To effectively manage a retail store, it is necessary to control not only the trade margin (that is, the difference between the sales price and the purchase price), but also the cost of goods sold.

If you focus only on the trade margin, then a situation is possible when expenses (rent, salaries, taxes, etc.) completely “eat up” the trade margin and the business will operate with a negative profit.

What is the cost of goods?

The cost of trade includes all store costs associated with trading activities:

- costs of purchasing goods from the supplier;

- costs of delivery, warehousing and any other costs directly related to the purchase of goods;

- costs of renting premises and utility bills;

- salary costs for all employees;

- taxes, fees and other payments to the budget;

- costs for maintenance and repair of commercial equipment;

- other expenses (fire and security alarms, video surveillance, cleaning, etc.).

The cost price in trade is used when calculating the profit of an enterprise in management accounting, and is also important for tax reporting and affects the amount of taxes. It is at cost that goods sold are written off from the warehouse, and financial reports and indicators depend on how it is calculated. The difficulty of calculating cost in trade is due to the fact that goods are usually delivered in batches and sold individually. In this case, it is quite difficult to understand the exact cost of each item sold. Therefore, there are several legally permitted methods for estimating costs, described below.

Results

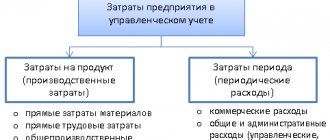

Due to the fact that variable costs change in direct proportion to production volume, and the same costs per unit of finished product usually remain unchanged, when analyzing this type of cost, the value per unit of product is initially taken into account.

In connection with this property, variable costs are the basis for solving many production problems related to planning. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Method 1. Unit cost

Calculating the cost of each unit of goods is a rather rare case in trade. Used to account for unique, piece goods that vary in price. For example, in jewelry stores or when selling cars. You can use this method if you always know from which delivery the goods sold came from. Those. if you have the opportunity to calculate the exact cost for each item that is in stock.

The difficulty of this method (besides the need to calculate the trade margin for each unit of goods) is that you need to divide all expenses across all categories and goods in order to calculate the cost of a specific unit. As a result, this type of calculation of the cost of goods can only be used if there is a developed automation system and is rarely used.

Formula for calculating variable costs/expenses

As a result, you can write a formula for calculating variable costs:

Variable costs = Costs of raw materials + Materials + Electricity + Fuel + Bonus part of salary + Interest on sales to agents;

Variable costs = Marginal (gross) profit – Fixed costs;

The combination of variable and fixed costs and constants constitute the total costs of the enterprise.

Total costs = Fixed costs + Variable costs.

The figure shows the graphical relationship between enterprise costs.

Method 2. Average cost of goods

When goods are delivered in batches, it is difficult to determine from which batch a particular item was sold. But for the average cost method this is not important. It involves calculating the cost using the arithmetic average once a month.

The method is suitable for companies that keep records in notebooks without special automation tools.

To calculate the average cost of goods, the following formulas are used:

Average cost = (cost of balances at the beginning of the month, cost of goods received during the month) / (quantity of goods at the beginning of the month, amount of goods received during the month)

Cost of written-off goods = (average cost) X (quantity of goods sold per month)

An example of calculating the average cost of a product.

Suppose there are 100 items of goods in the warehouse for 20 rubles. Within a month, 2 more batches of the same product arrived: 50 pieces for 18 rubles and 50 pieces for 16 rubles. 160 items sold for 25 rubles (4000 rubles). Let's calculate the cost using the formulas indicated above.

Average cost : (20X100 18X50 16X50)/(100 50 50) = 18.5 (rub.)

Cost of written-off goods : 160X18.5 = 2960 (rub.)

Profit : 4000 - 2960 = 1040 (rub)

A fairly simple calculation method, but not always profitable from a tax accounting point of view. For example, when the cost of the goods you purchase decreases, the average cost turns out to be lower than when calculating using the FIFO method, which means you will have to pay a higher income tax.

