Certificates issued by Kontur will remain valid until the end of their validity period.

Electronic signature certificates issued to you when connecting to Extern will remain valid until the end of their validity period, including in 2022.

It is not necessary to change the current signature of the Contour to the electronic signature of the Federal Tax Service by January 1, 2022. You will be able to receive a signature from the Federal Tax Service when the validity period of the electronic signature of the Contour expires.

According to the explanations of the Ministry of Digital Development, electronic signature certificates issued by certification centers that are accredited according to the new rules of 63-FZ will remain valid until the end of their validity period. TC SKB Kontur and TC Sertum-Pro received such accreditation, information about this was published on the website of the Ministry of Digital Development.

What should managers of organizations and individual entrepreneurs do?

Until July 1, 2022

There is no need to do anything new. If the signature has expired, update it at any certification center convenient for you.

From July 1, 2022 until the end of 2022

You can receive a new digital signature only at a CA that has been accredited according to the new procedure . Individual entrepreneurs and directors of companies can contact the tax office.

Closer to January 1, 2022

Presumably, by that time the procedure for using electronic powers of attorney for employees will be clarified and a list of trusted centers of the Tax Service will be formed. We offer an approximate forecast :

- if you are not a manager, you will need to obtain an electronic signature of an individual from a CA accredited under the new procedure. But first, make sure that the necessary portals and online services will accept the electronic power of attorney.

- If you are an individual entrepreneur or the head of a company, you will need to contact either the Federal Tax Service CA directly or its trusted CAs to obtain an electronic signature of a legal entity.

What will change

From July 1, 2022

The Federal Tax Service began issuing free certificates for legal entities and individual entrepreneurs. This is a non-copyable certificate for the head of the organization. At the same time, territorial tax authorities have been issuing certificates in pilot mode in most regions of the country since the end of April.

Find out how to get a certificate for a manager at the Federal Tax Service Center in step-by-step instructions.

From January 1, 2022

From January 1, 2022, you can choose one of the options for how to work:

- Continue to work in Externa with the electronic signature that you received in Kontur until the end of its validity period.

- Receive a new electronic signature in accordance with changes to 63-FZ.

Heads of legal entities and individual entrepreneurs will be able to do this at the certification center of the Federal Tax Service of Russia (hereinafter referred to as the Federal Tax Service CA) or trusted certification centers. Banks - in the certification center of the Central Bank, government agencies - in the certification center of the Treasury.Employees of organizations and authorized persons will receive certificates of individuals for signing personal and work documents at CAs accredited under the new rules. To sign documents of the organization, you will additionally need an electronic power of attorney. The electronic power of attorney will be transferred to the Federal Tax Service through the special operator’s reporting system; there is no need to duplicate it on paper.

- You can also obtain a new signature if you have a valid Contour signature. Both will work until the end of their validity period.

Read more in the article “Electronic signature: what will change from July 1, 2022 and later.” And also watch video instructions on how to work with certificates of the Federal Tax Service, individuals and electronic powers of attorney in Externa.

The changes will affect all organizations. The transition period was originally intended to last 6 months - from July 1, 2021 to January 1, 2022, but is likely to last even longer. Not all processes are now completely clear and transparent; a number of regulatory documents are still in development. We are closely monitoring the situation, adapting our systems and helping users transition to new work patterns. In the “Infoblock” section of Extern there are instructions and recommendations that you need to study before starting to work with Federal Tax Service certificates and electronic powers of attorney.

How to work with the signature of the Federal Tax Service

To work with an electronic signature, you will need a crypto provider - a program that allows you to sign documents, encrypt and protect data. Some tokens have a built-in crypto provider and some do not.

The Federal Tax Service recommends using the CIPF “CryptoPro CSP”. The program can also be purchased from us, to do this, follow the link and leave a request.

We remind you once again that only the person for whom it was issued can use a signature issued by the Federal Tax Service certification center. The signature cannot be copied, and employees must have their own electronic signature. This can be obtained from our certifying service, you can conduct electronic document management, participate in procurement and send reports.

How to set up a certificate from the Federal Tax Service CA

If you plan to work externally with a certificate from the Federal Tax Service, you will need to additionally purchase:

- A medium to store the certificate and electronic signature keys on.

- If you have Rutoken Light, issued earlier when connecting to Extern, then the certificate of the Federal Tax Service CA can be written on it. The total size of Rutoken Light is 64 KB, you can store up to 15 containers with certificates on it.

- Suitable media: Rutoken EDS 2.0, Rutoken S, Rutoken Lite, JaCarta GOST, JaCarta-2 GOST and others that meet the requirements of the FSB or FSTEC. A certificate of compliance with the FSTEC of Russia for the key media, which is required to obtain a certificate from the Federal Tax Service CA, can be requested at your service center.

