Target

The report reflects the state of affairs of the company regarding the issue of accrual, withholding and payment of personal income tax. Personal income tax is imposed on monetary benefits received by citizens in the organization. The accounting department of the enterprise pays consolidated tax deductions from the income received by employees at the enterprise. In essence, the Report monitors the employer on a quarterly basis and protects the interests of working citizens. The report is used by the tax office as a tool to identify those taxpayers who delay or do not pay wages to those who work for them. With the introduction of the Report, the tax authorities received transparency in the actions of the employer in relation to the payment of income to individuals with whom it interacts and makes payments.

Structure

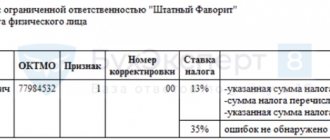

The 6-NDFL report consists of a title page and two sections. The title page contains information about the taxpayer (codes, INN, KPP, name, etc.), the code of the tax office branch to which the enterprise belongs, and information about the report (number of pages, for example). Section one (lines “010-090”) contains cumulative information from the beginning of the year to the current moment on the amounts accrued to employees and individuals with whom the enterprise interacted, in the form of income. And information about what taxes are calculated and withheld. Section two reflects information on the dates when individuals received income for the past quarter. In addition, the section provides information on the withholding of tax contributions from specified individuals for the past quarter (date and amount of withholding from the individual, date of transfer to the Federal Tax Service).

Penalty for violating the reporting method

If you submit 6-NDFL in paper form instead of electronically, you will be fined 200 rubles under Article 119.1 of the Tax Code for violating the established method of reporting. A fine will be charged for each document submitted in violation.

Thus, from January 1, 2022, Form No. 6-NDFL and information on the income of individuals must be submitted electronically if the number of your employees is more than 10 people (letter of the Federal Tax Service of Russia dated November 15, 2019 No. BS-4-11 / [email protected] ).

But there will be no liability for failure to comply with the electronic method of filing 2-NDFL, even if the number of your employees exceeds 10 people (letter of the Federal Tax Service of Russia dated March 16, 2020 No. BS-4-11/4531).

Also on topic:

Instead of 2-NDFL, we issue employees a new certificate from form 6-NDFL

Fines

If the enterprise submits to the inspection a Report with incorrect indicators or indicates inaccurate information in sections of the Report, which:

- contributed to the payment of less than the full amount of tax deductions;

- violated the rights of citizens;

it is subject to penalties in the form of a monetary fine. The amount of the fine for errors made by the taxpayer does not depend on the number of inaccuracies discovered by the inspector, since the fine is assessed for the fact that documentation with deficiencies was submitted. A fine will also result from failure to submit the Report or submitting it to the tax office later than the deadline established by law.

Which BCC must be indicated when paying a fine?

When paying fines for violating the rules for reporting in Form 6-NDFL, the payment document must indicate the appropriate budget classification codes (BCC):

- for fines for failure to submit a report - 182 1 1607 140;

- for fines for false information (errors) in the report - 182 1 1608 140;

- for fines for violation of the delivery method - 182 1 1603 140;

- for fines that are applied to officials under Art. 15.6 Code of Administrative Offenses of the Russian Federation - 182 1 1606 140.

If you enter the code incorrectly, the payment of the fine may not be counted. In order for the fine to be considered paid, it is necessary to submit an application to the tax service to clarify the identity of the payment. The Ministry of Finance indicated this possibility in its letter dated January 19, 2022 No. 03-02-07/1/2145.

In a letter dated October 8, 2022 No. KCH-4-8/ [email protected] , the Federal Tax Service presented a table that will help you sort out payments. It contains the following details:

- BIC;

- name of the territorial body of the Federal Treasury;

- name of the recipient's bank;

- recipient's account number (treasury account number);

- bank account number of the recipient of the funds (number of the bank account included in the single treasury account);

- number of the current bank account of the territorial body of the Treasury.

