Individual entrepreneurs are currently actively using the Federal Tax Service, which has been providing an online service on its website since 2012. It consists of opening an entrepreneur’s personal account on the website. The service is available for both individual individuals and legal entities. Important actions and procedures that people previously had to spend a lot of time on began to be performed quickly, efficiently, in a few minutes. Below we discuss why this service has proven to be incredibly beneficial for entrepreneurship in general.

What is LC NP IP on the Federal Tax Service website

A personal account is an Internet page on the Federal Tax Service website that contains the data of a separate individual entrepreneur. Everyone has their own, with an individual password to log into the system.

Personal account is available for individual entrepreneurs

Using the taxpayer’s personal account, the individual entrepreneur performs various actions:

- controls the calculation of taxes;

- pays taxes via the Internet;

- receives information in the form of notifications from the government on time. authorities, as well as documents in the form of extracts, receipts;

- through online communication, consults on various issues with representatives of the Federal Tax Service.

Official website Tax ru

There are many clones of the tax service website on the Internet, but there is only one official tax service website and is available at www.nalog.ru. Only on this website you will be able to log into your personal account and pay current taxes, penalties, view your debt, register an individual entrepreneur or request a certificate from the tax office online.

Using the official website of the Federal Tax Service, you can perform the following operations:

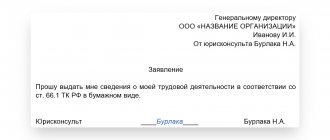

- Notify about refusal to use your personal account (needed to receive the requested certificates on paper at the Federal Tax Service office)

- Report the presence of property or vehicles

- Submit an application for property tax benefits

- Get a certificate of mutual settlement with the budget

- Submit an application for tax deduction rights

- Get a certificate about the status of settlements

- Notify about the availability of accounts opened in foreign banks

- Make an appointment with the tax authority

The official tax website looks like this:

Immediately at the top there are links to enter the personal accounts of various types of persons, then there are links to electronic services and on the side there is a brief summary of the latest news.

Clearing the browser cache

Our portal is constantly improving and changes are taking place in Users' Personal Accounts. To see updates and improvements, we recommend clearing data from the cache. Use your browser's F5 key.

The Ministry of Taxes and Duties of the Republic of Belarus informs that a new version of the Personal Account is available for Tax Payers. Access to the personal account is carried out using logins and passwords, a physical digital signature and a mobile digital signature.

To work with a physical digital signature, the service is available only in the Internet Explorer browser version 11. The Ministry of Taxation recommends updating the Internet Explorer browser to version 11. Old versions of the Internet Explorer browser (versions 8, 9 and 10) are not supported in this Personal Account.

For Legal entities, access to the Personal Account is possible only with a physical digital signature. With a mobile digital signature (MEDS), the Personal Account is not available for Legal Entities.

For individual entrepreneurs, access to the Personal Account is possible with a physical and mobile digital signature. The service for working with mobile digital signature (MEDS) is available in various browsers.

Note! The use of the Personal Account using login and password and via the electronic digital signature is carried out without certified means of protection.

This document provides brief instructions describing the capabilities of the new personal account - Instructions in PDF format.

You can find complete instructions for using your Personal Account by clicking the Help in the top menu.

If you have difficulty logging into your Personal Account in Google Chrome and Opera browsers, follow the steps described in these instructions.

The following services are available in your Personal Account:

- Submit an application to receive documents from the Ministry of Taxation;

- Pay taxes (land and real estate) through Internet banking of Alfa Bank, Belarusbank, Belgazprombank, Belinvestbank, Priorbank Technobank, Belagroprombank (only individual entrepreneurs and individuals:);

- Fill out and submit a declaration to the Internal Revenue Service (tax return for personal income tax);

- Receive notifications for payment of land tax, real estate tax and income tax;

- Submit a notice of activity to calculate the single tax;

- Provide the Ministry of Taxes with information on the conclusion (non-conclusion, absence) of contracts for the provision of services in the field of agroecotourism;

- View tax objects;

- View initiative documents from the Tax Inspectorate;

- Edit personal information.

The Pre-registration service is available at the old address without authorization.

A mobile application is available for payers - individuals.

