Why does the HR manager need to follow the rules for filling out sick leave?

Issuing sick leave is a procedure strictly regulated by the legislator.

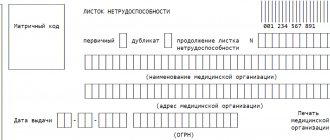

This follows from the fact that sick leave must be issued exclusively on official form. Its form was approved by order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n. In addition, it is important to follow the rules for filling out sick leave in 2022, including by the employer, established for him by order of the Ministry of Health and Social Development of the Russian Federation dated November 23, 2021 No. 1089n. The document contains a list of general requirements for filling out sick leave, which are still relevant today.

The main thing you should know: in accordance with the traditional rule (which follows from the provisions of previously existing standards for filling out sick leave - orders dated 06/29/2011 No. 624n, dated 09/01/2020 No. 925n), the employer enters information only in part of the points on the sick leave form that are combined into the “To be completed by the employer” block.

The current standard - order No. 1089n - provides for filling out:

- electronic sick leave - only by medical institutions (in the order, in principle, there are no regulations relating to employers in terms of working with this version of sick leave);

- paper sick leave - by the employer in some cases.

Let us remind you! Since 2022, electronic sick leave will be used as a general rule throughout the Russian Federation. For more details, see the special material on this topic.

Thus, from 2022, employers will, in principle, not fill out any parts of the electronic sick leave. At the same time, enterprises must, in accordance with the law, organize work with electronic sheets. Find out more about effective ways to solve this problem from expert material in the ConsultantPlus system. Get it for a free trial.

Here you can familiarize yourself with the procedure for obtaining an electronic sick leave certificate by an employee in order to provide the necessary information to the employer.

The employer fills out a paper sick leave - the version of the sick leave that he can fill out from 2022, in relation to (Part 28, Article 13 of Law No. 255-FZ of December 29, 2006):

- employees whose information constitutes state or other secrets;

- persons in respect of whom state protection measures are applied.

Sick leave for the specified categories of workers is assigned on the basis of the provisions of a special regulatory act - Order of the Ministry of Labor of Russia dated October 29, 2021 No. 777n.

IMPORTANT! The sick leave certificate must correctly indicate the data filled in by both the doctor and the employer.

If the responsible person of the employer, before filling out the sick leave certificate, discovers errors in the block drawn up by the doctor, it makes no sense for the employer to fill out the part. Most likely, the FSS will not pay for it. It is necessary to request a new document from the medical organization.

The FSS sanction can be just as severe for mistakes made due to ignorance of how the employer fills out sick leave. Let's look at how they can be avoided.

Common errors and fixes

It often happens that inaccuracies and gross miscalculations are made due to carelessness. Because of this, the sick leave is invalid and a duplicate is required. When checking by FSS auditors, an error in filling out is a reason for the return of payments made to the employee. You should immediately carefully review the sick leave certificate for compliance with the requirements for completion.

- If placed in the wrong place. An incorrectly placed seal is classified as a gross error. An application is drawn up in the name of the head physician of the institution with a request to issue a duplicate BL.

- If it is not readable or blurry, it was poorly placed. In this case, a duplicate of the document will also be required. The imprint requirement has been violated. This error could have been avoided at the stage of designing the sheet by drawing the administrator’s attention to the quality of the print.

The document may be classified as a counterfeit sheet. For accounting purposes, you will need to provide a new form with o. A repeat sheet is drawn up by the attending physician. An application addressed to the head of the medical institution will be required. It is written by the employer as a request or by the employee in any form.The sheet is certified by the attending physician and the deputy head of the medical organization for clinical expert work.

- If it goes beyond the limits. It is allowed if the print extends beyond the allocated field. Staying in other places is prohibited. The accounting department will not miss such a document. In this case, you will also need to issue a duplicate sick leave.

- If you put the wrong stamp. Order of the Ministry of Health of the Russian Federation No. 624n allows the following correction: the incorrect seal must be carefully crossed out. On the back side of the BL there is a correct seal and the signature “Believe the corrected one.” The permissible number of corrections is two, and it does not matter who made the error, the medical institution or the employer.

On our website there are additional materials about codes in b/l, about filling out the length of service, about calculating and filling out b/l from the minimum wage.

Instructions for filling out sick leave in 2022 by an employer

Taking into account the requirements set out in regulatory documents, the filling out of a paper sick leave by the employer - in the above exceptional cases - will be carried out in accordance with the rules defined by section X of the Conditions and procedure for the generation of sick leave by order No. 1089n (the employer is concerned, first of all, with the provisions of paragraph 85-87 Conditions).

For example, the following algorithm for working with sick leave is possible:

- If in the section “To be completed by a doctor of a medical organization” in the line “Cause of disability” code 01 or code 11 is given, the employer:

- calculates sick leave paid at the expense of the enterprise (using, for example, a certificate from the accounting department);

- fills out the section “To be completed by the employer”, taking into account the rules under Section X of the Conditions of Order No. 1089n (at the same time, information for entering data on earnings and the amount of benefits at the expense of the enterprise on the sick leave can be taken from the same certificate-calculation).

