Contract agreement and 6-NDFL: basic provisions

A work contract is one of the types of civil law agreements (GPC), in which:

- the contractor (performer) has the obligation to perform the work stipulated by the contract according to the customer’s instructions;

- The customer assumes the obligation to accept the results of the work performed and pay for it.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Find out what to pay attention to when concluding a contract in this article.

To reflect “contract” income in 6-NDFL, the following data will be required:

- the cost of “contract” work - it falls on pages 110 and 113 of section 2 of the report;

- calculated and withheld personal income tax - it is reflected on pages 140 and 160;

- in section 1 of the report, blocks pp. 021-022 are filled in for each withholding of the “contractor” personal income tax (they will be discussed in more detail later).

ATTENTION! If you fill out the 6-NDFL calculation for the tax period, then include information about payments under the contract and personal income tax on them in the certificates of income and tax amounts of the individual.

In order for “contract” payments to be reflected without errors in 6-NDFL, you should remember the following tax requirements:

- all payments under the contract (including advances) are subject to reflection in 6-NDFL (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982);

- the data in section 2 of the report is presented on an accrual basis, in section 1 - on the withholding of personal income tax for the last 3 months of the reporting period;

- the date an individual receives “contract” income is the day it is transferred to the card or money is issued from the cash register, including the date the advance is issued to the contractor. But the date of signing the work acceptance certificate does not matter, which is confirmed by tax authorities (see, for example, letter from the Federal Tax Service for Moscow dated January 16, 2019 No. 20-15 / [email protected] );

- The deadline for transferring personal income tax is no later than the day following each “contract” payment.

Find out the nuances of a contract from the perspective of international standards from the article “IFRS No. 11 Contracts - application features” .

For 2022, 6-NDFL is submitted using a new form. Use sample 6-NDFL for 2021, compiled by ConsultantPlus experts, and see if you fill out everything correctly. This can be done for free by getting trial online access to the system.

Do I need to include GPA payments in 6-NDFL?

*Expert answer

Question:

Is it necessary to submit reports in Form 6-NDFL if there are payments under civil contracts? If yes, how to fill out the calculation?

Answer:

Remuneration under civil law contracts must be included in the calculation of 6-NDFL. Details are in the justification.

Rationale:

Remuneration under civil law contracts must be included in the calculation of 6-NDFL starting from the reporting period in which they were paid to an individual, since the day of actual receipt of such income is the date of their payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Please note that the date of signing the act on work performed, services provided does not matter (Letters of the Federal Tax Service of Russia dated 12/05/2016 N BS-4-11/ [email protected] , dated 10/26/2016 N BS-4-11/20365 (p 1), Federal Tax Service of Russia for Moscow dated January 16, 2019 N 20-15/ [email protected] ). These clarifications were given during the period of validity of the previous form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] We believe that they are still relevant.

In Sect. 1 of the 6-NDFL calculation, it is necessary to reflect the amount of tax withheld for the last three months of the reporting period from payments under civil contracts, regardless of the period of its transfer (clauses 3.1, 3.2 of the Procedure for filling out the 6-NDFL calculation, Letter of the Federal Tax Service of Russia dated 12.04 .2021 N BS-4-11/ [email protected] , from 04/01/2021 N BS-4-11/ [email protected] ):

- in field 020, include in the total tax withheld for the last three months of the reporting period the amount of personal income tax withheld from remuneration under civil contracts. The deadline for transferring the tax does not matter;

- in field 021 indicate the first working day following the day of payment of remuneration (clauses 6, 7, article 6.1, clause 6, article 226 of the Tax Code of the Russian Federation);

- in field 022 reflect the amount of withheld personal income tax, the transfer deadline for which falls on the date specified in field 021.

If remuneration is paid to an individual in parts, then each of them is reflected in a separate block of fields 021, 022. This is due to the fact that the timing of the transfer of personal income tax on each part of the remuneration paid is different.