Errors without penalties

The Federal Tax Service of the Russian Federation explains that some Reports submitted with errors will not be the basis for the accrual of fines. For example, letters from the Federal Tax Service were published in which it was stated that the Federal Tax Service applies punishment in a mitigating form to those taxpayers who made minor errors that did not cause damage to the rights of the individuals about whom information was submitted. Errors that did not cause underpayments to the budget for personal income tax were also not considered serious violations. That is, minor arithmetic inaccuracies and minor spelling errors will not be a reason for applying penalties to the organization. But experienced entrepreneurs prefer to more carefully check the lines filled in the Report before submitting the Report to the tax office in order to protect themselves from penalties. If, even after submitting the Report, an error is still discovered, the enterprise should immediately provide the inspection with a clarification, having managed to get ahead of the inspectors, then both penalties and additional inspections by state regulatory authorities can be avoided. We will consider below what errors in 6-NDFL will be fined.

What is considered failure to report?

The deadlines for submitting a report in form 6-NDFL are established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation:

- the last day of the month that occurs after the reporting period - for a quarterly report;

- March 1 of the year following the reporting year - for the annual report.

If the deadline for submitting a report falls on a weekend or holiday, it must be submitted on the next business day. This rule is provided for by the Tax Code in paragraph 7 of Art. 6.1.

The tax service will consider the report on Form 6-NDFL not submitted if the employer who bears such responsibility has not submitted the reporting document or has submitted it, but not on time, after the deadline. Violations of the rules for submitting 6-NDFL are considered:

- submission of a report containing errors in calculations or false information - penalties for such a violation are applied to the employer if the tax office identifies errors before the employer corrects them independently (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation);

- incorrect way to submit a report - an employer with more than 10 people on staff is required to submit Form 6-NDFL only in electronic form (clause 2 of Article 230 of the Tax Code of the Russian Federation).

2-NDFL and 6-NDFL

Until 2016, the only report on listed tax collections from individuals from an organization was a 2-NDFL certificate. The deadline for submitting it to the inspection is until the end of March of the year following the reporting year. Now Report 6-NDFL has joined 2-NDFL, and it is submitted to the inspection quarterly. Tax authorities have developed control relationships between these forms. It is important that information on employees from 2-NDFL is correlated with the general indicators for all individuals from the first section with the final annual data of the 6-NDFL Report. It is possible that 2-NDFL and the 6-NDFL Report will not agree on the control ratios due to the last salary of the year; it may be accrued in December of the current year, and cards are issued or transferred to employees in January of the next year. Thus, personal income tax will be accrued in December and withheld in January. The 6-NDFL Report does not include the amount of tax withholdings for December; withholdings will appear in this report in January, and the information is indicated only in the “accrued” line. In the 2-NDFL certificate, accrued tax withholdings are reflected in the current period, regardless of what month they will be withheld. That is, the personal income tax accrued on the December salary is included in the 2-personal income tax certificate. Such a discrepancy is not considered an error. Read more about how to fill out 2-NDFL if wages are accrued but not paid. For all other inconsistencies in control ratios, the head of the enterprise will have to submit clarification, for example:

- the value on line “080” of the Report does not coincide with the data on non-withheld tax deductions from all employees (the consolidated amount of non-withheld tax deductions for all 2-NDFL certificates in the company);

- the indicator on line “040” of the Report does not correspond to the amount of calculated personal income tax at the specified rates based on the sum of the values of all 2-personal income taxes at the corresponding rates;

- the indicator on line “020” does not correspond to the sum of the “Total Amount of Income” values of all 2-NDFL certificates;

- the value on line “025” does not correspond to the amount of all dividends indicated in the 2-NDFL certificates;

- the value on line “060” of the Report does not correspond to the total number of 2-NDFL certificates issued to employees who received income in the specified period.

For some business managers who submit 6-NDFL, penalties (for errors due to inconsistencies) seem insignificant. Carefully check the updated Report for compliance with 2-NDFL and 6-NDFL (clarified). Repeated penalties for such discrepancies are only the beginning of the taxpayer’s troubles; it will be followed by additional clarifications and even audits.

How to check 6-NDFL before sending: control ratios

Before submitting corrective 6 personal income tax to the Federal Tax Service, check it. For this purpose, the Federal Tax Service of the Russian Federation has prepared control ratios of indicators. They are fully set out in letter No. BS-4-11/ [email protected] .

Use them to check that the data entered into the form is correct:

- p. 110 > or = p. 130, otherwise tax deductions were inflated;

- (p. 110 – p. 130) / 100 * p. 100 = p. 140, or the amounts of calculated tax were overestimated or underestimated;

- p. 140 > or = p. 150, or the fixed advance payment is too high;

- average salary > or = minimum wage, or the tax base may be underestimated.