Fixed costs and the break-even point of the enterprise

Variable costs are part of the break-even point model. As we determined earlier, fixed costs do not depend on the volume of production/sales, and with an increase in output, the enterprise will reach a state where the profit from products sold will cover variable and fixed costs. This state is called the break-even point or the critical point when the enterprise reaches self-sufficiency. This point is calculated in order to predict and analyze the following indicators:

- at what critical volume of production and sales will the enterprise be competitive and profitable;

- what volume of sales must be made in order to create a zone of financial security for the enterprise;

Marginal profit (income) at the break-even point coincides with the enterprise's fixed costs. Domestic economists often use the term gross income instead of marginal profit. The more the marginal profit covers fixed costs, the higher the profitability of the enterprise. You can study the break-even point in more detail in the article “Break-even point. Graphs and example of model calculation in Excel. Advantages and disadvantages".

Take our proprietary course on choosing stocks on the stock market → training course

Method 3. Calculation of the cost of goods using the FIFO method (FIFO)

FIFO is a method of calculating costs in retail trade, requiring the use of automated sales and warehouse accounting systems. FIFO stands for “first in, first out”. Goods from the warehouse are written off in order of priority: first at the cost of the first delivery (previous), then at the cost of the next, etc. That is, the cost is calculated taking into account the cost of a unit of goods in each specific batch.

Example of cost calculation using the FIFO method.

There are 100 items in the warehouse for 20 rubles, and in a month there were 2 deliveries: 50 pieces for 18 rubles and 50 pieces for 16 rubles.

Sold: 160 items for 25 rubles.

First of all, 100 positions are written off at 20 rubles (2000 rubles), then 50 at 18 rubles (900 rubles) and another 10 at 16 rubles (160 rubles).

Profit : 160X25 - (2000 900 160) = 940 rub.

The profit indicator in this case is lower than when calculating using the average cost. Those. income taxes will be lower. Most often, this method of estimating cost when writing off goods from a warehouse is most beneficial for the entrepreneur.

An organization or individual entrepreneur independently chooses a method for estimating costs and, according to Article 313 of the Tax Code of the Russian Federation, informs the tax authorities about this once a year.

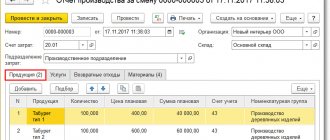

Accounting for finished products at actual cost

In accordance with PBU 5/01, finished products of a production organization are inventories intended for sale. Clause 5 of PBU 5/01 establishes that inventories are accepted for accounting at actual cost. If an organization independently produces inventories, then the actual cost is calculated based on all actual costs associated with their production (clause 7 of PBU 5/01). The organization carries out accounting and formation of production costs in the manner established for determining the cost of relevant types of products. Thus, the actual cost of finished products is a valuation of the natural resources, raw materials, materials, fuel, energy, fixed assets, labor resources, and so on used in the process of its production.

In accounting, finished products can be accounted for both at actual production costs and at standard (planned) costs. Depending on the method chosen by the production organization, the order in which finished products are reflected in the accounting accounts depends.

If the manufacturing organization decides to account for finished products at actual cost, then in this case, accounting for finished products will be carried out only using account 43 “Finished products”.

When accounting for finished products at actual cost, the receipt of the latter into the warehouse is reflected by the following posting:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 43 | 20 | Finished products accepted for accounting |

Despite the fact that it is easier to reflect finished products at actual cost in accounting (one account is used), organizations do not often use this method. The actual cost of manufactured products can be formed only at the end of the reporting month, when all costs of production, both direct and indirect, have been determined. Therefore, when using this method, it is almost impossible to determine the cost of products as they are produced and transferred to the warehouse, which creates additional inconvenience if products manufactured within a month are sold in the same period. With this method of accounting, the cost at which products of the same type, manufactured at different times, are accepted for accounting may be different. Therefore, when selling or otherwise disposing of finished products, they must be written off in one of the following ways:

- at unit cost;

- at average cost;

- using the FIFO method;

- using the LIFO method.

The transfer of finished products to the organization's warehouse is documented with acceptance documents (invoices).

