What payments to foreign organizations are included in the report?

A Russian company or individual entrepreneur becomes an income tax agent in case of payments to foreign companies:

- Interest and dividends on placed funds on repurchase transactions, securities, including municipal and state securities (subclause 1, clause 4, article 282 of the Tax Code of the Russian Federation, clause 6, article 282.1 of the Tax Code of the Russian Federation, clause 5, article 286 of the Tax Code of the Russian Federation, art. 310.1 Tax Code of the Russian Federation).

- Distributed profits (dividends) from participation in domestic organizations (clauses 1, 3 of Article 275 of the Tax Code of the Russian Federation).

- Income to a non-resident without a registered representative office in Russia related to (clause 1 of Article 309 of the Tax Code of the Russian Federation): intellectual property rights;

- sale of real estate and financial instruments (including property rights in the form of shares and shares of enterprises), consisting of more than 50% of it;

- real estate rental, leasing operations;

- levying penalties in connection with violation of contractual obligations;

For an example, see here.

- sale of shares in rental-type mutual funds or real estate funds;

- other income.

Clause 2 art. 310 of the Tax Code of the Russian Federation provides for the exemption of certain categories of payments to non-residents from withholding tax. In such cases, the Russian organization does not become an intermediary in the transfer of tax amounts and does not submit the corresponding reports.

Liability for failure to provide

Situation: what are the consequences of untimely submission of tax reports on income paid to foreign organizations and taxes withheld?

The organization will be fined 200 rubles. for every document not submitted, and its officials may be held administratively liable.

A tax calculation of the amounts of income paid to foreign organizations and taxes withheld is a document required for tax control (subclause 4, clause 3, article 24 of the Tax Code of the Russian Federation). If the tax agent does not submit it within the prescribed period, the tax inspectorate has the right to present him with a fine, which is provided for in paragraph 1 of Article 126 of the Tax Code of the Russian Federation. The fine is 200 rubles. for each document not submitted.

Administrative liability is also provided for such a violation. At the request of the tax inspectorate, the court may fine officials of the organization (for example, the manager) in the amount of 300 to 500 rubles. (clause 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Liability under Article 119 of the Tax Code of the Russian Federation does not apply in this situation. The tax inspectorate has the right to fine an organization under this article only if the tax return was submitted late. A tax calculation of income paid to foreign organizations is not a declaration (Clause 1, Article 80 of the Tax Code of the Russian Federation).

Situation: does the inspectorate have the right to fine a tax agent who has not submitted a calculation of income paid to foreign organizations? Income is exempt from income tax under an international agreement (treaty).

Yes, you have the right.

Based on the results of the past reporting (tax) period, the tax agent must draw up and submit to the inspectorate a calculation of the amounts of income paid to foreign organizations and taxes withheld (clause 4 of Article 310 of the Tax Code of the Russian Federation). Income tax is withheld and transferred to the budget with each payment (Clause 1, Article 310 of the Tax Code of the Russian Federation).

The exception is when an organization is exempt from the obligation to withhold tax. They are listed in paragraph 2 of Article 310 of the Tax Code of the Russian Federation. However, tax exemption does not remove the organization’s status as a tax agent. That is, in these cases, she is obliged to submit to the inspectorate the documents necessary for tax control (subclause 4, clause 3, article 24 of the Tax Code of the Russian Federation). Calculation of income paid to foreign organizations refers to such documents. Therefore, if it is not submitted, the tax inspectorate has the right to impose a fine on the organization under paragraph 1 of Article 126 of the Tax Code of the Russian Federation.

Information on the income of foreign organizations that are exempt from income tax is reflected in the calculation for the period in which the tax agent paid this income. This follows from paragraph 1 of Article 310 of the Tax Code of the Russian Federation. The document confirming the right to preferential taxation is indicated in line 160 of subsection 3.2 of section 3 of the calculation (clause 8.7 of the Procedure approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115).

How to determine other income of non-resident companies

Tax legislation does not explain the composition of other income of non-resident organizations, which creates a certain ambiguity in the case of payments that are difficult to classify as one of the categories of paragraph 1 of Art. 309 of the Tax Code of the Russian Federation.

