If the SZV-M is submitted untimely, a fine of 500 rubles is provided. for each insured person.

If there are many employees on staff, then the fine amounts to tens and hundreds of thousands of rubles. For example, if information was not submitted for 300 employees, the fine will be very impressive - 150,000 rubles.

In this case, responsibility is assigned even if the delay in submitting the report is only a few days. However, during court proceedings, judges often side with the employer, and not the Pension Fund, canceling such punishment.

Correction of the error led to late submission of SZV-M

The policyholder sent the report to SZV-M in a timely manner, after which an error was found in the document. To correct it, an updated report is submitted, but it arrives at the Pension Fund after the deadline for submitting the SZV-M.

If the employer independently discovered the error and corrected it, no penalties are applied to him. This point is indicated in paragraph 40 of the Instructions, regulated by Order of the Ministry of Labor dated April 22, 2020 No. 211n.

As practice shows, even those who corrected the error after it was pointed out by the Pension Fund can avoid a fine. For example, the individual entrepreneur mixed up the columns in SZV-M for filling out the first and middle names. He was able to challenge the fine in court because the mistake was minor (Resolution of the Court of Justice of the West Siberian District dated December 14, 2018 No. A27-6320/2018). Another case is that the organization made a mistake in the patronymic of an employee, and the court also sided with it (Determination of the Supreme Court of the Russian Federation dated September 28, 2018 No. 309-KG18-14482).

Also, the court may side with the employer and cancel the Pension Fund’s fine if the policyholder indicates the second part of the foreign employee’s name instead of the patronymic, or makes a mistake in indicating the reporting period, or incorrectly indicates the employee’s SNILS or his registration number in the Pension Fund. In these cases, the court may support the employer even though the inaccuracies will be corrected after they are identified by the Pension Fund.

When passing the SZV-M, take advantage of the capabilities of the 1C program and its 1C-Reporting service. In this case, you will be able to correctly generate a report and send it to the Pension Fund in a timely manner. Thus, you will protect yourself from fines and possible proceedings in court.

Penalty for submitting reports in paper form

If the employer's staff does not exceed 25 people, reporting to the Pension Fund should be submitted only in electronic format. Submitting reports in paper form is permitted provided that the employer has less than 25 people on staff. At the same time, the employer has the right to choose the format: he can submit reports both on paper and in electronic form.

There are several ways to generate and submit reports electronically:

- using free software on the Pension Fund website;

- through the policyholder’s personal account on the Pension Fund’s website (at the moment only the delivery of SZV-TD has been implemented);

- through the electronic reporting system.

The web service “Astral Report 5.0” will allow you to quickly generate and transmit reporting documents not only to the Pension Fund of the Russian Federation, but also to other regulatory agencies (Federal Tax Service, Social Insurance Fund, Rosstat). You can manage several organizations simultaneously in the system, exchange unformalized documents with regulators, and work with documents that were generated in other accounting software. The “smart” editor will tell you how to fill out the fields in the report and help correct any errors found.

If an employer with more than 25 employees submits a paper report instead of an electronic one, the Pension Fund of Russia applies liability measures in the form of a fine. For failure to provide reporting in electronic format, when this form is mandatory for the employer, a fine of 1 thousand rubles is provided.

The initial SZV-M report did not indicate the employee

There are situations in which employers submit the original SZV-M report form, which is missing information about some employees. Once the error is discovered, they submit an additional form for employees who were not previously included in the report.

If additional information is received by the Pension Fund after the deadline established for submitting the SZV-M, the employer will be fined 500 rubles. for every forgotten employee. The Pension Fund of the Russian Federation indicates this point in its Letter dated March 28, 2018 No. 19-19/5602. A similar position is contained in the Letter of the Pension Fund of Russia branch for Moscow and the Moscow region. dated 04/16/2021 No. T-3586-16-02-204/4335.

In past years, employers have in some cases been able to challenge such fines through court proceedings. But now the situation has changed, since from July 27, 2022, the Instruction regulated by Order of the Ministry of Labor dated April 22, 2020 No. 211 n. Based on clause 39, it can be concluded that if the employer submits an additional SZV-M for forgotten employees and the deadline for submitting the report has already passed, then a fine will be imposed. In this regard, it will be quite difficult to challenge the sanctions.

However, sanctions can be avoided when the Pension Fund, upon discovering an incorrectly indicated number of insured persons, did not send the employer a notice to eliminate the discrepancies. If there is no document, you can use this as an argument to cancel the fine (Resolution of the Central District Court of June 8, 2021 No. A83-22006/2019).

How are fines imposed by the Pension Fund?

