GPC agreement with a foreign citizen: legal regulators

The possibility and procedure for concluding GPC agreements with foreigners is regulated by:

- Ch. and 39 of the Civil Code of the Russian Federation (when concluding contract agreements or paid services);

- Federal Law No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”;

- Order of the Ministry of Internal Affairs of the Russian Federation No. 363 (on the procedure for notifying working foreigners).

In cases where it is intended to conclude a civil process agreement with a foreign citizen to perform work or services specified in the terms of the agreement (including one-time ones), the customer is obliged to be guided and rely specifically on these legislative norms.

Differences between an employment agreement and a GPC agreement

The differences between the two types of documents concluded with foreigners are presented in the table:

| Index | GPC | Contract of employment |

| Legislative regulation of the process of concluding a document. | Ch. 37, ch. 39 of the Civil Code of the Russian Federation. | Labor Code of the Russian Federation, letter of the Ministry of Labor No. 17-3 / OOG-900 dated December 5. 2014 |

| Parties | The customer is a Russian company or individual entrepreneur. The performer is a foreign citizen. | Employer organization and employee. |

| The essence of the document | Regulations of obligations and rights to perform one specific task. | Regulations for permanent labor cooperation. |

| Providing conditions for completing the task | Performer (except for tools and equipment). | Employer. |

| Wage | A fixed one-time remuneration or staged remuneration paid upon fulfillment of obligations. | Permanent remuneration, calculation, accrual and issuance of which occurs in accordance with the norms of Russian labor legislation. |

| Financial liability for refusal of obligations, poor quality performance, non-fulfillment or failure to meet deadlines. | Cases in which financial liability is provided and the amount of recovery are determined by the provisions of the document. In this case, the contents of the document must satisfy both parties. | The employer does not have the right to fine for failure to fulfill obligations (he can use disciplinary action or dismiss “under the article”). |

| Insurance coverage | From the performer’s earnings, contributions are deducted to:

| All mandatory contributions to funds, in accordance with the norms of the Labor Code. |

GPC agreement with a foreigner: about the form, structure, features

The legal system distinguishes several types of GPC agreements concluded in various situations with migrants, however, the most common in this group are contract agreements and agreements for the provision of services (one-time or systematic).

The subject of such agreements is the performance by a migrant of specifically designated types of work or provision of services.

The forms of GPC agreements for the performance of work or provision of services concluded with foreign individuals have not been standardized by current legislation, therefore they do not have a unified template.

In its structure, the GPC agreement with a foreign citizen does not have significant differences with similar agreements concluded with citizens of the Russian Federation. However, some features are still present in this document. So:

- a GPC agreement with a migrant can be concluded only on the condition that his presence on the territory of the Russian Federation is legalized and he has the right to work (for example, a GPC agreement can be signed with a foreign citizen under a patent, or if he has a work permit);

- information about the availability of a patent for the right to work (or a work permit) is stated in the preamble of the contract;

- a contract with a foreigner must not only indicate its subject matter, but also the deadline for completing the ordered work, and in the contract concluded for the provision of services by a migrant, it is necessary to specify both the type of services and their cost;

- contract agreement, in accordance with paragraph 1 of Art. 420 of the Civil Code of the Russian Federation, can be concluded with either one or several individuals with foreign citizenship at the same time.

In the case of a “brigade” contract format:

- in its installation part (preamble) all performers should be listed,

- Each foreigner listed as a performer of work must put his signature on the agreement, and upon completion of the work, on the acceptance certificate.

Please note: work contracts concluded with a foreigner must indicate the end date of their validity. This date cannot exceed the calendar limit for the permitted stay of a foreigner in Russia. What does this mean:

- For foreigners who have received a patent or work permit, migration authorities establish a period of stay on the territory of the Russian Federation. After this period, the migrant is obliged to leave Russia, and all agreements concluded with him are considered void.

- Cooperation under a GPC agreement with a foreigner beyond the established period of stay in Russia (after which his stay is considered illegal) is a direct violation of current legislation and entails liability for the customer of the work (services).

What documents to request

The list of documents is slightly larger than with a citizen of the Russian Federation.

Here are the documents needed to draw up a civil process agreement with a foreign citizen, regardless of his status - all categories of foreign citizens will definitely need:

- passport;

- SNILS (for permanently and temporarily residing foreigners);

- license, if the services provided require it.