- Please note that in some regions inspections ask for an empty token. In this case, copy all containers with certificates and keys to any other media or computer so that in the future you can decrypt your reporting or enable External storage mode for decrypted documents.

- If there is no token, you need to purchase it by contacting your service center.

- CIPF license CryptoPro CSP. A license is required for each workplace from which your organization will work with a certificate from the Federal Tax Service CA. In Kontur you can buy a CryptoPro license for 12 months or perpetual.

The process of obtaining UKEP from the Federal Tax Service

In May of this year, tax authorities published clarifications on the issue of obtaining free EPC.

The certification center of the Federal Tax Service of Russia is accredited by the Ministry of Digital Development, Communications and Mass Communications of the Russian Federation, so it must have such an official document as the “Procedure for the provision of services of an accredited certification center...” (hereinafter referred to as the Procedure).

The procedure for obtaining a signature from the Federal Tax Service:

- Make an appointment at the Federal Tax Service Center.

- Purchase of key information media certified by FSTEC or FSB of Russia.

- Personal visit of the director at the time appointed by the CA with a package of documents (passport and SNILS) and a carrier to the Federal Tax Service to undergo personal identification and receive an electronic digital signature certificate.

Making an appointment at the Federal Tax Service Center

So, in order to obtain UKEP from the tax office, you should start by making an appointment with the Federal Tax Service.

From July 1, 2022, individual entrepreneurs and persons entitled to act without a power of attorney on behalf of the organization can register through:

- “Personal account of a legal entity”

- Online registration for an appointment with the inspection

- “in other information systems” (not yet specified which ones)

- in person at the local Federal Tax Service (clause 22 of the Procedure).

What documents are required to obtain an electronic signature?

A package of documents that should be brought to the Federal Tax Service Center:

- Identity document.

- SNILS.

- A key information carrier (token) for recording a certificate and an electronic signature key;

- Documentation for the key storage medium - certificate of conformity from FSTEC or FSB of Russia (you can use a scanned copy of certificates of conformity from the websites of FSTEC or FSB of Russia or manufacturers of key storage media).

- TIN of the organization and TIN of the individual manager (it is enough to know the number, a scan is not needed).

Application and identification

The application is filled out by the inspector. It will indicate (clause 23 of the Procedure):

- Full name of the applicant-individual, name of the applicant-company

- OGRN or OGRNIP number

- details of the applicant's identity document

- SNILS of the applicant

- TIN of the applicant (an individual who has the right to act without a power of attorney on behalf of a legal entity), as well as TIN of a legal entity (for legal entities)

The application must be signed by the person who plans to apply for registration of the UKEP (clause 24 of the Procedure). Submitting an application will be accompanied by a procedure for identifying your identity.

There are several identification methods (clause 25 of the Procedure):

- in personal presence using an identification document of the applicant

- without personal presence using the current UKEP and biometric personal data

When receiving the UKEP for the first time at the Federal Tax Service Center of Russia, identification of the identity of the head of the organization (IP) is carried out only with his personal presence at the place of receipt (clause 25 of the Procedure)!!! Those. The manager will definitely have to visit the tax office once. In this regard, difficulties may arise for managers who are not located on the territory of the Russian Federation.

After submitting an application for receiving UKEP, all information specified in the application is checked in departmental systems (Federal Tax Service, Pension Fund of the Russian Federation, Ministry of Internal Affairs). If the result of all checks is positive, the Federal Tax Service Center will prepare a UKEP certificate within 5 calendar days (clause 26 of the Procedure); in fact, the check takes a few minutes.

Certified secure media for recording CEP

It is also necessary to bring to the Federal Tax Service Center a certified secure medium for UKEP that complies with the standards of the Tax Service (clause 22 of the Procedure). According to the rules, a qualified certificate must be recorded on a provided key information carrier certified by FSTEC or FSB.

The Federal Tax Service certification center accepts key USB Type-A format media that meets established technical requirements, for example:

- Rutoken EDS 2.0

- Rutoken Lite

- Rutoken S

- ESMART Token

- ESMART Token GOST

- JaCarta GOST

- JaCarta-2 GOST

- JaCarta LT

The applicant independently records the electronic signature keys on a secure medium either at his workplace or at the point of issue on a “special computer” (clause 11 of the Procedure) after the personal identification procedure (clause 12 of the Procedure).

Obtaining a CEP

When all the data from the application has been checked and confirmed, and you have successfully completed personal identification (clause 26 of the Procedure), the Federal Tax Service Center will give you a UKEP certificate within 15 minutes (clause 27 of the Procedure). Then you will be given a guide to ensure the safety of using UKEP (clause 29 of the Procedure).

Having received the CEP at the Federal Tax Service certification center, if necessary, you will be able to contact the Technical Support Service , as well as call the Federal Tax Service Unified Contact Center number: 8-800-222-2222 .