Over the past years, explanations from tax authorities and decisions of courts of various instances have formed two main judgments on this issue:

| Other income of foreign firms is | Rationale |

| Income similar to those given in paragraph 1 of Art. 309 Tax Code of the Russian Federation |

|

| Any rewards not included in those provided for in paragraph 1 of Art. 309 of the Tax Code of the Russian Federation and not associated with ordinary activities (except for real estate transactions) |

|

Due to the vagueness of the wording of the term “other similar income,” we recommend checking the practice of judicial proceedings in order to avoid a dispute with tax authorities about the legality of taxation of a particular foreign company.

For more information about the income included in the calculation, see the material “Tax agent for income tax when paying income to a foreign organization.”

Calculation of amounts of income paid to foreign organizations - form, deadline and procedure for submission

The obligation to provide calculations of amounts paid to non-resident companies is enshrined in clause 4 of Art. 310 of the Tax Code of the Russian Federation and arises in the reporting period in which such payment was made.

The report is submitted at the place of registration of the Russian organization before the 28th day of the month following the end of the reporting quarter. When submitting annual reports, there is a deadline of March 28. If a company pays income tax using advance payments once a month, then the deadline for submitting the report is the 28th day of the month following the reporting month. You can submit the calculation to the Federal Tax Service both in paper and electronic form.

The form and procedure for filling out the calculation are regulated by the order of the Federal Tax Service of Russia “On approval of the calculation form for income paid to foreign companies and withheld taxes and the procedure for filling it out” dated 03/02/2016 No. ММВ-7-3/115 (hereinafter referred to as the Procedure for filling out). You can download the calculation from the link below:

Calculation form

The new tax calculation form was approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115. The procedure for filling it out is given in the same order. The order came into force on April 10, 2016 and applies to calculations that organizations submit after this date. In this regard, the Federal Tax Service of Russia explained that calculations for the first quarter of 2016 (for quarterly reporting) or January–March 2016 (for monthly reporting) can be submitted on both new and old forms (letter dated April 11, 2016. No. SD-4-3/6253). In both cases, tax inspectorates must accept them. Starting with reporting for the half-year (January–April) 2016, submit calculations only using the new form.

Calculation sections: where to start filling out tax accrual data

The report form includes a title page and three sections:

- the calculated amount of income tax to be paid;

- calculation of taxes on payments to non-residents;

- calculation of remuneration paid to non-resident companies and amounts of withheld tax.

The calculation must be completed on an accrual basis from January 1 of the next year. The currency of payment of remuneration is also the main one for filling out the report. In this case, amounts in Russian rubles are rounded to whole numbers, and amounts in foreign currency are left without rounding.

Since each subsequent section performs a decryption function for the previous one, the report should be filled out from the end. In this case, there is no need to fill out section 3 if non-residents did not receive payments during the reporting period (letter of the Federal Tax Service “On filling out tax calculations” dated 04/13/2016 No. SD-4-3/6435).

Composition and features of filling out the calculation

Just like the calculation of amounts paid to foreign organizations, the instructions for filling it out were approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/115 (Appendix No. 2).

The payment calculation includes:

- Title page,

- Section 1 – tax payable on payments of the last quarter, or month,

- Section 2 – calculated tax on income paid,

- Section 3 – information on income and taxes, including 3 subsections: 3.1 – information about the foreign company that received income,

- 3.2 – income paid and tax calculation,

- 3.3 – information about the person who has the actual right to income.

Section 3 is formed separately for each foreign counterparty that received income, with a unique number assigned. The number of completed subsections 3.1 will be equal to the number of organizations that received income from the agent, and the number of subsections 3.2 for each counterparty will be equal to the amount of income paid to it.

Section 3 should be completed when the tax agent made payments in the last quarter or month of the reporting period. If there were none, then section 3 of the calculation does not include information on amounts paid to foreign organizations, but sections 1 and 2 are submitted (letter of the Federal Tax Service of the Russian Federation dated April 13, 2016 No. SD-4-3/6435).

All codes required when filling out the calculation are indicated in the tables as appendices to the filling procedure.

