A limited liability company is a commercial entity created to make a profit. LLC participants can receive their share of income from the business only after making a decision on the distribution of profits and withholding taxes. What is the tax on dividends in 2022? The tax rate on dividends in 2022 depends on which category the participant belongs to (individual or legal entity), and on several other important criteria, which we will consider further.

Free tax consultation

Dividend tax for individuals in 2022

The taxation of dividends from individual participants depends on their status: whether they are recognized as residents of the Russian Federation at the time of payment of income. The tax rate on dividends in 2022 is:

- 13% for resident individuals (with income up to 5 million rubles per year);

- 15% for non-resident individuals, as well as for residents with income over 5 million rubles per year.

The status of a Russian resident depends on how many calendar days over the last 12 months the participant was actually in Russia. If there are at least 183 such days (not necessarily in a row), then the citizen is recognized as a resident of the Russian Federation. Periods spent abroad for valid reasons, such as treatment and training, are not taken into account (Article 207 of the Tax Code of the Russian Federation).

Citizenship does not affect the status of a resident of the Russian Federation, so it can also be a foreign founder if he has actually been in Russia for most of the last 12 months.

The company itself is obliged to withhold personal income tax from dividends in 2022 for transfer to the budget. For individuals receiving income from business, the company is a tax agent. The founder is paid dividends after taxation, so he does not have to independently calculate and transfer personal income tax.

However, if dividends are not transferred in cash (fixed assets, goods, other property), then the situation changes. The tax agent cannot withhold the tax amount for transfer, because funds, as such, are not paid to the participant. In this case, the LLC is obliged to inform the inspectorate about the impossibility of withholding personal income tax.

Now all responsibilities for paying personal income tax are transferred to the participant himself who received dividends in property. To do this, at the end of the year, you need to submit a declaration in form 3-NDFL to the Federal Tax Service and pay the tax yourself.

Additional difficulties when paying the founder non-monetary income are due to the fact that the Federal Tax Service and the Ministry of Finance have long recognized such a transfer of property as a sale, because this involves a change of owner (for example, letter from the Ministry of Finance dated 02/07/18 No. 03-05-05-01 /7294). And when selling property, its value must be taxed, depending on the taxation system on which the company operates:

- VAT and income tax (for OSNO);

- single tax (for simplified tax system).

This results in a truly absurd situation when property transferred as dividends is taxed twice:

- Personal income tax paid by the founder;

- tax on “sales” in accordance with the regime that the Federal Tax Service obliges the company itself to pay.

Judicial practice on this issue has developed contradictory, however, in one of the latest rulings (dated 07.29.21 No. 302-ES21-11699), the Supreme Court recognized that there is no implementation in this case, therefore it is impossible to levy additional tax on the LLC. However, the risk of tax disputes still exists.

Calculation of personal income tax on dividends from 2022

According to Art. 43 of the Tax Code, dividends - any income that is received by a shareholder (participant) when distributing net profit among owned shares or shares in proportion to the contribution to the authorized (joint) capital. In addition, dividends are any income that is received from sources outside the Russian Federation and relates to dividends under the laws of another country.

According to paragraph 3 of Art. 214 of the Tax Code, if the source of dividends is a domestic legal entity, then it is a tax agent.

As for dividends from equity participation in the company’s activities, the following personal income tax rates are established for them on the basis of Art. 224 NK:

- 13% - for individual residents of the Russian Federation with income up to 5 million rubles. and 15% from income more than 5 million rubles. per calendar year. The rule was established from January 1, 2022 (clause 1 of Article 224 of the Tax Code);

- 15% - for non-resident individuals of the Russian Federation on the basis of clause 3 of Art. 224 NK. Such individuals include preferential non-residents, for example, highly qualified foreign specialists, stateless persons, foreign workers with a patent, etc. A 15% tariff is used for non-residents, unless other tariffs are specified in double tax treaties with other countries (Article 7 NK). When, according to the agreement, this type of income is not subject to personal income tax in Russia at all, then the paying party does not have the obligation to withhold tax.

