Any organization must maintain accounting and tax records, recording the methods of their maintenance in its accounting policies. The accounting policy of the organization creates a unified system of accounting and document flow, which all employees and divisions of the company must follow. Lack of accounting policies is a serious violation for which the company can be fined. How to draw up an accounting policy for 2022, and what features should be taken into account - this is what our material is about.

Accounting policy of an enterprise: general requirements for registration

The accounting policy is drawn up in accordance with the rules established by the accounting law No. 402-FZ of December 6, 2011, as well as PBU 1/2008. In addition, each industry may have its own regulations that affect its content.

The accounting policy consists of two parts: accounting and tax. They can be drawn up as a single document consisting of two sections, or two separate provisions can be made.

The organization's accounting policies are applied continuously from year to year, and reasonable changes to it can only be made from the beginning of the reporting year. The order on the accounting policy is approved by the manager no later than 90 days after registration of the company. For example, the accounting policy for 2022 had to be adopted before December 31, 2019, and the document approved in 2022 will come into force only from January 1, 2021.

An organization's accounting policies should reflect accounting methods only for actual assets, transactions, and liabilities. It is advisable to fix in the text of the document those accounting aspects for which there is a choice from several options, or the law does not contain an unambiguous interpretation on them. For example: what methods of depreciation are used, how reserves are created, etc. It makes no sense to rewrite unambiguous provisions of the PBU, or the Tax Code, that do not offer a choice.

“Accounting policies of the organization” PBU 1/2008: changes

From 08/06/2017, amendments to PBU 1/2008 “Accounting Policy of the Organization” came into force (Order of the Ministry of Finance of the Russian Federation dated 04/28/2017 No. 69n). Its provisions include, in particular, the following innovations:

- PBU “Accounting Policies” now applies to all legal entities, except credit and government organizations,

- a rule has been introduced on independent choice of the accounting method, regardless of the choice of other organizations, and subsidiaries choose from the standards approved by the main company (clause 5.1),

- the concept of rational accounting has been clarified - accounting information must be useful enough to justify the costs of its formation (clause 6),

- in cases where there is no specific method of accounting in federal standards, the organization develops it itself, based on paragraphs. 5 and 6 PBU 1/2008 and accounting recommendations, consistently referring to IFRS standards, federal (PBU) and industry accounting standards (clause 7.1), and to companies conducting simplified accounting (small enterprises, non-profit organizations, Skolkovo participants) , when forming an accounting policy, it is enough to be guided by the requirements of rationality (clause 7.2),

Documents are the basis for the formation of accounting policies.

When forming an accounting policy, an institution should be guided by (clause 7 of the GHS “Accounting Policy”):

- features of its structure;

- industry characteristics of activity;

- GHS “Accounting Policies”;

- regulatory legal acts governing accounting and preparation of accounting (financial) statements;

- accounting policy of the founder.

If, in relation to any accounting object, the regulatory legal acts governing the maintenance of accounting and the preparation of accounting (financial) statements do not establish the rules for its reflection in accounting, the institution, in agreement with the founder and financial body of the public legal entity carrying out consolidation of reporting, determines accounting policies based on the requirements of the GHS “Conceptual Framework”[4].

It is permissible to formulate an accounting policy through both the adoption of a single legal act, which includes the entire set of accounting methods, and the adoption of separate legal acts or the inclusion of relevant provisions in separate legal acts (for example, a legal act on the organization of the exercise of powers of the budget revenue administrator may include provisions establishing the features of accounting in terms of the procedure for filling out (compiling) and reflecting in budget accounting primary documents on administered budget revenues) (Guidelines No. 02-06-07/62480).

Organizations exercising the powers of the recipient of budget funds, when developing accounting policies, must provide for the specifics of organizing and maintaining accounting records in terms of operations for the execution of these powers (clause 10 of the GHS “Accounting Policies”).

Contents of the accounting policy of the organization (LLC)

Accounting policies should reflect:

- list of regulations on the basis of which the company keeps records: Law on Accounting No. 402-FZ, PBU, Tax Code of the Russian Federation, etc.,

- working chart of accounts, prepared as an annex to the accounting policy,

- positions responsible for organizing and maintaining records in the company,

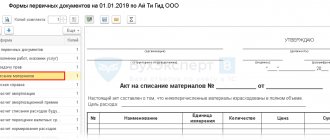

- forms of the “primary” used, accounting and tax registers - unified forms, or independently developed,

- depreciation issues – calculation methods, frequency (monthly, once a year, etc.),

- limits on the value of fixed assets, the procedure for their revaluation,

- accounting of materials, finished products, goods,

- accounting of income and expenses,

- the procedure for correcting significant errors and the criteria for classifying them,

- other provisions that the organization deems necessary to reflect.

If the “accounting” part of the organization’s accounting policy is quite universal for everyone, then the tax part will be different for each taxation regime, but in any case should contain:

- information about the applicable tax system, and if there is a combination of tax regimes - the procedure for maintaining separate accounting,

- how taxes are paid in separate divisions, if any,

- whether the company has tax benefits, and under what conditions they apply.

