Who should submit the payment?

Only those manufacturers and importers who have not recycled packaging and goods from the List or have completed it in volumes less than the standard must submit the calculation. In the case when the organization carries out recycling in full in accordance with accepted standards (approved by Order of the Government of the Russian Federation dated December 28, 2017 No. 2971-R), the payment for the environmental fee is zero. Then you do not need to submit a calculation or pay a fee to the budget.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Who pays the environmental fee in 2020-2021

Manufacturers and importers of goods who cannot independently dispose of waste from the use of goods are required to pay an environmental fee.

The environmental fee is paid by manufacturers, importers of goods, for each group of goods, the list of which is established by the Government of the Russian Federation, before April 15 of the year following the reporting year (Clause 2 of Article 24_5 of the Federal Law of June 24, 1998 N 89-FZ) .

Important!

Standards for recycling waste from the use of goods for 2018-2020 are established by Order of the Government of the Russian Federation dated December 28, 2017 N 2971-r.

Recycling standards are introduced with a smooth, annual increase in values for each specific group of goods. Recycling standards are reviewed once every 3 years.

The environmental fee for packaged goods that are not ready-to-eat products is paid only in relation to the packaging itself (Clause 3, Article 24_5 of the Federal Law of June 24, 1998 N 89-FZ).

With regard to packaging that is subject to disposal after loss of consumer properties, the obligation to comply with recycling standards rests with manufacturers and importers of goods in this packaging (Clause 10, Article 24_2 of the Federal Law of June 24, 1998 N 89-FZ).

That is, the environmental tax in relation to the packaging itself is paid by the manufacturer, the importer of goods in this packaging, and not by the manufacturer of the packaging itself.

Important!

The environmental fee is not paid in relation to the quantity of goods, packaging of goods that are exported from the Russian Federation (Clause 4, Article 24_5 of the Federal Law of June 24, 1998 N 89-FZ).

Since 2015, the obligation has been introduced for manufacturers and importers of goods to pay an environmental fee in cases where it is impossible to independently dispose of waste from the use of their goods after they have lost their consumer properties. The implementation of this requirement will make it possible to place the burden of paying the costs of waste processing on those who produce or import products into the Russian Federation. Those companies that do not process waste themselves will be required to pay an environmental fee.

The procedure for collecting environmental fees is regulated by Government Decree No. 1073 dated 10/08/2015, as amended on 08/23/2018. Recycling standards for the use of goods for 2018-2020 are established by Decree No. 2971-r dated 12/28/2017. List of finished goods, including packaging and subject to disposal after they have lost their consumer properties are approved by Government Order No. 2970-r dated December 28, 2022.

We carry out our work using special software designed to calculate this type of work, with further uploading to the Rosprirodnadzor portal.

We can immediately say that a number of enterprises fall under the law. It is required to dispose of waste or pay an environmental fee when producing or importing 54 groups of goods into the country.

Deadline

Rosprirodnadzor accepts calculations annually until April 15. For 2019, the calculation had to be submitted by April 15, 2022. The deadline for submitting calculations for 2022 is April 15, 2022.

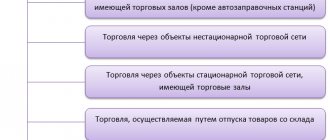

The delivery location depends on the type of activity of the organization:

- Manufacturers submit calculations (like other forms of environmental collection) to the territorial RPN authority at their location.

- Importers submit calculations to the RPN Central Office (in Moscow).

- If an organization simultaneously produces and imports, it submits one report (indicating both the quantity of goods produced and the quantity of imported goods) to the Central Office of the RPN.

Environmental fee rate and recycling standard 2022

The required percentages and amounts per unit are shown in the table:

The environmental fee rate and recycling standards in 2022 for some categories are under development. These include:

- wiring and cables;

- primary elements and batteries;

- filters for internal combustion engines;

- containers made of aluminum, polymers, corrugated cardboard, glass, wood, textiles;

- multilayer glass products;

- metal containers;

- pipes, hoses;

- reels and spools made of paper raw materials, etc.