Citizen status (resident or non-resident) is established at the time of payment of dividends. A tax non-resident is an individual who stays in the Russian Federation for less than 183 days for 12 consecutive months (Clause 2 of Article 207 of the Tax Code). When determining status, the citizenship, place of birth or residence of an individual is not taken into account. A citizen of the Russian Federation can also be a tax non-resident.

The tax base for dividends is the sum of all dividends received in a calendar year (Letter of the Federal Tax Service dated June 22, 2021 No. BS-4-11/8724).

For example, in the 1st quarter, a resident received dividends of 3 million rubles. Personal income tax is calculated at a rate of 13%. In the 2nd quarter, he again received dividends - 3 million rubles. Personal income tax is calculated at a rate of 13% from 2 million rubles. and at a rate of 15% from 1 million rubles, because Since the beginning of the calendar year, dividends have been paid in the total amount of 6 million rubles. and there is an excess of the tax base.

In addition, it must be taken into account that when calculating personal income tax, tariffs of 13% and 15% are applied separately to each set of tax bases based on articles of the Tax Code. For example, according to paragraph 1 of Art. 224 of the Tax Code, personal income tax is calculated on dividends, and according to paragraphs. 2-9 clause 2.1. Art. 210 Tax Code - other tax bases. They must be counted separately. Let’s say that in the 1st quarter, a resident individual received a salary of 4 million rubles. and dividends in the amount of 3 million rubles. In both cases, personal income tax will be calculated at a rate of 13%, since there is no excess for both tax bases, and they should not be summed up. The 15% personal income tax rate will begin to apply only if the specific tax base (separately for dividends or wages) exceeds the established limit - 5 million rubles.

These rules must be used for domestic companies (personal income tax agents) that pay dividends to residents of the Russian Federation, as well as for resident citizens who independently pay personal income tax on dividends received (income received from a foreign company not registered in Russia).

Calculation of personal income tax on resident dividends is carried out on an increasing basis from the beginning of the calendar year.

According to paragraph 3 of Art. 214 of the Tax Code, when the source of dividends is a Russian legal entity, it is a tax agent, and therefore must determine the amount of personal income tax separately for each taxpayer in relation to each payment of income at the rates determined in Art. 224 Tax Code, taking into account the provisions of clause 3.1 of Art. 214 NK.

At this point, it may seem that the calculation of personal income tax on dividends is carried out not incrementally, but separately for each payment. However, the article contains a clarification regarding the tax rate - “according to the tax rates provided for in Art. 224 NK". The specified rates are also provided for dividend payments. For them, paid to residents, a tax rate is provided on the basis of clause 1 of Art. 224 NK (13% + 15%). For these incomes, on the basis of clause 2.1 of Art. 210 of the Tax Code provides for the determination of the aggregate base. And in accordance with paragraph 3 of Art. 226 of the Tax Code, which regulates the calculation of personal income tax on an accrual basis from the beginning of the tax period from 2022, removed the exception for dividends. In other words, now when paying dividends to a resident, personal income tax is calculated in the same way - on an accrual basis. This approach does not apply to dividends, which are subject to different personal income tax rates. The tax authorities clarified this point in their Letter dated June 22, 2021 No. BS-4-11/8724.

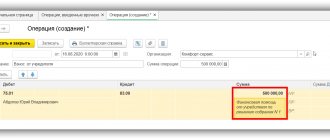

When dividends are paid, the amount of personal income tax is calculated on the date of actual income received. For dividends, this is the day of their payment (transfer to the taxpayer’s current account or, on his behalf, to the account of other persons). When dividends are paid in kind (in goods, property, etc.), the date of their actual receipt is the moment of transfer of income in kind.

Personal income tax is withheld when dividends are paid. If they are paid in kind, then tax is withheld from any income that is paid by the tax agent to the taxpayer in cash. It is important to take into account that the withheld personal income tax should not exceed 50% of the amount of cash income paid (clause 4 of Article 226 of the Tax Code).