Common errors

When preparing the title page, accountants often make mistakes in this document on Form 6 of Personal Income Tax when filling out information about codes, tax identification numbers and checkpoints. Even in the information that an accountant works with every day, a typo can creep in, which the tax office considers as errors for which they will be fined. 6-NDFL is a very important form of reporting; any mistake for the inspector will become unreliable information about the organization. After all, the inspector will not even be able to identify such a report; the codes are very important information! Due to the same inattention, other errors arise in 6-NDFL, for example, the location of, for example, a branch of the organization is incorrectly indicated, because in the bustle and filling out several reports (for each separate division, the accountant of the main office fills out a separate Report), the accountant did not change this address in the corresponding line. Often, when generating a Report, an error is hidden when specifying the reporting period code. Errors include submitting a Report prepared in an organization with more than 25 people on paper. For enterprises with such staff, there is an obligation to submit the Report in electronic form through an electronic document management operator. The indicated errors will serve as a refusal to accept the Report, and the inspection will assign the organization the status of not submitting the Report. How to correct errors in 6-NDFL? In this case, the company will have to correct the errors and submit the Report again as a primary report with the correction code “000”. Individual fines are imposed on the legal entity and the head of the organization personally. Errors made in the calculations that were not noticed by the inspector when receiving documents, but discovered when processing the provided data later, the organization will have to correct and submit an updated Report to the tax office. The correction code for clarifying Reports will coincide with the number of the attempt to submit the Report to the inspection: “001”, “002”, etc.

What can you be fined for?

A tax agent (organization or individual entrepreneur) may be held liable in the form of fines in two cases related to the timing:

- the calculation is not presented at all,

- payment was submitted late.

Tax penalties for organizations and individual entrepreneurs

The amount of financial sanctions for 2022 is 1 thousand rubles for each month of late payment. Thus, the fine for late submission of 6-NDFL, if the delay is 6 months, will be equal to 6 thousand rubles. This mechanism for calculating sanctions is specified in paragraph 1.2 of Article 126 of the Tax Code of the Russian Federation.

Tax inspectors will impose a fine within 10 working days from the date the tax agent submitted the report. They are not required to wait until the end of the desk audit.

If you do not submit the payment within 10 days from the due date, the tax inspectorate also has the right to block the bank account of the tax agent (clause 3.2 of Article 76 of the Tax Code of the Russian Federation). The Federal Tax Service of Russia clarified this in a letter dated August 9, 2016 No. GD-4-11/14515.

If there is false information in 6-NDFL

The fine for each payment with false information is 500 rubles. But if you discovered an error and submitted an updated calculation before the tax inspectors noticed it, there will be no sanctions (Article 126.1 of the Tax Code of the Russian Federation).

Inspectors may impose a fine due to any error in the calculation in Form 6-NDFL. Inaccuracy in income and deduction codes, total indicators. But in some cases, inspectors reduce the fine, citing mitigating circumstances (clause 1 of Article 112 of the Tax Code of the Russian Federation). These are cases when the tax agent, due to an error (Letter of the Federal Tax Service of Russia dated August 9, 2016 No. GD-4-11/14515):

- did not underestimate the tax;

- did not create adverse budgetary consequences;

- did not violate the rights of individuals.

Administrative fines for officials

If the tax agent is an organization, officials of the organization, for example its head, will be fined. A fine of 300 to 500 rubles is possible. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation). Keep in mind that individual entrepreneurs, lawyers, and notaries are not held administratively liable (Article 15.3 of the Code of Administrative Offenses of the Russian Federation).

Errors in the first section

A common mistake when entering data and calculating indicators in the first section is that the indicators are indicated in the lines without an accrual total. Let's give examples of what other mistakes in 6-NDFL, for which you will be fined, can be made in the first section:

- line “020”: income not subject to personal income tax is included;

- line “070”: the indicator includes a tax deduction, the deduction of which will be made only in the next quarter (personal income tax on wages accrued in the last month of the quarter, and actually issued in the first month of the next quarter);

- line “080”: the indicator takes into account the amount of tax withholdings for which the time of payment has not arrived.