Download the mobile application for Android OS ver. 4.3 and higher you can from the Google Play website

Download mobile application for iOS ver. 11.0 and higher you can from the App Store website

Attention!

If you have a mobile application version 1.31 or lower on your device, you need to manually remove it from your device and install the application from the Google Play website again.

If your mobile device has software for accessing the Internet via VPN connections (for example Psiphon), the operation of the MNS mobile application is not guaranteed

In our time of information technology, more and more government agencies are switching to an electronic method of providing services. This can significantly reduce queues at institutions and improve the speed and quality of public services.

Reference! Services of the Federal Tax Service of Russia can also be provided on the portal in electronic form. One of these electronic services is the individual entrepreneur’s account. Personal Area

Or use the link: https://lkip.nalog.ru/

Who needs it

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

A personal account, as mentioned above, is used today by all categories of entrepreneurs.

Important! To the old, pre-existing electronic services for individuals and legal entities, which have been in operation for more than one year, the Tax Service of the Russian Federation has added one more service: “LK IP”.

An entrepreneur can use his personal account to remotely contact the tax office. The level of employment among entrepreneurs is always high. They can’t afford to waste time on frequent trips to the tax office. There was an urgent need to develop a way to relieve the burden on business representatives, including all categories of business representatives. The one provided on the Federal Tax Service website dealt with this best.

For individual entrepreneurs, as well as for individuals, it was decided to simplify the possibility of doing business. From now on, if you have a personal identification document, an individual entrepreneur spends much less time checking documentation with government agencies. Tax reporting is sent to LC online. An electronic signature expands the functionality of your account.

Relevance and necessity

Disadvantages of the tax office

The service for individual entrepreneurs has its drawbacks, although there are not many of them:

- As already mentioned, to transfer applications and other documents to the Federal Tax Service you will need an electronic signature - this involves spending money and time on installing and configuring a computer. However, the opportunity to avoid going to the tax office with applications outweighs this disadvantage.

- Glitches and bugs when generating reports. Some templates on the site do not work quite correctly and may freeze, freezing the work.

- To register, you will need to visit the Federal Tax Service.

- The figures for debts and overpayments are not always displayed correctly - often with a delay, which can lead to additional unnecessary queries being submitted in an attempt to find out where the debts come from.

In general, similar shortcomings occur in any electronic systems. The Federal Tax Service tries to eliminate them whenever possible.

Registration and login to your personal account

The remote method of registering online in your personal account is perceived as the most optimal option. Otherwise, you have to collect a package of documents and go directly to the tax office.

Do individual entrepreneurs submit a balance sheet or not - why is it needed?

After logging in and registering in your personal account, you can follow the link to the page requesting registration data. Move the cursor down to reach the third section. The procedure for submitting documents is explained here. The main attention is paid to the “Remotely” item, where two types of application submission are offered.

To register an individual entrepreneur, select form 21001 on the Federal Tax Service website. Fill out items requesting passport data, contact numbers, and email of the taxpayer. You will also be asked to enter a combination of several numbers. You need to come up with it yourself and be sure to remember or write it down for reliability. A digital code will protect your personal account from hacking.

Note! An individual entrepreneur is not completely exempt from going to the tax office. He will need to do this in order to deliver the documents. But he can submit the application electronically, which will save him from having to visit the Federal Tax Service several times.

Tax office: personal entrepreneur

After sending the application and subsequent submission of documents, three days are allocated for their consideration. During this time, the entrepreneur pays a state duty in the amount of 800 rubles. Without payment, the application may be rejected.

Authorization on the service involves the use of several systems. For example, a system for creating an electronic signature. It allows you to exchange documentation with the Federal Tax Service and transfers all tax document flow online. Or use the JaCarta Smart Card system, which has an electronic signature. You can also use Rutoken EDS 2.0, which also contains an electronic signature. Authorization on the service takes place using an INN and password.

Important! Ordinary taxpayers using the login and password received from the inspection can register an individual entrepreneur’s personal account on the Federal Tax Service website.

The final action is a visit to the Federal Tax Service:

- with a passport;

- the original document of registration of the taxpayer as an individual entrepreneur;

- original TIN or notification of registration.

