What is reserve capital

This is one of the components of the organization's own funds. To create it, the company makes contributions to it every year. Funds for this are taken from retained earnings and contributions from members of the organization.

The method of creation depends on the legal form. JSCs are required to create reserve capital, and only from profits, but LLCs have no such obligation at all: they are formed at their own request and from almost any sources (clause 1, article 35 of the Federal Law of December 26, 1995 No. 208-FZ, clause 1 of Art. 30 Federal Law dated 02/08/1998 No. 14-FZ).

JSCs indicate in the regulations the minimum amount of the reserve, the amount of deductions, rules of use and sources of formation. The company prescribes the rules in its charter, taking into account the requirements of the law. For example, the joint-stock company itself determines the size of the fund and the amount of investments, but there is a rule of 5%. 5% or more of net profit is allocated to the reserve, and the reserve itself must be at least 5% of the authorized capital.

Legal basis for the formation and use of reserve capital

In accordance with paragraph 1 of Art. 35 of the Law on JSC, joint-stock companies are required to create a reserve fund in the amount provided for by the company’s charter, but not less than 5% of its authorized capital.

The reserve fund of a joint-stock company is formed through mandatory annual contributions until it reaches the size determined by the charter of the joint-stock company. The amount of annual contributions is provided for by the charter of the joint-stock company, but cannot be less than 5% of net profit until the amount determined by the charter of the joint-stock company is reached. The reserve fund of the joint-stock company is intended to cover the losses of the company, as well as to repay the bonds of the joint-stock company and repurchase the shares of the joint-stock company in the absence of other funds. The reserve fund cannot be used for other purposes.

Article 30 of the LLC Law provides that the company may create a reserve fund and other funds in the manner and in the amounts determined by the company's charter. Since Art. 30 of the LLC Law does not establish the target nature of the reserve capital; the LLC remains guided by clause 69 of the Regulations on accounting and financial reporting in the Russian Federation . Despite the fact that this paragraph focuses on the procedure for dividing reserve capital into subaccounts, it provides an exhaustive list of areas for spending the reserve. In relation to an LLC, reserve capital can be used:

- to cover losses;

- to pay off bonds;

- to buy out shares.

Thus, reserve capital is created in JSCs and LLCs, and JSCs do this on a mandatory basis, and LLCs do it on a voluntary basis.

How can you use your emergency fund?

Organizations with a reserve obligation are usually limited in how they can use it. The law sets out certain goals, for example:

- for JSC - covering losses, repurchasing its shares;

- for unitary enterprises - only compensation for losses;

- credit cooperative - compensation for losses and unexpected expenses.

Organizations that form it according to their wishes decide for themselves what it can be spent on and prescribe the options in the charter. This applies to LLCs, HOAs, etc.

The reserve fund must be replenished until it reaches the size prescribed in the charter. Then you don’t have to make any contributions. But if the organization spends part of the reserve and it again falls below the required level, it will have to be replenished again until enough funds accumulate there.

Reserve Fund LLC

The Law on Limited Liability Companies (No. 14-FZ) provides for the independent decision-making by the founders of the organization on the need to form a reserve fund. There is no minimum threshold for the amount of reserve capital. The only mandatory condition is to record the decision on the size of the fund in the statutory documentation.

The source of financing when replenishing the reserve fund, as in the case of a joint-stock company, is the deduction of part of the profit. The amount of contributions is set by the founders at their discretion.

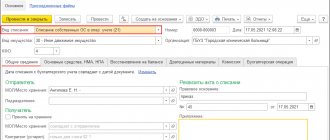

Accounting for reserve capital

To account for it, the accounting department has a special account - 82. It is passive, so the creation of the reserve is reflected as a loan, and its use as a debit. The account that will stand next to it depends on how the capital was formed and what it was spent on. The same goes for supporting documents.

Postings for the formation of reserve capital

At the expense of net profit , it is recorded by posting Dt 84 (99) Kt 82. The basis document is an accounting certificate calculating the amount of deductions to the reserve fund. The posting is generated in the year in which the profit was made. No additional decisions from the meeting of participants or shareholders are required for this.

Example of formation from net profit

Epic JSC stated in its charter that its reserve fund should be 8% of the authorized capital, and annual contributions should be 5% of net profit. The authorized capital is 200,000 rubles; now Epic already has 10,000 rubles in its reserve fund.

At the end of 2022, Epic’s net profit amounted to 500,000 rubles. It turns out that 25,000 rubles (500,000 × 5%) must be transferred to the fund. But since the fund already has 10,000 rubles, and only 6,000 rubles are missing from the minimum amount, it will be enough to transfer only this amount.

Then the following entry will be made in accounting:

Dt 84 Kt 82 - 6,000 rubles - part of the undistributed net profit was transferred to the formation of the reserve fund.

Due to contributions from members (shareholders) it is reflected in the following entries:

- Dt 76 Kt 86 - reflect the debt of members for contributions to the fund;

- Dt 51 (50, 55) Kt 76 - show the receipt of contributions;

- Dt 86 Kt 82 - we send contributions to the reserve fund.

To confirm the postings, you will need documents with the calculation of outstanding contributions and documents for the transfer of funds (payment orders, bank statements, receipts).

Entries for using reserve capital

The repayment of the loss of the reporting year is documented by posting Dt 82 Kt 84. The accounting entry is prepared as of the date of the decision to use part of the reserve to cover losses. To confirm the operation, you will need this decision and an accounting certificate with the calculation. Such coverage is considered an event after the reporting date, therefore, in the explanations to the annual report for the loss-making year it will be necessary to reflect this decision and the amount allocated to cover the loss.