Please note that documents reflecting the release and delivery of finished products are issued in duplicate, usually under the same number. They indicate the workshop that produced the product and the number of the warehouse that accepted it; in addition, the name of the finished product, the number of products transferred to the warehouse, the discount price and the total amount must be indicated. One copy of the document remains in the production workshop and is used for operational accounting, the second is transferred to the finished product warehouse and serves as the basis for maintaining warehouse and accounting records. For each batch of products delivered, an entry is made in both copies of the acceptance documents. After the completion of delivery of all products, in both copies of the acceptance documents for each name, grade and type of product, the quantity or weight is counted and recorded in numbers and in words. Data on the products being handed over is confirmed by the signature of the receiver in the deliverer’s copy and vice versa, by the signature of the deliverer in the receiver’s copy. Note!

Acceptance documents must be accompanied by a conclusion from a laboratory or technical control department on the quality of manufactured products.

Accounting for finished products at standard (planned) cost.

Production organizations in the food industry, as a rule, use the standard method of accounting for finished products, since it is its use that allows the revenue from the sale of products and its actual cost (which is determined only at the end of the month) to be correctly reflected in accounting.

If accounting for finished products is carried out at standard (planned) production costs, then the organization establishes accounting prices for products that remain constant for quite a long time and at which, within a month, products are accepted into the warehouse and written off from the warehouse when they are sold or otherwise disposed of. . At the end of the month, when all costs have been generated and the amount of work in progress has been determined, the difference between the planned and actual costs is determined. You can keep records of these deviations in two ways - with and without the use of account 40 “Output of products (works, services)”.

If account 40 “Release of products (works, services)” is not used, then when finished products arrive at the warehouse within a month, the following posting is made:

Debit 43 “Finished products” Credit 20 “Main production”

– finished products arrived at the warehouse at planned prices.

When selling products within a month, writing off their cost is reflected by posting:

Debit 90 “Sales” subaccount “Cost of sales” Credit 43 “Finished products”

– the cost of finished products in planned accounting prices is written off.

At the end of the month, the actual cost of production is determined, and the amount of deviations of the actual cost from the planned cost is reflected in the same accounts. Namely, additional postings if the actual cost exceeds the planned one, or reversal entries if the actual cost is less than the planned one. In this case, an adjustment is made to the cost of products accepted for accounting - for the entire amount of the deviation and the cost of products sold - in the share attributable to products sold.

Example 1.

Within a month, finished products were accepted into the warehouse of the Solnechny LLC meat processing plant, the planned cost of which was 750,000 rubles. The cost of products sold at planned prices amounted to 500,000 rubles. The total amount of costs recorded in the debit of account 20 “Main production” during the month is 900,000 rubles.

a) Suppose that the balance of work in progress at the end of the month is 180,000 rubles.

Then the actual cost of the finished product: 900,000 rubles – 180,000 rubles = 720,000 rubles.

The amount of deviation of the actual cost from the planned cost is 750,000 rubles – 720,000 rubles = 30,000 rubles.

The actual cost is less than the planned cost, so the amount of savings must be reversed.

The amount of deviation attributable to sold products: (30,000 rubles / 750,000 rubles) x 500,000 rubles = 20,000 rubles.

The amount of deviation attributable to the balance of finished products in the warehouse: (30,000 rubles / 750,000 rubles) x 250,000 rubles = 10,000 rubles.

Actual cost of products sold: 500,000 rubles – 20,000 rubles = 480,000 rubles.

Balance of finished products in the warehouse (at actual cost): 720,000 – 480,000 = 240,000 rubles.

In the accounting of Solnechny LLC, these transactions are reflected as follows:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| Within a month | |||

| 43 | 20 | 750 000 | Finished products were accepted into the warehouse at planned prices |

| 90-2 | 43 | 500 000 | The cost of products sold was written off at planned accounting prices. |

| In the end of the month | |||

| 20 | 02, 10, 70, 69, 25, 26 | 900 000 | Production costs taken into account |

| 43 | 20 | 30 000 | REVERSE! The amount of deviation of the actual cost from the planned cost is taken into account |

| 90-2 | 43 | 20 000 | REVERSE! The amount of deviation of the actual cost from the planned cost in the share of products sold is taken into account |

b) Suppose that the balance of work in progress at the end of the month is 120,000 rubles.

Then, the actual cost of finished products: 900,000 rubles – 120,000 rubles = 780,000 rubles.

The amount of deviation of the actual cost from the planned cost is: 780,000 rubles – 750,000 rubles = 30,000 rubles.

