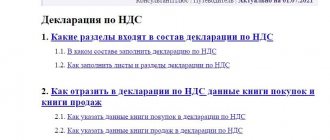

- Procedure for submitting a tax return

- Date of submission of the tax return. Responsibility for failure to submit on time

- Tax return form. Information indicated in the declaration

- Acceptance of the declaration by tax authorities

- Making changes and additions to the tax return

A tax return is a written statement by the taxpayer about income received and expenses incurred, sources of income, tax benefits and the calculated amount of tax and (or) other data related to the calculation and payment of tax.

A tax return is submitted by each taxpayer for each tax payable by that taxpayer, unless otherwise provided by the legislation on taxes and fees.

The absence of a tax payable amount from a taxpayer based on the results of a particular tax period does not in itself relieve him from the obligation to submit a tax return (Article 80 of the Tax Code of the Russian Federation) for a given tax period, unless otherwise established by the legislation on taxes and fees.

To illustrate, let us give an example from judicial practice. Thus, the tax authority appealed to the arbitration court with an application to collect from the limited liability company a fine provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation, for late submission of tax returns on income taxes and value added taxes.

The defendant did not voluntarily pay the fine, but did not present arguments to the court to substantiate his position.

The court decision rejected the claim with reference to the company’s lack of amounts of the specified taxes to be paid at the end of the corresponding tax period. According to the court, the taxpayer has no obligation to submit a “zero” tax return.

The cassation court overturned the decision and satisfied the claim, noting the following.

According to para. 2 p. 1 art. 80 of the Tax Code of the Russian Federation, a tax return is submitted by each taxpayer for each tax payable by this taxpayer, unless otherwise provided by the legislation on taxes and fees.

By virtue of this norm, the taxpayer’s obligation to submit a tax return for a particular type of tax is determined not by the presence of the amount of such tax to be paid, but by the provisions of the law on this type of tax, by which the corresponding person is classified as a payer of this tax.

Chapter 21 of the Tax Code of the Russian Federation does not establish any other (special) rules for submitting a tax return for value added tax.

Article 289 ch. 25 of the Tax Code of the Russian Federation (Part II), which regulates the submission of a tax return for income tax, in this case is consistent with the provisions of paragraph. 2 p. 1 art. 80 Tax Code of the Russian Federation.

Thus, the defendant, being a payer of the above types of taxes, was obliged to submit tax returns within the time limits established by law, regardless of the results of calculations of the amounts of taxes payable based on the results of certain tax periods.

The rules provided for in Art. 80 of the Tax Code of the Russian Federation do not apply to the declaration of goods transported across the customs border of the Russian Federation.

The specifics of submitting tax returns when implementing production sharing agreements are determined by Ch. 26.4 Tax Code of the Russian Federation.

Procedure for submitting a tax return

The tax return is submitted to the tax authority at the place of registration of the taxpayer in the prescribed form on paper or electronically in accordance with the legislation of the Russian Federation. Tax return forms are provided by tax authorities free of charge.

The tax return can be submitted by the taxpayer to the tax authority in person or through his representative, sent in the form of a postal item with an inventory of the contents, or transmitted via telecommunication channels.

Each document of the accepted tax return (title page) contains information about the submission of the tax return to the tax authority. In cases where tax returns and financial statements are submitted by the taxpayer in person (through a representative), on the remaining copies of tax returns, the tax authority, at the taxpayer’s request, puts a mark of acceptance and the date of its submission.

The tax authority does not have the right to refuse to accept a tax return and is obliged, at the request of the taxpayer, to put a mark on the copy of the tax return about acceptance and the date of its submission. Upon receipt of a tax return via telecommunication channels, the tax authority is obliged to provide the taxpayer with an acceptance receipt in electronic form.