Registration

To register with an electronic signature, you must:

- Obtain a key certificate. This is done at the official center. The key is transferred to the media. They keep it on a disk or smart card;

- The key is connected to the computer on which the entrepreneur will work with the individual entrepreneur’s personal account. The correct connection is checked;

- Open the “Go to IP Personal Account” window;

- Place an electronic signature under the agreement that opens on the screen;

- Enter personal data into the profile form;

- Enter your email address;

- By clicking on “Next”, check the correctness of the entered data;

- Create and enter a password;

- Activate the individual taxpayer’s personal account via the link received in the email.

Hotline

If you have any complaints, questions or suggestions for improving the service, it is recommended to immediately contact the Federal Tax Service support service.

Telephone number of the Unified Contact Center:

8-800-222-2222

To leave a review about the work of the portal, you need to click on the corresponding tab on the official website and fill out the proposed form:

https://www.nalog.ru/rn50/

It is also recommended that each new user carefully read the section containing answers to frequently asked questions. You can go to the desired page through the official website:

https://www.nalog.ru/rn50/

Having a personal account as an individual entrepreneur provides entrepreneurs with the opportunity to conveniently and easily interact with tax authorities. You can register an account on the official website of the Federal Tax Service (www.nalog.ru) so as not to visit the Federal Tax Service yourself, and also not to spend too much time preparing reports.

The personal account of an individual entrepreneur taxpayer is a personal section for a person who is engaged in business privately, provides services or goods on a small scale, or is a freelancer. Thanks to this section, it is possible to minimize the time spent on performing ordinary work, as well as to avoid future problems with tax inspectors.

Functionality of the taxpayer's account

Important! The main functions of the Federal Tax Service website include a number of options provided to individual entrepreneurs registered in personal accounts.

How to find out OKATO IP by TIN: what is it and why is it needed

It's about giving them the opportunity to:

- send appeals to the Federal Tax Service, file complaints, make requests and other similar actions;

- receive information on tax debts, deductions and other payments made through your personal account or directly to the Federal Tax Service;

- get acquainted with information about various taxation systems in order to choose the most optimal version for yourself and submit an application for its connection;

- conduct budget calculations, make payments according to reporting periods;

- receive information regarding unspecified payments;

- get acquainted with the data on the status of documents sent to the Federal Tax Service for verification or confirmation;

- receive statements of payments made, data on reconciliation reports, and other documentation;

- have access to the SME business navigator portal (form business plans, pay for premises, perform other operations);

- make changes to the Unified State Register of Individual Entrepreneurs, receive an electronic extract from the Unified State Register of Individual Entrepreneurs.

In addition to the main functions in the personal account, each individual entrepreneur has access to functionality containing many services with specifics to choose from for each individual entrepreneur.

Important! Some additional services cannot be used if there was no electronic signature when registering for the service. You can exchange official documentation online only with a signature.

Mobile applications

The ability to log into your personal account for self-employed citizens on mobile devices with iOS and Android operating systems. In some cases, you may need to download additional software.

Advantages of the mobile application:

- the ability to register from your phone;

- ease of generating and sending a check to the client;

- ease of tracking tax accruals;

- timely notification of debt payment deadlines;

- availability of a certificate to confirm your status;

- available analytics tools for detailed financial analysis of ongoing activities.

You can download the mobile application in the corresponding online stores:

- App Store;

- Play Market.

What data can be viewed in LC

In addition to sending documents to the tax service through your personal account, you can view the receipt of extracts from the Unified State Register of Individual Entrepreneurs and other important operations. An individual entrepreneur can clearly see all the information related to running a business. If necessary, make changes and track your finances.

In particular, in the LC an individual entrepreneur has access to:

- change data in information about individual entrepreneurs;

- see the operations that are carried out when calculating the budget;

- see and work with statements of transactions for budget calculations;

- view reconciliation reports with the Federal Tax Service;

- if the tax service sends information about debt, overpayment by an individual entrepreneur, the entrepreneur sees this data in the taxpayer’s personal account for the Federal Tax Service on the same day. The same thing happens with the message about the upcoming tax payment;

- see general information on taxation systems used by individual entrepreneurs;

- What is important is the ability of an individual entrepreneur to see in the personal account information about documents previously sent to the tax office. Make timely edits and add missing data.

