A contract for the provision of gratuitous services implies an agreement under which one party undertakes to perform certain actions and provide services to the other party without charging a fee for it.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

This type of agreement is not enshrined in the Civil Legislation, however, due to the principle of freedom of contract, the parties can enter into an agreement free of charge. This type of transaction is often used in the field of charity, when foundations or organizations provide services not related to making a profit. Or, the specified agreement may be some kind of trick in order to avoid taxation.

Subjects under a contract for the provision of services free of charge can be both individuals and legal entities.

Below we will go through step by step how to draw up such a document and what nuances you should pay attention to when drawing it up.

Agreement for the provision of free services

Kurgan

January 17, 2023

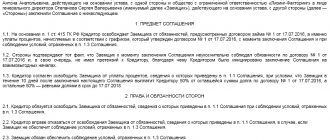

RRC "Scientific Center" represented by General Director Albert Albertovich Pavlov, acting on the basis of the Charter, hereinafter referred to as the Customer on the one hand, and Stroy LLC, represented by General Director Mikhail Stanislavovich Mikhailov, acting on the basis of the Charter, hereinafter referred to as the executor on the other hand We have entered into this agreement as follows:

The preamble of the document traditionally includes:

- name of the type of transaction;

- place and date of conclusion of the contract;

- names and roles of the parties to the agreement.

The essential terms of the contract for the provision of services free of charge are:

- subject of the agreement;

- term of provision of services;

- duties of the parties;

- responsibility of the parties.

Contract for free performance of work and provision of services: features

The main feature of a contract for the gratuitous performance of work or services is that the performer does not receive remuneration. This clause must be specified in the contract. Otherwise, regulatory authorities or the court will consider the work paid.

Another feature is the restrictions for individual entrepreneurs and legal entities. The activities of entrepreneurs and companies are aimed at making a profit, so transactions between them require payment. An agreement to perform work or provide services free of charge can only be concluded if one of the parties receives a benefit in the amount of no more than 3,000 rubles. (Subclause 4, Clause 1, Article 575 of the Civil Code of the Russian Federation)

Item

Information about the subject appears in the initial paragraphs of this document. The subject in this case is the services themselves, which are provided free of charge. It will look like this:

The Contractor undertakes to provide the services specified in the contract, and the Customer undertakes to accept them. The Contractor provides the following services: Installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345), located at the address: Kurgan region, Kurgan city, Mashinostroiteley Avenue 333B. The contractor can provide services both personally and with the involvement of third parties. The period for installation of air conditioners is 2 (Two) calendar days from the date of signing this agreement. Carrying out the work does not entail payment, since the contract is concluded free of charge.

In what cases is it impossible to conclude?

Quite often, a gratuitous agreement is equated or confused, they do not know how to formulate it correctly, but, nevertheless, this peculiarity is observed due to the fact that in our law there are no certain conditions under which this type of agreement must be drawn up.

But what is known for certain is that not everyone can draw up such a “free” contract. This especially applies to this type of contract that provides for the donation of an item.

In addition, commercial organizations cannot and simply do not have the right to negotiate . Since it is believed that the purpose of this type of structure is primarily to make a profit .

Money the main and final goal of absolutely any activity of entrepreneurs. Consequently, transactions that are concluded between several organizations cannot be considered free of charge.

For other people, who are legal entities and individuals, there are no restrictions regarding the conclusion of an agreement.

Duties of the parties

This section sets out the obligations between the Counterparties. Such a clause may indicate various obligations by mutual agreement of the parties, but we will focus on the basic wording. So this section looks like this:

The Contractor undertakes to: Perform the installation of air conditioners of the Subtropic SUB-07HN1_18Y brand in three work rooms of the Center (rooms numbered 343; 344; 345). Provide air conditioner installation services properly. The criterion for the quality of work performed is the normal functioning of air conditioners in work rooms. Complete the work within 2 (Two) calendar days from the date of conclusion of this agreement. The Customer undertakes to: Provide assistance when the Contractor performs the work in the form of providing all necessary documentation related to the fulfillment of the obligation under the contract. Provide the necessary conditions for the Contractor to carry out the work. Upon completion of the work by the contractor, accept these works by drawing up an act of acceptance and transfer of completed work.

Contract for the provision of accountant services: main nuances

An agreement for the provision of accountant services is a document that describes the conditions of joint work, the rights of the parties and the responsibility of a company or individual entrepreneur when ordering the services of a third-party accountant. The features of its preparation, possible risks and ways to eliminate them will be discussed in this material.