However, in accordance with the order of the Ministry of Taxes of the Russian Federation dated August 10, 2004 N SAE-3-27/468 “On approval of the regulations for organizing work with taxpayers,” an official of the department of work with taxpayers may refuse to accept reports to a taxpayer if they are not submitted in the form, approved by federal, regional executive authorities and executive authorities of local self-government. If such reporting is received by mail, the department for working with taxpayers, having received it from the department of financial and general support (general security), considers it not accepted, does not register it and within 3 days sends a notification to the taxpayer that the reporting was not submitted in accordance with the form. not accepted and must be submitted within the established time frame and in the approved form. When sending a notice by mail, the official of the department for working with taxpayers puts a mark on the second copy indicating that the document was sent by mail.

The procedure for submitting a tax return in electronic form is determined by the Ministry of Finance of the Russian Federation. The procedure for submitting a tax return in electronic form via telecommunication channels was approved by order of the Ministry of Taxes of the Russian Federation dated April 2, 2002 No. BG-3-32/169.

The specified Procedure for submitting a tax return in electronic form via telecommunication channels (hereinafter referred to as the Procedure) defines the general principles of organizing information exchange when taxpayers submit a tax return in electronic form via telecommunication channels.

Participants in the information exchange when submitting a tax return in electronic form are taxpayers or their representatives, tax authorities, as well as specialized communication operators who transmit tax returns in electronic form via communication channels from taxpayers or their representatives to the tax authorities.

Relations between participants in information exchange when submitting a tax return in electronic form are regulated by: the Civil Code of the Russian Federation; Tax Code of the Russian Federation; Federal Law of November 21, 1996 N 129-FZ “On Accounting” (as amended and supplemented by June 30, 2003); Federal Law of January 10, 2002 N 1-FZ “On Electronic Digital Signature”; Federal Law of February 20, 1995 N 24-FZ “On Information, Informatization and Information Protection” (as amended and supplemented on January 10, 2003); Federal Law of July 7, 2003 N 126-FZ “On Communications” (as amended and supplemented on November 2, 2004), other federal laws, other regulatory legal acts, as well as the Procedure itself.

Submission of a tax return in electronic form is carried out at the initiative of the taxpayer and if he and the tax authority have compatible technical means and capabilities for its reception and processing in accordance with the standards, formats and procedures approved by the Ministry of Taxes and Duties of the Russian Federation.

Submission of a tax return in electronic form is carried out through a specialized telecom operator providing services to the taxpayer.

When submitting a tax return electronically in accordance with the Procedure, the taxpayer is not required to submit it to the tax authority on paper.

When submitting a tax return in electronic form in accordance with the Procedure, the taxpayer and the tax authority ensure its storage in electronic form in the prescribed manner.

Submission of a tax return in electronic form is permitted with the mandatory use of electronic digital signatures (hereinafter referred to as EDS), certified by the Federal Agency for Government Communications and Information under the President of the Russian Federation, which allow identifying the owner of the signature key certificate, as well as establishing the absence of distortion of the information contained in the tax return in electronic form. form.

In order to protect the information contained in the tax return, when transmitting it over communication channels, participants in the exchange of information use cryptographic information protection tools (hereinafter referred to as cryptographic information protection), certified by the Federal Agency for Government Communications and Information under the President of the Russian Federation.

The use, accounting, distribution and maintenance of CIPF and digital signature tools when submitting a tax return in electronic form is carried out in accordance with the requirements of the legislation of the Russian Federation and other regulatory legal acts.

When a taxpayer submits a tax return in electronic form, the tax authority is obliged to accept the tax return and provide the taxpayer with a receipt of its acceptance, which is the received tax return, signed with the digital signature of an authorized person of the taxpayer, certified with the digital signature of an authorized person of the tax authority.

The taxpayer submits a tax return electronically to the tax authority with which he is registered, through a specialized telecom operator.

Submission of a tax return in electronic form via telecommunication channels is possible if the taxpayer is connected to public communication systems, has the necessary hardware, as well as appropriate software that performs:

- generation of tax return data in accordance with the standards, formats and procedures approved by the Ministry of Taxes and Duties of the Russian Federation, for their subsequent transmission in the form of electronic documents via telecommunication channels;

- generating requests to receive from the tax authority at the place of registration an information extract on the fulfillment of tax obligations to budgets of various levels;

- encryption when sending and decryption when receiving information using CIPF;

- generating a signature when transmitting information and verifying it upon receipt using electronic digital signatures.

