Those filling out a payment order often come across field No. 22, and the question immediately arises: what is this “UIN code” and where can I get it from? We would like to reassure you right away - it is not always needed (or rather, in many cases it is set to zero). So, UIN is a unique accrual identifier. It must be registered when making payments through the bank.

Where can I get the UIN for field 22 of the payment order ?

What is UIN

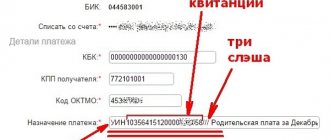

UIN is a digital code that is needed to control payments to the state budget from individuals and legal entities. This is a value that includes 20 digits. Numbers are separated from other information by the symbol “///”.

The identifier is a component of the Information System (GIS GMP). The code is set for all types of payments sent to the budget. The UIN allows you to determine the type of payment and facilitate the receipt of funds at the destination.

What UIN should I indicate in the payment order for tax payment ?

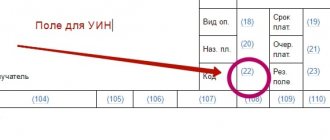

The identifier is entered in the “Code” field. This field is designated by the numbers 22. It is necessary to indicate the UIN code in payment documents. Without this, it is impossible to direct funds to the country's budget. Those. even if there is no UIN, you need to enter zero. The field cannot be left empty. For example, these could be payments:

- Taxes.

- State duties.

- Fines.

- Peni.

- Various debts.

What UIN should I indicate in the payment order for payment of insurance premiums ?

Bank employees will not accept payments without specifying the code. It also needs to be registered when transferring funds through terminals.

FOR YOUR INFORMATION! For each type of payment, the UIN code will be different. Therefore, confusion very often arises. Payers do not know which numbers to indicate on their payments.

What does the abbreviation UIP hide?

UIP can be deciphered as “unique payment identifier”. On the receipt it is located in field number 22. The identifier is indicated by a 20-digit number and contains information about:

- type of transfer of funds;

- recipient of the transfer;

- document that orders the translation.

The function of a unique payment identifier is to systematize the process of transferring funds and assist government agencies in monitoring transfers.

Where can I find the UIP code? This value is generated by the recipient of the funds, that is, it can be found out:

- from the document that became the basis for the payment;

- at the addressee.

In some cases, the UIP is simply not generated , so filling out this detail is not always required. However, there is no need to leave the field empty, if the value is unknown, just enter “0” in the line.

Important! By law, the bank cannot refuse to transfer funds if the UIP is not among the payment details. But in this case, you must fill in the TIN field.

You should be careful when filling out the UIP field. If you enter an incorrect value, the funds will go to another account. This means that fines and penalties are possible for late payments, although the client will think that the money has been transferred.

If an error is detected in time, the operation will have to be repeated, carefully checking the UIP for correctness. Only after this should you go to the bank and write there an application for the return of the erroneously transferred payment.

The meaning of the identifier components

Each number included in the identifier has its own meaning:

- The first three numbers. Assigned by the Treasury.

- The fourth number. Indicates the department from which the request for funds transfer came.

- Fifth number. Represents the payment code.

- Sixth and seventh numbers. Date of payment.

- Numbers from 8th to 12th. Series and number.

- The twentieth. Needed to increase the uniqueness of the identifier. Assigned to a specific payment card.

What UIN should I indicate in the payment order for payment of state duty ?

The identifier is approved by the recipient of the funds. Its formation is an automatic process. The code must be unique for each payment document.

IMPORTANT! The payer cannot generate the code independently using arbitrary numbers. If the UIN code is simply invented, the funds will not reach their recipient.

ATTENTION! Sometimes, if a person does not know his or her ID, you can enter “0”. In some cases, the UIN code is supplemented with letter designations. These can be Russian or Latin letters.

What does the ID on the receipt mean?

The code serves to identify the payment. It contains this information:

- Who issues the payment?

- Payment addressee.

- What exactly are the funds paid for?

The bank employee can decipher the code, after which he sends the payment to its recipient. All accruals to the budget are recorded in the GTS GMP system. The presence of the code allows you to immediately record the payment.

Guide to payment using UIN via Sberbank Online

In the digital age, more and more people are using remote services. It’s very convenient that you don’t need to go anywhere, and you can make the necessary payment almost anywhere. All you need is a computer or smartphone with Internet access.

To pay for kindergarten using a unique code in Sberbank Online, follow the following steps:

- Log in to your Sberbank Online personal account on the official website or mobile application.

- Go through verification.

- Click on “Transfers and Payments”.

- Select "Organization transfer".

- Enter the required bank details.

- Select the card from which funds will be debited.

- Check the details and click the “Confirm” button.

- Enter a one-time password to confirm the transaction.

Paying traffic police fines looks a little different. In this case, the instructions look like this:

- Log in to online banking.

- Click on the “Taxes, fines, duties, budget transfers” button.

- Select “Staff Police” or enter in the search bar.

- Click on “Payment by receipt”.

- Enter the UIN that is indicated on the receipt.

- Specify the card from which funds will be debited.

- Check the details and click on the “Confirm” button.

- Enter a one-time password to confirm the operation.

Please note that you may not provide bank details. For example, when choosing traffic police fines in the catalogue, indicate “Payment by QR or barcode”. The system will automatically calculate the payment, and all that remains is to pay it.

READ Printing a receipt at an ATM or Sberbank terminal for previously made payments

Legal basis

The use of the identifier was established by Order of the Ministry of Finance No. 106n dated November 24, 2004. This was the first document that approved the use of UIN as details. However, when only this document was in effect, the code was used in a recommendatory manner. The need for its use arose after the release of Order No. 107 of the Ministry of Finance of November 12, 2013. The corresponding obligation is associated with the formation of the GIS GMP system.