Personal income tax payment deadline:

- for dividends from a joint-stock company - no later than 1 month from the date of payment of income (clause 4 of article 210, clause 9 of article 226.1 of the Tax Code);

- for dividends from an LLC - no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code).

Important! If the decision to pay dividends was made in one year, and the payment itself was made in another year, personal income tax must be calculated and withheld when paying the funds, and not when making a decision about it. In reporting, dividends will be reflected on the date of income actually received - that is, in the period when they were actually paid, and not when the decision was made or the payment was accrued.

When a Russian company pays dividends to an individual resident of the Russian Federation, but does not itself receive dividends from other legal entities, personal income tax from 2022 should be calculated as follows:

When a domestic company receives dividends from other legal entities, and income tax is calculated and withheld from them, and after that the profit is divided between participants - resident individuals, personal income tax from 2022 is calculated according to the updated rules on dividends and is reduced by the income tax paid (p 3.1 Article 214 Tax Code).

Then personal income tax should be calculated as follows:

where Znp is the amount of corporate income tax that is subject to offset, calculated in proportion to the individual’s share of participation in the company paying him dividends.

Amount of income tax to be credited:

where BZ is an indicator equal to the smallest of these values:

- the amount of income from equity participation on which the amount of personal income tax is calculated;

- the product of indicators K and D2, where K is the ratio of the amount of the taxpayer’s dividends to the total amount of dividends, and D2 is the amount of dividends received by the company, determined according to the rules of clause 5 of Art. 275 NK.

Important! The offset does not apply to dividends paid by a foreign company (with the exception of a foreign company acting in the interests of third parties and the actual recipients of dividends are residents of the Russian Federation).

Calculation of personal income tax when paying dividends to non-resident individuals is carried out as follows:

In this case, it does not matter whether the company distributing dividends itself receives dividends from other organizations or not.

For income from equity participation in the company's activities, personal income tax deductions specified in Art. 218-221 of the Tax Code do not apply (clause 3 of Article 210 of the Tax Code).

The payment of dividends is not subject to insurance premiums, since it is not remuneration under employment or civil servants' contracts (clause 1 of article 420 of the Tax Code, clause 1 of article 5, clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

Dividend tax for legal entities in 2022

A participant in a limited liability company can be not only an individual, but also a legal entity (Russian or foreign company). Taxation of dividends paid by legal entities in 2022 is carried out according to the standards established by Article 284 of the Tax Code of the Russian Federation.

| Tax rate on dividends in 2022 for organizations | |

| Russian organization | 13 percent |

| A Russian organization, if for at least 365 calendar days before the decision to pay dividends is made, it owns a share of at least 50% in the authorized capital of the organization that is the source of the payment. | zero |

| Foreign organization | 15 percent or other rate if provided for by an international agreement for the avoidance of double taxation |

As we can see, if a Russian organization has at least 50% in the authorized capital of another Russian company, then no income tax is levied on dividends received (zero rate). To confirm this benefit, the participant-legal entity must submit to the inspection documents confirming the right to a share in the capital of the organization paying the income.

Such documents may be:

- contract of sale or exchange;

- decisions to divide, spin off or convert;

- court decisions;

- agreement on establishment;

- deeds of transfer, etc.

Income tax on dividends in 2022 is also established for legal entities that operate under special regimes (USN or Unified Agricultural Tax). In relation to the income they receive from their activities, such legal entities do not pay income tax. However, exceptions are made for income received from participation in other organizations:

- for companies using the simplified tax system, the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation apply;

- For companies on the Unified Agricultural Tax, the norms of paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation apply.

These articles explicitly state that the special tax regime does not apply to profits received from participation in other enterprises.

Thus, the tax on dividends of a legal entity for 2022 is paid in the form of income tax (at the rates indicated in the table), even if, in general, a company under a special regime is exempt from paying this tax.

As in the case of an individual participant, the tax agent obligated to withhold and remit income tax is the organization that paid the dividends. The tax payment deadline is no later than the day following the day of payment (Article 287 of the Tax Code of the Russian Federation).

