of voluntary repayment of wage debt. If the debt is paid according to a writ of execution or a decision of the Labor Inspectorate, then 2 is entered in field 21 of the payment slip.

For alimony payments, indicate 1. This code applies regardless of the basis for withholding alimony (writ of execution, court order or notarial agreement).

For payments under writs of execution, the order may vary: 1st, 2nd and 4th orders are possible. It all depends on the essence of the payment specified in the writ of execution. For example, as already mentioned, money under writs of execution for the collection of alimony should be written off first. The first priority also includes payments under a writ of execution, which establishes obligations to compensate for harm to life and health.

Payments under writs of execution for the recovery of wages, severance pay and royalties require the number 2 to be indicated in field 21. And payments under all other writs of execution are made in the fourth place.

Attention

A credit institution does not have the right to refuse to accept a payment order if it incorrectly indicates the order of payment (letter of the Ministry of Finance dated October 4, 2017 No. 05-07-06/64623).

Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

What to do if the order is incorrect

If there are enough amounts in the client’s current account to make all requested and necessary payments, then the queue specified in the order does not play a fundamental role. All payment orders will be executed by the bank in the order they are received. If there is not enough money in the account to fulfill all orders, the bank will write off the amounts in the order established by law (see above).

The bank has no right to refuse to transfer money to a client using a payment document that incorrectly indicates the order of payment.

If this detail is specified incorrectly, there are 2 options for correcting this error:

- Bank employees may ask the client to redo the payment document, since it is the bank that the inspection authorities will make complaints about the order of payments.

- The bank will make an independent decision to make the payment in accordance with the queue determined by law.

In any case, incorrect indication of the details in question in the payment will not affect the receipt of the transferred amounts into the budget.

Sequence of payments when seizing an account

The seizure of funds in an account (for example, as a measure to secure a claim or to execute a decision to collect taxes) in itself cannot violate the order of write-offs established by Article 855 of the Civil Code of the Russian Federation. This means that it does not prevent the transfer of payments that have a higher priority than the requirement due to which the account was blocked (Section II of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 1996 No. 6).

For example, if an organization’s account is seized based on a decision of the Federal Tax Service in connection with non-payment of taxes, then payments that belong to the first and second stages can still be made on it. And if the blocking comes from bailiffs who have a writ of execution to transfer payments of the fourth stage, then the current salary can also be paid from the seized account.

Sequence of payments in bankruptcy

If the paying company is at the stage of bankruptcy, then additional requirements are imposed on orders for the transfer of current payments. They are contained in paragraph 2 of Article 134 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”.

Thus, first of all, requirements for current payments related to legal costs in a bankruptcy case are satisfied; payment of remuneration to the arbitration manager; collection of arrears in payment of remuneration to persons who performed the duties of an arbitration manager in a bankruptcy case.

Find out OKVED, taxation system and income of your counterparty

The first priority also includes payment in favor of persons whom the arbitration manager is obliged to involve in the bankruptcy case on the basis of the law (for example, payment for the services of a servicing bank). At the same time, payment for the activities of other specialists attracted by the manager at his own discretion is included in the third priority.

Secondly, the requirements for payment of wages of persons working or who worked (after the date of acceptance of the application for declaring the debtor bankrupt) under an employment contract, and the requirements for payment of severance pay are satisfied. This same line includes the transfer to the budget of personal income tax withheld from current wages (clause 41.1 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 60).

In fourth place, utility bills, fees under energy supply contracts and other operating expenses are transferred. Finally, the fifth priority includes claims for all other current payments.

Attention

In field 21 of the payment order, the “bankruptcy” order is not reflected. Control over its compliance is carried out by the credit institution directly when spending funds from the bankrupt’s account. It conducts a check on formal grounds, determining the order of payment based on the information contained in the order or documents attached to it (resolution of the Arbitration Court of the Volga District dated October 8, 2018 No. F06-37700/2018).

Features of the most popular codes

What does payment order 3 mean?

Indicating the number 3 in field 21 of the payment order means that this is a document for the transfer of wages that the employer pays on a voluntary basis. If the organization’s account does not have enough funds to satisfy all requirements, or it is seized, then the money based on such payment will be debited in third place. Namely: after money under writs of execution for the payment of alimony, funds as compensation for harm to life and health, wages, severance pay and royalties. But before the bank begins to fulfill the requirements for other executive documents and for payment orders for the transfer of payments assigned to the fifth stage.

Accordingly, if an organization’s account is arrested as part of enforcement proceedings initiated on the basis of a writ of execution, which provides for the recovery of funds in favor of counterparties, then the payment order with the number 3 in field 21 must be executed without any delays. The salary for such a payment will be transferred even if the Federal Tax Service issued collection orders to this account, but they arrived at the bank later than the payment from the company (clause 2 of Article 855 of the Civil Code of the Russian Federation).

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

What does payment order 5 mean?

A payment order with the number 5 in field 21 means that the bank is entrusted with the transfer of current payments that are not wages and are not related to the fulfillment of requirements under executive documents. The bank must accept such a payment if there is enough money in the organization’s account to satisfy all higher-level requirements available on the same date. And also provided that the account is not blocked, including collection orders from the Federal Tax Service. Payments with the number 5 do not compete with each other - the bank executes them in the order they are received.

In conclusion, we note that correct determination of the order of payment will allow you to correctly fill out the payment order and promptly transfer it to the bank for execution. This will make it possible to make payments without delays, and in some cases, make payments from a blocked account.

Please note: errors when filling out payment slips can be eliminated if payment documents are generated automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in 1 click based on data from the declaration (calculation) or the request for payment of tax (contribution) sent by the inspectorates. All necessary data (recipient details, current BCC, account numbers of Federal Treasury departments, codes for payer status) are promptly updated in the service without user participation. When filling out a payment slip, all current values are entered automatically.

Features of using codes 3 and 5

If all payments are made by the company within the specified time frame, code 5 is written on the payment slip. It is relevant for taxes of any type: simplified tax system, income tax, property tax.

Code 3 becomes relevant when there is a demand for debt payment. For example, this could be a collection order in which there is a sequence.

IMPORTANT! If the debt was identified by the organization itself, the number 5 is indicated on the payment slip.

Sequence under different circumstances

In some circumstances, the accountant may have difficulty indicating the priority code. Let's consider typical situations.