Agreement for the provision of accounting services: description and main provisions

When using the services of a freelance accountant, not an employment agreement should be concluded with him, but an agreement for the provision of paid services in accordance with the norms of Chapter. 39 of the Civil Code of Russia. The parties to this transaction are the client (company or individual entrepreneur) and the performer (an individual accountant or a company providing such services).

In this case, the accountant must provide accounting support for the company’s activities for a specified period of time, and the client must pay for its services.

Paragraph 2 of Article 779 of the Civil Code of Russia states that the contract for the provision of services, in addition to the relevant provisions of Chapter. Article 39 of this code also regulates the rules of contract transactions. That is, when compiling a list of the main conditions and powers of the client and the outsourcer, the norms of Articles 702-729 of the Civil Code of Russia should also be taken into account.

The contract in question is drawn up on paper. It is advisable to define the following conditions in the document:

- the subject of the agreement (clause 1 of Article 779 of the Civil Code of Russia) is a list of services that can be specified both in the main agreement and in the corresponding appendix. The most important condition;

- price of service or rules for determining it (Article 781 of the Civil Code of Russia). This condition is not considered significant, but it is advisable to agree on it, since the agreement is of a compensatory nature;

- term of service provision (initial and final) (clause 1 of Article 708 of the Civil Code of Russia). This condition is not considered significant, but it is advisable to agree on it.

A transaction that involves the provision of accountant services is drawn up on paper. There are no special requirements for it, for example, state registration or certification by a notary.

Obligations and responsibilities of the client and the outsourcer, example of an agreement for the provision of third-party accountant services

The client is obliged not only to pay for the services of the outsourcer, but also:

- provide the specialist with primary accounting documentation (invoices, acceptance certificates, etc.) in a timely manner and explain their contents;

- provide him with timely information about transactions, employment contracts, hired employees, open bank accounts, etc.;

- prepare instructions for the specialist’s work, approved by the company’s management;

timely sign the reports prepared by the outsourcer, evaluate the results of its activities (reporting documents).

Main responsibilities of an accountant:

- execution of instructions from the company’s management, timely and proper preparation of reports in accordance with the provisions of the legislation “On Accounting...” dated December 6, 2011 No. 402, current regulations and standards;

- representing the interests of the company in bilateral relations with tax authorities;

- preparation of explanations for accounting, warning the company’s management about possible unfavorable consequences of concluding certain transactions or carrying out any operations;

- periodically providing the head of the company with reports on work performed, etc.

Responsibility of the customer and contractor

The responsibility of the customer and the contractor for untimely or poor-quality performance of obligations is described in the provisions of the Civil Code of Russia on contracts. If shortcomings are identified in the work of the contractor, the client, in accordance with the norms of paragraph 1 of Article 723 of this code, has the right to demand (at his discretion):

- eliminate defects free of charge;

- reduce service costs proportionately;

- reimburse the company's costs for eliminating defects by third parties.

Article 782 of the Civil Code of Russia states that the client and the contractor may unilaterally declare their refusal to fulfill the terms of the contract. In this case, the client is obliged to compensate all the costs incurred by the specialist, and the outsourcer is obliged to compensate the costs incurred by the client.

Risks of ordering the services of a third-party specialist: how to protect yourself in a contract

The main advantage of hiring the services of an outsourced accountant is profit and stability. Paying a monthly subscription fee for the services of such a specialist is much cheaper than paying wages to an employee, from whom you also have to make insurance contributions to the funds and contribute 13% of personal income tax. Also, the hired specialist will not go on sick leave or vacation without completing his tasks.

However, there are some risks that can be minimized in an agreement with an outsourcer:

- under-receipt of services (expectation contradicts reality). If a full-time employee fulfills all the requirements, then an hired employee fulfills only the terms of the contract. It is necessary to describe in detail the services provided by the outsourcer in the agreement. It is advisable to indicate approximate volumes, for example, for transactions over 7 days;

- failure to receive important information and accounting documentation from counterparties. Who collects the data - the manager collects and provides it to the accountant, or the contractor does everything independently. In the second case, the outsourcer will need to pay additionally;

- ignoring the demands of tax authorities. It is important to specify in the contract who interacts with the tax and other authorities - the contractor or the company’s management;