Tax rates

An organization can both pay dividends and receive them. In both cases, it may have obligations to pay tax on income in the form of dividends to the budget. In this case, an organization can act as either a tax payer or a tax agent both for income tax ( clause 2 of Article 275 of the Tax Code of the Russian

) and for personal income tax (

clause 2 of Article 214 of the Tax Code of the Russian Federation

)

Based on clause 3 of Art. 284 Tax Code of the Russian Federation

The following rates apply to dividend income:

1) 6 percent - on income received in the form of dividends from Russian organizations by Russian organizations and individuals - tax residents of the Russian Federation;

2) 15 percent - on income received in the form of dividends from Russian organizations by foreign organizations, as well as on income received in the form of dividends by Russian organizations from foreign organizations

.

Individuals -

tax residents of the Russian Federation are citizens of the Russian Federation, foreign citizens and persons who are actually on the territory of the Russian Federation for at least 183 days in a calendar year

(

Article 11 of the Tax Code of the Russian Federation

).

Any income of individuals who are not tax residents of the Russian Federation, including income in the form of dividends, is subject to personal income tax at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation

).

Calculation formula

Concluding our consideration of the question of what taxes dividends are subject to in 2022, we present the calculation formula from Article 275 of the Tax Code of the Russian Federation. You need to know about it if dividends are paid by a company that itself has received profit from participation in another organization.

Н = К x Сн x (D1 – D2)

- N - amount of tax to be withheld;

- K is the ratio of the amount of dividends to be distributed in favor of their recipient to the total amount of distributed profit;

- Сн - tax rate;

- D1 - the total amount of dividends distributed in favor of all recipients;

- D2 - the total amount of dividends received by the organization itself in the current and previous reporting (tax) periods, if they were not previously taken into account when calculating income.

At the same time, indicator D2 does not include dividends, to which a zero profit tax rate is applied.

This formula must be applied when calculating taxes on dividends in 2022, which are paid to Russian legal entities and individual residents of the Russian Federation. For other categories of LLC participants, tax is calculated according to the rules of paragraph 6 of Article 275 of the Tax Code.

Payment of dividends to foreign legal entities

If among the shareholders (participants) of Russian organizations there are foreign legal entities that are not registered for tax purposes in the Russian Federation, then the dividends paid to them are recognized as income received from sources in the Russian Federation and must be subject to income tax at the source of payment ( clause 1 of Article 309 Tax Code of the Russian Federation

).

The organization withholding income tax is recognized as a tax agent for each such payment. The tax base is determined as the amount of dividends paid and a rate of 15% is applied to it ( clause 3 of Article 275

and

subclause 2 of clause 3 of Article 284 of the Tax Code of the Russian Federation

).

Double taxation agreements between the Russian Federation and foreign countries (if any) should also be taken into account. Thus, many of them contain provisions establishing specific or maximum rates for taxation of dividends, as well as non-discrimination rules, according to which taxation of non-residents in Russia should not be more burdensome than taxation of residents of the Russian Federation. Despite the fact that in this case the international treaty comes into conflict with the Tax Code of the Russian Federation, which determines the rate of income tax, on the basis of Art. 7 Tax Code of the Russian Federation

the rules and norms of international agreements of the Russian Federation should be applied.

The foreign person may therefore be exempt from withholding taxes or be eligible for reduced tax rates on the dividend income it pays. To do this, it is necessary to provide the tax agent paying the income with confirmation that this foreign organization has a permanent location in the state with which the Russian Federation has an international treaty (agreement) regulating taxation issues, which must be certified by the competent authority of the relevant foreign state

(

p 1 Article 312 of the Tax Code of the Russian Federation

).

Requirements for the form of documents confirming the permanent residence of organizations in a foreign state are given in the Methodological recommendations to tax authorities on the application of certain provisions of Chapter 25 of the Tax Code of the Russian Federation

[5].

The amount of tax withheld from the income of foreign organizations is transferred by the tax agent to the federal budget simultaneously with the payment of income either in the currency of payment of this income, or in the currency of the Russian Federation at the official exchange rate of the Central Bank of the Russian Federation on the date of transfer of the tax ( clause 1 of Article 310 of the Tax Code of the Russian Federation

).

