Why is UTII form 3 submitted?

An application in Form UTII 3 is submitted if an organization ceases business activities in this special regime or switches to another regime (on its own initiative or involuntarily, due to violations).

The application is necessary for the tax authority to remove the company from the register of impostors.

However, the functions of the form are not limited to this. The organization also has the right to notify the tax authority about changes that have occurred in the types of activities used and the places where it carries out these types of activities. The UTII form 3 is also used for this .

Purpose of this form

An application in the form specified above is mandatory specifically for organizations. They serve it on different occasions which include:

- Termination of activities that are subject to UTII.

- Changing the type of activity itself, even if the new one is still subject to UTII.

- Changing the addresses at which the organization reproduces its activities.

- Desire to switch to a new tax regime.

- Desire to return to the old tax regime.

Regardless of the reason, the tax authority must remove this organization from the register of UTII payers. This is what this document is for.

Separately, it is worth noting the changes within the organization itself. If she has changed the nature of her occupation, if she has changed the addresses at which she provides services, then it is the organization’s responsibility to notify the tax authority about these changes.

Even in the case when the company’s activities go beyond the scope of the subject to “imputation,” that is, the organization loses the right to this special. regime, her responsibilities still remain the independent submission of documents in order to deregister the organization as a UTII payer.

Where and when should the UTII-3 form be submitted?

for filing an UTII 3 : the document must be submitted to the tax office within 5 days from the moment business activity is terminated or a transition to a different tax regime is made. If the activity is terminated as a result of violations, then the 5-day period is calculated from the last day of the month of the tax period in which the violations occurred.

The application must indicate the day on which the activity ceased; this date will be considered, in accordance with paragraph 3 of Art. 346.28 of the Tax Code of the Russian Federation, the date of deregistration.

More information about the conditions for deregistration of UTII can be found in the material “Deregistration of UTII in 2014–2015: conditions and terms.”

Types of application for termination of UTII

There are 2 forms of statements designed to notify about the completion of UTII. Their use depends on the type of business entity that supplies them. Legal entities, notifying the Federal Tax Service, use the UTII-3 application. Individuals and individual entrepreneurs use the UTII-4 document. Both of these forms were approved by order of the Federal Tax Service of the Russian Federation dated December 11, 2012 No. ММВ-7-6/ [email protected] and are valid to this day.

UTII-3 and UTII-4 forms are available for download on our website.

The applications indicate the taxpayer's information:

- Name;

- OGRN;

- TIN;

- the reason for the termination of activities on UTII;

- date of its completion;

- manager's signature.

Electronic application format is also available.

The date of termination of activity becomes the date specified in the application. Please indicate the date depending on the situation:

- if they stopped engaging in an assigned activity (for example, when closing a store) - the date of termination of this activity (date of store closure);

- if you want to switch from UTII to the simplified tax system or OSNO - January 1 of the year from which you switch to another taxation regime;

- if you violated UTII restrictions, for example, exceeded the number of employees, put dashes in the “Date of termination of application…” column.

Regardless of the reason for deregistration, the Federal Tax Service, after receiving your application, will send you a notice of deregistration. Submit your application within 5 days from the date of termination of the imputed activity. Late submission of a document means deregistration of the entity on the last day of the month in which the application was submitted (clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

For examples of filling out applications, see the materials:

- “UTII Form 3: application for deregistration of an organization”;

- “UTII Form 4: application for deregistration of individual entrepreneurs.”

Notes contained in the UTII-3 form

- You should indicate the checkpoint that was assigned by the tax authority where the organization registered as a UTII payer. In this case, this indicator has the value 780401001.

- Form UTII 3 should indicate the date on which the termination of activities occurred or the transition to another tax regime was made.

- If Form 3 UTII is submitted by a representative of the organization, then copies of a document should be attached to the application, on the basis of which you can verify the authority of the representative.

Title page

The title page of the application is filled out by the taxpayer, except for the sections “To be completed by an employee of the tax authority” and “Information on deregistration .

“TIN” and “KPP” lines are filled in automatically from the client’s registration card in the “SBIS” system.

The “KPP” field indicates the KPP assigned to the organization by the tax authority due to its registration as a UTII taxpayer (the values of 5 and 6 characters in the KPP can only be “35” or “77”).

“tax authority code” field indicates the code of the tax authority to which the application is being submitted.