Employers submit reports to the Pension Fund of the Russian Federation using the forms SZV-M, SZV-STAZH and SZV-TD.

The report in the SZV-M form contains a list of employees with information about their TIN and SNILS. Only individual entrepreneurs who do not have employees are exempt from taking the SZV-M. Legal entities are required to take the SZV-M in any case, since the director of the organization is considered an employee. Information about him must be reflected in the SZV-M, even if he does not receive a salary and no contract has been concluded with him.

In the employee experience report using the SZV-STAZH form, the employer enters information about each employee with whom an employment or civil law contract has been concluded: full name, dates of hiring and dismissal, as well as other information necessary for calculating the pension.

The SZV-TD report is generated when an individual is hired or when an employee is dismissed. It contains information about the employee (full name, position) and dates of personnel events.

The Pension Fund imposes a fine on the employer for violating deadlines for providing information about employees, as well as for errors in reporting.

The forms of reporting documents that the employer is required to provide to the Pension Fund of Russia, as well as the procedure for filling them out, are established by Resolution of the Board of the Pension Fund of the Russian Federation dated September 27, 2022 No. 485p.

According to Federal Law No. 27-FZ of April 1, 1996, an employer who violates the rules for providing information about its employees is subject to liability in the form of a fine. This measure threatens the violator if:

- deadlines for submitting information for each employee were not met;

- reporting data are not presented in full or not presented at all.

If violations are detected, the Pension Fund draws up a report that is submitted to the employer. The act can be delivered in person against a signature, or sent by registered mail or electronically via TKS. Within 15 days, the employer will have to submit explanations to the Pension Fund regarding the failure to submit reporting documents, delays, or errors in the information provided.

In a controversial situation, the company can file an objection addressed to the head of the territorial branch of the Pension Fund. In this case, a special commission will be created that must make a decision - if there are no violations, the sanctions will be canceled, but if violations are confirmed, the employer will be held accountable. Either the head of the organization that filed the objection or his representative by proxy can be present at the commission meeting.

If the violation is confirmed, the Pension Fund will send the employer a request to transfer the fine. 10 days are given for payment. If the fine has not been paid after the deadline, the amount is collected forcibly.

In this case, the Pension Fund draws up a corresponding claim and sends it to court. From August 2022, the Pension Fund of Russia can sue only if the amount of the fine exceeds 3 thousand rubles. Previously, there was no such restriction, and the Fund could recover money in court for any amount of the imposed fine. If the violator “accumulates” several fines totaling 3 thousand rubles, the Pension Fund of Russia will be able to go to court.

There is a statute of limitations for collection - three years. If an organization is fined less than 3 thousand rubles, the Pension Fund will wait for the next violation by the company within the specified period until the amount accumulates at which the company can be sued. If there are no violations on the part of the company during this time, the Pension Fund of the Russian Federation will demand the collection of the initial amount of the fine.

Due to errors regarding employees, the SZV-M report was not submitted on time

SZV-M is a table that contains data on employees - full name, SNILS, INN. To successfully submit a report, you must provide correct information, and if there is an error, the Pension Fund of Russia may refuse to accept the report.

The employer needs to correct the report and resubmit it, but he may miss the deadline for filing the SZV-M. And then the Pension Fund of the Russian Federation applies penalties, but not for the employee for whom the error was discovered, but for all the employees who were in the report (although the information on them was initially correct).

Employers do not agree with this position, believing that fines should only be for employees for whom mistakes were made. At the same time, the courts cannot come to a common position when resolving this issue. In some cases, they support the Pension Fund (Resolution of the Administrative District of the Far Eastern District dated November 21, 2017 No. F03-4421/2017), and in others - employers (Resolution of the Administrative District of the West Siberian District dated August 23, 2017 No. A27-22235/2016) . For example, protecting the interests of policyholders, the courts believe that a report with errors on individual employees is not considered not submitted in full. Accordingly, a fine cannot be applied based on the total number of employees.

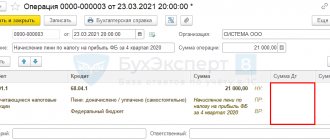

Postings on fines SZV m

The amount of accrued tax sanctions does not form a conditional income tax expense (clause

Postings If it is discovered that the SZV M form has not been submitted, Pension Fund officials are required to send a demand to the employer to pay a fine.