If SNILS is not available, the employer is allowed to issue it. The remaining set of documents depends on the regime used by the foreigner for temporary residence (TRP or residence permit) or the permitted type of temporary stay:

- visa - a work permit is required (paragraph 16, clause 1, article 2 of Federal Law-115 of June 21, 2002);

- visa-free - a patent for work is issued (Article 2 of Federal Law-115 of June 21, 2002);

- for citizens of the EAEU a patent is not required (Article 2 of Federal Law-115 of June 21, 2002).

IMPORTANT!

The Eurasian Economic Union (EAEU) unites the Russian Federation, Belarus, Kazakhstan, Kyrgyzstan and Armenia - citizens of these countries work in the Russian Federation without a patent or work permit.

About the content of contracts

Since the legislator has not provided a standard civil process agreement with a foreign citizen in the regulatory legal framework, a sample of such an agreement can be created by the customer of the work/services independently.

And yet, there are mandatory information that must be present in the contract concluded with a foreigner. These include:

- status and information:

about the customer - full name, passport details, current registration information (for an individual), full name of a representative acting on behalf and on behalf of the company without a power of attorney, full name of the company and its registration data - TIN, OGRN, address (for a legal entity);

- about the performer - full name, details of the identity document (national passport), information about the document legalizing the presence of a foreigner on the territory of Russia and giving the right to carry out labor activities;

- for construction contracts - this is the subject of the agreement, precisely established initial and final deadlines for the fulfillment of obligations under the agreement (if necessary, intermediate deadlines are also indicated if the terms of the agreement provide for the phased fulfillment of obligations);

What should be in the text?

The form of a civil law contract with a foreign citizen does not differ from the form of an ordinary civil law contract. A civil contract with a foreigner can be of two types, one of which is a contract, and the other is a contract for paid (that is, paid) provision of services .

Standard contract

Contract for paid services

For both types there is a mandatory list of conditions that must be reflected in it. First of all, such agreements reflect the types of work performed or services provided and the requirements for their quality.

In addition, the deadline for fulfilling the obligations assumed by the hired employee under such an agreement, the procedure for the delivery and acceptance of work or services, payment for the results of fulfilled labor obligations, as well as the responsibility of the parties for a possible violation of the terms of the concluded agreement must be stipulated.

Another mandatory point is, as in all other civil contracts, the details of the participating parties.

If necessary, an annex to such an agreement can be drawn up with the form of a bilateral act, on the basis of which the work performed in accordance with the agreement or services provided under it are accepted and their subsequent payment is made.

GPC agreement with a foreign citizen: notification of the FMS about the agreement with the migrant

The legislator has established the obligation of the customer of work (recipient of services) to notify the migration authorities (territorial division of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs) about cooperation with a foreign citizen. Moreover, you need to send a message (both about signing and terminating the GPC agreement with a migrant) within 3 working days from the corresponding date. This requirement is provided for in paragraph 8 of Art. 13 of Law No. 115-FZ, and the procedure for providing this information (information composition, deadlines, methods of transmission, forms of forms) - by Order of the Ministry of Internal Affairs of the Russian Federation No. 363 of 06/04/2019.

The procedure for providing information about a GPC agreement with a foreigner is similar to the procedure for notifying about an employment contract with a foreign citizen.

How a contract is drawn up

The document is drawn up in free form. The legislation does not provide a unified form for this. However, its content must reflect 10 sections.

- Registration information: name of the document, number assigned to it, date and address of preparation.

- Personal information of the parties: Full name or name of the organization, passport data or extracts from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, legal status.

- Subject of the agreement: description of the task.

- List of essential conditions: time allotted for completing the work, algorithm for receiving the result, description of the stages and rules for their implementation (if required), other information included in the document by agreement of both parties.

- List of rights and obligations of the customer and contractor.

- Payment provisions: amount of remuneration, timing of funds transfer, algorithm for issuing prepayment and amount (if used), amount of compensation for expenses (if provided).

- Penalties for failure to fulfill obligations.

- Algorithm for resolving conflict situations and disputes.

- The validity period of the document, the algorithm for its early termination.

- Signatures of the parties.

ATTENTION:

The Civil Code of the Russian Federation prohibits concluding GPC agreements for an indefinite period, since this will already constitute an employment relationship. In the case of foreign citizens, the period of validity of the contract cannot exceed the period during which the person can legally stay in the territory of the Russian Federation or legally work (validity of a visa, temporary residence permit, patent or admission).