You can check how correctly the tax calculation has been prepared by using the control ratios from the letter of the Federal Tax Service of the Russian Federation dated June 14, 2016 No. SD-4-3/10522.

Section 3 structure

The number of sections 3 is determined based on all non-resident counterparties to whom payments were made, broken down by recipient (line code 010). If payments to the same counterparty refer to different codes, then fill out a separate section for each code.

For example, in the reporting period, a foreign company was paid by the Russian depositary a discount on securities and an amount on one of the grounds specified in clause 1 of Art. 309 NK. Section 3 for such a non-resident will be filled out twice.

The section contains 3 subsections:

| Subsection | Content |

| 3.1 | Recipient company details |

| 3.2 | Amounts of remuneration and accrued taxes |

| 3.3 | Payment beneficiary information |

If subsection 3.1 is filled in by recipient attribute codes, then subsection 3.2 should contain a breakdown by recipient number and for each case of transfer of funds.

Check whether you have correctly filled out the tax calculation of the amounts of income paid to foreign organizations and taxes withheld using the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

Calculation submission

Submit calculations of income paid to foreign organizations to the tax office at the location of the organization (paragraph 2, paragraph 1, article 289 of the Tax Code of the Russian Federation). The exception is organizations that belong to the category of largest taxpayers. They submit the calculation to the tax office at the place of registration as the largest taxpayer (paragraph 3, paragraph 1, article 289 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated November 9, 2010 No. ШС-37-3/15036).

The deadline for submitting the calculation is the 28th day of the month following the reporting period (clause 3 of Article 289 of the Tax Code of the Russian Federation). For example, submit your report for the first quarter no later than April 28. The final calculation drawn up at the end of the year must be submitted to the inspectorate no later than March 28 of the following year (clause 4 of Article 289 of the Tax Code of the Russian Federation).

An example of filling out a tax return on income paid to foreign organizations

On January 28, Alpha LLC paid dividends to its shareholder, Liberia Company (Netherlands), in the amount of 30,000 euros.

Paragraph 2 of Article 10 of the Agreement between Russia and the Kingdom of the Netherlands of December 16, 1996 and subparagraph 3 of paragraph 3 of Article 284 of the Tax Code of the Russian Federation provide for the same tax rates on dividends - 15 percent. Therefore, Alpha calculates the tax without a document confirming the permanent location of the company shareholder in the Netherlands.

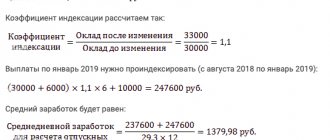

The amount of tax that must be withheld from the income of a foreign counterparty is equal to:

30,000 EUR × 15% = 4,500 EUR.

The conditional euro exchange rate on the date of transfer of tax to the budget is 85.84 RUB / EUR.

The amount of tax payable to the budget is equal to:

4500 EUR × 85.84 RUB/EUR = 386,280 RUB.

On April 28, Alpha submitted to the inspectorate a tax calculation of the amounts of income paid to foreign organizations and taxes withheld for the first quarter.

Section 3: Completion Procedure

Subsection 3.1 reflects the identification data of the income recipient. The peculiarities of filling it out is the ability not to fill in the address of the organization (line 040) for banking structures if they have a SWIFT code. And in lines 050–080 you need to enter data only if it is provided by a non-resident.

Structure of section 3.2. provides for an unlimited number of blocks from lines 010–190 for entering data on each transfer of remuneration using the unique non-resident number assigned in subsection 3.1. In this case, line 030 “Income symbol” is filled in only when settlements with non-resident banks have taken place.

Line 040 “Amount of income” generally involves indicating the full amount of the payment. But in certain paragraphs 3 of Art. 280 of the Tax Code of the Russian Federation and paragraph 1 of Art. 268 of the Tax Code of the Russian Federation, in cases it must be reduced by the amount of regulated expenses confirmed by documents provided by the non-resident. If a specific remuneration is not subject to tax on any basis, then in line 070 “Tax rate” the symbolic designation “99.99” must be displayed, and lines 080–140 must be left blank.