If an employee has been accrued money earned within the quarter, but the period has expired and it has not yet been paid due to the taxpayer’s financial problems, then information about them is entered only in the first section (in line “020” - accrued payment; in line “040” - accrued income tax; in lines “070” and “080” for the rolling payment we set 0 until the moment of actual disbursement of funds). In this case, no accounting is carried out in the second section. Line “070” often contains errors due to the fact that the accountant indicates in it the amount of tax deduction, which is subject to withholding only in the next period (this is especially common for issues related to wages paid in the first month of the next quarter). If such an error occurs, it is important to make and reflect the actual payment in the subsequent report; the Federal Tax Service does not require an updated Report to be provided for this error.

What errors can there be in 6-NDFL?

Error in details

Firstly, there may be an error in filling out the details on the title page. For example, incorrect TIN or organization name. In this case, we change the details and fill out the remaining data in the same way as the first time.

Lines 110–190 for each tax rate are not highlighted

When filling out section 2, it may not be taken into account that for each tax rate, lines 110–190 are filled out separately. In the adjusted calculation, we add lines 110–190 for each bet.

Errors in the reflection of salaries paid in the next reporting period

The data on lines 140 and 170 should not be equal. If an organization pays wages next month, then personal income tax will also be withheld in the next month, but accrued in the current one. For example, if the salary for June is 10,000 rubles. is paid on July 5, then the calculation for the half-year will be the following data:

| Line number | Meaning |

| 110 (112) | 10 000 |

| 140 | 1 300 |

| 170 | 0 |

| Section 1 of the calculation for the half-year for the June salary is not completed. Section 1 of the calculation for 9 months will contain the following data: | |

| 021 | 06.07.2022 |

| 022 | 1300 |

The same approach applies to salaries for December of the previous year. It does not fall into section 2 as accrued, but will be reflected in section 1 as paid.

Error in the number of individuals

The incorrect number of individuals on line 120 is also subject to correction. The same employee cannot be counted twice, even if he was fired and rehired.

Error in filling lines 021–022

Personal income tax must be transferred no later than the next day after the actual payment of wages (line 021). Line 021 must indicate the date in accordance with the requirements of the Tax Code of the Russian Federation, and not the date when the tax agent made the transfer to the budget. The data in this column is verified by tax authorities with their information on receipt of payment to the budget. And if the money arrived later than the next day after the salary was paid, the tax agent will receive a question from the Federal Tax Service. For example, the salary was paid on June 7, and the tax was transferred on June 13. In line 021 - June 8.

The annual calculation of 6-NDFL is submitted according to the new form as amended by the order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11 / [email protected] Read more about this in our article.

Find out how to fill out the clarification from the article “ of 2021. ”

In addition, look for all the latest information and news on filling out the calculation in the section of our website “Calculation of 6-NDFL” .

Errors in the second section

The second section is filled out with data only for the last quarter. Sometimes organizations submit reports indicating the data of the second section on an accrual basis, similar to the first section, which is recognized as gross errors in 6-NDFL. To check the correctness of filling out the second section, it is recommended to reduce the amount of tax withholdings on line “140” by the figure on line “090”; the calculated amount in section two should be paid into the treasury in the time interval between lines “110” and “120”. If the amount is taken into account in the period specified in the lines (from the date of tax deduction to the date of its transfer), then the inspection will count this result. If the result is that the amount “falls” ahead of schedule, then this result will be the cause of debt. The tax office will make a demand. Upon termination of employment relations with employees and dismissal, the employee is given wages for the past month and actually worked days in the current month, as well as compensation for unused vacation days. It is considered an error if the accountant does not reflect earnings for the previous month separately from the amount of compensation with wages in the current period.

Request from the Federal Tax Service

If an accountant has received a tax report, and suddenly a request arrives indicating error code 0000000001 in 6-NDFL, what is this? The point is that the report provided to the tax authorities requires clarification; according to the tax authority, there may have been a discrepancy in the control ratios. If you are sure that there cannot be any errors in the Report itself, then you need to check whether there are any discrepancies in the reports provided to the Funds and the Federal Tax Service regarding the information specified in them regarding insured individuals. If, based on the results of your check, there are no errors, report this to the Federal Tax Service, indicating that you have not found any discrepancies with the data provided to the Federal Tax Service.