LC - quick access

Find out the debt by individual entrepreneur

One of the significant advantages of Personal Account is the ability to track bank accounts and transactions on them. Directly from the account, an entrepreneur can:

- open an account;

- close an account;

- change details;

- find out about debt.

The last option is extremely important for individual entrepreneurs. After all, ignorance of a debt does not exempt you from paying it. Moreover, delay entails penalties. In some cases they reach 40% of the unpaid amount. The longer the delay lasts, the higher the fine will be. Therefore, it is important for business entities to learn about debts immediately after they arise.

tax debt check

You can check your status as follows:

- log in to your personal account;

- go to the “My taxes” section;

- check unpaid fees;

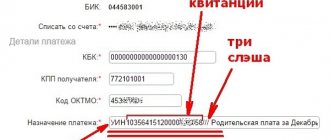

- log in to the “Pay taxes” service;

- fill out a payment order;

- make payment using CEP.

The account also offers another option for action after discovering a debt:

- click on the “Pay charges” tab;

- fill out a receipt;

- make a payment.

Both methods are quite convenient, but the second is faster and simpler. Although it only allows you to pay tax debt. The second one is a little more complicated, but through the service it is possible to pay for different items:

- state duty;

- taxes;

- fees;

- debts of various types and more.

What to do if you forgot your password

Situations where a password is lost or forgotten happen all the time. On the Federal Tax Service website, the personal account of an individual entrepreneur becomes inaccessible due to the loss of the password. The user needs to request a new password. To do this, he needs to present to the service a certain list of documents, including:

- passport or other identity document;

- original or certified copy of individual entrepreneur registration certificate;

- TIN.

LC is an advantageous offer that you can’t refuse

Password regeneration is carried out by an inspectorate working with individuals. You need to go there and make a request. If a ban on entering the Inspectorate of the Federal Tax Service or Individual Entrepreneur is displayed when using an electronic password, you will have to visit the center where the key was issued.

Creating a personal account for an individual entrepreneur on the Federal Tax Service website turned out to be beneficial for many reasons. At one time, the tax service took into account all the critical aspects associated with the work of individual entrepreneurs and gave them the opportunity to carry out many current transactions, including financial ones “through their personal account.” In turn, this greatly increased the efficiency of their work.

Functions and capabilities of the service

For businessmen, a personal page on the Federal Tax Service website is an interactive office that is filled with all sorts of functions within the tax and accounting sphere. Inspectorate staff have developed detailed instructions for maintaining a personal fee payer page for individual entrepreneurs.

Connecting to a remote account is not necessary, but businessmen who use the account for work purposes are satisfied with the service provided by the tax office. Individual entrepreneurs maintain their personal account in any place where there is Internet and at any time.

List of functions and features of the personal page on the tax server, which were rated by users:

- the opportunity to obtain up-to-date information about tax debt, the amount of accrued and paid fees, and outstanding payments;

- checking the tax authorities’ decision on partial refund of tax funds;

- check deadlines for filing returns and paying fees in the tax calendar;

- choosing a tax scheme: in your personal account there is a specialized calculator that will help you calculate the approximate amount of payment of fees under a particular tax regime;

- request, referral, receipt of income certificates, reconciliation statements for payment of fees, insurance contributions for yourself and employees;

- receipt of papers and payment of accrued fines, interest, penalties;

- submission of tax and accounting reports online in the taxpayer’s personal account;

- drawing up applications for a partial refund of overpaid fees;

- drawing up applications for compensation claims when preparing 3-NDFL;

- obtaining information and extracts from the Unified State Register of Individual Entrepreneurs and information about registration or deregistration with the Federal Tax Service;

- sending applications for changes to the Unified State Register of Individual Entrepreneurs;

- remote registration with the Federal Tax Service, as well as deregistration during the closure of the company;

- tracking and monitoring the status of sent reports.

The businessman also receives notifications from tax authorities about any news or changes in the activities of the individual entrepreneur. Your personal account contains answers to frequently asked questions: the inspectorate analyzed a number of questions that entrepreneurs ask and provided answers in the appropriate section. Therefore, a businessman has the right to find the answer to his question without visiting the service.