In the line “Amount of benefit at the expense of the employer” the amount for the first 3 days of illness is recorded. If during the period of temporary disability the benefit is paid only at the expense of the enterprise, then filling out the line “At the expense of the Social Insurance Fund” is not required.

Familiarize yourself with the procedure for reflecting amounts on a sick leave certificate that affect the amount of benefits in a special material prepared by ConsultantPlus experts. Get free trial access to the system.

One way or another, in practice, the employer - in cases where he is obliged to fill out a paper sick leave - can enter data into any part of the certificate of incapacity for work in the column “To be filled out by the employer” of the sick leave form according to Order No. 347n. So, the employer can provide there:

- Information about the employee’s place of work by indicating:

- the name of the company (full or abbreviated) in accordance with the constituent documents, if the employer is a legal entity;

- Full name of the entrepreneur, if the employer is an individual entrepreneur.

- A note indicating whether the work is primary for the employee or not by checking the appropriate box.

- Employer registration number in the Social Insurance Fund.

- Code of subordination of the FSS body that issued the registration number to the employer.

- TIN of the employee for whom sick leave is issued (not indicated for women receiving maternity benefits for pregnancy and childbirth, as well as after registration with a medical institution in the early stages of pregnancy).

- SNILS of the employee.

- Code indicating the conditions for calculating sick leave (one or more) - on the reverse side of the sheet:

- 43, if the employee has benefits as a victim of radiation exposure;

- 44, if the employee worked in the regions of the Far North or in territories equivalent to them before 2007;

- 45 if the employee has a disability;

- 46, if the term of the employee’s employment contract with the employer is less than 6 months (not recorded if the cause of disability is indicated on the sick leave as corresponding to code 11);

- 47, if the employee went on sick leave within 30 days after dismissal;

- 48, if going on sick leave was accompanied by a violation of the regime for a good reason (subject to marking this in the appropriate column of the form);

- 50, if under the same conditions the sick leave lasts five or more months in a calendar year;

- 51 if the employee is employed part-time.

- Details of the report in form N-1 (about an accident during work), if it was drawn up.

- The start date of work of the employee whose contract was canceled, but he went on sick leave before the cancellation. If the employment contract with the employee is valid, the corresponding column does not need to be filled out.

- Length of insurance period in full years and months.

Read more about calculating length of service and its impact on the amount of disability benefits here.

- Duration of non-insurance periods (a citizen is serving in the army, law enforcement agencies, fire service).

- The period for which benefits must be paid to the employee.

- The employee’s average earnings on the basis of which sick leave is calculated.

- The employee's average daily earnings.

- The amount of compensation for sick leave, paid from the funds of the Federal Social Insurance Fund of the Russian Federation.

- The amount of compensation paid at the expense of the employer.

- The total amount of sick leave.

- Full name of the manager and chief accountant of the employer.

For more information about the procedure for calculating the total amount of sick leave, read the material “Maximum amount of sick leave in 2020-2021.”

Information from the doctor

Here are the main stages of document preparation, presented in order of completion:

- At the very top, next to the document number and code, the document category is written down - primary or duplicate.

- The name of the clinic where the paper is issued.

- Date of issue of the form and official OGRN of the medical institution. If the clinic is a legal entity, 13 numbers are written down, if an individual entrepreneur – 15.

- If the reason for the disability is caring for a sick close relative or child, information such as age, relationship with the patient and his full name are written down.

- Personal information about the employee, in a situation where it was he who was ill. Information such as full name, gender, date and place of birth, SNILS number and the main cause of disability is entered.

- A period of complete release from assigned duties is written. We are talking about the start date and complete end date of the disability.

This information part of the sick leave is certified by a doctor. His name and signature must be written, and the seal of the medical institution must be affixed.

Certificate-calculation as a mandatory attachment to sick leave: is it necessary?

In the current order No. 1089n there are no provisions similar to what was given in paragraph 67 of order No. 624, which ordered that a hospital certificate be attached to the hospital certificate.

At the same time, in addition to the sick leave itself, the employer may need to submit to the Social Insurance Fund data from another certificate-calculation of benefits in the form that was approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. This certificate is issued by the employee’s previous employer upon dismissal in accordance with clause 3, part 2, art. 4.1 of the law of December 29, 2006 No. 255-FZ.

Cases of using such a certificate are described in clause 13 of the Rules approved by Decree of the Government of Russia dated November 23, 2021 No. 2010. For example, when recalculating a previously assigned benefit, information from the certificate is transferred by the employer to the Social Insurance Fund within 5 working days from the date of receipt of an application from the employee for recalculation.

It is advisable to transfer information on sick leave to the Social Insurance Fund to the required extent upon request, and not in a proactive manner. The fund does not encourage excessive activity of employers in this regard.

The calculation certificate, however, as we noted above, may be useful to the employer himself for correctly calculating the amount of sick leave benefits. Consultant Plus specialists spoke about the preparation of this document. Get a free trial of material on this topic.

Filling out a special statement

A properly completed and certified document is submitted to the Social Insurance Fund organization. Attached to it is an accounting statement with information that is necessary for calculating and calculating benefits. These are indicators such as:

- The amount of average daily and average monthly earnings;

- Official salary;

- All required allowances;

- Official work time sheet.

