Who is entitled to receive

Tax deductions are provided to individuals who paid for treatment, medications or contributions under VHI:

- to myself;

- spouse;

- parents and children (including adopted children and wards under the age of 18).

At the same time, the paid services must be included in the list of expensive treatment for tax deduction, and the medical organization must have a Russian license. This list is contained in Decree of the Government of the Russian Federation dated March 19, 2001 No. 201. It, among other things, contains medical services provided in sanatorium and resort institutions. But when purchasing a voucher, reimbursement is made only from the direct cost of medical services, which is indicated in the certificate of payment for these services.

How to get a tax deduction for medical services

First of all, it is necessary to understand that the citizen first pays all expenses independently. Keep all payment documents supporting expenses. And they are issued to an individual applying for compensation. Let's figure out how to apply for a tax deduction for medical services and what documents are needed for this.

There are two ways to receive funds: through the employer or the Federal Tax Service.

Method 1. Refund through the employer

It is easier for a working citizen to obtain a refund of money spent on treatment through an employer. And this is the only way to make a tax deduction for medical services and receive money before the end of the calendar year. To do this, you must submit a corresponding application.

To confirm the legitimacy of your claims, prepare:

- payment documents;

- a copy of the contract for the provision of medical services;

- a copy of the license of the medical organization;

- original certificate of payment for treatment;

- a copy of a document confirming the relationship (if medical care was provided to a relative and not to the applicant).

If you purchased medications, you will need a prescription form with the stamp “For the tax authorities of the Russian Federation, Taxpayer INN.”

To reimburse the costs of voluntary health insurance you need:

- a copy of the insurance contract;

- a copy of the insurance company's license;

- a copy of a document confirming relationship.

With this package of documents, go to the Federal Tax Service and receive a notification confirming your right to deduction. Please contact your employer with it and the corresponding application.

Method 2. Refund of personal income tax through the Federal Tax Service

Let's look at how to return a tax deduction for medical services through the tax authority.

Before contacting the Federal Tax Service, you must collect the same package of documents plus a certificate of income from the employer in Form 2-NDFL.

Then a tax return is filled out in form 3-NDFL and an application for a refund of overpaid taxes (KND 1150058).

All these papers are submitted to the Federal Tax Service within three years from the date of the expenditure.

After this, tax authorities will conduct an audit within three months, as a result of which they will decide on a refund of the overpaid tax.

Refund of personal income tax for medical expenses

We often hear that taxes collected by the state go to improve our lives, that is, they are returned in the form of free services (medicine, education), pensions, subsidies, compensation, etc. At the same time, each of us can really improve our lives by getting our hands on the personal income tax (PIT) withheld from our income.

Every person who receives income on the territory of the Russian Federation is a personal income tax payer.

For individuals who are tax residents of the Russian Federation, personal income tax is also withheld from income received outside the Russian Federation.

You can reduce your taxable income by taking advantage of a tax deduction, which is the portion of income received that is not subject to tax. There are few such deductions and they are divided into four groups: standard, property, professional and social deductions.

Standard deductions are provided at the place of work upon application by the person. These include:

a) deductions provided to the person himself; the amount of the deduction depends on the categories into which taxpayers are divided (the list of categories is given in Article 218 of the Tax Code of the Russian Federation);

b) deductions provided to parents, guardians, trustees, adoptive parents, spouses of an adoptive parent for each child.

If for some reason a person was unable to take advantage of these deductions at his place of work, he can do so through the tax office at the end of the year.

There are two types of property deductions:

1) provided to a person upon the sale of property (housing, dachas, land plots and other property), and in this situation the tax in hand is not returned, but the use of this deduction allows you to reduce or not pay tax at all on income received from the sale of property;

2) provided to a person during the construction or acquisition of a residential building, apartment, room or share(s) in them on the territory of the Russian Federation.

Professional deductions are provided:

individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice;

persons receiving income from the performance of work (provision of services) under civil law contracts: work contract, agency agreement, commission agreement, lease agreement, etc. (a full list of such agreements is given in the Civil Code of the Russian Federation);

persons receiving royalties or remuneration for the creation, performance or other use of works of science, literature and art, remuneration to the authors of discoveries, inventions and industrial designs.

