Payment period

Such insurance payments can be assigned after a person presents a sick leave certificate. For their timely accrual, the responsible person is given 10 calendar days. The payment itself is made on the day the salary is paid, which will be after the benefits are assigned (regulated by the provisions of Federal Law No. 255-F3 on compulsory social insurance).

Taking into account the fact that a special scheme has been launched and continues to operate in a number of regions, payment for sick leave in 2022 has undergone minor changes. Thus, in the case of timely submission of comprehensive data to the Social Insurance Fund by the responsible person for the assignment of benefits (within 5 calendar days) and the Social Insurance Fund makes a positive decision, the minimum period for transferring funds in 2022 is 15 calendar days (regulated by the provisions of Government Resolution No. 294 of April 21. 2011).

For employers, compliance with legally established deadlines remains very important, since delay will entail an obligation to pay compensation to their employee (Article 236 of the Labor Code of the Russian Federation).

Who pays

Law No. 255-FZ of December 29, 2006 states that the obligation regarding payment of sick leave lies with the employer. He must perform calculations, assign and transfer the required amount to the employee who provided a correctly completed document of the established type (in accordance with Order No. 624n of the domestic Ministry of Health and Social Development). Only after this can you apply to the Social Insurance Fund to receive compensation for sick leave in 2022, except for the first 3 days of the employee’s illness. For the specified period, funds are not reimbursed.

In regions where the Social Insurance Fund continues the pilot project, the employer will pay sick leave according to the usual scheme. That is, payments are made for the first 3 days of illness. The remaining amount is reimbursed by the FSS representative of this region - for the period from the 4th to the last day, which is indicated on the certificate of incapacity for work.

The FSS also pays insurance amounts for pregnancy and childbirth, as well as for caring for a temporarily disabled family member - from the 1st to the last day of illness (articles of Law No. 255-F3 and the provisions of Order No. 1012n of the Ministry of Health and Social Development).

Insurance experience and paid premiums

The key factor that influences the amount of cash payment during illness is the specialist’s insurance experience. Thus, Law No. 255-FZ establishes that the insurance period is the period of a citizen’s working activity for which the employer accrued and paid insurance premiums for temporary disability and maternity.

Payment of sick leave in 2022 based on length of service is carried out under the following conditions:

- If the employee does not have 6 months of experience, then sick leave is paid based on the minimum wage.

- If the length of service is from six months to 5 years, then the benefit is accrued in the amount of 60% of average earnings.

- If a specialist has worked for a total of 5 to 8 years, then in the amount of 80% of average earnings.

- If the insurance period exceeds 8 years, the state benefit is calculated at 100% of the average daily wage.

- If the patient violates the sick leave regime established for him, then payment will also be from the minimum wage.

But once again we draw your attention: there is a “ceiling” of payments established by law. We just wrote about it in the section about average daily earnings.

However, for some types of illnesses, benefits are calculated regardless of length of service. For example, we discussed maternity benefits and this procedure for paying sick leave in 2022 in a separate article, “Maternity benefits in 2022: how much, when and how.”

How is it paid?

The procedure for paying sick leave to the Social Insurance Fund in 2022 has not been changed. That is, the amount of the benefit is calculated based on the person’s average earnings, which he received over the last two years before the occurrence of the insured event. Namely – illness, pregnancy, etc.

It is worth noting that the maximum payments for a certificate of incapacity for work in 2022 are limited. But the employer can initiate additional monetary compensation - an additional payment up to average earnings. In this case, the indicated restrictions will not affect the person.

Domestic legislation determines the minimum amount of payment for sick leave in 2022. Or more precisely, the minimum value of average earnings, which is calculated based on the minimum wage. A similar value is used to calculate insurance if, for example, the average monthly salary of a worker is below the minimum wage. Other situations are also possible that require calculation based on the “minimum wage” values.

The federal minimum wage for 2022 is 9,489 rubles. obtained by calculation. Based on the provisions of the Ministry of Labor bill, the minimum wage for the next year is determined as 85% of the cost of living for the 2nd quarter of 2022 (RUB 11,163 × 85%). The average earnings for sick leave are calculated using the formula (clause 15.3 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375): Average daily earnings for payment on a certificate of incapacity = minimum wage × 24 ÷ 730

Knowing that from January 1, the minimum wage for sick leave is 9,489 rubles, you can calculate the average daily earnings. It will be 311.97 rubles.

Also see “Sick leave from the minimum wage in 2022“.

In Russia, the rules for payment of sick leave have changed

In 2022, sick leave will be paid in a new way. In addition to changing the minimum and maximum amounts of payments, the procedure for calculating them has also changed, reports the Social Insurance Fund (SIF) and the official government source - Rossiyskaya Gazeta.

From January 1 of this year, the maximum benefit amount is 2,572 rubles 60 kopecks per day, which equates to almost 80 thousand rubles per month. The minimum monthly payment cannot be less than the minimum wage (minimum wage), that is, 13,890 rubles per month and 456 rubles 66 kopecks per day.

Thus, if an employee was on sick leave for 14 days, then the minimum payment amount will be 6,393 rubles 24 kopecks, and the maximum can reach 36,016 rubles 40 kopecks, which is 1,936 rubles 90 kopecks more than in 2022. Let us remind you that these benefits are also subject to personal income tax (NDFL), thus the final amount upon receipt will be 31,334 rubles 26 kopecks.

However, not everyone can count on such sick leave, but only workers with earnings of over 78 thousand rubles per month and more than eight years of experience. In the event that the salary is lower than indicated, but the length of service is the same or greater, then the employee can count on benefits equal to 100% of his average earnings.