Order on approval of accounting policies

The director of the enterprise approves the policy - a separate order is issued for this purpose. The form of the document is not determined by the legislator - when drawing it up, you should be guided by the document flow rules in force in the company.

As a rule, an order approving accounting policies includes the following information:

- name of company;

- Title of the document;

- date of issue of the order;

- serial number of the order;

- the date from which the order comes into effect;

- a list of documents approved by the order (usually the accounting policy is an appendix to the order, signed and stored together with it; in addition, appendices are created to the accounting policy itself - for example, the chart of accounts used in the work is included in the appendix);

- the responsibility of managers to familiarize subordinates with the content of the approved accounting policy;

- the person responsible for executing the order;

- FULL NAME. and the signature of the head of the organization.

Accounting policy of the simplified tax system

The nuances of tax accounting policy with “simplified” depend on the selected object: “income” (6%), or “income minus expenses” (15%).

When applying the simplified tax system “income”, tax policy should reflect:

- income accounting procedure,

- indicate how the paid insurance premiums reduce the tax base,

- in what order and at what rate are taxes and advance payments calculated,

- tax register - KUDIR.

With the object “income minus expenses”, special attention should be paid not only to income, but also to expenses, indicating:

- the procedure for accounting for fixed assets, the method of calculating depreciation,

- composition of material costs,

- procedure for accounting for sales costs (if any),

- recognition of past losses in the current period,

- procedure for calculating and paying the minimum tax,

Otherwise, the tax policy points will be similar to those indicated for the simplified tax system for “income”.

The main components of accounting on OSNO

Like any other taxation regime, OSNO has a number of its own features that must be taken into account when forming the UE.

It is necessary to reflect the following important nuances that are associated with accounting:

- Indication of persons responsible for accounting.

Often, accounting is handled by the chief accountant, but other options are also permitted by law, such as accounting carried out by a third-party outsourcing company.

- Development of a form of primary documentation.

You can use standardized document forms or develop your own.

- Selecting a depreciation method.

There are 4 options for calculating depreciation of fixed assets and 3 options for intangible assets. The company chooses the most suitable one for itself.

- OS cost limit.

In accordance with the law, objects related to fixed assets worth less than 40,000 rubles can be taken into account as part of the inventory.

- Revaluation of fixed assets.

The law allows for the revaluation of fixed assets and intangible assets. The company conducts it on its own initiative and, in the event of such a decision, undertakes to conduct it in the future.

- Accounting for inventory items.

Here it is necessary to determine the procedure for assessing inventories and their write-off for production, the procedure for procurement, and assessment of finished goods.

- Income and expenses.

It is necessary to specify which of them are the main ones and which are the others.

- Materiality criterion and recognition of significant errors.

This paragraph specifies what needs to be disclosed in the report, and also sets the threshold for determining errors as significant.

These components of the UE are not complete. The company has the right to introduce other items that will reflect its scope of activity or the necessary accounting methods.

OSNO accounting policies

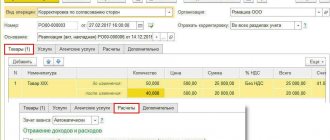

One of the main points of tax policy under OSNO is accounting for income tax. The document should reflect:

- procedure for recognizing direct and indirect expenses of an enterprise (cash or accrual method),

- the procedure for accounting for fixed assets, whether increasing coefficients are used for depreciation, depreciation bonus, for which objects,

- methods for assessing materials, raw materials and goods,

- Are reserves formed to evenly distribute expenses throughout the year (vacations, bad debts, OS repairs, etc.),

- accounting for transactions with securities,

- in what order is income tax and advance payments on it calculated and paid,

- applicable tax registers, etc.

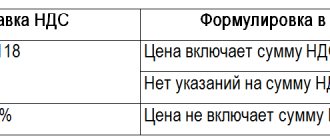

The specifics of VAT accounting when developing accounting policies should be pointed out to those who are exempt from tax or who carry out transactions taxed at a rate of 0% - this concerns the order of distribution of “input” VAT.

What is accounting policy and why is it needed?

Enterprises using OSNO often encounter differences in accounting and tax accounting. Such differences arise in the accounting of fixed assets, certain types of income, interest on loans and borrowings, exchange rate and amount differences, etc. As necessary (when legislation changes or new types of financial and economic activities emerge), the accounting policy of the LLC on OSNO with subaccounts and tax accounting principles are established on the date of such changes and are valid indefinitely. The concept of accounting policy is enshrined in clause 2 of Art. 11 of the Tax Code of the Russian Federation.

Tax accounting is maintained in order to correctly determine income and expenses for calculating income tax and other mandatory taxes paid by the enterprise on OSNO. The method by which income from sales is determined largely determines the principle by which tax accounting policies should be formed. Most organizations use the accrual method, according to which income is determined at the time of shipment of goods (performance of work or provision of services), regardless of whether payment has been received from the buyer or not.

The accrual method is used for income tax and VAT.

ConsultantPlus experts analyzed which accounting records should be used to reflect the main transactions with fixed assets when applying FAS 26/2020 and FAS 6/2020. Use these instructions for free.