In the field “I request, in accordance with paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation, to deregister the organization in connection with” the reason for deregistration is indicated:

“1” - if the organization ceases the imputed activity as a whole;

“2” - in connection with the transition to another taxation system;

“3” - if the organization violated the terms of application of UTII;

“4” - if the organization closes a separate type of activity for which UTII was applied.

In a separate field, “1” is indicated if the application is submitted by a Russian organization and “2” if it is submitted by a foreign organization.

When filling out the line “name of organization,” the name of the organization corresponding to the one specified in the constituent documents is reflected. By default, this detail is filled in automatically in the program in accordance with the name specified in the taxpayer’s registration card.

“OGRN” field indicates the main state registration number of the organization, which can be found in the certificate of state registration of the legal entity.

“OGRN” field is filled in only by Russian organizations.

In the field “Date of termination of application of the taxation system in the form of a single tax on imputed income for certain types of activities,” the date of termination of the organization’s application of the taxation system in the form of UTII is entered.

The date of termination of the use of UTII is not filled in if the organization indicated code “3” as the reason for deregistration.

In the field “Annex to the application is compiled on ___ pages” the number of pages of the attachment to the form of this application is automatically indicated.

When filling out the indicator “with a copy of the document on ___ sheets”, the number of sheets of a copy of the power of attorney confirming the authority of the organization’s representative is reflected (if the application is submitted by a representative of the organization).

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

“3” - if the application is submitted by the head of the organization,

“4” - if the document is submitted by a representative of the organization. In this case, the name of the document confirming the authority of the representative is indicated and a copy of the specified document is attached.

In the field “last name, first name, patronymic in full” the full name of the head or other representative of the organization is indicated.

In the “TIN” , the TIN of the head or other representative of the organization is indicated.

When filling out the “Contact telephone number” , indicate the telephone number at which you can contact the taxpayer.

Also on the title page, in the “I confirm the accuracy and completeness of the information” , the date is automatically indicated.

What information does the appendix to the UTII-3 form contain?

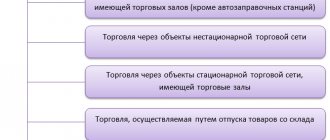

UTII form , an organization has the right to notify the tax authority not only of the termination of all activities on UTII, but also of the termination of one of the types of activities with this special regime, as well as of a change of address for such activities. In this case, you will have to use the attachment to the UTII form 3 .

The appendix contains information about the types of activities that are carried out by the taxpayer within the framework of UTII, and the places where these activities are carried out. There is space on one sheet to notify of 3 types, but an unlimited number can be added if necessary.

Completing Page 2

The page must be completed if the organization deregisters a certain type of activity, which will need to be indicated along with the address. If there are more than 3, then additional sheets are filled out for the application.

In the activity code field, indicate the code in accordance with Appendix 5 to the filling procedure.

Next, postal code, region code (Appendix 6) and then indicate the address at which the activity was carried out, as in the example. All fields must be filled with dashes to the end of the fields.

UTII-3 - download and then submit

Despite the simplicity of filling out the UTII application form 3 , it has its own characteristics that should be taken into account when submitting it. For this reason, in practice, taxpayers first look for where there is a form available for completion and current in 2016 . Form 3 UTII, which can be downloaded for free on our website without forced registration, and only then fill it out and submit it to the tax authorities.

To learn about what other responsibilities a taxpayer has after being deregistered as a UTII payer, read the material “Deregistered as a UTII payer?

Don’t forget to submit your declaration.” You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadline for submitting the declaration and paying tax for the 2nd quarter.

Organizations and individual entrepreneurs who are payers of the Unified Tax on Imputed Income must submit quarterly reports to the tax office by the 20th day of the month following the reporting quarter. Therefore, the deadline for submitting the UTII declaration for the fourth quarter of the current quarter is January 20, 2022.

If a declaration is submitted later than this period, the Federal Tax Service may impose a fine of 5% of the UTII amount that must be paid for the Ⅳ quarter, but not less than 1 thousand rubles. and no more than 30% of the amount of tax payable. The fine is calculated for each month of delay, including incomplete (Article 119 of the Tax Code of the Russian Federation).

The tax must be transferred to the budget no later than the 25th day of the month following the reporting period. For the Ⅳ quarter of 2022, the deadline for paying UTII is until January 25. 2022 inclusive.

Sample filling

The application is very easy to fill out. It consists of two sheets - the first sheet is the application itself, and the second sheet is the Appendix to the application.