The procedure for filling out the calculation provides for the submission of section 3.3 only if there is information that the beneficiary of the payment is a person other than the recipient.

Subsection 3.1 section 3

For each unique number of section 3, fill out a separate subsection 3.1. In it, indicate information about the foreign organization to which the tax agent paid income in the last quarter (month).

Full name, country of registration (incorporation) code, address

This is the full name of the foreign organization - the recipient of the income. If it has a name in both Latin and Russian transcription, indicate both options in subsection 3.1. If the documents contain one version of the name (either Latin or Russian), indicate only that. If there is a document confirming the permanent location (residence) of the organization in a foreign country, rewrite the name from there.

At the bottom of subsection 3.1, provide the details of this document: date, number and country code according to the OKSM classifier.

Address of the foreign organization

Take the data for this detail from the primary documents on the basis of which the income of the foreign organization was paid (for example, from an agreement or contract). The line may not be filled in if the income was paid to the bank for which the SWIFT code is indicated below.

Taxpayer code in the country of registration (incorporation)/SWIFT code

Please provide your tax code or its equivalent here. It is assigned to a foreign organization in the country of registration (incorporation). Enter it if income is paid:

- to a foreign bank whose SWIFT code is unknown;

- another foreign organization.

If you know the SWIFT code of a foreign bank, enter it in this field.

Filling out section 2

Section 2 accumulates the data specified in Section 3, with the only exception: this section should not contain information about those payments for which the beneficiary is an individual.

The structure of Section 2 represents tax data on each remuneration, which must be reflected in a breakdown by income code from Appendix No. 2 to the Filling Out Procedure. In the case where the tax was not paid in the reporting period, but is payable or was paid in the future, you should pay attention to:

- if a foreign company received payment in Russian rubles, then the amount of tax on it is reflected in line 050 “Tax due at the end of the reporting period”, regardless of whether the tax was paid before the date of submission of the calculation;

- if payment is made in foreign currency, the amount of tax paid on the date of filing the tax calculation falls into line 050, and unpaid amounts should not appear either in line 050 of section 2 or in line 040 of section 1 (clauses 4.5 and 5.7 of the Filling Out Procedure).

Subsection 3.2 section 3

For each unique number of section 3, fill out a separate subsection 3.2. In it, indicate information about the income paid to the foreign organization in the last quarter (month) and the taxes withheld from them.

Serial number, code and symbol of income

Assign a number in order to each income that is paid to a foreign organization. For example, the first income is “000000000001”, the twentieth “000000000020”, etc. Fill out as many sheets of subsection 3.2 as the amount of income paid by unique number.

Take the income code from Appendix 2 to the Procedure approved by Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115. For example:

- 01 – dividends;

- 12 – income from the use of intellectual property rights in the Russian Federation;

- 17 – income from the sale of movable property.

Indicate the income symbol if the recipient of the income is a foreign bank. In other cases, put a dash in this field. Income symbols are given in the Rules for Accounting in Credit Institutions, approved by Bank of Russia Regulation No. 385-P dated July 16, 2012.

Amount of income before tax

In line 40, enter the income that is due to the foreign organization under the agreement - in the currency in which this income was paid. In some cases, it is not the entire amount of income that is taxed, but the difference between income and documented expenses. In particular, this rule applies to the sale of Russian real estate (subclause 6, clause 1, clause 4, article 309 of the Tax Code of the Russian Federation).

If there are documents confirming the expenses of a foreign organization, indicate in line 40 the difference between income and expenses. If there are no such documents, provide here the entire amount of income accrued under the agreement.

Currency code, date of payment of income, date of calculation (withholding) of tax

For line 050, take the currency code in which the foreign organization receives income from the All-Russian Currency Classifier.

On line 060, indicate the date when the money was debited from the bank account or issued from the cash register. If the income was paid in kind, enter here the date when the items were transferred. If the obligations are repaid by offset - the date when the agreement on it was signed. On line 080, indicate the day when the tax was calculated and withheld from the recipient’s income.