Until March 31, 2014, the identifier was indicated in the “Destination of funds” field. After this date, the code began to be entered in the “22” field.

Another regulatory document is Federal Law No. 210 “On the provision of public services” dated July 27, 2010. He approved the payment identifier, which is needed for the rapid delivery of funds to their destination.

Why do you need a UIN?

UIN is required for quick and efficient distribution of funds. Representatives of banks and budgetary structures, based on this code, determine to whom the funds are intended. Since the code serves as identification, it will be unique for each payment document.

The UIN system serves to simplify the system of budget payments and fees. It allows you to exclude the appearance of payments with an undefined purpose. Specifying the identifier allows you to be sure that the funds will definitely reach their addressee.

How to get an ID

To obtain a UIN you need to do the following:

- Receiving demands from budgetary structures for the payment of funds (fines, penalties, taxes).

- It is in this requirement that you can find the required identifier.

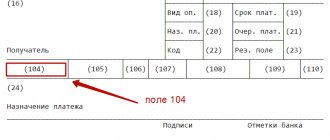

- All the numbers contained in the request are entered into the payment document. They need to be entered in code “22”. This field is located in the lower block of the payment order.

ATTENTION! The codes are not contained in any tables or directories for the simple reason that they are unique. For this reason, a list of identifiers simply cannot exist. Each payment is assigned its own number. The UIN can only come from the controlling structure. It is indicated in the request on the basis of which the payment is made.

IMPORTANT! The UIN code is relevant only for payments the addressee of which is government and budgetary structures.

Where can I get a unique identifier?

Finding a UIN is not difficult and you will need a standard receipt. Typically, the code is located at the top of the payment paper and is signed as a “document index”.

Irina Bolshakova

Bank loan officer

In 1 minute! Let's calculate overpayments using a calculator. We will offer a sea of profitable offers on loans, credits and cards, very flexible conditions. Shall we try?)

Important! The UIN should not be confused with the receipt number. This may lead to payment refusal.

The code on receipts that are used to pay for the same service is the same. If you use the standard feature of the service and make a template for subsequent translations, the code will be in the template. SB Online also offers an additional option for obtaining information about the identifier, namely:

- Log in to your SB Online personal account and go to the payments and transfers section.

- Click on the “Information” panel and find the operation where the transfer was made according to the UIN.

- Open the document and find the required 20-digit code in it.

Attention! Sometimes the system displays a “search error”. This means that the identifier has not been used anywhere, and the information cannot be found here. Lack of information can also occur when the payer did not write the UIN due to its absence, but simply indicated zero.

When the UIN code is not necessary

In some cases it is not necessary to enter an identifier. In particular, the code is not needed when transferring current payments. Individual entrepreneurs and legal entities themselves calculate the amount of taxes and pay them based on the tax return.

Let's look at an example. The legal entity pays VAT. The requisite in this case may be the KBK. It is indicated in field 104. Individual entrepreneurs and individuals can use the TIN as a code. However, if nothing is indicated on line 22, the payment will not be accepted. Therefore, you need to write “0” in this line.

Features of specifying the code for various types of payments

The nuances of specifying the UIN depend on the specific type of payment.

Taxes

The required UIN is contained in the requirement index. This is relevant if the payer is issued a payment invoice. If he pays the current tax himself, the identifier is not required. In field 22 the code “0” is entered. Reason – Letter of the Social Insurance Fund No. 17-03-11/14-2337 dated February 21, 2014. You can also replace the details with an INN (letter of the Federal Tax Service No. 3N-4-1/6133 dated April 8, 2016). However, you can indicate both UIN and Taxpayer Identification Number (TIN) in payment documents.

State duty

The state duty is paid based on the received receipt. If it was received at the place of application, the required identifier is the receipt index. However, usually the payer does not apply to the authorities for the document. That is, there is no place for him to find out the code. In this case, line 22 indicates “0”.

Payment for kindergarten services

When paying for kindergarten services, you must also indicate the ID. The nuance of obtaining a code is that kindergartens usually do not make any written demands to parents. Where can I get a UIN? You can contact the garden accounting department for this. The code includes the designation of the child. You only need to apply for a UIN once. In the future, payments will be made using the previously received code. Payments for tuition in fee-paying schools are also carried out.

Traffic police fines

Traffic police fines are paid according to a document that serves as the basis for assigning payment. The UIN is indicated in the same document. The code contains this information:

- Protocol number.

- The date of this paper.

Let's look at the decryption of the identifier:

- The first three numbers. Manager number. The number for the traffic police is 188.

- Fourth character. Addressee – 1.

- Fifth character. Purpose of funds. If a fine is paid, the number 1 is entered.

- Sixth and seventh characters. The date of execution of the paper on the basis of which the payment is made.

- The rest of the numbers. Serial number.

If there is a resolution on the basis of which a fine is paid, the payer does not have to indicate the UIN. A bank employee can do this for him.

What types of services can be paid through UIN

Of course, the individual identifier appears on many payment receipts. You can make a payment using a digital code in the following cases:

- tax;

- educational services (school, kindergarten);

- traffic police fine;

- state duty;

- legal debt.

Almost all budget payments are made using a unique identifier.

When making any payment, you must enter your bank details correctly. Banking experts warn that writing unique code should be taken seriously. After all, the system will not be able to recognize an incorrectly entered identifier, which means that the payment will go to the wrong place. Which, in turn, will lead to the following troubles:

- financial debt arises;

- penalties and fines for late payments may begin to accrue;

- lengthy proceedings are possible about where the money went and how it was returned;

- payment terms are violated.

READ The procedure for restoring a payment receipt in Sberbank