For the period 2019-2020. The Ministry of Natural Resources did not provide zero standards for this type of payment. However, zero rates are indicated in the 2022 document. Accordingly, non-tax payment payers only had to fill out reports to Rosprirodnadzor.

How to calculate the amount of environmental tax for 2019

To calculate the amount of environmental tax payable, perform the following calculation:

- Multiply the eco-fee rate by the weight of the product/packaging sold in the Russian Federation for domestic consumption (or by the number of units of the product, depending on the type of product).

- Multiply the resulting number by the recycling standard (in relative units).

To calculate the mass or quantity of goods and packaging, take them into account for the year preceding the reporting period. That is, in the report for 2022, the mass and quantity are taken according to 2022 data. Accordingly, the 2022 report will require 2019 information.

If you carried out recycling, but did not comply with the standard in full, then calculate the difference between the standard and actual volume of recycling for the reporting year. It is this value that must be multiplied by the eco-fee rate.

Environmental fee: calculation of the amount

If recycling standards are not met or not fully met, you need to calculate the amount of the environmental fee and submit the calculation to Rosprirodnadzor before April 15 of the year following the reporting year. The environmental fee refers to non-tax revenues of the federal budget. For packaging, it is paid by the manufacturer of the product in the package, and if the product is not ready for consumption, then the fee is paid only for packaging. Collection rates are established by Decree of the Government of the Russian Federation dated 04/09/2016 N 284 “On establishing collection rates for each group of goods, group of packaging of goods, waste from the use of which is subject to disposal, paid by manufacturers of goods, importers of goods who do not ensure independent disposal of waste from the use of goods (environmental fee).” Rates are set in rubles per ton of waste and are formed for each group of goods and packaging, varying from 2025 rubles / ton of lead batteries (“Group N 38”) to 33,476 rubles / ton for Group N 37 “Primary elements and batteries of primary elements” and Groups N 39 “Rechargeable batteries”

According to Parts 5 and 6 of Article 24.5 of Federal Law No. 7-FZ: 5. The environmental fee rate is based on the average cost of collection, transportation, processing and disposal of a single product or unit of mass of a product that has lost its consumer properties. The environmental fee rate may include the specific cost of creating infrastructure facilities intended for these purposes. Environmental tax rates for each group of goods, group of packaging of goods, waste from the use of which are subject to disposal, are established by the Government of the Russian Federation. 6. The environmental fee is calculated by multiplying the environmental fee rate by the weight of the product or by the number of units of the product (depending on the type of product) or by the weight of the product packaging put into circulation on the territory of the Russian Federation, and by the recycling standard expressed in relative units.

The procedure for collecting environmental fees is established by the Government of the Russian Federation through Resolution No. 1073 dated October 8, 2015 (as amended on August 23, 2018) “On the procedure for collecting environmental fees.” Order of Rosprirodnadzor dated August 22, 2016 N 488 approved the form for calculating the amount of environmental fees. This form includes:

Section 1. General information about the manufacturer, importer of finished goods, including packaging of such goods Section 2. Calculation of the amount of environmental fees

When calculating the fee, an indicator of the number of goods (finished goods/packaging) put into circulation on the territory of the Russian Federation is used, which must be taken from the declaration on the number of finished goods put into circulation on the territory of the Russian Federation for the previous calendar year, including packaging, subject to disposal. The total quantity to be disposed of is included in the calculation in accordance with the specified quantity from the reporting on compliance with waste disposal standards from the use of goods subject to disposal after they have lost their consumer properties. The amount of the environmental fee for finished goods and the amount of the fee for packaging are determined by summing the values for groups of goods, including packaging, subject to disposal. The total amount is determined by summing the amount of the fee for finished goods and the amount of the fee for packaging.

If the product is packaged in packaging produced by a third-party organization, you need to request information about its production and composition at the stage of declaring the quantity of goods in order to find out what proportion of the packaging is recycled materials, which will allow you to use a reduction factor in the calculation.