Sample agreement for work performance:

dogovor_na_ispolnenie_rabot.docx

Sample agreement for the provision of services:

dogovor_na_okazanie_uslug.docx

GPC agreement with a foreign citizen: taxation

Signing a GPC agreement with a citizen of another state automatically classifies the customer of services (regardless of his status) as a tax agent, which obliges him to transfer personal income tax on the amount of remuneration of the contractor (performer) stipulated by the agreement.

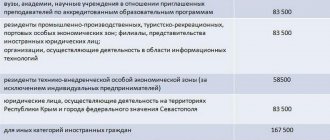

The personal income tax rate is variable and depends on the status of the person (Article 224 of the Tax Code of the Russian Federation):

- According to paragraph 2 of Art. 207 of the Tax Code of the Russian Federation, with continuous residence in the territory of the Russian Federation for at least 183 days (for 12 months in a row), a foreigner is considered a resident, with a shorter period of residence - a non-resident. The amount of income tax on the date of receipt of income is 30% for non-residents and 13% for residents.

- According to Article 73 of the Treaty on the EAEU, if a foreign resident or non-resident has citizenship of a country that is part of the EAEU (Armenia, Belarus, Kyrgyzstan, Kazakhstan), the amount of personal income tax is always calculated at a general rate of 13%.

- An income tax of 13% is imposed on the income of foreign citizens belonging to the following categories:

who have received temporary (with a specified duration) asylum in the Russian Federation,

- refugees,

- highly qualified specialists.

Is it necessary to register the performer with migration registration?

IGs are often hired to provide services as repairmen, house helpers, caregivers, nannies, and other work related to temporary residence on the customer’s premises. In this case, he automatically becomes the receiving party for the IS and is obliged to register the foreigner with migration records. This is done by submitting a special form approved by order of the Ministry of Internal Affairs No. 1280 dated March 24, 2020, in person to the Department of Internal Affairs, by mail or through the MFC. In addition to the notification, you will need documents from the IG, the employer and title to the premises where the migrant actually lives.

Example. A GPC agreement was concluded with a citizen of Uzbekistan to accompany the child as a tutor and live at the employer’s home address. The notification in this case will take the following form:

When a foreign citizen departs from the territory of the receiving party, they are notified of this in a similar form, approved by Order of the Ministry of Internal Affairs No. 142 of March 18, 2019.

Insurance premiums

A person or enterprise acting as a customer in an agreement is obliged to deduct insurance premiums from the income of the contractor under the agreement. The amount of payments depends on the status of the migrant. They are presented in the table:

| Status | Contributions to the formation of a pension | Social insurance contributions | Contributions for compulsory health insurance |

| Temporary residence | 22% from total earnings up to 1 million 292 thousand rubles. 10% - over 1 million 292 thousand rubles. | Not paid | At least 5.1% with no restrictions on the maximum contribution amount. |

| Permanent residence | |||

| A person with citizenship of countries that are members of the EAEU. | |||

| Refugee. | |||

| Temporary stay. | Not paid | ||

Non-residents in tax legislation

The legal provisions regarding personal income tax taxation divide individuals into tax residents and non-residents.

In Art. 207 of the Tax Code of the Russian Federation outlines the conditions for recognizing an individual as a resident. Other citizens not accepted into this category are non-residents and, as a rule, bear a higher tax burden compared to residents on income received in Russia. When applying the rules of taxation of income of non-residents by virtue of paragraph 1 of Art. 7 of the Tax Code of the Russian Federation, one must also take into account the taxation rules contained in international treaties of the Russian Federation.

In Art. 207 of the Tax Code of the Russian Federation, the criterion by which tax agents and tax authorities identify a taxpayer as a tax resident is the period of stay of an individual in the Russian Federation - at least 183 calendar days over the next 12 consecutive months. Moreover, in paragraphs. 2.1 and 3 of this article indicate the circumstances of traveling abroad that are not taken into account when calculating the period:

- for a period of less than six months for treatment or education;

- to offshore hydrocarbon deposits;

- foreign business trips of military personnel, employees of state authorities and local governments.

Other individuals who receive income from sources in the Russian Federation are non-residents.

ConsultantPlus experts explained who is a non-resident for the purpose of calculating personal income tax. Get free trial access to the system and move on to the Ready-made solution.

When calculating the period, all days are taken into account, including days of entry and exit from the country. According to the Ministry of Finance, the application of Art. 6.1 of the Tax Code of the Russian Federation for calculating deadlines is not required (letters of the Ministry of Finance of Russia dated 02/15/2017 No. 03-04-05/8334, dated 03/21/2011 No. 03-04-05/6-157).

Foreigners and their statuses affecting the calculation of contributions

Foreigners are persons who are not citizens of the Russian Federation, but either have confirmation of citizenship of another state or are unable to confirm such citizenship.

They can be in the Russian Federation for three reasons (Clause 1, Article 2 of the Law “On the Legal Status of Foreign...” dated July 25, 2002 No. 115-FZ):

- permanent residence, which requires a residence permit;

- temporary residence, during which a document permitting residence is issued;

- temporary stay when a person enters the Russian Federation with or without a visa, receiving a migration card and issuing a document giving the right to work.

Read more about these reasons in our material .

Foreigners can engage in labor activities:

- under an employment or civil contract agreement;

- as an individual entrepreneur.

To temporarily carry out activities, a foreigner must have a work permit (if he arrived on a visa) or a patent (if a visa is not required). The period of temporary stay in Russia will determine the validity period of the corresponding document. This period may be extended.

Does not make exceptions regarding the compulsory nature of insurance and, accordingly, with regard to the calculation of insurance premiums from foreigners in 2020–2021:

1. Neither paragraph 1 of Art. 7 of the Law “On Compulsory Pension...” dated December 15, 2001 No. 167-FZ, establishing the need for compulsory pension insurance (OPS) for all persons working both under contracts (labor or GPC) and as individual entrepreneurs, except those temporarily in the Russian Federation highly qualified specialists.

2. Neither paragraph 1 of Art. 2 of the Law “On Mandatory Social...” dated December 29, 2006 No. 255-FZ, obliging the implementation of compulsory social insurance (OSI) for disability and maternity of individuals working under employment contracts, except for highly qualified foreign specialists temporarily staying in the Russian Federation. But this law exempts individual entrepreneurs (and, accordingly, foreigners) from OSS (clause 3 of Article 2).

3. Neither art. 10 of the Law “On Compulsory Medical...” dated November 29, 2010 No. 326-FZ, which determines the need to obtain compulsory medical insurance (CHI) for persons working under contracts (labor or GPC) or who are individual entrepreneurs, but who are not classified as highly qualified foreign specialists or foreigners temporarily staying in the Russian Federation.

4. Neither the Law “On Mandatory Social...” of July 24, 1998 No. 125-FZ (clause 2 of Article 5), which extends the obligation for employers to make contributions for injuries and the income of foreigners. These contributions will be accrued in any case, regardless of the status of a foreigner working in the Russian Federation.

That is, insurance premiums for payments to foreigners must be calculated. But these charges have their own nuances, depending on the category of the contribution payer, the basis for the foreigner’s stay in Russia and the qualifications of the foreign specialist.

How can the head of an organization conclude a contract with a foreigner?

Algorithm for concluding a GPC agreement, example of a manager’s actions:

- Checking the legality of a migrant’s presence in the country.

- Verification of the authenticity and integrity of the package of documents provided by foreigners.

- Drawing up the provisions of the contract in compliance with the number of sections.

- Coordination of the document with the contractor.

- Signing of the document by both parties.

- Drawing up a notification for the Federal Migration Service and sending it within 72 hours from the conclusion of the contract.

Temporarily staying foreign citizens: features of contributions

The imposition of contributions on foreigners temporarily staying in the Russian Federation has its own rules, primarily because among them are highly qualified specialists, whose income under a contract (labor or civil service agreement) is not subject to any contributions, except for contributions for injuries.

The income of other foreign workers registered under the contract will not be subject to contributions to compulsory health insurance, but will be subject to payments to compulsory health insurance and compulsory health insurance. Tariffs for them will generally be equal (Article 426 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2017 No. 03-15-06/11189):

- on OPS - 22% from income not exceeding 1,465,000 rubles. (in 2021), and 10% of income above this amount;

- for OSS for disability and maternity - 1.8% from income not exceeding 966,000 rubles. (in 2022), contributions will not be accrued above this income.

At the same time, situations may arise for the contribution payer when he has:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee (Articles 428, 429 of the Tax Code of the Russian Federation);

- the possibility of using reduced tariffs in accordance with Art. 427 Tax Code of the Russian Federation.

Contribution rates for injuries will depend on the type of activity carried out by the employer.

For individual foreigners with a temporary stay, insurance payments will be determined in the same way as for individual entrepreneurs who are citizens of the Russian Federation and individual entrepreneurs who live (temporarily or permanently) in Russia.