Social deductions are provided for:

- transferring money for charitable purposes;

- paying for education for yourself or for your children (or wards);

- payment for treatment and medications for yourself, your spouse, your parents and (or) your children (from January 1, 2013 and (or) wards) under the age of 18;

- payment of pension contributions under an agreement (agreements) of non-state pension provision concluded by a person with a non-state pension fund in his own favor and (or) in favor of a spouse (including in favor of a widow, widower), parents (including adoptive parents), disabled children (including adopted children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under a voluntary pension insurance agreement (agreements) concluded with an insurance organization in its favor and ( or) in favor of a spouse (including a widow, widower), parents (including adoptive parents), disabled children (including adopted children under guardianship);

- payment of additional insurance contributions for the funded part of the labor pension in accordance with the Federal Law “On additional insurance contributions for the funded part of the labor pension and state support for the formation of pension savings.”

Let us consider in detail the return of personal income tax when using a social deduction for medical services.

The Federal Tax Service, in a letter dated November 22, 2012 No. ED-4-3 / [email protected], proposed the following scheme for obtaining this deduction:

Social tax deduction for treatment and (or) purchase of medicines

provided to the person who paid:

medical preparations included in the list of medicines medical services included in the list of medical services and (or) in the list of expensive types of treatment consumables (prostheses, etc.) for expensive types of treatment

Prescribed by a doctor:

- directly to this person

- his wife (husband)

- to his parents

- his children under 18 years of age

A “medical” social deduction can be provided to a person who during the year paid for:

for whom : yourself, spouse, parents, children (including adopted children) under the age of 18 (from January 1, 2013 and wards under the age of 18);

that: the cost of medicines (in accordance with the list of medicines approved by the Government of the Russian Federation), prescribed by the attending physician, purchased by the taxpayer at his own expense; treatment services provided to them by medical organizations that have appropriate licenses to carry out medical activities, issued in accordance with the legislation of the Russian Federation (from January 1, 2013, the Tax Code of the Russian Federation was supplemented in this part by individual entrepreneurs carrying out medical activities, although it should be noted that Previously, the right to a deduction in a situation where medical services were provided by an entrepreneur on the basis of a license was confirmed by both the Supreme Court of the Russian Federation in Ruling No. 8-B05-2 dated March 29, 2005, and the Federal Tax Service of Russia in letter dated June 13, 2006 No. 04 -2-03/ [email protected] );

insurance premiums under voluntary insurance contracts concluded by him with insurance organizations that have licenses to conduct the relevant type of activity, providing for payment by such insurance organizations exclusively for treatment services;

how much: the amount of the deduction depends on the amount of income received by a person during the year; type of expense.

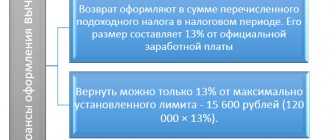

When using a “medical” deduction, personal income tax withheld during the year from income is subject to refund. The personal income tax rate on income to which a deduction can be applied is 13%. So, if an employee received an income of 100,000 rubles during the year, then personal income tax in the amount of 13,000 rubles must be withheld from him. (RUB 100,000 x 13%). If a citizen confirms his right to apply a deduction from the amount of 40,000 rubles, then he should return 5,200 rubles. (RUB 40,000 x 13%). If the amount of the deduction is greater than the income received during the year, then the employee will only be able to return the personal income tax that was withheld from him during the year. Do you agree that it is impossible to return what was not paid? For example, if the same employee submitted documents for a deduction from the amount of 150,000 rubles, then the personal income tax will be returned in the amount of 13,000 rubles.

The maximum amount of social deduction can be presented in the form of a table.

Type of expenses

Sum

All of the following types of social deductions, except:

expenses for charity

expensive treatment

expenses for children's education In total, no more than 120,000 rubles. and no more than the amount of income received per year

Expensive treatment

In the amount of actual expenses incurred, but not more than the amount of income received for the year

Medicines

The deduction can be obtained only for medicines listed in a special List of Medicines approved by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201.