When submitting a tax return electronically, the taxpayer follows the following electronic document flow procedure:

- after preparing the information containing the data of the tax return, the taxpayer signs it with the digital signature of an authorized person of the taxpayer and sends it in encrypted form to the tax authority at the place of registration;

- Within 24 hours, the tax authority sends a receipt for acceptance of the declaration in electronic form to the taxpayer. After verifying the authenticity of the digital signature of an authorized person of the tax authority, the taxpayer saves the document in his archive.

Tax Code of the Russian Federation (Part One)

<< table of contents..Section V. Tax return and tax control

Chapter 13. Tax return

Article 80. Tax return

1. A tax return is a written statement by the taxpayer about the objects of taxation, about income received and expenses incurred, about sources of income, about the tax base, tax benefits, about the calculated amount of tax and (or) about other data that serves as the basis for the calculation and payment of tax .

A tax return is submitted by each taxpayer for each tax payable by that taxpayer, unless otherwise provided by the legislation on taxes and fees.

The calculation of the advance payment is a written statement by the taxpayer about the calculation base, the benefits used, the calculated amount of the advance payment and (or) other data serving as the basis for the calculation and payment of the advance payment. The calculation of the advance payment is presented in the cases provided for by this Code in relation to a specific tax.

The calculation of the fee is a written statement by the payer of the fee about the objects of taxation, the taxable base, the benefits used, the calculated amount of the fee and (or) other data that serves as the basis for the calculation and payment of the fee, unless otherwise provided by this Code. The calculation of the fee is presented in the cases provided for in part two of this Code in relation to each fee.

The tax agent submits to the tax authorities the calculations provided for in Part Two of this Code. These calculations are presented in the manner established by part two of this Code in relation to a specific tax.

2. Tax returns (calculations) for those taxes for which taxpayers are exempt from the obligation to pay them due to the application of special tax regimes are not subject to submission to the tax authorities.

A person recognized as a taxpayer for one or more taxes, who does not carry out transactions that result in the movement of funds in his bank accounts (at the organization’s cash desk), and who does not have objects of taxation for these taxes, represents a single (simplified) tax assessment for these taxes. declaration.

The form of a single (simplified) tax return and the procedure for filling it out are approved by the Ministry of Finance of the Russian Federation.

A single (simplified) tax return is submitted to the tax authority at the location of the organization or place of residence of the individual no later than the 20th day of the month following the expired quarter, half-year, 9 months, or calendar year.

3. The tax return (calculation) is submitted to the tax authority at the place of registration of the taxpayer (fee payer, tax agent) in the established form on paper or in the established formats in electronic form along with documents that, in accordance with this Code, must be attached to the tax return (calculation). Taxpayers have the right to submit documents that, in accordance with this Code, must be attached to the tax return (calculation), in electronic form.

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as newly created (including during reorganization) organizations whose number of employees exceeds the specified limit, submit tax returns (calculations) to the tax authority in established formats in electronic form, unless a different procedure for presenting information classified as state secret is provided for by the legislation of the Russian Federation.

Information on the average number of employees for the previous calendar year is submitted by the taxpayer to the tax authority no later than January 20 of the current year, and in the case of creation (reorganization) of an organization - no later than the 20th day of the month following the month in which the organization was created (reorganized) . The specified information is submitted in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees to the tax authority at the location of the organization (at the place of residence of the individual entrepreneur).

Taxpayers, in accordance with Article 83 of this Code, classified as the largest taxpayers, submit all tax returns (calculations) that they are required to submit in accordance with this Code to the tax authority at the place of registration as the largest taxpayers in the established formats in electronic form, if a different procedure for presenting information classified as state secret is not provided for by the legislation of the Russian Federation.

Tax declaration (calculation) forms are provided by tax authorities free of charge.

4. A tax return (calculation) can be submitted by a taxpayer (payer of a fee, tax agent) to the tax authority in person or through a representative, sent by mail with a list of the contents, or transmitted via telecommunication channels.