In Sect. 2 calculations of 6-NDFL, remuneration under a civil contract and the corresponding tax must be reflected on an accrual basis, starting from the report for the period in which the payment was made until the end of the reporting year as follows (clauses 4.1 - 4.3 of the Procedure for filling out the 6-NDFL calculation ):

- field 100 indicates the rate at which the tax on remuneration under the contract is calculated (for example, 13);

- in field 110 - the total amount of income for all individuals since the beginning of the year, which are taxed at this rate, including remuneration under a civil contract;

- in field 113 - taxed at the rate reflected in field 100, the total amount of income for all individuals from the beginning of the year under civil contracts, the subject of which is the performance of work (rendering services);

- in field 120 - the total number of individuals who received payments reflected in field 110;

- in field 130 - the total amount of tax deductions for personal income tax provided for payments from field 110, including deductions for remuneration under a civil contract;

- in field 140 - the amount of personal income tax calculated on all income indicated in field 110 (including deductions), including tax calculated on remuneration under a civil contract;

- in field 160 - the total amount of personal income tax withheld since the beginning of the year, including the tax withheld from remuneration under a civil contract.

You can check the correctness of filling out form 6-NDFL using the control ratios sent by the Federal Tax Service of Russia (Letter dated March 23, 2021 N BS-4-11 / [email protected] ).

If you fill out the 6-NDFL calculation for the tax period, then include information about payments under a civil contract and personal income tax on them in the certificates of income and tax amounts of an individual.

Use income code 2010 when reflecting payments under the GPA in the Appendix to the certificate of income and personal income tax amounts (in the general case).

A ready-made solution will help you reflect various types of payments in the 6-NDFL calculation.

The answer was prepared by experts from the Consultation Line “What to do Consult”

The ConsultantPlus legal reference system will help you fill out tax calculations correctly, determine deadlines and avoid penalties

Sample 6-NDFL under the GPC agreement

The following example will help you understand the peculiarities of filling out 6-NDFL for “contract” payments.

Geodesist LLC entered into a contract agreement with M. N. Berezkin to perform contract work on the repair of furniture in workshop No. 12. According to the terms of the contract, during the execution of the work (4th quarter of 2022), the specified person received an advance payment on November 15, 2021 (RUB 5,000 .) and final payment on November 26, 2021 (RUB 22,000).

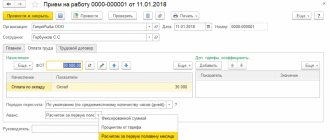

The contract in Section 2 of 6-NDFL is as follows:

In Section 1 of Section 6-NDFL, the contract is reflected in the following form:

How the data in lines 6-NDFL will change if the “contract” income is paid to a non-resident or individual entrepreneur, find out in the next section.

ConsultantPlus experts explained in detail how to display other payments in 6-NDFL. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Reflection in 6-NDFL of interim payments and final settlement under the GPC agreement

Section 1: 1 section is completed in the usual manner. All payments made under the GPC agreement will be included in total income and reflected on line 020. From this amount, personal income tax will be indicated below on lines 040 and 070.

Section 2: the advance payment, as well as the final payment that was paid over the last three months, will be indicated in a separate block on lines 100-140. This is due to the fact that they were paid at different times.

The nuances of “contract” payments

A contract may be concluded with an individual:

- having the status of individual entrepreneur;

- being a non-resident (a subject staying on the territory of Russia for less than 183 calendar days within 12 months).

For 6-NDFL this means:

- The money paid by an individual entrepreneur under a contract is not reflected in 6-NDFL by the tax agent - the entrepreneur himself pays taxes on the income received and reports on them;

- “contract” income of a non-resident is taxed at a rate of 30% (instead of the usual 13%).

Payment of income to a non-resident will not in any way affect the completion of the dates in the 1st section of 6-NDFL, and page 022 of this section and the lines of section 2, reflecting the personal income tax withheld from “contract” income, will change and will be reflected as follows:

Thus, the status of an individual affects the fact of reflecting “contract” income, as well as the amount of personal income tax.

The article “Tax resident of the Russian Federation is…” will tell you more about the status of a tax resident.

How to reflect GPC agreements in 6-NDFL

Accountants often confuse employment contracts and GPC (civil law) contracts, although the procedure for reflecting payments under these contracts in 6-NDFL is different. Therefore, you need to understand the difference between them.