Medicines must be paid for by the citizen himself (including partial payment for subsidized prescriptions), and not by the organization in which he works, or a charitable foundation, etc.

Note! These medications must be prescribed by your doctor. Knowing the love of our citizens for self-medication, legislators emphasized this.

When a doctor prescribes a medicine, it is necessary to fill out, in addition to the regular prescription, an additional prescription on prescription form Form No. 107/u (form approved by Order of the Ministry of Health and Social Development of Russia dated February 12, 2007 No. 110) for submission to the tax authorities of the Russian Federation (hereinafter referred to as the Prescription for the tax authorities) . If the medicine is dispensed in pharmacies without a prescription, then in this case a Prescription for the tax authorities is also required.

Most likely, the attending physician does not have such forms at his disposal. Usually they are prescribed by the chief physician of the medical institution, to whom you should bring a medical card with notes on the prescribed treatment.

If, after reading these lines, you realized that you did not write out such a prescription, do not be upset. You have the right, within three years after the end of the calendar year in which the drugs were purchased, to apply for the specified prescription. The most important thing is that you keep your receipts.

The rules for registration and issuance of Prescriptions for tax authorities are established by Appendix No. 3 “The procedure for prescribing medicines prescribed by the attending physician to the taxpayer and purchased by him at his own expense, the amount of the cost of which is taken into account when determining the amount of social tax deduction” to the order of the Ministry of Health of Russia and the Ministry of Taxes of Russia dated July 25 .01 No. 289/BG-3-04/256.

The prescription for the tax authorities is written out in two copies, one of which is presented to the pharmacy to obtain medicines, the second is presented to the tax authority of the Russian Federation when filing a tax return at the taxpayer’s place of residence. If a citizen comes for this Prescription after purchasing the medicine, then one copy is enough.

On a copy of the prescription intended for submission to the tax authorities of the Russian Federation, the attending physician affixes the stamp “For the tax authorities of the Russian Federation, Taxpayer INN” in the center of the prescription form; the prescription is certified by the signature and personal seal of the doctor, the seal of the healthcare institution. If the taxpayer does not have such a Recipe, then you will be able to receive a social deduction (letter of the Federal Tax Service of Russia dated August 31, 2012 No. ED-4-3 / [email protected] ).

Sometimes the name of a medicine indicated in the Prescription does not correspond to the name of the same medicine in the List. The fact is that the List of Medicines is compiled according to international nonproprietary names containing the chemical formula of the drug, which is in accordance with international practice. However, the trade names of the same medicinal product included in the List, patented by manufacturers, are different. For example, the international nonproprietary name of a drug is acetylsalicylic acid, and the most common trade names patented by companies are aspirin, aspirin-s, aspirin-upsa, etc.

The Ministry of Taxes and Taxes of Russia in a letter dated July 12, 2002 No. BK-6-04/ [email protected] explained that “when providing a social tax deduction, the amounts actually incurred by taxpayers related to the acquisition of any of the registered trade names of medicines that included in the List of Medicines approved by Resolution No. 201.”

The Government of the Russian Federation, by Resolution No. 201, also approved:

a list of medical services in medical institutions of the Russian Federation provided to the taxpayer, his spouse, his parents and (or) his children under the age of 18, the amount of payment for which at the expense of the taxpayer’s own funds is taken into account when determining the amount of social tax deduction;

a list of expensive types of treatment in medical institutions of the Russian Federation, the amounts of expenses actually incurred by the taxpayer are taken into account when determining the amount of social tax deduction.

The question of which of the above lists the provided medical services belong to is decided by the medical institution. If in doubt, you should contact the Ministry of Health of Russia (letter of the Ministry of Finance of Russia dated November 14, 2012 No. 03-04-05/7–1278).

Please note that in order to receive a deduction, treatment, as well as medicines, must be paid for by the citizen himself, and not by the organization in which he works. In case of partial payment, a deduction is provided only for the part that was paid by the citizen himself.