The tax authority does not have the right to refuse to accept a tax return (calculation) submitted by a taxpayer (fee payer, tax agent) in the established form (established format), and is obliged to mark, at the request of the taxpayer (fee payer, tax agent) on a copy of the tax return (copy of calculation ) a mark of acceptance and the date of its receipt upon receipt of a tax return (calculation) on paper, or transfer to the taxpayer (payer of the fee, tax agent) a receipt of acceptance in electronic form - upon receipt of a tax return (calculation) via telecommunication channels.

When sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting a tax return (calculation) via telecommunication channels, the day of its submission is considered the date of its dispatch.

The procedure for submitting a tax return (calculation) and documents in electronic form is determined by the Ministry of Finance of the Russian Federation.

5. The tax return (calculation) is submitted indicating the taxpayer identification number, unless otherwise provided by this Code.

The taxpayer (fee payer, tax agent) or his representative signs the tax return (calculation), confirming the accuracy and completeness of the information specified in the tax return (calculation).

If the accuracy and completeness of the information specified in the tax return (calculation) is confirmed by an authorized representative of the taxpayer (fee payer, tax agent), the tax return (calculation) indicates the basis of the representation (the name of the document confirming the authority to sign the tax return (calculation). In this case, a copy of the document confirming the authority of the representative to sign the tax return (calculation) is attached to the tax return (calculation).

6. The tax return (calculation) is submitted within the time limits established by the legislation on taxes and fees.

7. Forms of tax declarations (calculations) and the procedure for filling them out are approved by the Ministry of Finance of the Russian Federation, unless otherwise provided by this Code.

Formats for submitting tax returns (calculations) in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, based on the forms of tax returns (calculations) and the procedure for filling them out, approved by the Ministry of Finance of the Russian Federation.

The Ministry of Finance of the Russian Federation does not have the right to include in the tax return (calculation) form, and tax authorities do not have the right to require taxpayers (payers of fees, tax agents) to include in the tax return (calculation) information not related to the calculation and (or) payment of taxes and fees, except:

1) type of document: primary (corrective);

2) name of the tax authority;

3) location of the organization (its separate division) or place of residence of an individual;

4) last name, first name, patronymic of an individual or full name of the organization (its separate division);

5) contact telephone number of the taxpayer.

8. The rules provided for in this article do not apply to the declaration of goods transported across the customs border of the Russian Federation.

9. The specifics of submitting tax returns when implementing production sharing agreements are determined by Chapter 26.4 of this Code.

10. The specifics of fulfilling the obligation to submit tax returns by paying a declaration payment are determined by the federal law on the simplified procedure for declaring income by individuals.

Article 81. Amendments to the tax return

1. If a taxpayer discovers in the tax return submitted by him to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable, the taxpayer is obliged to make the necessary changes to the tax return and submit to the tax authority an updated tax return in in the manner prescribed by this article.

If a taxpayer discovers inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of tax payable, the taxpayer has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner established by this article . In this case, an updated tax return submitted after the expiration of the established deadline for filing the return is not considered submitted in violation of the deadline.

2. If an updated tax return is submitted to the tax authority before the deadline for filing a tax return, it is considered submitted on the day the updated tax return is submitted.

3. If an updated tax return is submitted to the tax authority after the expiration of the deadline for filing a tax return, but before the expiration of the deadline for paying the tax, then the taxpayer is released from liability if the updated tax return was submitted before the moment when the taxpayer learned that the tax authority had discovered the fact of non-reflection or incompleteness reflection of information in the tax return, as well as errors leading to an underestimation of the amount of tax payable, or the appointment of an on-site tax audit.

4. If an updated tax return is submitted to the tax authority after the deadline for filing a tax return and the deadline for paying the tax, the taxpayer is released from liability in the following cases:

1) submission of an updated tax return before the taxpayer learns that the tax authority has discovered non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable, or about the appointment of an on-site tax audit for a given tax for a given period, provided that before submitting an updated tax return, he paid the missing amount of tax and the corresponding penalties; 2) submission of an updated tax return after an on-site tax audit for the corresponding tax period, the results of which did not reveal non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable.