Details of the first sheet of UTII-3:

- Details of the legal entity submitting the application - KPP, INN, OGRN, name of the legal entity;

- Which tax office is the application submitted to? - Federal Tax Service code;

- Form filing basis:

- if the company has switched to another taxation regime;

- if you have ceased to carry out this type of economic activity;

- if the company violated the requirements of the Tax Code regarding which company can be the payer of the “imputation”.

- The date when the company ceased to conduct this activity;

- Contact details and details of the person who filled out the form.

The second sheet contains data on types of activities that are deregistered as activities subject to UTII. That is, this is the code of the type of activity and the address of its implementation (city, street, zip code, house and apartment or office number.

| UTII form-3 | |

| UTII-3 form in .tif format | UTII-3 form in pdf format |

We recommend downloading the form in pdf format, because in this format you can fill it out directly on your computer and then print it out, sign it, stamp it and take it to the tax office.

Important! The date when a legal entity is deregistered with the tax office as a payer of “imputation” is considered to be the date indicated in UTII-3 as the date of termination of activities under UTII,

General information ↑

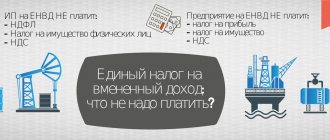

The regime called UTII is a reporting form in which the taxpayer transfers only one tax.

UTII replaces the following fees in favor of the state budget:

| For individual entrepreneurs | personal income tax; Property tax for individuals; UST |

| For legal entities, commercial organizations | Income tax; Property tax; UST. |

Basic elements of taxation

Everything related to objects taxed under UTII is indicated in the corresponding section of the Tax Code of the Russian Federation (Article No. 346.29 of the Tax Code of the Russian Federation).

The main provisions of this article:

- the tax base is the imputed income received by the organization/entrepreneur during the reporting period;

- object of taxation is imputed income.

According to this article, imputed income is defined as the product of the basic profitability value and the actual physical indicator.

At the same time, when preparing reports, in particular, UTII form 3 code according to KND 1111050, it is necessary to use special deflator coefficients:

- K 1;

- K 2.

The value of the coefficient K 1 is set differently every year. For example, in 2013 it is 1.569 according to the relevant Order of the Ministry of Economic Development No. 707 dated December 31, 2010.

The value of the deflator coefficient K 2 is constant. It is calculated based on a combination of factors influencing the conduct of any type of activity.

In this case, K 2 is established at the local level by special acts:

- municipal districts;

- cities;

- urban districts.

The value of the coefficient is strictly regulated by law. It can only fluctuate between 0.005 and 1.

The tax period when using the Unified Tax on Imputed Income is a quarter. The tax rate is 15% of the total imputed income.

Where to apply

An application of the type in question must be submitted within the time limits established by law at the place of registration of the individual entrepreneur or organization with the tax authorities.

Moreover, it is very important to correctly register UTII-3. Because otherwise, the tax service has every right to refuse the applicant to terminate activities under UTII or switch to another regime.

You will need to re-compile the UTII-3 application form, which leads to a loss of a lot of time.

Legal grounds

In order to officially stop conducting business activities, or switch to another taxation regime (Article No. 346.26 of the Tax Code of the Russian Federation), an individual entrepreneur or the head of an enterprise must be deregistered.

This is done by submitting an application in the UTII-3 form. Today, in connection with the reform of the current legislation, a taxpayer working for UTII is not required to inform the tax authority at the place of registration about a change in the type of activity, as well as the place of its implementation.

At the same time, the taxpayer has the legal right to do this using the Application for deregistration/registration (Form 1, Form 2).

They cannot use UTII:

- large taxpayers;

- entrepreneurs providing catering services in medical institutions and schools;

- enterprises and entrepreneurs whose total number of employees exceeds 100 people;

- organizations in which the share of participation of other organizations is more than ¼ (exceptions are indicated in Article No. 346.26 of the Tax Code of the Russian Federation).

If one of the above conditions is violated, then the taxpayer is obliged to switch from UTII to a tax regime that suits him. Otherwise, problems with the tax authorities cannot be avoided.

What is the object of taxation under UTII, see the article: object of taxation UTII. Are there any changes to the checkpoint for LLCs on UTII in 2022, read here.

Also, entrepreneurs engaged in activities specified in clause 2 of Article No. 346.26 of the Tax Code of the Russian Federation cannot use UTII.

It is not possible to use this tax regime:

- if there is a simple partnership agreement;

- if there is a property trust management agreement.

An important advantage of “imputation” is the absence of restrictions on the amount of income. It should also be remembered that UTII is planned to be abolished by 2022.