To confirm expenses for treatment in a medical organization, you should obtain:

documents for payment for treatment (cash receipts, strict reporting forms, slips for payment by bank cards, etc.);

treatment agreement with annexes and additional agreements to it. This document is not mandatory, since not all medical organizations sign it. However, if there is such an agreement, then it will also be useful when receiving a deduction;

Certificate of payment for medical services for submission to the tax authorities of the Russian Federation (hereinafter referred to as the Certificate), the form of which was approved by the joint order of the Ministry of Health of Russia No. 289 and the Ministry of Taxes of Russia No. BG-3-04/256 dated July 25, 2001 “On the implementation of the resolution of the Government of the Russian Federation” Federation dated March 19, 2001 No. 201 “On approval of lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, the amounts of payment for which at the taxpayer’s own expense are taken into account when determining the amount of social tax deduction.” The same order approved the Instructions for recording, storing and filling out a certificate of payment for medical services for submission to the tax authorities of the Russian Federation.

Unlike a contract, the presence of a Certificate is mandatory. It is issued at the request of the patient (or the patient’s relative who paid for medical services) after payment for medical services on the basis of relevant documents.

Once you receive the Certificate, check it carefully! In the upper left corner of the Certificate there is the following information about the medical organization, which can be written down or stamped: full name and address of the institution; TIN of the institution; license, date of issue of the license, period of its validity, by whom it was issued.

I hope that you will not have the same situation as the author of this article. The tax inspector, who checked the documents for receiving a medical social deduction, demanded a copy of the license of the medical organization, despite the fact that its details were indicated in the Certificate. And here I was helped by the letter of the Federal Tax Service of Russia dated August 31, 2006 No. SAE-6-04 / [email protected] “On certain issues of providing social tax deductions”, according to which, in accordance with the provisions of paragraphs. 3 p. 1 art. 219 of the Tax Code of the Russian Federation requires that the medical organization or individual entrepreneur who provided treatment services have appropriate licenses issued in the prescribed manner. However, this does not mean that in order to receive a social tax deduction, taxpayers must submit copies of such licenses to the tax authority, along with other necessary documents. The said letter noted that in cases where a reference to the license details is contained in the treatment contract itself, concluded by the taxpayer with a medical organization or individual entrepreneur, or in a certificate issued to the taxpayer by a medical organization or individual entrepreneur about the treatment services provided, the tax authorities are not recommended require the taxpayer to provide copies of the relevant licenses. If the tax authority has grounds to check whether a medical organization has a license, it is necessary to send a request to this medical institution or to the appropriate licensing authority.

The last name, first name and patronymic of the payer and patient are indicated in full in the Certificate. If the patient pays for medical services for himself, and therefore will receive a deduction himself, then a dash is placed instead of the patient’s data.

According to the payer, his tax identification number and information about family relationships with the patient are indicated if medical services are paid for a relative. Thus, sometimes the requirement of some medical organizations to present a tax authority certificate of TIN assignment in order to receive a Certificate is illegal.

Based on a cash receipt (receipt order or other document confirming the payment of funds), the cost of the paid medical service is indicated in rubles in words with a capital letter.

Attention! In order to classify a medical service as routine or expensive treatment, the service code must be entered correctly on the certificate: code 1 means routine treatment, code 2 means expensive treatment.

The Certificate indicates the date of payment for the medical service, which does not necessarily coincide with the date of issue of the certificate. You can apply for a Certificate within 3 years after payment for medical services.

The Certificate indicates the full last name, first name, patronymic, position held, and telephone number of the person who issued the certificate.

The official seal of the healthcare institution is placed in the lower left corner of the Certificate.

The spine of the Certificate with the signature of the recipient of the Certificate remains in the medical organization.

It should be noted that a deduction can be obtained for medical services received not only in medical organizations, but also in sanatorium-resort institutions (clause 4 of the List of Medical Services approved by Resolution No. 201).

The Certificate does not indicate the entire cost of the voucher, since it includes the cost of not only treatment, but also accommodation, food, etc. The Certificate issued by the sanatorium will indicate that part of the cost of the voucher that corresponds to the volume of medical services included in the voucher in sanatorium and resort institutions, as well as the amount of payment for medical care, not included in the cost of the voucher, but additionally paid by the taxpayer.