5. The updated tax return is submitted by the taxpayer to the tax authority at the place of registration. The updated tax return (calculation) is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made.

6. If a tax agent discovers in the calculation submitted to the tax authority the fact that information is not reflected or is incompletely reflected, as well as errors leading to an understatement or overestimation of the amount of tax to be transferred, the tax agent is obliged to make the necessary changes and submit to the tax authority an updated calculation in the manner established by this article.

The updated calculation submitted by the tax agent to the tax authority must contain data only in relation to those taxpayers in respect of whom facts of non-reflection or incomplete reflection of information, as well as errors leading to an understatement of the tax amount, were discovered.

The provisions provided for in paragraphs 3 and 4 of this article regarding exemption from liability also apply to tax agents when they submit updated calculations.

7. The rules provided for in this article also apply to updated calculations of fees and apply to payers of fees.

<< previous chapter.. next chapter.. >>

Date of submission of the tax return. Responsibility for failure to submit on time

The date of submission of tax returns and financial statements is the date of their actual submission to the tax authority on paper or the date of sending a registered letter with a list of attachments.

When sending a tax return by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting a tax return via telecommunication channels, the day of its submission is considered the date of its dispatch.

The date of submission of the tax return in electronic form is the date of its sending, recorded in the confirmation of the specialized telecom operator.

When submitting a tax return in electronic form, the taxpayer has the right to contact the tax authority at the place of registration with a request to receive an information extract on the fulfillment of tax obligations to the budget (hereinafter referred to as the extract). Requests and statements are signed with digital signatures of authorized persons of the taxpayer and the tax authority and are transmitted via communication channels in encrypted form. The procedure for electronic document flow when exchanging requests and statements corresponds to the procedure for electronic document flow when submitting a tax return. When exchanging requests and statements, confirmation of the timing of transfers and electronic documents by a specialized telecom operator is not required.

If a taxpayer fails to submit tax returns and financial statements within the period established by the legislation on taxes and fees, the penalties provided for by the Tax Code of the Russian Federation and other legislative acts will be applied to him.

No later than the next working day from the date of acceptance, tax returns and financial statements are subject to registration by officials of the department for working with taxpayers using software.

If the tax authority does not have the technical capabilities to automate the process of registering accepted tax returns and financial statements, they are registered in a registration journal, which must be bound, numbered and sealed by the tax authority.

Each received document of tax returns and financial statements is assigned a registration number, which is affixed to the accepted document.

The tax return is submitted within the deadlines established by the legislation on taxes and fees. For violation of the deadlines for submitting tax returns, tax (Article 119 of the Tax Code of the Russian Federation) and administrative (Article 15.5-15.6 of the Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation) dated December 30, 2001 N 195-FZ (as amended on 9 May 2005) responsibility.

According to the Regulations for organizing work with taxpayers, if a violation of the deadlines for its submission established by law is detected at the stage of accepting a tax return:

- in case of submission of a tax return by the taxpayer, an employee of the desk audit department is personally invited to draw up a protocol on the administrative offense;

- If a tax return is submitted on behalf of the taxpayer by a representative of the taxpayer, the taxpayer’s representative is personally given a notice of the need to appear at the tax authority of the person responsible in accordance with the current legislation for the timely submission of reports to the tax authority, and at the same time the department of desk audits is notified of the fact that the taxpayer has submitted a return in violation deadlines established by law;

- in case of submission of a tax return on paper by mail or electronically, a daily list of such tax returns is compiled and submitted to the desk audit department for information and appropriate action.

After 6 days after the deadline established by the legislation on taxes and fees for submitting tax returns and financial statements to the tax authority, employees of the desk audit department verify the list of registered taxpayers required to submit tax returns and financial statements within the appropriate period with data on their actual submission using an automated system.

Based on the results of this reconciliation, the department of desk audits in accordance with the right granted to the tax authorities in paragraph 4 of Art. 31 of the Tax Code of the Russian Federation, summons taxpayers on the basis of a written notification to the tax authority to give explanations on the circumstances related to their failure to comply with the legislation on taxes and fees (failure to submit tax returns and financial statements within the prescribed period). This notice informs the taxpayer of his failure to fulfill the obligation to submit tax returns and financial statements to the tax authority, and also indicates the need for their submission.

