Material aid

Financial assistance is usually understood as a payment that is not directly related to the company’s production activities. Such a payment does not reduce the base when calculating profit and cannot be taken into account in expenses when calculating the simplified tax system. It is usually paid in connection with some event, for example, in connection with the birth of a child, the death of a close relative, illness, or simply due to a difficult financial situation. Payment of financial assistance is not mandatory; the employer can independently decide on its assignment. All payments due to the organization must be recorded in local regulations. In addition to the size of the payment, the document sets out the conditions for receiving them (

Due to the death of a relative

If the payment is a one-time payment, then, in accordance with the above norms of the Tax Code of the Russian Federation, personal income tax and insurance premiums for financial assistance in connection with the death of a close relative in 2022 are not charged. In accordance with the letter of the Ministry of Labor No. 17-3/B-538 dated November 09, 2015), close relatives include:

- spouses;

- parents;

- children, including adopted children.

If an organization provides monetary compensation in connection with the death of other relatives (sister, brother, grandmother, grandfather, etc.), amounts exceeding 4,000 rubles are subject to taxes.

Social financial assistance

Despite the fact that an employment relationship has been concluded between the employee and the employer, this does not mean that all payments transferred to the employee are related to wages. In addition to the employment contract, the employer and its employees can sign a collective agreement, which applies not only to labor relations, but also to social ones.

Those payments that, on the basis of a collective agreement, are of a social nature are not a lever for stimulating workers, since they do not depend on their qualifications, as well as the complexity of the work performed and its quality. In other words, such payments are not remuneration for work. Based on this, we can conclude that assistance to an employee for expensive treatment should not be subject to insurance premiums if the conditions for social benefits are met (Presidium of the Supreme Arbitration Court of the Russian Federation, Resolution No. 17744/12 of May 14, 2013). According to the court ruling, the financial assistance provided for by the company’s collective agreement, despite the fact that it is not included in the list of payments exempt from insurance premiums, may not be included in the base for their calculation.

Tax deduction for treatment

You can take advantage of the social tax deduction for treatment and get part of your expenses back in the following cases.

- You can receive a tax deduction when paying for medical services if you paid for services for your own treatment or treatment of immediate relatives (spouses, parents, children under 18 years old) provided by medical institutions in Russia; paid services are included in a special list of medical services for which a deduction is provided (the list of services is defined in Decree of the Government of the Russian Federation dated March 19, 2001 No. 201); the treatment was carried out in a medical institution licensed to carry out medical activities, or by individual entrepreneurs carrying out medical activities.

- You can receive a tax deduction when paying for medicines if you paid at your own expense for medicines for yourself or your immediate family (spouse, parents, children under 18 years of age) prescribed by your doctor; paid for medications are included in a special list of medications for which deductions are provided (this list of medications is defined in Decree of the Government of the Russian Federation dated March 19, 2001 No. 201).

- You can receive a tax deduction when paying for voluntary health insurance if you have paid insurance premiums under a voluntary health insurance agreement or insurance for immediate relatives (spouse, parents, children under 18 years of age); the insurance contract only provides for payment for treatment services; the insurance organization with which the voluntary insurance agreement has been concluded has a license to conduct the corresponding type of activity.

The Ministry of Finance of Russia noted that for sanatorium-resort treatment, the specified tax deduction can be provided to the taxpayer for part of the cost of the voucher, which corresponds to the costs of medical services included in its price, as well as for the amount of payment for medical services not included in the cost of the voucher, if payment at the expense of the taxpayer.

The taxpayer has the right to return up to 13 percent of the cost of paid treatment, but not more than 15,600 rubles. This is due to the restriction on the maximum deduction amount of 120,000 rubles (120,000 rubles × 13% = 15,600 rubles).

Expert “NA” S.M. Lvovsky

Financial assistance to an employee for treatment

Help is provided to employees not only in connection with their illness, but also with the illness of their close relatives, for example, parents, children, husband or wife. Help can be provided if the employee (or relatives):

- Received paid medical services;

- Purchased expensive medications as prescribed by a doctor;

- Carry out other expenses related to treatment based on doctor’s prescriptions.

If an employee is paid compensation related to the purchase of medications, confirmation from the attending physician in the form of a prescription will be required.

One-time financial assistance to an employee whose children are entering first grade

One-time financial assistance to an employee whose children are going to first grade is provided to one of the parents (an employee of St. Petersburg Electrotechnical University "LETI") in the amount of 6,000 rubles

for each child who is a first-grade student, if an application for financial assistance is submitted to the OSR in the current calendar year.

List of required documents:

- a copy of the child(ren)'s birth certificate;

- certificate of study in first grade or a copy of the student ID.

The procedure for obtaining financial assistance to an employee for treatment

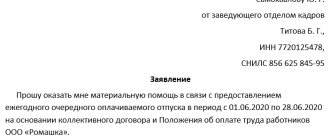

To receive financial assistance for treatment from the employer, the employee must write an application. There is no special form for such a statement, so it is drawn up in free form. An application is drawn up addressed to the head of the company, indicating the following information: the employee’s full name, his position and personal data, as well as a request for assistance in connection with the upcoming treatment, or in connection with expenses already incurred for treatment. If necessary, supporting documents are attached to the application. Such documents may include:

- receipt for payment for treatment;

- prescription from a doctor;

- doctor's report;

- act on the services performed by the medical organization.

An employee is not always required to submit an application. Sometimes the employer, on its own initiative, pays assistance to the employee. Next, an order is issued to pay a specific employee a specific amount of money.

Reasons for payment

Financial assistance is paid based on the employee’s personal application. As a rule, it is accompanied by papers that explain why he is asking for financial support. But since the decision to issue financial assistance is entirely within the competence of the employer, and the procedure and conditions for such payment are not regulated by law, the employer has the right to pay financial assistance without supporting documents - only on the basis of a personal request and oral explanations of the employee.