The following documents are attached to the completed form for calculating the environmental fee: a) copies of payment documents confirming payment of the environmental fee; b) a document confirming the authority of the payer’s representative to carry out actions on behalf of the payer.

Who is the payment administrator?

The payment administrator is Rosprirodnadzor. The amount can be calculated using software or on paper. The date of submission of the calculation of the amount of the environmental fee in electronic form is considered to be the date of its sending via the Internet to Rosprirodnadzor; on paper, the date is considered to be the mark of Rosprirodnadzor on its receipt indicating the date stamped on paper, or the date of mailing. The payment administrator can draw up an act of monitoring the correctness of calculation of the amount of the environmental fee, the completeness and timeliness of its payment when these facts are identified. The act is sent to the payer within 3 days, but the payer can, within 10 days, send to the administrator copies of documents confirming the validity of the calculation, payment of the fee, as well as explanations of the reasons for the discrepancy in the information provided by the payer.

15(3). The control report indicates:

a) facts of errors made when performing calculations and contradictions (inconsistencies) between the information contained in the calculation of the amount of the environmental fee and the information available to the administrator of the environmental fee and (or) received by him in the prescribed manner when declaring goods and packaging of goods, when reporting on standards and when monitoring compliance with established recycling standards, as well as federal state environmental supervision;

b) facts of non-payment, incomplete payment or untimely payment of the environmental fee;

c) the fact of overestimation of the amount of calculated and (or) paid environmental fees;

d) the requirement to submit to the administrator of the environmental fee, within 10 working days from the date of receipt of such a requirement, reasonable explanations regarding the calculation of the amount of the environmental fee, and (or) making corrections to it to eliminate the facts specified in subparagraph “a” of this paragraph, by introducing changes in the calculation of the amount of the environmental fee, which are re-sent to the administrator of the environmental fee, and (or) repayment of debt on the environmental fee if the facts specified in subparagraph “b” of this paragraph are revealed.

If the payer cannot justify the correctness of the calculations, the amount of the fee may be recovered in court. In addition, it is possible to credit the collection amounts to future payments or return the fee upon application after drawing up a report of a joint reconciliation of the calculations of the amount of the environmental fee. The application can be submitted by the payer or his representative to the administrator within 3 years from the date of the last payment (collection) of the environmental fee, attaching the following documents:

a) allowing to determine the payment (collection) of an environmental fee in an amount that exceeds the amount of the environmental fee subject to payment, as well as erroneous payment (collection) of an environmental fee;

b) confirming the authority of the person who signed the application or a certified copy of the specified document;

c) confirming the authority to carry out actions on behalf of the payer, if the application specified in paragraph 19 of these Rules is submitted by a representative of the payer.

In case of non-payment, partial payment of the fee and (or) failure to submit a calculation of the amount of the fee by the payer within the established time frame, the administrator sends the payer a request for voluntary repayment of the debt and submission of a calculation of the amount of the environmental fee, 15 days are allotted for this, after which collection begins in court .

Collection rates

All collection rates for groups of packaging and goods are given in Government Decree No. 284 dated 04/09/2016. For example, if an organization produces handmade carpets or floor coverings, it needs to find group 2 “Carpets and rugs”. The line opposite will reflect the rate of 16,304 rubles per ton. If a company imports barrels or plywood drums, it needs to go down to group 9 “Wooden containers” - here the rate will be 3066 rubles per ton. An importer or manufacturer of anti-corrosion or hydraulic oils should look into group 17 “Petroleum products” - the rate will be equal to 3,431 rubles per ton.

An example of submitting reports and calculating the amount of environmental fees

Malachite and Lapis Lazuli LLC purchased 135 tons of cardboard boxes for packaging its products in 2022, and 158 tons in 2022. We will determine the packaging group that is indicated in the List. For cardboard boxes, this is group No. 51 “Packaging made of paper and non-corrugated cardboard”. In the declaration on the quantity of packaging released into circulation, we will indicate the number of boxes sold in 2022 - 158 tons. In the report on compliance with recycling standards, we use the volume of packaging sold for 2022 - 135 tons. For 2022, the recycling standard for group No. 51 is 15%, which means that it is necessary to dispose of:

135 × 0.15 = 20.25 tons.