A civil contract (CLA, GPC contract) is an agreement under which the contractor undertakes to perform specific work or provide a service, and the customer undertakes to pay for it. That is, unlike an employment contract, an organization does not buy a person’s working time, but the result of labor. And how to achieve the result, he decides independently. At the same time, the term “GPA” is not specified in the Civil Code of the Russian Federation; this type of agreement does not exist separately. In practice, it is understood as contracts for construction, services, leases, and agency agreements that are concluded with a specific person, and not with a company. At the same time, the performer on the GPD is not subject to the labor regulations of the organization; he does not have a work schedule, position or superiors.

For a company, a GPC agreement, usually a civil law agreement, is more convenient than an employment agreement. According to the GPA, the customer is not obliged to compensate for vacations, sick leave and fulfill other requirements of the Labor Code of the Russian Federation. The process of concluding and terminating a GPA is not as complicated as the process of terminating a contract in accordance with the Labor Code of the Russian Federation. The requirement to comply with the minimum wage does not apply to the GPC agreement; the term of the agreement can also be any. The frequency of payment in the GPA can be agreed upon, and the Labor Code of the Russian Federation obliges to pay wages twice a month. There is no need to pay contributions for VNiM from payments under the GPA, and contributions for injuries are paid only if this is provided for in the contract. However, personal income tax is assessed on remuneration under the GPA.

In Russian practice, GPC agreements are often concluded instead of labor agreements to cover labor relations. Such actions are strictly prohibited by law (Article 15 of the Labor Code of the Russian Federation). Replacing an employment contract with a civil law one is risky. If the contract is recognized as an employment contract, the organization faces a fine of 50 to 100 thousand rubles and additional contributions. In addition, the court may oblige the employer to pay the employee everything that would be due under the employment contract (Article 5.27 of the Code of Administrative Offenses of the Russian Federation, paragraph 24 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated May 29, 2018 No. 15, paragraph 15 of the “Review of Judicial Practice of the Armed Forces of the Russian Federation”).

In the 6-NDFL report, you need to indicate accruals to employees under GPC agreements, from which the customer is obliged to withhold personal income tax and pay it to the budget (clauses 1, 2 of Article 226, clause 2 of Article 230 of the Tax Code of the Russian Federation). Remuneration under civil law contracts from which the tax agent does not withhold personal income tax does not need to be recorded in the calculation. So, in particular, they do not reflect in the calculation: • payments under a civil contract, if it is concluded with an individual entrepreneur or self-employed (Federal Law No. 422-FZ of November 27, 2018), since these persons pay taxes for themselves; • amounts paid to individuals for property purchased from them. An exception is payments under agreements for the purchase and sale (exchange) of securities, unless otherwise provided in clause 2 of Art. 226.1 Tax Code of the Russian Federation.

The listed persons independently submit declarations to the tax authority on their income and they do not fall into personal income tax reporting (clause 1, clause 1, clause 5, article 227, clause 2, clause 1, clause 3, article 228 of the Tax Code of the Russian Federation) .

The customer is obliged to pay personal income tax on the contractor’s income no later than the business day following the day the remuneration is transferred (paragraph 1, paragraph 6, article 226, paragraph 7, article 6.1 of the Tax Code of the Russian Federation). If the date of receipt of income from wages for personal income tax purposes is considered the last day of the month (clause 2 of Article 223, clause 3 of Article 226 of the Tax Code of the Russian Federation), then for GPC this date is the day of receipt of remuneration (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated 09/06/2021 No. 03-04-05/71980). In this way, payments under the GPA are significantly different from payments under employment contracts, so the accountant should not confuse full-time employees and employees on the GPA.

Income of individual entrepreneurs and non-residents: how to reflect in 6 personal income taxes

If a citizen contractor is registered as an individual entrepreneur, then the legal entity has no obligation to withhold and transfer personal income tax, that is, to perform the functions of a tax agent. There is no need to reflect such payments in the 6 personal income tax report. The contractor independently reports to the regulatory authorities about the income he received and the taxes paid on it.

Concluding a contract with a non-resident citizen does not exempt an organization (legal entity or individual entrepreneur) from submitting a report. The only difference from the registration and reflection of financial relationships with a resident individual is the amount of the interest rate at which personal income tax should be calculated. It is 30 percent, indicated on line 010 of the report.