Tax return form. Information indicated in the declaration

Tax return forms and the procedure for filling them out are approved by the Ministry of Finance of the Russian Federation. Letter of the Federal Tax Service dated February 11, 2005 N MM-6-01/119 “On the acceptance of tax returns” established a rule according to which, if, after the tax authority has accepted a tax return, a new tax return form is approved or changes are made to the current form and (or) additions, the taxpayer does not need to submit a tax return in the newly approved form.

Uniform requirements for the formation and formalization of tax returns and other documents serving as the basis for the calculation and payment of taxes and fees were approved by order of the Ministry of Taxes of the Russian Federation dated December 31, 2002 N BG-3-06/756 (as amended by the order of the Ministry of Taxes of the Russian Federation dated September 1 2003 N BG-3-06/484).

Thus, a tax return consists of the following components:

- title page;

- section 1 of the declaration, containing information about the amounts of tax payable to the budget according to the taxpayer;

- section (sections) of the declaration containing (containing) the main indicators of the declaration involved in control ratios and used for calculating tax, as well as necessary for the generation of statistical reporting by tax authorities;

- sections (appendices) of the declaration containing additional data on individual indicators used in calculating tax (if necessary).

A typical form for the cover page of tax returns for various types of taxes includes:

1) information provided by the taxpayer:

a) about the type of tax return, the tax period for which it was submitted, the date of its submission to the tax authority; b) basic accounting information about the taxpayer; c) the signature of the taxpayer - an individual or the signature of the manager, chief accountant of the taxpayer - organization and (or) an authorized representative (if any), confirming the accuracy and completeness of the information specified in the declaration;

2) information indicated by the tax authority employee when accepting the tax return:

a) on the submission of a tax return; b) on determining the category of taxpayer (largest, main and others).

Instructions for filling out a tax return are formed taking into account the Procedure for filling out a standard form for the title page of a tax return (Appendix No. 2 to the Uniform Requirements).

The instructions for filling out tax returns include relevant sections that define the procedure for paying taxes, taking into account the specifics established by the legislation on relevant taxes and fees or regulations of the Ministry of Taxes of Russia.

Section 1 of the declaration, containing information on the amounts of tax payable to the budget according to the taxpayer, must include indicators of the amounts of tax accrued for payment to the budget according to the taxpayer, broken down by budget classification codes and OKATO codes, taking into account the specifics of calculation and payment of a specific type of tax.

When developing the forms of the title page and section 1 of the tax return for a specific tax, it is possible to include additional details (indicators) or exclude the corresponding details (indicators) given in the standard forms of the title page and section 1 of the declaration.

The section(s) of the declaration containing the main indicators of the declaration involved in the control ratios and used for calculating tax, as well as necessary for the generation of statistical reporting by tax authorities, must include:

1) indicators characterizing the main elements of taxation:

a) tax bases; b) tax rates; c) tax amounts subject to payment or refund; d) other indicators used in calculating the corresponding tax (object of taxation, tax benefits, tax deductions, etc.).

The sequence of arrangement of indicators characterizing the main elements of taxation and their composition is determined in accordance with the procedure for calculating the corresponding type of tax established by part two of the Tax Code of the Russian Federation. At the same time, sections containing the main indicators of tax declarations for all taxes (levies), for which the legislation on taxes and fees provides for the transfer of part of the taxes to various types of budgets, should include indicators of the code of the All-Russian Classifier of Objects of Administrative-Territorial Division (OKATO) of certain municipal territories entities where funds from the payment of taxes and fees are accumulated, as well as codes of types of income from the payment of relevant taxes and fees in accordance with the Classification of Budget Income of the Russian Federation (KBK);

2) indicators involved in control ratios and used to conduct an automated desk tax audit.