Please attach the following documents to your application for financial assistance due to illness:

- an agreement with a licensed medical organization;

- certificate - doctor's referral;

- documents confirming actual payment (payment documents, invoices, invoices, receipts, etc., issued in the name of the applicant, and KKM checks for the purchase of medicines);

- personalized recipes;

- various types of certificates from a medical institution confirming the need for paid expensive treatment for vital indications.

Order for payment of financial aid for treatment

The employer has the right to draw up an order in free form, taking into account the legal requirements for primary documents.

It is issued either on the basis of an employee’s application, or on the basis of a provision on financial assistance or another regulatory document of the company. The order must contain the following information: name and details of the company, information about the employee, reason for providing assistance, amount of payment, appointment of the responsible person. The reasons for providing assistance may include: the need for expensive treatment for the employee, the acquisition of medications by the employee, or the employee undergoing rehabilitation measures. The order may also contain other information at the discretion of the manager (

Financial assistance for treatment and personal income tax

When determining the tax base for personal income tax, it is necessary to take into account the employee’s income received not only in cash, but also in kind. Payments in the form of financial assistance should also be taken into account, since this is also the employee’s income. But the amount of financial assistance that will be taxed will depend on the size of the payment. Financial assistance not exceeding 4,000 rubles is not subject to insurance contributions (217 Tax Code of the Russian Federation). At the same time, 4,000 rubles is the maximum amount of assistance per year per employee, which will not be subject to personal income tax. If during the year the employee was paid financial assistance in a larger amount, then personal income tax will be withheld only from the amount that exceeds 4,000 rubles. For example, an employee was paid 3,000 rubles for vacation and 10,000 rubles for treatment during the year. Personal income tax will need to be withheld only from 9,000 rubles (3,000 + 10,000 – 4,000).

Financial assistance up to 4000 (taxation 2020)

Let's consider the taxation of financial assistance to an employee in 2022. Is financial assistance subject to personal income tax (2020)? The withholding of personal income tax is indicated in Chapter 23 of the Tax Code of the Russian Federation, and Article 217 of the Tax Code of the Russian Federation specifies whether financial assistance is subject to personal income tax. If you carefully read this article, it will become clear that income tax for individuals is not withheld in the same cases when insurance premiums are not collected. We are talking about the payment of money upon the birth of a child or the death of a family member, amounts up to 4,000 rubles (for any purpose). At the same time, we must remember that the 2-NDFL certificate will have different income codes and deduction codes each time - depending on the type of financial assistance provided and taxation or collection of insurance premiums (Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/).

Here are some more interesting points:

- According to the Ministry of Finance, monthly financial assistance to a person on maternity leave can be subject to personal income tax, taking into account standard tax deductions, the amounts of which are contained in paragraphs. 4 clause 1 of Article 218 of the Tax Code of the Russian Federation (Letter dated 02/17/2016 No. 03-04-05/8718). In other words, if an employer pays extra every month to a woman on maternity leave, he can reduce the amount of the extra payment by the so-called child deduction. Since this form of support may be a general type of financial assistance, and not a one-time payment in connection with the birth, although one reason is the birth of a baby;

- financial assistance, tax-free in 2022, is provided by the employer to family members of a deceased employee or former employee who previously retired due to disability, age or old age, or to the employee (pensioner) himself if one of his family members has died (Letters from the Ministry of Finance dated 16.12 .2014 No. 03-04-05/64847, dated 12/02/2016 No. 03-04-05/71785);

- if the fact of an emergency or terrorist act is not confirmed, the employer takes personal income tax from compensation (Letter of the Ministry of Finance dated January 20, 2017 No. 03-04-06/2414).

Insurance premiums for financial assistance for treatment

All payments or rewards that are made to individuals under an employment contract or civil servants' agreement must be subject to insurance contributions (No. 212-FZ). In this case, the exception is payments in the form of financial assistance in the amount of 4,000 rubles per year. This rule applies to any type of financial assistance, even if assistance is provided to the employee in connection with expensive treatment. Maternity assistance is exempt from insurance premiums only in certain cases: if it is paid in connection with natural disasters, terrorist attacks and other emergency circumstances in order to compensate for damage to health. Law 212-FZ does not explain what exactly is meant by “extraordinary circumstances”. But in practice, it is necessary that they be confirmed by some official documents, for example, a certificate from medical institutions, a decision of the authorities on the introduction of an emergency, the Ministry of Internal Affairs, etc.

In other words, if the company can confirm that the treatment costs allocated to the employee as financial assistance are due to the occurrence of an emergency, then such a sum of money will not be subject to insurance premiums.

It should be remembered that you will have to prove your case to the inspection authorities, since financial assistance for treatment is not included in the list of payments exempt from insurance contributions (422 of the Tax Code of the Russian Federation).

Results

In conclusion, let's summarize some results:

- There is no legislative concept of financial assistance for the treatment of an employee;

- Based on the norms of tax law and the positions of domestic judicial authorities, such payment should not be made within the framework of labor relations (but follow from the collective agreement);

- regardless of whether there is proof of medical expenses, assistance in the amount of up to 4,000 rubles per year is not taxed and insurance premiums are not charged;

- the payment initiative can come both from the employee (this requires his application) and from the employer himself (in this case, one order is sufficient);

- the form of application and order is free, but they must contain a justification for the reason for payment and a description of the needs for treatment, in addition, they must be carried out in accordance with the internal rules of office work and have the necessary details;

- Payment can be made not only for medical treatment, but also for medications necessary for the employee in accordance with doctor’s prescriptions.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.