The actual cost is higher than the planned cost, so additional entries need to be made for the amount of overrun.

The amount of deviation attributable to sold products: (30,000 rubles / 750,000 rubles) x 500,000 rubles = 20,000 rubles.

The amount of deviation attributable to the balance of finished products in the warehouse: (30,000 rubles / 750,000 rubles) x 2,500,000 = 10,000 rubles.

Actual cost of products sold: 500,000 rubles + 20,000 rubles = 520,000 rubles.

Balance of finished products in the warehouse (at actual cost): 780,000 rubles – 520,000 rubles = 260,000 rubles.

In the accounting of Solnechny LLC, these transactions are reflected as follows:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| Within a month | |||

| 43 | 20 | 750 000 | Finished products were accepted into the warehouse at planned prices |

| 90-2 | 43 | 500 000 | The cost of products sold was written off at planned accounting prices. |

| In the end of the month | |||

| 20 | 02, 10, 70, 69, 25, 26 | 900 000 | Production costs taken into account |

| 43 | 20 | 30 000 | The amount of deviation of the actual cost from the planned cost is taken into account |

| 90-2 | 43 | 20 000 | The amount of deviation of the actual cost from the planned cost in the share of products sold is taken into account |

End of the example.

Note!

This method is a simplified version of calculating deviations, since in this case there was no balance of finished products in the warehouse at the beginning of the month.

In cases where there are balances of finished products at the beginning and end of the month, for the correct reflection and distribution of deviations, it is advisable to use the calculation method, the principle of which is specified in paragraph 206 of Guidelines No. 119n:

“If accounting for finished products is carried out at standard cost or at contract prices, then the difference between the actual cost and the cost of finished products at accounting prices is taken into account in the “Finished Products” account under a separate subaccount “Deviations of the actual cost of finished products from the accounting cost.” Deviations in this subaccount are taken into account by product range, either by individual groups of finished products, or by the organization as a whole. The excess of the actual cost over the accounting value is reflected in the debit of the specified subaccount and the credit of the cost accounting accounts. If the actual cost is lower than the book value, then the difference is reflected in a reversal entry.

Write-off of finished products (during shipment, issue, etc.) can be carried out at book value. At the same time, deviations related to finished products sold are written off to sales accounts (determined in proportion to their accounting value). Deviations related to the balances of finished products remain in the “Finished Products” account (sub-account “Deviations of the actual cost of finished products from the book value”).

Regardless of the method used to determine accounting prices, the total cost of finished goods (accounting cost plus variances) must equal the actual production cost of those products.”

Example 2.

The balance of finished products in the warehouse of the Solnechny LLC meat processing plant at the beginning of the month is 240,000 rubles at planned prices, the amount of deviations is 5,000 rubles (overexpenditure). Within a month, finished products arrived at the warehouse at planned prices in the amount of 750,000 rubles. The amount of costs for the production of finished products, recorded on account 20 “Main production”, amounted to 900,000 rubles, the balance of work in progress – 120,000 rubles. The planned cost of products sold is 500,000 rubles.

Actual cost of finished products: 900,000 rubles – 120,000 rubles = 780,000 rubles.

The amount of deviations for finished products transferred to the warehouse: 780,000 rubles – 750,000 rubles = 30,000 rubles.

Percentage of deviations for shipped products:

(5,000 rubles + 30,000 rubles) / (240,000 rubles + 750,000 rubles) x 100% = 3.54%.

The amount of deviations attributable to shipped products: 500,000 rubles x 3.54% = 17,700 rubles.

Actual cost of shipped products: 500,000 + 17,700 = 517,700 rubles.

Balance of finished products at the end of the month at actual cost:

(240,000 + 5,000) + (750,000 + 30,000) – (500,000 + 17,700) = 507,300 rubles, including:

planned cost: 240,000 + 750,000 – 500,000 = 490,000 rubles;

amount of deviations: 5,000 + 30,000 – 17,700 = 17,300 rubles.