The repurchase of own shares and the redemption of bonds is formalized by posting Dt 82 Kt 66, 67. This is possible if there are not enough other sources of own funds for this.

Coverage of unforeseen expenses is reflected in the debit of account 82 in correspondence with the expense account. These may be the costs of main production (account 20), general production costs (account 26), general business expenses (account 26), sales costs (account 44), costs for the purchase of materials from suppliers (account 60) and others.

Unforeseen expenses are considered to be expenses that the organization could not have foreseen. For example, an industrial accident, theft of property, a large fine, etc.

The operation must be confirmed by a decision of the general meeting. Additionally, you may need an accounting certificate.

Postings to reduce reserve capital

It happens that an organization immediately prescribes in its constituent documents the size of the reserve fund, which is much greater than the minimum required by law. In such cases, you can reconsider your decision and reduce the minimum.

In this case, the dissolved part of the reserve capital is returned to retained earnings. The wiring for such an operation is Dt 82 Kt 84.

In which account is reserve capital accounted for in accounting?

In accounting] reserve capital [/anchor] (abbreviated as RK) is accounted for in account 82. It is used to reflect and summarize any information characterizing the state and dynamics of reserve funds at a particular enterprise.

As a rule, the reserve fund is formed from the disposable net profit received by the organization at the end of the year. This profit is taken into account in the company’s accounting under account 84, called “Retained earnings (uncovered loss).”

Thus, funds that are allocated to reserve capital from the firm’s retained earnings are displayed under credit 82 in correspondence with debit 84 - posting Dt 84 Kt 82.

If the fund is replenished by depositing appropriate funds from participants (shareholders) of the organization, then this operation is recorded under credit 82 in strict correspondence with debit 75 “Settlements with founders” - posting Dt 75 Kt 82.

As for the use (expenditure) of reserve funds by the company for its intended purpose, these transactions are subject to accounting under debit 82 in clear correspondence with the credit of the following accounts:

- 84 - if funds are sent by the enterprise to cover its losses received as a result of a specific reporting year - posting Dt 82 Kt 84.

- 66, called “Settlements for short-term credits/loans”, or 67, which is called “Settlements for long-term credits/loans”. These accounts correspond with debit 82, if RK funds are used by the company to repay issued bonds (own debt securities) - posting Dt 82 Kt 66, 67.

Count 82 - active or passive?

Account 82, used in accounting to reflect all operations related to the creation, replenishment and expenditure of reserve capital, is passive.

This is explained by the fact that the reserve capital itself is a liability, while the formation and subsequent replenishment of the reserve fund are displayed in accounting under credit 82, and the intended use (expense) is shown under debit 82.

Reflection of an increase in loan liability and a decrease in its debit is typical for passive accounts.

Which line of the balance sheet does it include?

The balance of account 82 - both initial and final - is recorded in the liabilities side of the organization's balance sheet on line code 1360. Moreover, this balance is a credit balance.

Joint-stock companies (JSC) are required to create reserve capital, which is taken into account in the balance sheet on line 1360 (credit balance) and amounts to at least 5% of the authorized capital. For a JSC, the amount of annual replenishment of the Republic of Kazakhstan cannot be less than 5% of the net profit earned by the legal entity for the corresponding year.

As for LLCs, these organizations voluntarily form this capital, prescribing the procedure for its creation and expenditure in the charter.

Taxation

The formation of a reserve fund does not affect taxes in any of the taxation systems. When it is formed at the expense of net profit, no expenses are generated that could be taken into account for taxation. And if contributions are made by shareholders or members, then they are considered targeted income and are not taken into account in income.

Using the reserve fund to cover losses, buy back shares, or use it for unplanned expenses will also not affect taxes. In this case, the operations themselves will be taken into account.

Reserve capital in financial statements

It is shown in the balance sheet and statement of changes in equity.

In the balance sheet, this is line 1360 of the same name in Section III “Capital and Reserves”. The balance of account 82 must be entered into it.

In the report on changes in capital, this is line 3340. Here you need to show how the reserve capital changes due to other components of capital (that is, without changing the total amount). For example, the report for 2022 may include:

- directing part of the 2022 profits to the reserve fund;

- allocation of the reserve fund to cover losses in 2020.

Keep records of reserve capital in the Kontur.Accounting web service. It will help to reflect operations on the formation and use of the reserve fund and, based on the results of the reporting period, to automatically draw up a balance sheet and a statement of changes in capital. And in the Accounting Department you can submit reports via the Internet and conduct settlements with employees

Synthetic and analytical accounting of reserve capital

For synthetic accounting of reserve capital, passive account 82 “Reserve capital” is provided.

The credit of this account reflects the formation of reserve capital, and the debit reflects its use.

Thus, the formation of reserve capital at the expense of the enterprise’s profit is accompanied by the posting: D-t 84 K-t 82

If the reserve capital is subsequently used to cover losses, an entry is generated: D-t 82 K-t84

If the reserve capital is formed from contributions from the founders (shareholders), then the following entry is generated: D-t 75 K-t 82

The debt of the founders as it is repaid is accompanied by the entry: D-t 50(51) K-t 75

Interest on bonds can also be accrued from the reserve capital. In this case, the following entry is generated in accounting: D-t 82 K-t 66.67

When repurchasing own shares at the expense of reserve capital, the difference between the repurchase price and the par value of the canceled shares is reflected and the entry is generated: D-t 82 K-t 81