Alfa-Bank, Lit. No. 1326

Credit card “Whole year without interest” 365 days without interest, up to 500,000

Alfa-Bank, Lit. No. 1326

Apply for a card

Bankiros.ru

If your insurance period is from 5 to 8 years, then the amount of sick pay will be 80% of average earnings, and for up to 5 years of service - 60%. As noted by the department, regardless of the insurance period, sick leave for child care is paid at 100% of the amount.

The lowest benefit amount is 5,562 rubles 12 kopecks for two weeks of sick leave. Such a payment will be received by those whose insurance experience is less than six months or whose earnings are below the minimum wage. In particular, the minimum wage is calculated taking into account the regional coefficient, and for part-time employees - in proportion to the length of working hours.

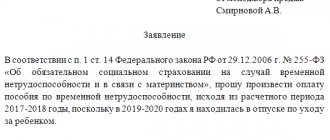

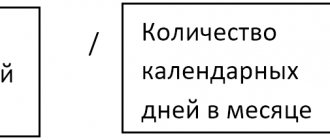

How to calculate the amount of benefits yourself? The total amount is calculated from the average earnings for two calendar years, that is, the salary is multiplied by 24 months and divided by 730 days. However, two or one year of this period can be replaced, for example, if you were on maternity leave at that time. This is possible if this measure leads to an increase in payments; for this, the employee only needs to fill out an application.

MTS Bank, Lic. No. 2268

Credit card “Money Zero (with secure card delivery)” 1100 days without interest, up to 150,000

MTS Bank, Lic. No. 2268

Apply for a card

New calculation in 2022

To calculate sick leave correctly, you need to take into account the main changes from 2022:

- New billing period – 2016 and 2022;

- Maximum earnings - 1,473,000 rubles (2016 - 718,000 rubles, 2022 - 755,000 rubles);

- The new minimum wage as of January 1, 2022 is 9,489 rubles;

- The number of days in the billing period is 730, for maternity leave – 731.

Calculation example

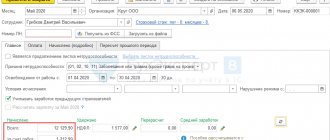

In 2022, the employee brought a certificate of incapacity for work, the period of illness was from March 12 to 22, 2022. Income subject to contributions to the Social Insurance Fund in 2016 amounted to 713,500 rubles, in 2022 - 748,300 rubles. Experience – 5 years.

- Billing period – 2016-2017, 730 days. The number of days of incapacity for work is 11.

- Let's calculate the average daily earnings and compare them with the minimum: Average daily earnings = (713,500 + 748,300) / 730 = 2002.46 rubles. The employee’s income for 2016 and 2022 is less than the limit (RUB 713,000 < RUB 718,000, RUB 748,300 < RUB 755,000). Therefore, we must take into account the actual earnings for 2016-2017 in the amount of 2002.46 rubles.

- Let's determine the percentage of sick leave payment based on length of service: Experience is 5 years, so you need to pay 80% of average earnings.

- Let's calculate the sick leave benefit: 2002.46 x 11 days. x 80% = 17,621.65 rub.

- Let's calculate the amount that the employee will receive after withholding personal income tax at a rate of 13%: The amount of sick leave tax will be: RUB 17,621.65. x 13% = 2291 rub. Amount of sick leave payable to the employee: RUB 17,621.65. – 2291 rub. = 15,330.65 rub.

- Let's determine the source of sick leave payments: The first three days of illness are paid at the expense of the employer (RUB 4,805.90). The remaining 8 days are subject to reimbursement from the Social Insurance Fund. In the calculation of 4-FSS we will show 12,815.75 rubles. is the amount to be reimbursed.

Average earnings are important

The amount of a specialist’s earnings is directly related to the amount of the state benefit we are considering. Federal Law No. 255-FZ establishes a separate procedure for calculating average daily earnings for calculating state benefits. How is it calculated:

- The calculation includes a period equal to two calendar years that precede the year of the occurrence of the insured event - illness. For sick leave issued in 2022, the years 2016 and 2017 are included in the calculation.

- Not all accrued income is taken into account, but only those payments for which insurance premiums were accrued. For example, vacation pay, salary, bonuses and part-time additional payments are included, but previously received sick leave benefits, as well as maternity leave, are excluded from the calculation.

- A similar procedure applies to the duration of periods. In other words, all non-working days, as well as those periods for which insurance premiums were not calculated, are excluded from the two-year period. For example, vacation at your own expense should be excluded. If there are no excluded days, then the calculation period of 2016 and 2022 is equal to 730 days (for maternity leave 731).

IMPORTANT! Legislators have established the minimum and maximum payment for sick leave in 2022. All amounts of accrued income are applied to the calculation, but not more than the limits established for the payment of insurance premiums. So, for 2016 there is a limit of 718,000 rubles, for 2022 - 755,000 rubles. Also, sickness benefits cannot be less than the minimum wage.

Electronic sick leave certificates in 2018

In 2022, employees can bring not only paper sick leave certificates for payment, but also electronic sick leave numbers. The latter can be issued by those medical organizations that have connected to the information interaction system with the FSS. In this case, the doctor does not fill out the paper version, but enters the data into an electronic database or electronic medical record when opening a sick leave. An electronic certificate of incapacity for work is equivalent to a paper document.

To work with electronic sheets, an organization will need a personal account at cabinets.fss.ru. Here the accountant sees the employee’s sick leave and fills out his part of the sheet.