You can apply for a Certificate within 3 years after the end of the year in which the services of the sanatorium institution were paid for.

Upon application of the taxpayer (written request), the Certificate may be sent to him by registered mail with acknowledgment of receipt. Payment of postage costs in cases of sending the Certificate by registered mail is made by the recipient at his own expense.

Certificates are issued by both sanatorium-resort institutions and medical organizations free of charge.

Often, when receiving expensive treatment, the cost of the necessary expensive medical consumables is separately allocated. These include, for example, endoprostheses, artificial valves, lenses, etc. If the medical organization does not have these, the relevant agreement provides for their purchase, then their cost is also included in the Certificate indicating the code of expensive treatment - 2 (letters of the Federal Tax Service of Russia dated August 31 .06 No. SAE-6-04/ [email protected] , dated 05/18/11 No. AS-4-3/ [email protected] , Federal Tax Service of Russia for Moscow dated 10/19/10 No. 20–14 /4/109572, dated September 8, 2008, No. 28–10/ [email protected] ). It does not matter under what conditions (paid or free) the medical organization provided the patient with medical services using the specified medical consumables. For example, cataract surgery is usually done free of charge, but the patient pays for the artificial lens.

Payment by the taxpayer of insurance premiums during the tax period under voluntary insurance contracts, which are concluded by the payer for himself or his relatives with insurance organizations and have licenses to conduct the relevant type of activity, provides for payment by such insurance organizations exclusively for treatment services.

In this case, a deduction for the payment of insurance premiums is provided to the taxpayer if treatment is carried out in medical organizations that have appropriate licenses to carry out medical activities, issued in accordance with the legislation of the Russian Federation, from individual entrepreneurs carrying out medical activities on the basis of a license for this activity, issued in in accordance with the legislation of the Russian Federation. In this case, it is necessary to submit documents confirming payment of insurance premiums.

Let's return to the question of the amount of medical social deduction.

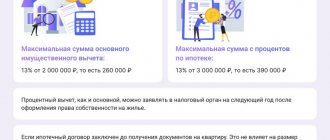

Let us remind you that in order to receive a medical deduction, expenses for expensive treatment are recognized in full, but not more than the amount of income received in a calendar year.

For other medical expenses, stricter limits apply. Based on the results of the calendar year, the taxpayer has the right to receive a social deduction in the amount of no more than 120,000 rubles. and no more than the income received in a calendar year in aggregate for the following types of expenses:

- own training;

- medical treatment (your own and (or) relatives), purchase of medicines and health insurance;

- expenses under the agreement (agreements) of non-state pension provision, under the agreement (agreements) of voluntary pension insurance and the payment of additional insurance contributions for the funded part of the labor pension.

You will have to choose which expenses to take into account to receive a deduction yourself.

Of course, if the total amount of the listed expenses does not exceed the specified values, then all of them can be accepted. To receive a social tax deduction for treatment and (or) purchase of medicines, the following documents must be submitted to the tax authority at your place of residence:

1) tax return in form 3-NDFL;

2) a treatment agreement with annexes and additional agreements to it (if concluded) - a copy;

3) a certificate of payment for medical services for submission to the tax authorities of the Russian Federation - original;

4) prescription form with the stamp “For the tax authorities of the Russian Federation, Taxpayer INN” - original;

5) documents confirming payment for medicines (for example, a cash register receipt) - a copy;

6) a document confirming the degree of relationship (for example, a birth certificate) - a copy;

7) a document confirming the marriage (for example, a marriage certificate) - a copy;

application for personal income tax refund;

9) certificate from place of work in form 2-NDFL (if there are several places of work, then certificates are submitted from all places) - original.

When checking a declaration, the tax inspector has the right to demand the originals of those documents that are presented in copies.

The tax return in form 3-NDFL was approved by order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/ [email protected]

When returning personal income tax by receiving a social deduction, the deadline for filing a declaration is not strictly established. However, there is still a time limit. You can declare your desire to return the tax, and therefore submit a declaration, within three years after the end of the year in which the relevant expenses were incurred.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up