Tax rate

This line is for the tax rate at which tax is calculated on income paid to a foreign organization. Either fill in or cross out all cells in the field. For example, if the tax rate is 15 percent, enter “15.—” here, if the tax rate is 0 percent, enter “0-.—”. Profit tax rates are established by Article 284 of the Tax Code of the Russian Federation.

If preferential tax treatment is applied to the payment, please indicate here:

- reduced rate (for example, “7-.5-” – if the tax rate is 7.5%);

- “99.99” – if the income is exempt from taxation.

Apply benefits if a foreign organization has submitted documents confirming that its activities are subject to an international treaty (agreement on the avoidance of double taxation) (clause 1 of Article 312 of the Tax Code of the Russian Federation).

Place 3 dashes in lines 080–140 of subsection 3.2 of section if:

- income is exempt from taxation;

- tax rate 0 percent;

- the person has the actual right to income (in line 020 of subsection 3.3 of section 3 the code “2” or “4” is indicated). In this case, also cross out line 160.

This follows from paragraphs 2.4, 8.1 and 8.7 of the Procedure approved by Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115.

Tax amount and payment deadline to the budget

On line 100, indicate the amount of tax that was withheld from the income of the foreign organization - in the currency in which it received the income. To do this, multiply the amount of income before tax (line 040) by the tax rate (line 070).

The deadline for paying tax to the budget is the deadline established by paragraphs 2 and 4 of Article 287, as well as paragraph 11 of Article 310.1 of the Tax Code of the Russian Federation.

Official ruble exchange rate on the date of tax transfer to the budget

If a foreign organization received income in rubles, put a dash here. If the money was paid in foreign currency, indicate its exchange rate established by the Bank of Russia on the date when the tax was transferred to the budget.

Amount of tax in rubles and date of transfer of tax to the budget

The tax amount in rubles (line 140) is the product of the tax amount in foreign currency (line 100) and the official exchange rate on the date of payment of the tax to the budget (line 120). It happens that the tax agent did not remit the tax in the last quarter or month, since the deadline for payment fell on the next reporting (tax) period. In this case, the procedure for filling out line 140 depends on how the income was paid - in rubles or in foreign currency.

If a foreign organization received income in rubles, put a dash in line 130, and in line 140 - the tax amount in rubles. If the income is paid in foreign currency, it is important whether the withholding agent paid the tax before filing the calculation. If at this moment the tax is transferred to the budget, fill out both line 130 and line 140. If the tax is not transferred, put dashes in lines 120–140. Do not take into account the amount of this tax in line 040 of section 2 and in line 040 of section 1 of the calculation.

When calculating for the period in which the tax payment date fell, fill out a separate section 3 for the income from which the tax was withheld. Indicate there the amount of tax in rubles, the date of its payment and the official exchange rate on this date. Include the amount of tax paid in line 040 of section 2 and line 040 of section 1.

Such rules are established by clause 8.13 of the Procedure approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115.

Code of actual right to income

The actual right to income paid to a foreign organization may not be held by it, but by someone else. Enter here the code from Appendix 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115. For example:

- 00 – if the tax agent does not know who has the actual right to the income;

- 01” – if the tax agent knows who has the actual right to the income.

Basis for reduced tax rate or tax exemption

A reduced tax rate or exemption of income from tax may be established by the Tax Code of the Russian Federation or an international treaty (agreement). Indicate in line 160 of subsection 3.2 of section 3 the desired subclause, paragraph, article of this document. Fill in the cells of the field with capital letters, and put dashes in the remaining empty cells.

Information about the issuer of issue-grade securities

Fill in this field if you paid a foreign organization income on equity securities (except for income on state or municipal securities).

How to fill out section 1 and title page

The first section of the report contains summarized data on the amounts of accrued tax, divided by BCC. The section structure allocates a block of four lines for each KBK. The organization submitting the calculation must fill out such a block for each payment of remuneration in accordance with section 3. Similar to section 2, data on payments of which the beneficiary is a private person will not be included here.

The title page displays the identification data of the tax agent, adjustment number, reporting period and year. Data about the reorganized enterprise (form and INN/KPP) are filled in only if there has been a reorganization of the tax agent.

Check the calculation before sending using the control ratios issued by the Federal Tax Service. Details here.