The tax return contains a breakdown of the indicators used to determine the tax base, tax deductions, and tax benefits (if necessary). This decoding may be contained in sections (appendices) containing data on individual indicators used in calculating tax. In the sections giving the main indicators of the declaration, references may be given to the numbers of the corresponding appendices (lines) of the sections (appendices) containing data on individual indicators used in calculating the tax (if any).

Section (sections) containing the main indicators of the declaration, as well as sections (appendices) containing data on individual indicators used in calculating tax, may contain details to reflect the values of individual indicators of the tax declaration, calculated according to the tax authority. The specified details are provided for those tax return indicators, the correctness of calculation of which can be determined during a desk tax audit (for example, by requesting additional information from the taxpayer, obtaining explanations and documents confirming the correctness of calculation and timely payment of tax, etc.).

The requirements for the formation of other documents that serve as the basis for the calculation of taxes and fees are similar to the requirements for the formation of tax returns.

According to current legislation, state tax inspectorates are required to provide declaration forms free of charge. However, due to existing financing problems and the lack of possibility of additional support for tax inspectorates in accordance with their requests, letter of the Ministry of Taxes of the Russian Federation dated February 19, 1999 N VG-6-08/130 “On the free provision of declaration forms” proposed to establish strict accounting of declaration forms issued to individuals , if possible, avoiding repeated issuance of forms to the same persons. In case of urgent need, it is allowed to reproduce forms in black and white at your own expense.

The tax return is submitted indicating a single taxpayer identification number for all taxes.

Tax authorities do not have the right to require the taxpayer to include in the tax return information not related to the calculation and payment of taxes.

Concept and purpose of a tax return

A tax return is an official statement by a taxpayer about the income he received for a certain period and the tax discounts and benefits that apply to them, submitted to the tax authorities using a special form.

The declaration is filled out once a year. A tax return is required to be filed. Filing deadlines depend on the type of declaration.

Tax accounting data of an enterprise is formed according to a generally accepted structure.

The resulting report must be made available to the inspecting institution.

Among the information provided:

- The amount of income and expenses incurred during the year.

- Information about taxable resources.

- About sources of profit.

- About the tax base.

- Tax benefits.

- Information about the calculated amount of payments and data according to which calculation and payment are made.

You can learn more about what a tax return is here.

Acceptance of the declaration by tax authorities

In accordance with the order of the Ministry of Taxes of the Russian Federation dated February 14, 2003 N BG-3-06/65 “On the introduction into force of the Regulations for the acceptance and entry into the automated information system of tax authorities of data submitted by taxpayers of tax returns, other documents serving as the basis for the calculation and payment of taxes and financial statements” at the stage of accepting tax returns and financial statements, all submitted documents are subject to visual control for the presence of the following details:

- full name (full name of the individual, date of birth) of the taxpayer;

- taxpayer identification number;

- reason code for registration (for legal entities);

- the period for which tax returns and financial statements are submitted;

- signatures of persons authorized to confirm the accuracy and completeness of information in tax returns and financial statements of the taxpayer (manager and chief accountant of the taxpayer organization) or his representative.

If any of the above details are missing from the submitted tax returns and financial statements, the employee of the taxpayer relations department must verbally warn the taxpayer or his representative about this and offer to make the necessary changes. At the same time, an employee of the department for working with taxpayers does not have the right to refuse to accept tax returns and financial statements, except in the case of submission of the above documents not in the established form.

If the taxpayer (his representative) refuses to make the necessary changes to tax returns and financial statements at the acceptance stage, as well as in the case of submitting tax returns and financial statements by mail and they do not contain any of the above details, the department for working with taxpayers in 3- within one day from the date of registration, the taxpayer must notify the taxpayer in writing of the need to submit a document in the form approved for this document in the following cases:

- the absence of any of the necessary details in the tax returns and financial statements submitted by the taxpayer;

- when there is unclear filling in of certain details of a document, making it impossible to read them unambiguously, filling them out in pencil, or the presence of corrections not specified by the signature of the taxpayer (manager and chief accountant of the taxpayer organization) or his representative;

- preparation of tax returns and financial statements in languages other than Russian;

- discrepancies between information about the permanent executive body of a legal entity and information about the head of the legal entity who signed the tax return and financial statements contained in the Unified State Register of Legal Entities (USRLE).