83 Regulations on accounting and reporting, clause 20 PBU 18/02). Therefore, in accounting, reflect these amounts directly on account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees” (69 “Calculations for social insurance and security”). To ensure analytical accounting of tax sanctions to accounts 68, 69, it is advisable to open sub-accounts in the context of taxes for which sanctions are accrued (for example, the sub-account “Fines (penalties) for income tax”).* Reflect the accrual of tax sanctions by posting:* Debit 99 Credit 68 (69) subaccount “Fines (penalties)” – a fine for a tax offense (fines for arrears) has been assessed.

When calculating income tax, the organization does not have the right to take into account the amount of fines and penalties (clause

2 tbsp. Thus, legal entities should not submit such documents to the Pension Fund body starting from the 1st quarter of 2022. Regarding the deadlines, if until 2022 different deadlines for submitting reports on social contributions were established depending on the form of submission (paper or electronic version), now there is no fundamental difference in how the subject will submit the necessary documents. The new calculation and submission methodology obliges taxpayers to submit any type of reporting by the 30th day of the month following the reporting period.

The uniform deadlines for submitting reports on insurance premiums are presented in Table 2. Table 2 - Deadlines for submitting reports on insurance premiums for 2022

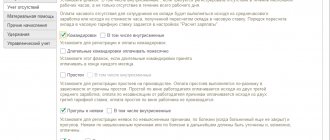

Failure to submit the SZV-M report on time in the presence of extenuating circumstances

If a company or individual entrepreneur has a lot of employees, then the amount of the fine for late submission of the SZV-M report will be very significant. Even if the employer’s guilt is proven, you can try to reduce the amount of financial liability through the court. It is necessary to provide evidence that the offense was committed under mitigating circumstances.

One example of mitigating circumstances is a short period of delinquency. Often the courts understand this as a delay in submitting a report for a period of no more than 16 days. In addition, it can be argued that the employer committed the offense for the first time, and before that he always fulfilled his obligation to submit the report on time. Also, a mitigating argument may be the absence of debt on insurance premiums.

It is possible to somehow reduce the fine or cancel it completely if you prove the presence of technical problems at the time of submitting the report - lack of electricity.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

PFR fines in 1s

Contents: Question: The organization missed the deadline for submitting a calculation of insurance premiums. The inspectorate demanded payment of a fine. How to reflect a fine for a tax violation in accounting? Expenses in the form of taxes, insurance premiums, customs duties Reflection of additional charges for tax audits for previous years in the 1C program Answer dated 08/22/2017: An organization that fails to timely submit a tax return or calculation of insurance premiums to the inspectorate may be fined under Article 119 of the Tax Code of the Russian Federation.

The decision to bring to tax liability is made by the tax authority on the basis of an act, which is drawn up when facts of a tax offense are discovered (Article 101.4 of the Tax Code of the Russian Federation) or during a tax audit (Article 101.4 of the Tax Code of the Russian Federation).

101 of the Tax Code of the Russian Federation). At the same time, the amounts of such a fine and other sanctions transferred to the budget are not taken into account as expenses in tax accounting (Clause 2 of Article 270 of the Tax Code of the Russian Federation). In the accounting of an organization, fines and other similar charges are reflected in the debit of account 99 “Profits and losses” in correspondence with the credit of account 68 “Calculations for taxes and fees”.

Thus, the following entries will be generated in the organization’s accounting records: Dt 99.01.1

“Profits and losses from activities with the main tax system”

– Kt 68 “Calculations for taxes and fees” – the amount of the fine is accrued; This posting is generated on the date of receipt of the decision from the tax office.

Dt 68 “Calculations for taxes and fees” - Kt 51 “Current account” - the fine has been paid.

How the 1C Program provides automatic execution of many frequently repeated operations.

Posting a fine for late submission of reports

Author of the article Victoria Ananyina 4 minutes to read 8,922 views Contents Despite the fact that every accountant tries as much as possible to avoid violations in the field of accounting and tax legislation, no one is immune from mistakes, including in the context of untimely filing of reports. And further on what fines can be applied to business entities by regulatory authorities and how to correctly reflect them in accounting. To begin with, we will determine that the nature of such a violation depends on what kind of reporting was untimely submitted to the competent authorities.

Tax fines are a type of tax sanctions that are applied in accordance with Art. 114 of the Tax Code of the Russian Federation to taxpayers for offenses committed in this area. Such fines are paid by the enterprise solely on the basis of a decision of the Federal Tax Service, and the costs of paying for such a violation in accounting are included in the expenses of the reporting period. The amount of fines is presented in Table 1. Table 1 - Calculation of the amount of penalties for late submission of reports (click to expand) Situation What the NK says The tax on the declaration was paid on time, but the declaration itself was filed in violation of the deadlines. The fine in this case is 1000 rubles for any type of tax.