If “Malachite and Lapis Lazuli” recycled boxes in the reporting year (2019) or in the year preceding the reporting year (2018), then this report includes information on the number of recycled boxes, and also indicates on the basis of which documents it was produced (contract , act, license).

Let's assume that in 2022 the enterprise recycled 8 tons out of 20.25 (20.25 -8 = 12.25), so it will need to contribute to the budget the amount for 12.25 tons:

12.25 tons × 2,378 rub. = 29,130.5 rub.

What reporting must be submitted by manufacturers and importers of goods?

All reporting that must be submitted to manufacturers and importers of goods:

- Declaration of the quantity of goods produced and packaging. The declaration is submitted annually, before April 1 of the year following the reporting period;

- Reporting on compliance with waste disposal standards for these products and packaging. Reporting is submitted annually, before April 1 of the year following the reporting period;

- In case of non-compliance with the standards, the amount of the environmental fee is calculated and its payment.

The declaration on released goods and packaging is drawn up in accordance with the Regulations on the declaration by manufacturers and importers of goods subject to disposal of the quantity of finished goods released into circulation on the territory of the Russian Federation during the previous calendar year, including packaging, approved by the Decree of the Government of the Russian Federation dated December 24, 2015 N 1417.

If a product is produced in the Russian Federation and exported, it is not indicated in the declaration. Manufacturers of goods include information about goods in the declaration based on primary accounting documents. Importers of goods - on the basis of customs documents. The declaration is filled out for each product name, the quantity is indicated in kilograms. If you registered a legal entity (or individual entrepreneur) during the year, then the declaration is filled out from the date of registration until the end of the year. At the same time, Rosprirodnadzor may request, during the verification of the authenticity of the declaration, certified copies of the documents on the basis of which it was compiled. The declaration is submitted by April of the year following the reporting year.

How to fill out the calculation of the amount of environmental tax in Externa

The calculation includes:

- Title page

- Section 2.1. and Section 2.2

Fill out the title page of the report on the standards in the same way as the title page of the declaration. To fill out the title page:

- Indicate the type of activity of the organization. If the organization is an importer or a manufacturer and an importer at the same time, then the on-load tap-changer body will be filled in automatically.

If the organization is only a manufacturer, indicate the territorial office of the RPN where the report will be sent. Start typing the name or code of the organ and select it from the list that appears.

- Specify the reporting period.

- Fill in the remaining information about the organization and the performer who completed the report. Some of the data is automatically filled in from the details in Externa. If there is an error in some data, correct it not on the title page, but in the details, so that in the future all forms are filled out with the correct data. To do this, in Extern, select the menu item “Details and settings” → “Payer details”.

Section 2.1. and section 2.2

The sections are filled out in the same way, only in section 2.1 the amount of the fee for goods is calculated, and in section 2.2 - for packaging. Below is a detailed description of how to fill out section 2.1:

- Click on the “+ Add Row” link.

- In column 3, select a product in the directory. To do this, start entering the code or name of the product in the search bar and select it from the drop-down list.

- In column 6, indicate the total weight of goods produced or imported during the calendar year preceding the reporting period, in kg (clause 6 of the Rules for collecting environmental fees).

- If waste disposal was carried out, in column 9 indicate how much waste from the use of goods was transferred for disposal. The remaining data (columns 7-8, 10-12) will be filled in automatically.

- Fill in the data for all products/packaging, adding new lines.

The total fee for the goods/packaging is automatically calculated in the summary line.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

General information: environmental fee

Legal entities and individual entrepreneurs producing goods on the territory of Russia and importing goods from third countries or importing goods from EEC member states are required to ensure compliance with the recycling standards established by the Government of the Russian Federation. Manufacturers and importers of goods ensure the disposal of waste from the use of goods themselves by organizing infrastructure for the collection of such goods or by concluding agreements for the disposal of goods with third parties. This standard can be met during the disposal of not only waste generated from a specific product, but also from a group of similar products in accordance with the list of goods.