Title page

On the title page, indicate general information about the organization - tax agent.

TIN and checkpoint

At the top of the sheet, indicate the TIN and KPP of the organization. Take the TIN and KPP from the registration notice issued by the Federal Tax Service of Russia upon registration. Fill out the cells reserved for the TIN, starting from the first cell. Place dashes in the remaining free cells.

If the calculation is submitted by the largest taxpayer, indicate the checkpoint assigned by the interregional or interdistrict inspection (clause 5 of the appendix to the order of the Ministry of Finance of Russia dated July 11, 2005 No. 85n). Take it from the notice of registration as the largest taxpayer.

Correction number

How to fill out this field depends on what kind of calculation the organization submits. If this is the usual (first) calculation for the period, put “0—” in the “Adjustment number” field. It’s another matter if the organization has already submitted calculations for the past period, but wants to correct some information in it. In this case, enter the serial number of the correction (for example, “1—” if this is the first clarification, “2—” for the second clarification, etc.).

Tax (reporting) period

In the line “Tax (reporting) period (code)”, indicate the code of the period for which you are submitting the calculation. The calculation is made for the reporting (tax) period in which the tax agent actually paid income to foreign organizations (clause 1 of Article 310 of the Tax Code of the Russian Federation). Tax agents who report income taxes quarterly and monthly fill out the “Reporting (tax) period” field differently. For example:

- code 21 – for the first quarter;

- code 34 – for the year when submitted quarterly;

- code 37 – three months;

- code 46 – for a year with monthly filing.

All codes for this field are given in Appendix 1 to the Procedure, approved by Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115.

In the “Reporting year” line, reflect the year for which you are submitting the calculation. Let's assume you are filing a tax return in 2016 for the first quarter of 2016. Then enter “2016” here.

Submitted to the tax authority

Submit your tax calculation to the inspectorate at the location of the organization. If the organization is classified as the largest, submit the calculation to the inspectorate at the place of registration as the largest taxpayer (clause 1 of Article 289 of the Tax Code of the Russian Federation). In the line “Submitted to the tax authority...” enter the inspection code. It is indicated in one of the documents issued by the Federal Tax Service of Russia:

- notification of registration;

- notification of registration as a major taxpayer.

In the line “at location (accounting) (code)”, enter the code depending on the capacity of the organization submitting the calculation. So, for example, provide the code:

- 214 – if this is an ordinary organization;

- 213 – if it is the largest taxpayer;

- 245 – if it is a permanent representative office of a foreign organization;

- 335 – if this is a separate division of a foreign organization in Russia.

The codes for this line are given in Appendix 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/115.

Name of the organization

In the line “Full name of the organization”, indicate the name of the legal entity exactly as stated in the constituent documents. If it is registered in Latin transcription, enter it. Enter capital letters of the name into the cells of the field, starting from the left edge. In the cells that are left empty, put dashes.

Reorganization or liquidation

Fill out the lines “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” only if you are submitting a payment for the reorganized organization. In other cases, put dashes here. If the reorganized organization has not submitted calculations for the last year before the date of deregistration, it is submitted by the legal successor to its tax office.

On the cover page of the payment for the reorganized organization, indicate:

- in the field “at location (registration)” - code “215” (at the location of the legal successor who is not the largest taxpayer) or “216” (at the place of registration of the legal successor who is the largest taxpayer); 0 – upon liquidation;

- in the upper part of the title page - TIN and KPP of the successor organization;

- in the fields “Full name of the organization”, “TIN/KPP of the reorganized organization” - the name, TIN and KPP of the reorganized organization.

In the “Form of reorganization (liquidation) (code)” field, enter the code, for example:

- 0 – upon liquidation;

- 1 – during reorganization in the form of transformation;

- 2 – during reorganization in the form of a merger.

This is provided for in clause 2.5 of the Procedure approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. MMV-7-3/115. Codes for forms of reorganization and liquidation are given in Appendix 1 to this Procedure.

Telephone

In the line “Contact telephone number”, indicate the mobile or landline telephone number of the accountant or tax representative, that is, the one who prepared the calculation.