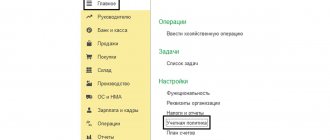

How to approve the accounting policy

The approval procedure depends on the form in which the accounting policy for tax accounting purposes is drawn up - by order of the manager or a separate provision.

The order is drawn up indicating the responsible persons, who put their signature confirming familiarization with the responsibilities assigned to them. The order is signed by the head of the company.

Let's consider an example of an accounting policy for tax purposes with grounds, drawn up in the form of an order.

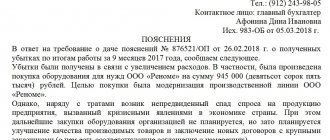

The accounting policy regulations are drawn up by the chief accountant or any other person responsible for maintaining tax accounting at the enterprise, and approved by the manager.

An example of an accounting policy for tax purposes for 2022:

| Order on the adoption of accounting policies for tax purposes at the LLC Clubtk.ru enterprise December 30, 2022 I order:I. In accordance with paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, approve the organization’s accounting policy for tax purposes. Value added tax 1. Maintain a log of received and issued invoices, a purchase book, a sales book and additional sheets to them in electronic form using the 1C: Accounting computer program. 2. Control over the correctness of maintaining the log of received and issued invoices, the purchase book, the sales book and additional sheets to them is carried out by the chief accountant V.F. Smirnova. Decree of the Government of the Russian Federation “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” No. 1137 of December 26, 2011 (as amended by Decree of the Government of the Russian Federation No. 981 of August 19, 2017). 3. A single continuous numbering is provided for invoices. Invoices issued for prepayment are numbered with the prefix “A”. 4. The right to sign invoices extends, in addition to the manager and chief accountant, to the following responsible persons:

Income tax1. Tax accounting is carried out in a mixed way, both with the use of accounting documents for individual groups of business transactions, and with the use of specialized tax accounting documents for those groups of business transactions, the tax accounting of which differs significantly from the accounting rules (Article 313, 314 Ch. 25 “Profit Tax” of the Tax Code of the Russian Federation). 2. The date of receipt of income (expense) is determined using the accrual method (Articles 271, 273, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation). 3. In the case of the organization providing services, the amount of direct expenses incurred in the current reporting (tax) period when carrying out this activity in full shall be attributed to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress (clause 2 Article 318 Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 4. Form the cost of goods purchased for the purpose of their further sale, without taking into account the costs associated with the acquisition of goods (Article 320, Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 5. When determining the amount of material expenses when writing off raw materials and supplies used in the production (manufacturing) of goods (performing work, providing services), in accordance with the accounting policy adopted by the organization for tax purposes, one of the following methods for assessing the specified raw materials and supplies is used average cost (Clause 8, Article 254, Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 6. When selling purchased goods, the cost of purchasing these goods is written off as expenses at the average cost (Clause 1, Article 268, Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 7. Calculate depreciation on fixed assets using the straight-line method (Clause 1, Article 259, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation). 8. For intangible assets specified in subparagraphs 1-3, 5, 6 of paragraph three of paragraph 3 of Article 257 of the Tax Code, determine the useful life in the usual manner (clause 2 of Article 258, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation) . Personal income tax1. The organization is a tax agent for personal income tax. To control the correctness of calculation, withholding and payment of personal income tax, the 1C: Accounting program is used. II. Provide for the possibility of introducing clarifications and additions to the accounting policy of the enterprise in connection with changes in tax legislation, the emergence of business transactions, the reflection of which in tax accounting is provided for by several methods, the choice of which is entrusted to the enterprise by law, or for other reasons. III. Responsibility for organizing tax accounting at the enterprise should be assigned to the chief accountant V.F. Smirnova. Gene. Director _______________________/Voronov A.V./ M.P. |

When accounting policies are changed

The organization has the right to make changes to the document at any time as necessary. For example:

- when legislation changes;

- when new accounting objects appear, the taxation procedure for which is not described in the previous version of the accounting policy;

- when changing the methods of tax accounting within the framework of current legislative norms;

- when responsible persons change.

Accounting policy: sample

It is impossible to create a sample accounting policy that would be equally suitable for all enterprises.

Each case has its own characteristics, depending on the type of activity, the applied tax regime and many other factors. The accounting policy, an example of which is given here, was drawn up for an enterprise operating on OSNO. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample OSNO

Production

Download for free: Accounting policy of the organization for 2013 on OSNO (production).doc (for 2018-2019, it needs to be corrected, but mostly suitable) Word (73 kb).

: Accounting policy of the organization for 2013 on OSNO (production).doc (for 2018-2019, it needs to be corrected, but basically it’s suitable) Word (73 kb).

Services

Download for free: Accounting policy of the organization for 2013 on OSNO (services).doc (for 2018-2019, it needs to be corrected, but mostly suitable) Word (73 kb).

: Accounting policy for 2013 on OSNO (services).doc (for 2018-2019, it needs to be corrected, but basically it’s suitable) Word (73 kb).