- responsibility for shortcomings in tax accounting and accounting, preparation of reports. It is important to clearly state in the contract that the accountant is responsible for errors. Otherwise, the customer’s manager will be responsible;

- loss of control over the outsourcer’s work. The contract must clearly indicate in which service accounting is carried out, acceptable methods of client control, for example, access of both parties to the accountant’s cloud;

- loss of significant information when replacing an outsourcer. Specify in the contract how a certain specialist who keeps records is replaced, for example, upon dismissal;

— leakage of data of commercial value. Indicate in the contract a clause on the confidentiality of data provided to the outsourcer during the provision of services, determine liability for failure to comply with this condition. Even if the company does not have a trade secret regime, such a measure will be effective.

So, in an agreement with an outsourcer, it is important to define the subject of the transaction - the provision of certain paid accountant services.

It is also advisable to indicate in the document the price of service and the timing of the work. In this case, it is important not only to clearly and in detail describe the responsibilities of the outsourcer, but also to agree on the liability that will arise for the specialist under the contract if his obligations are violated. all articles

Responsibility of the parties

The text of the document contains information about the circumstances in the event of which the parties bear mutual financial liability. This clause is an integral component of this type of agreement. These provisions are written as follows:

The parties bear financial responsibility for non-fulfillment or improper fulfillment of their obligations under this agreement. In the event of damage to the Customer, work rooms, air conditioners when performing the work specified in the paragraphs of this document, the contractor bears financial liability. In the event of equipment breakdown due to the fault of the Contractor, which arose during the installation process, the Customer has the right to demand compensation for damage.

Free contract

The possibility of concluding a gratuitous contract is indicated in Art. 423 of the Civil Code of the Russian Federation, according to which an agreement is recognized as such if one party undertakes to provide something to the other party without receiving payment or any other counter-provision from it. At the same time, the Civil Code does not stipulate the procedure and conditions of a gratuitous contract for the provision of services.

A peculiarity of agreements on the performance of work and the provision of services on a free basis is the absence of conditions on remuneration for goods supplied or services performed, while a block of information about responsibility for failure to fulfill obligations assumed must be present. The absence of requirements for payment for services does not mean that one of the parties has the right to fulfill its obligations partially or in full, but in violation of other standards. Thus, the characteristic features of gratuitous contracts are the absence of payment terms and requirements for the payment of penalties or compensation for damages for improper or incomplete fulfillment of obligations.

The contract specifies the following conditions:

- the name of the document in which the gratuitous condition will appear;

- date and place of conclusion of the agreement;

- details of all parties involved;

- the subject of the agreement with a detailed description of the services or work performed and the deadline for their implementation;

- guarantees that the parties to the transaction will fulfill their obligations;

- contract time;

- signatures of the parties.

Final provisions

This section contains general information based on the content of the contract. Thus, the conditions for drawing up the contract may be indicated, that is, in how many copies it is drawn up. Also, from what moment does the contract begin to have legal force, and in what order can the transaction be terminated? The design of such a section looks like this:

This document is drawn up in 2 (two) copies, one copy for each party. This agreement has legal force from the moment it is signed by the Counterparties and terminates after the Parties fulfill their obligations under this agreement. This agreement may be terminated unilaterally at any time during its validity. In case of unilateral refusal to fulfill obligations, the party initiating the termination of the contract is obliged to notify the other party of its intentions no later than 1 (One) calendar day.

At the end of the document, the details of the parties are indicated and after signing the agreement, the contract is considered concluded.

Benefits of outsourcing accounting services

Small companies and enterprises (including those owned by individual entrepreneurs) are not always interested in hiring a permanent employee to provide accounting services, since they simply do not have enough work for him. In this case, outsourcing, that is, turning to third-party competent specialists to provide one-time or periodic services, is a rational solution to the issue.

Benefits of outsourcing:

- receiving quality services at the right time and in the required volume;

- possibility of reducing the company's staff. Accordingly, wages and other necessary deductions are reduced;

- the organization will focus all its efforts on its core activities;

- a third-party organization brings in professionals who specialize in a specific area.

In this case, a written contract for accounting services must be concluded. Only in this case will both parties have guarantees of fulfillment of obligations. The agreement describes in detail its subject matter and regulates the responsibilities of each counterparty (including the performance of clearly defined work and their payment at the specified rate and within the established time frame). In case of violation of obligations, only if you have a written document you will be able to protect your rights in court.