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 43 | 20 | 750 000 | Finished products were accepted into the warehouse at planned cost |

| 43 | 20 | 30 000 | The deviation of the actual cost from the planned cost for finished products accepted for accounting is reflected |

| 90-2 | 43 | 500 000 | The planned cost of shipped products was written off |

| 90-2 | 43 | 17 700 | The deviation of the actual cost from the planned cost for products sold was written off |

End of the example.

We examined the accounting of finished products at standard (planned cost) without using account 40 “Output of products (works, services)”.

For convenience and clarity of identifying deviations of the actual cost from the planned cost, the organization can use account 40 “Output of products (works, services)”.

In this case, the debit of account 40 “Output of products (works, services)” takes into account the actual production cost of products in correspondence with the production cost accounts, and the credit of account 40 “Output of products (works, services)” reflects the planned cost of finished products, which written off to the debit of account 43 “Finished products”. At the end of the month, when the actual cost of production is fully formed, by comparing the debit and credit turnover of account 40 “Output of products (works, services)” the amount of deviations of the actual cost from the planned one is determined. The chart of accounts provides for the following procedure for writing off deviation amounts.

If the credit turnover on account 40 “Output of products (works, services)” is greater than the debit turnover, that is, the actual cost is less than the planned cost and savings are identified, then an accounting entry is made for the amount of the deviation using the “red reversal” method:

Debit 90 “Sales” subaccount “Cost of sales” Credit 40 “Output of products (works, services)”.

If the debit turnover in account 40 “Output of products (works, services)” is greater than the credit one, that is, the actual cost exceeds the planned cost (overexpenditure), the usual accounting entry is made for the amount of the deviation:

Debit 90 “Sales” subaccount “Cost of sales” Credit 40 “Output of products (works, services)”.

Thus, account 40 “Output of products (works, services)” is closed monthly and there is no balance on this account.

Note!

The amounts of deviations are written off to account 90 “Sales” in full, regardless of the volume of product sales and thus increase or decrease the cost of products sold in the reporting period.

The balance of finished products in the warehouse in this case is taken into account at the planned cost.

Example 3.

The balance of finished products in the warehouse of the Solnechny LLC meat processing plant at the beginning of the month is 240,000 rubles at planned prices. Within a month, finished products arrived at the warehouse at planned prices in the amount of 750,000 rubles. The amount of costs for the production of finished products, recorded on account 20 “Main production”, amounted to 900,000 rubles, the balance of work in progress – 120,000 rubles. The planned cost of products sold is 500,000 rubles.

| Account correspondence | Sum, rubles | Contents of operation | |

| Debit | Credit | ||

| 20 | 10, 70, 69, 25, 26 | 900 000 | Costs of the current period are reflected |

| 40 | 20 | 780 000 | The actual production cost of the finished product is reflected (900,000 rubles – 120,000 rubles) |

| 43 | 40 | 750 000 | Finished products were accepted for accounting at planned accounting prices |

| 90-2 | 43 | 500 000 | Planned cost of goods sold is written off |

| 90-2 | 40 | 30 000 | Included in the cost of products sold (780,000 rubles – 750,000 rubles) is the amount of the identified deviation (overspend) |

The balance of finished products in the warehouse of Solnechny LLC at planned prices:

240,000 rubles + 750,000 rubles – 500,000 rubles = 490,000 rubles.

End of the example.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

How to calculate the cost of a product?

With a small number of goods and a small number of batches, you can use method 2 (average cost). But in reality, manually calculating the cost of goods in Excel with an assortment of hundreds/thousands of items is almost impossible.

It may seem that it is impossible to calculate the cost of goods without purchasing an accounting system and hiring programmers. However, this task is easily solved with the help of simple and modern systems.

You can do everything yourself in 1 day and start analyzing data without spending a penny. Connect your existing online cash register to SUBTOTAL to control sales, returns, markups, average check and other indicators critical for retail trade on the screen of a smartphone or laptop!

Fixed costs. Definition

Fixed costs (English: Fixed cost, FC, TFC or total fixed cost, analogous to fixed costs, fixed costs) are a class of enterprise costs that are not related (do not depend) on the volume of production and sales. At each moment of time they are constant, regardless of the nature of the activity. Fixed costs, together with variables, which are the opposite of constant, constitute the total costs of the enterprise.

Take our proprietary course on choosing stocks on the stock market → training course

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |