According to the provisions of Art. 3 of the Federal Law of November 3, 2006 No. 174-FZ “On Autonomous Institutions” (hereinafter referred to as the Law on Autonomous Institutions), especially valuable movable property means movable property, without which the institution’s implementation of its statutory activities (main activities) will be significantly difficult. A similar interpretation of the concept of “particularly valuable movable property” is contained in paragraph 11 of Art. 9.2 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations” (hereinafter referred to as the Law on Non-Profit Organizations). We will talk about the features of accounting for objects classified as especially valuable movable property in this article.

The procedure for classifying property as especially valuable movable property (VTsDI) is determined by Decree of the Government of the Russian Federation of July 26, 2010 No. 538 (hereinafter referred to as Resolution No. 538).

According to paragraph 2 of Resolution No. 538, the lists of especially valuable movable property of autonomous institutions are determined:

Bulleted list

federal government bodies exercising the functions and powers of the founder - in relation to autonomous institutions created on the basis of property owned by the federal government;

in the manner established by the highest executive body of state power of a constituent entity of the Russian Federation - in relation to autonomous institutions that are created on the basis of property owned by a constituent entity of the Russian Federation;

in the manner determined by the local administration - in relation to autonomous institutions that are created on the basis of property owned by the municipality.

Lists of especially valuable movable property of budgetary institutions are determined by the relevant bodies exercising the functions and powers of the founder ( clause 3 of Resolution No. 538 ).

Thus, Resolution No. 538 defines the criteria for classifying property as particularly valuable movable property. One of these criteria is the book value of the property. Based on the norms set out in this resolution, the founder for his subordinate institutions develops a normative act in which he establishes a list of especially valuable movable property. Thus, in relation to federal state budgetary institutions subordinate to the Ministry of Health, Order of the Ministry of Health of the Russian Federation dated 08/09/2012 No. 72n . Types of especially valuable movable property of state budgetary and autonomous institutions of the Moscow Health Department are given in Appendices 1 - 6 to Order of the Moscow Health Department dated May 17, 2012 No. 448 .

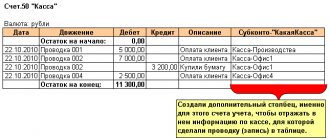

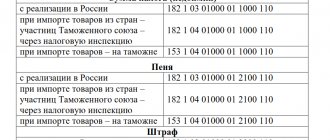

In accounting, non-financial assets classified as particularly valuable movable property are reflected in the following accounting accounts:

– 0 101 20 000 “Fixed assets are particularly valuable movable property of an institution”;

– 0 102 20 000 “Intangible assets are especially valuable movable property of an institution”;

– 0 105 20 000 “Material reserves are particularly valuable movable property of an institution.”

The founder makes changes to the list of OCDI objects. How to reflect this in accounting?

In practice, it sometimes happens that the founder makes changes to the list of especially valuable movable property. And the property that was previously classified as OCDN is now another movable property. At the same time, the accountant has a question: how to reflect in accounting the transfer of property from the category of “particularly valuable movable property” to the category of “other movable property”?

Instructions No. 174n , 183n do not contain correspondence accounts for reflecting such transactions in accounting. account 0 304 06 000 “Settlements with other creditors” ( Letter dated December 22, 2011 No. 02-06-07/5236 when bringing the closing balances into compliance with the requirements of the new .

Of course, the nature of accounting entries when transferring balances as a result of a change in the legal status of an institution and adjusting accounting entries made as a result of changes to the list of especially valuable movable property is different. However, in our opinion, it is possible to draw a parallel between these operations and use the account 0 304 06 000 .

According to the norms of clause 5 of Instruction No. 183n , clause 4 of Instruction No. 174n, in the absence of correspondence of accounting accounts in the instructions regarding a business transaction carried out by an institution in accordance with the legislation of the Russian Federation, the institution has the right, in agreement with the financial body of a public legal entity (RF, subject of the Russian Federation, municipal entity), on the basis of the property of which an institution was created (with a body exercising the functions and powers of the founder in relation to the institution), determine the correspondence of accounts necessary for reflection in accounting in the part that does not contradict instructions No. 174n, 183n. Therefore, taking into account the provisions of the above paragraphs, the institution agrees with the founder on the use of account 0 304 06 000 when performing operations to adjust the list of especially valuable movable property by the founder.

Example 1

As a result of changes made by the founder to the list of especially valuable movable property, the fixed asset recorded on account 0 101 26 000 “Production and business equipment - especially valuable movable property of the institution” was classified as “other movable property”. The cost of the fixed asset is 180,000 rubles, the amount of accrued depreciation is 58,000 rubles. The fixed asset is accounted for by activity code 4. The data in the example is conditional.

The correspondence of accounts for transactions involving the transfer of property from the category of especially valuable movable property to the category of other movable property will be as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The object of a non-financial asset has left the OCDI: | |||

| – in the amount of accrued depreciation | 4 104 26 410 | 4 101 26 410 | 58 000 |

| – in the amount of residual value (180,000 - 58,000) rub. | 4 304 06 830 | 4 101 26 410 | 122 000 |

| The object of non-financial assets is accepted for accounting as other movable property: | |||

| – in the amount of book value | 4 101 36 310 | 4 304 06 730 | 180 000 |

| – in the amount of depreciation previously accrued on OTsDI | 4 304 06 830 | 4 104 36 410 | 58 000 |

Reclassification of fixed assets into investment real estate

According to paragraph 31 of the Standard “Fixed Assets”, the transfer of fixed assets from the real estate occupied by the subject of accounting to the group of fixed assets “Investment real estate” must be carried out in relation to real estate objects (parts of the real estate object), as well as movable property that forms the same property with the specified objects. property complexes used by the subject of accounting for the purpose of receiving payment for the use of property (rent) and (or) increasing the value of real estate in the event of a change in the purpose of their use.

When applying the Fixed Assets Standard for the first time, it is necessary to transfer balances on objects recognized as investment real estate from accounts 101 00, 104 00 to accounts 101 03, 104 03 during the inter-reporting period in correspondence with account 401 30 “Financial result of past reporting periods” (letter Ministry of Finance of Russia dated November 30, 2017 No. 02-07-07/79257).

In the program “1C: Accounting of a State Institution 8”, edition 1 and edition 2, you can transfer balances to 01/01/2018 for objects recognized as investment real estate using the documents Transition to the application of order 64n (NFA).

The movement of fixed assets between groups and (or) types of property during reclassification during the year is reflected in accounting in correspondence with account 401 10 172 “Income from transactions with assets” (clause 9 of the Instructions for the application of the Chart of Accounts for budgetary institutions, approved. by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

To transfer fixed assets during the reporting year to investment real estate accounts 101.13 and 101.33 (104.13 and 104.33) from other subaccounts of account 101.00 (104.00), the documents Internal transfer of fixed assets are used: in BGU 1 - with the operation Internal transfer of fixed assets between accounts, in BGU 2 (Fig. 3) - Transfer of own fixed assets, intangible assets, legal assets on the balance sheet (101, 102, 103).

Rice. 3

How is the cost of OCDI reflected in account 0 210 06 000 “Settlements with the founder”?

According to Art. 298 of the Civil Code of the Russian Federation, an autonomous institution, without the consent of the owner, has no right to dispose of real estate and especially valuable movable property assigned to it by the owner or acquired by the autonomous institution at the expense of funds allocated to it by the owner for the acquisition of such property.

The autonomous institution has the right to dispose of the remaining property that it has under the right of operational management independently, unless otherwise established by the Law on Autonomous Institutions. In turn, a budgetary institution, without the consent of the owner, has no right to dispose of particularly valuable movable property assigned to it by the owner or acquired from funds allocated to it by the owner for the acquisition of such property, as well as real estate. The rest of the property that it has under the right of operational management can be disposed of by a budgetary institution independently, unless otherwise established by the Law on Non-Profit Organizations.

By virtue of clause 116 of Instruction No. 174n , clause 119 of Instruction No. 183n, account 0 210 06 000 is intended for accounting for property that the institution does not have the right to independently dispose of . The book value of particularly valuable property is reflected in this account.

Correspondence for account 0 210 06 000 , given in instructions No. 174n, 183n, differs from that contained in the Letter of the Ministry of Finance of the Russian Federation dated September 18, 2012 No. 02-06-07/3798 . The letter is not a normative act, unlike the above instructions . According to the correspondence of the accounts specified in clause 116 of Instruction No. 174n and clause 119 of Instruction No. 183n , account 0 210 06 000 is not closed. Due to the incorrect reflection of these transactions in accounting and reporting, the Ministry of Finance issued this letter. Projects were also developed to amend instructions No. 174n and 183n, which never became regulations. The information provided in the projects and the said letter is identical. By Order of the Ministry of Finance of the Russian Federation dated October 26, 2012 No. 139n, amendments were made to Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n “On approval of the Instructions on the procedure for compiling and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions . According to these changes, it is possible to fill out the forms introduced by this order only if you reflect transactions on account 0 210 06 000 in the manner established by Letter of the Ministry of Finance of the Russian Federation No. 02-06-07/3798.

Let us give an example of how transactions with particularly valuable movable property are reflected in accounting.

Example 2

The medical institution received from the founder property that was previously in use. According to the transfer and acceptance certificate (f. 0306001), the book value of the equipment is 350,000 rubles. The amount of accrued depreciation is RUB 90,000. After some time, the property was transferred to another budgetary institution subordinate to the same founder. The amount of depreciation accrued on equipment during its operation by the institution amounted to 70,000 rubles. The numbers in the example are conditional. Let's assume that the property transferred and received is reflected in account 4,101,26,000.

In accounting, operations for the receipt, operation and disposal of property will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The property received from the founder was accepted for accounting: | |||

| – for the amount of book value | 4 101 26 310 | 4 401 10 180 | 350 000 |

| – for the amount of depreciation previously accrued on the received property | 4 401 10 180 | 4 104 26 410 | 90 000 |

| Settlements with the founder for the amount of the book value of the received property are reflected | 4 401 10 172 | 4 210 06 660 | 350 000 |

| The amount of depreciation accrued on equipment is reflected (operations are carried out using the “red reversal” method) | 4 401 10 172 | 4 210 06 660 | (90 000) |

| The amount of depreciation accrued on the property during the period of its operation by the institution | 4 109 00 271 | 4 104 26 410 | 70 000 |

| The amount of depreciation accrued on equipment during the reporting period is reflected (transactions are carried out using the “red reversal” method) | 4 401 10 172 | 4 210 06 660 | (70 000) |

| Property transferred to another institution: | |||

| – for the amount of book value | 4 401 10 241 | 4 101 26 410 | 350 000 |

| – the amount of depreciation accrued on the property | 4 104 26 410 | 4 401 10 241 | 160 000 |

| Settlements with the founder for the amount of the book value of the transferred property (350,000 - 90,000 - 70,000) rubles are reflected. | 4 401 10 172 | 4 210 06 660 | (190 000) |

The question also often arises related to the use of account 0 210 06 000 in relation to particularly valuable movable property acquired under activity code 2. The Ministry of Finance in Letter No. 02-06-07/3798 provides correspondence of accounts, according to which account 0 210 06 000 is applied and in relation to property accounted for under activity code 2. The same information was contained in the draft amendments to instructions No. 174n, 183n ( clause 116 of Instruction No. 174n , clause 119 of Instruction No. 183n ).

Recognition of an asset as investment property

According to paragraph 7 of the Federal Accounting Standard for Public Sector Organizations “Fixed Assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257n, a real estate object (part of a real estate object), as well as movable property that constitutes a single property complex with the specified object, which are in the possession and (or) use of the subject of accounting for the purpose of receiving payment for the use of property (rent fees) and (or) increasing the value of real estate, but not intended to fulfill the state (municipal) powers (functions) assigned to the subject of accounting, carry out activities to perform work, provide services, or for the management needs of the subject of accounting and (or) sale, are recognized investment property.

Thus, investment real estate is recognized as property located in an institution with the right of operational management.

According to paragraph 3 of the Guidelines for the application of the federal Standard “Fixed Assets”, communicated by letter of the Ministry of Finance of Russia dated December 15, 2017 No. 02-07-07/84237:

Thus, if the provision of premises for rent is the main statutory activity of the institution, the purpose of using the building under the operational management of the institution initially implied the transfer of premises for rent; rental properties fall within the definition of investment property. According to paragraph 2 of Article 611 of the Civil Code of the Russian Federation, property is leased together with all its accessories and related documents (technical passport, quality certificate, etc.), unless otherwise provided by the contract. The “Fixed assets” standard provides for the inclusion in the “Investment real estate” group of movable property that forms a single property complex with the real estate property. According to paragraph 31 of the Standard “Fixed Assets”:

|

Is account 0 210 06 000 applied if OCDI was purchased using activity code 7?

The Ministry of Finance in connection with the receipt of questions about the procedure for maintaining accounting records of non-financial assets acquired by state (municipal) budgetary, autonomous institutions (hereinafter referred to as institutions) as part of activities in the field of compulsory health insurance in analytical accounting group 20 “Especially valuable movable property”, as well as on the formation of indicators for account 7 210 06 000 “Settlements with the founder” in Letter dated January 17, 2013 No. 02-06-07/111, the following is reported.

Non-financial assets of an institution acquired as part of its activities in the field of compulsory health insurance are subject to reflection in accounting on the appropriate accounts of the chart of accounts according to activity code 7 “Funds for compulsory health insurance” for the corresponding analytical group: 20 “Especially valuable movable property of the institution ", 30 "Other movable property of the institution."

According to activity type code 7, indicators for account 0 210 06 000 “Settlements with the founder”, intended for settlements with the body exercising the functions and powers of the founder, in terms of rights by order of OCDI in the amount of fixed assets accepted for accounting in the corresponding account of the analytical accounting of the account 7 101 20 000 “Fixed assets - especially valuable movable property of an institution” within the framework of the institution’s activities as a recipient of a subsidy (after changing the type), are not subject to formation.

Is part of a building considered investment property?

If not the entire building is leased, but only individual premises, is such a building recognized as investment property? If the building, the premises of which are leased, has one cadastral number, but in accounting the rented objects are assigned separate inventory numbers, are the individual premises recognized as investment property? Let's figure it out.

In accordance with International Financial Reporting Standard (IAS) 40 “Investment Property” (put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n), investment property is recognized as a property as a whole. The exception is a part of the property that can be sold separately from the other parts that make it up, which is possible if these parts represent different cadastral objects (for example, the first floor is one object with one cadastral number, and the second floor is another object with a different cadastral number number).

According to clause 10 of IAS 40, if a property includes a part which is held for the purpose of collecting rent or benefit from appreciation and another part which is held for the purpose of producing or supplying goods or providing services or for administrative purposes, then An entity accounts for these parts separately if the parts can be sold separately (or finance leased separately from each other). If the parts cannot be sold separately, the property concerned will be investment property only if the part held for use in the production or supply of goods or services or for administrative purposes is insignificant.

Unlike International Financial Reporting Standard (IAS) 40 “Investment Property”, the Standard “Property, Plant and Equipment” does not contain such restrictions and the requirement to apply the significance criterion. Therefore, individual premises with individual inventory numbers, in our opinion, can be recognized as investment real estate.

According to paragraph 45 of the Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n:

In paragraph 1 of part III.3 of the Guidelines for the application of the federal accounting standard for public sector organizations “Rent” (GHS “Rent”), communicated by letter of the Ministry of Finance of Russia dated December 13, 2017 No. 02-07-07/83464, the financial department clarifies:

|

Should OCDI be transferred from activity code 7 to activity code 4?

Until recently, medical institutions, when acquiring property under activity type code 7, due to the fact that the costs of maintaining this property were allocated under activity type code 4, transferred the property to activities financed by the founder’s funds.

However, the healthcare system now applies the principle of single-channel financing. The tariff for payment for medical care includes ( Part 7, Article 35 of the Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Medical Insurance in the Russian Federation” :

- salary expenses, wage accruals and other payments;

- expenses for the purchase of medicines, consumables, food, soft equipment, medical instruments, reagents and chemicals, and other supplies;

- expenses for paying the cost of laboratory and instrumental studies conducted in other institutions (if the medical organization does not have a laboratory and diagnostic equipment);

- expenses for catering (if there is no organized catering in the medical institution);

- expenses for payment of communication services, transport and utilities;

- expenses for payment of works and services for property maintenance;

- expenses for rent for the use of property;

- expenses for software and other services, social security for employees of medical organizations established by the legislation of the Russian Federation;

- expenses for the purchase of equipment worth up to 100,000 rubles. for a unit.

Since the single-channel financing system involves the allocation of funds for the maintenance of property according to activity code 7, there is no need to transfer property from one activity code to another. If the institution has not switched to a single-channel financing system, it should transfer the property received under activity code 7 to activity code 4.