In the tax return for corporate income tax

[6], the amounts of income paid to foreign organizations are reflected on line 030 of section A of sheet 03.

Based on the results of the reporting (tax) period, within the time limits established by Art. 289 Tax Code of the Russian Federation

, the tax agent submits to the tax authority at its location information on the amounts of income paid to foreign organizations and taxes withheld for the past reporting (tax) period in the form established by the Ministry of Taxes of Russia[7] (clause

4 of Article 310 of the Tax Code of the Russian Federation

).

Instructions for filling out this calculation are given in Order of the Ministry of Taxes of the Russian Federation No. SAE-3-23/287

[8]

Example 1

.

The organization awarded dividends in the amount of 30,000 rubles to an Iraqi company that does not have a representative office in the Russian Federation.

Since a foreign organization does not have a representative office in Russia, when paying dividends, the tax agent must withhold and pay the amount of income tax to the budget. Due to the fact that there is no double taxation agreement between the Russian Federation and the Republic of Iraq, dividends received by an Iraqi company will be taxed at a rate of 15%. The amount of income tax will be equal to 4,500 rubles. (30,000 rubles x 15%) and must be transferred to the budget within 10 days from the date of payment of income (clause 4 of article 287 of the Tax Code of the Russian Federation

).

We draw the attention of readers

: the list of foreign countries with which the Russian Federation does not have double taxation agreements is given in

Letter No. FS-6-26/360

[9].

Tax payment deadlines

Dividends must be paid to shareholders (participants) within the time limits established by civil law. Thus, dividends to a joint-stock company are paid within the period determined by the company’s charter or a decision of the general meeting of shareholders. If the company's charter does not specify the period for payment of dividends, the period for their payment should not exceed 60 days from the date of the decision to pay dividends

(

clause 4 of Article 42 of the Law “On Joint-Stock Companies”

).

The tax agent must transfer to the budget the income tax withheld when paying income in the form of dividends within 10 days from the date of payment of income ( clause 4 of Article 287 of the Tax Code of the Russian Federation

).

A joint stock company paying dividends to its shareholders may make the payment in several stages. In this case, in accordance with the requirements of paragraph 5 of Art. 286

and

clause 4 of Art.

287 of the Tax Code of the Russian Federation, the amount of tax is determined in relation to each payment of the specified income and is transferred to the budget by the tax agent making the payment within 10 days from the date of payment of the income.

The tax agent must transfer personal income tax no later than the day of actual receipt of cash from the bank for payment of income, as well as the day of transfer of income to the taxpayer’s bank accounts. If income is paid in kind, then the tax must be transferred no later than the day following the day of actual deduction of the calculated amount of tax ( clause 6 of Article 226 of the Tax Code of the Russian Federation

).

Payment of dividends to shareholders applying the simplified taxation system

An organization paying dividends to a Russian organization must have information about whether the latter has switched to a simplified taxation system. The fact is that the payment of a single tax by these taxpayers replaces, in particular, the payment of income tax (for an organization) and personal income tax (for individual entrepreneurs) ( Article 346.11 of the Tax Code of the Russian Federation

).

The dividends received are taken into account by them as part of non-operating income participating in determining the object of taxation under the single tax ( clause 1 of Article 346.15, clause 1 of Article 250 of the Tax Code of the Russian Federation

), and are taxed at a rate of 6 or 15% depending on the selected object of taxation.

Due to the fact that these persons are not taxpayers of income tax and personal income tax, there is no need to withhold these taxes when paying them income in the form of dividends. But in order to avoid possible claims from the tax authorities, the organization paying dividends must have the necessary confirmation that the organization receiving the income is using the “simplified tax system”.

For the attention of readers: By Letter of the Ministry of Finance of the Russian Federation dated March 11, 2004 No. 04-02-05/3/19

[11] it was established that if organizations using the simplified tax system pay dividends, then they need to keep accounting records.