If an employment agreement was previously concluded between the enterprise and the employee, valid for less than 6 months, a special mark 46 must be placed. In such a situation, disability benefits will be paid only for 75 days.

If an accountant has entered erroneous information, he can make corrections. Only two corrected defects are allowed per document.

What pen, what ink and what color to fill out a sick leave form

Entering data into sick leave forms created on paper is usually done manually using a pen - capillary, gel or black fountain pen. Entering data into a sick note with a ballpoint pen is not allowed.

In principle, you can fill out the form on a PC using a special program that can transfer data from a digital form to a paper one, transferring the data to the printer into which the official form is inserted. Moreover, it is permissible to fill out one part of the sick leave with a pen, and the other on a PC (letter from the Federal Social Insurance Fund of the Russian Federation dated October 23, 2014 No. 17-03-09/06-3841P, it is legitimate to talk about the relevance of the recommendations given there).

How to fill out the document

When filling out the sick leave sheet for 2022, it should be taken into account that the data must be entered in capital letters, starting from the first cell available on the left in the field being used. If the employer puts a stamp on the form, it should not go to the corresponding cells.

If errors are found in the sick leave columns, they can be corrected. To do this you need:

- cross out the incorrect entry;

- on the back of the document, enter the correct data in the format “form column name: correct information”;

- Make a note next to it: “Believe the corrected”;

- certify the record with the signatures of the director, chief accountant of the employer, as well as the seal (if used).

Regardless of the number of corrections in the sick leave, it is enough to make a note on the form: “Believe the corrected one”, affixing the signatures of the director, chief accountant, and the seal once.

How many should there be on a certificate of incapacity for work?

Sick leave has two parts. The top one is filled out by the doctor, the bottom one by the employer. The maximum number of stamps on a sick leave certificate is four, the minimum is two.

- From the employer. The employer may not put a seal, since its presence is not mandatory for individual entrepreneurs and legal entities.

But the administration puts a stamp to comply with the submitted document. For accounting, this is confirmation of recognition of the authenticity of the BC by management. The employer has the right to independently determine the required number of printed copies, which are determined by internal orders and acts of the organization. - From a medical organization. The medical institution puts two stamps. One is placed when opening the help, the second - when closing. If the sick person was sent for a medical examination, the stamp is affixed by the bureau of medical and social examination - in this case there will be three of them.

Electronic sick leave

On July 1, 2017, the use of an electronic sick leave form began (law dated May 1, 2017 No. 86-FZ), which is used on a par with a regular paper document.

The following distinguishes an electronic sick leave from a regular one:

- creation in an automated electronic system that provides the ability to work with it for all interested parties;

- certification by enhanced qualified electronic signatures of persons drawing up the document;

- protection from counterfeiting.

As we already know, from 2022 electronic sick leave is used in the general case. In this case, the employer does not fill it out, but works only with paper. In this case, you can check the electronic sick leave on the FSS website in the prescribed manner.

Read more about organizing the interaction of the parties when working with sick leave in the materials:

- “Electronic sick leave for transfer to the Social Insurance Fund online”;

- “Electronic sick leave: a new order”;

- “Step-by-step guide to working with electronic sick leave certificates.”

To print or not

What is written with a pen cannot be cut out with an axe. This truth is adhered to by most enterprises, so almost all HR officers and accountants know how to print an electronic sick leave sheet. Do I need to print? The answer on the official website of the FSS states: there is no need to print out and store a copy of the ENL. A digital document has the same legal force as a paper one, but, unlike the traditional version, it is stored in the FSS information system, the Unified Integrated Information System “Sotsstrakh”.

Results

The procedure for issuing sick leave in 2022 is still strictly regulated by the legislation of the Russian Federation - both in terms of requirements for the appearance of the document and in terms of the algorithm for filling it out.

An employer, like a medical institution, must clearly understand how to fill out a sick leave sheet correctly, and mistakes must not be made when filling out a sick leave note, otherwise the Social Insurance Fund will not accept it as a basis for compensating the employer’s expenses for paying benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out the form at a medical institution

Typically, a sick leave certificate is issued to a patient on the day of his discharge, but according to the new rules, the patient can pick it up on the first day. The medical employee fills out all the information about the patient and the medical institution. He writes the name and number of the hospital, the address of its location, the date of issue, the full name of the patient to whom this sheet is issued, his date of birth, the name of the organization where the sheet is required, the name of the attending physician, his position, the date of admission of the patient and the date of discharge, as well as the date on which the employee is required to start work.

The form also contains a column indicating the reason for the disability, which is also filled out by the doctor. But if earlier the name of the disease itself was written there, now it is customary to write a conditional code to which a particular disease is assigned (for example, 01, 02, 03, which means disease, injury and quarantine, respectively). This allows you to maintain medical confidentiality.

After discharge, the patient receives a form and submits it to the accounting department. But before doing this, he must carefully check all the data to eliminate possible errors and make sure that all signatures and seals are present, otherwise the form will be invalid and benefits will not be accrued on it.