If there are errors in the declarations registered and transferred to the input department that do not allow entry, the declarations according to the register are transferred from the data input and processing department to the department for working with taxpayers. The official of the department for working with taxpayers prepares a notice of the need to make clarifications in the submitted reports and submits it to the department of financial and general support for sending by registered mail with notification.

If, within 10 calendar days from the date of receipt of the postal item by the taxpayer or the return of the postal item due to the absence of the taxpayer at the address specified in the constituent documents, the taxpayer does not make clarifications in the reporting, a copy of the register of such declarations and declarations is sent to the department of desk audits to take appropriate measures.

How to determine what to submit to the Federal Tax Service

First of all, it is worth noting that the types of tax reporting are determined depending on the applied taxation system. In other words, a taxpayer in the main taxation regime is required to submit reports using the same format, while an entrepreneur in the simplified tax regime is required to submit completely different forms.

The second most important factor is the type of main activity. Thus, for a certain type, additional report forms are provided. For example, declarations on gambling business or water tax.

The type of products produced and sold also has a direct impact on the composition of the reports. For example, if an enterprise produces excisable products, it will have to submit an excise tax return. Moreover, there is not just one declaration form, there are several forms. Which one the company will have to hand over is determined by the type of excisable goods.

The presence of hired employees in the enterprise also affects the composition, which is included in tax reporting. If there are employees on staff, then the following forms are added:

- calculation of 6-NDFL;

- unified calculation of insurance premiums;

- 2-NDFL certificates.

In addition to reports to the Federal Tax Service, employers also submit pension reports (SZV-M, SZV-STAZH and others).

Making changes and additions to the tax return

If a taxpayer discovers non-reflection or incomplete reflection of information in the tax return submitted by him, as well as errors leading to an understatement of the amount of tax payable, he is obliged to make the necessary additions and changes to the tax return.

If provided for in paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, an application for additions and changes to a tax return is made before the expiration of the deadline for filing a tax return, it is considered submitted on the day the application is submitted.

If provided for in paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, an application to supplement and amend a tax return is made after the expiration of the deadline for filing a tax return, but before the expiration of the deadline for paying the tax, the taxpayer is released from liability if the specified application was made before the moment when the taxpayer learned about the discovery by the tax authority of the circumstances provided for in paragraph 1 tbsp. 81 of the Tax Code of the Russian Federation, or on the appointment of an on-site tax audit.

If provided for in paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, an application for additions and changes to the tax return is made after the expiration of the deadline for filing a tax return and the deadline for paying the tax, the taxpayer is released from liability, despite the fact that he made the specified application before the moment when he learned about the discovery by the tax authority of the circumstances provided for in paragraph 1 of Art. . 81 of the Tax Code of the Russian Federation, or on the appointment of an on-site tax audit. The taxpayer is released from liability in accordance with this, provided that before filing such an application he paid the missing amount of tax and the corresponding penalties.

According to the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 2001 No. 5 “On some issues of application of part one of the Tax Code of the Russian Federation” when applying the provisions of paragraphs 3 and 4 of Art. 81 of the Code, which provide for the release of a taxpayer from liability in the event that he independently discovers and corrects, in the manner prescribed by these norms, errors made when preparing a tax return, the courts must proceed from the fact that in this case we are talking about the liability provided for in paragraph 3 of Art. 120 “Gross violation of the rules for accounting for income and expenses and objects of taxation” and Art. 122 “Non-payment or incomplete payment of tax amounts” of the Tax Code of the Russian Federation

Results

Companies and individual entrepreneurs will have to report to the tax office at the end of the year at different times: no later than 01/25/2022 - for VAT, before 03/28/2022 - for income tax, no later than 03/01/2022 - for personal income tax, etc. Submit returns for transport and there is no need for land taxes.

Funds also expect final reporting: on January 15 and 20, as well as March 1, forms must be submitted to the Pension Fund; January 20 is the last day for submitting a paper report on injury contributions, and January 25 for its electronic version.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ

- Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p

- Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 No. 482p

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.