How to use an individual’s certificate and a Federal Tax Service CA certificate to enter Extern

- If you log into Extern using an individual certificate , you need to indicate your phone number or login and password in advance.

You will log in using them for the first time, and then you can log in using the certificate as usual. Don't worry, we will remind you in Extern to provide your login information if you don't already have it. But you can do this now by clicking on your full name. user in Externa in the upper right corner. - If you log in with a Federal Tax Service CA certificate , you most likely will not notice any changes and will log into the service as usual. If this does not happen, in Externa we will show you instructions on what you need to do to enter.

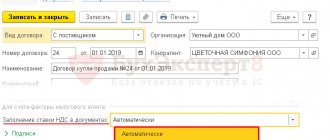

How to choose a signing certificate

Below we will tell you how to sign reports to regulatory authorities using a manager’s certificate issued by the Federal Tax Service Center or an individual’s certificate.

Reporting to the Federal Tax Service, Rosstat

To report to the Federal Tax Service and Rosstat, you will need to select a manager’s certificate issued by the Federal Tax Service CA, or an individual’s certificate in the payer’s details as a certificate for signature (instructions).

Reporting to the Pension Fund

To send reports to the Pension Fund, you, as before, will first need to transfer registration data with information about the certificate (instructions) to the Pension Fund. In this case, you will be able to select from the list a manager’s certificate issued by the Federal Tax Service Center, or an individual’s certificate.

When sending a SZV-TD report, as well as ZPED and UPUP documents, a certificate must be selected before sending - individual certificates and Federal Tax Service CA certificates will appear in the selection of certificates.

If you submit only SZV-TD reports to the Pension Fund, you do not have to send registration information.

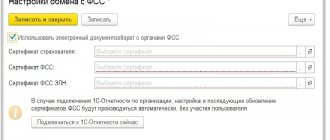

Reporting to the Social Insurance Fund

When sending reports, you will be able to select a manager’s certificate issued by the Federal Tax Service Center or an individual’s certificate from the list.

If an employee will send documents with an individual’s certificate, he must, as before, first register on the FSS portal and submit an old-style paper power of attorney (instructions) to the FSS.

Let's sum it up

- An electronic signature of the Federal Tax Service of Russia is issued to individual entrepreneurs , heads of legal entities and notaries .

- The signature is free , you can get it at the tax office by making an appointment in advance.

- To receive an electronic signature from the Federal Tax Service in 2022, you need to provide not only a package of documents (passport, SNILS and Taxpayer Identification Number), but also a certified medium - a token.

- Only the person for whom it is registered can use the signature. Employees must obtain personal signatures from an accredited certification center.

- To work with electronic signature, you will need a crypto provider , for example, CryptoPro CSP. The program is purchased separately.

Multi-user mode of operation in Externa

Previously, to add a user to Extern, you had to buy a seat and a certificate. In July, it became possible to add users to Extern without issuing a certificate for them during the purchase process, if they already have an individual certificate. The fact is that now, when moving to different organizations, an employee may still have the same individual certificate.

How to add a new user to Extern (with or without a certificate):

- An employee with administrator rights in Externa fills out an invitation, indicating the e-mail of the new user, and sends it.

- A new user can accept the invitation, immediately log in to Extern and, if desired, link their certificate to login. And then he will be able to log in either using a certificate or using a login-password.

Thus, additional users will be able to log into Extern in a convenient way: with a certificate, using a login-password, or by specifying a code from SMS.

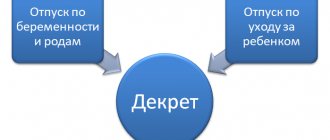

Electronic powers of attorney

From January 1, 2022, employees of organizations whose employee certificates expire will receive individual certificates. Such a certificate does not indicate the organization, only the full name. employee. To represent an organization and sign documents on its behalf, an employee will need an electronic power of attorney. We are preparing a solution that will allow it to be used in Contour services. The first system with which you can interact using an electronic power of attorney will be the Federal Tax Service.

Who will receive a free signature from the Federal Tax Service

From July 1, the Certification Center of the Federal Tax Service of Russia will begin issuing free qualified certificates only for individual entrepreneurs, notaries and legal entities (usually the general director, who acts on behalf of the company without a power of attorney).

Tax officials note that from January 1, 2022, certain restrictions will appear:

- CEP of credit institutions , payment system operators, non-credit financial organizations and individual entrepreneurs will be available at the Certification Center of the Central Bank of the Russian Federation;

- CEP of officials of state bodies , local government bodies or organizations subordinate to a state body or local government body can be obtained from the Certification Center of the Federal Treasury;

- CEP of individuals , as well as persons acting on behalf of a legal entity by proxy, can be obtained from commercial certification centers after their re-accreditation.

The validity period of a free electronic signature issued by the Federal Tax Service certification center will be 15 months .

Electronic powers of attorney for reporting to the Federal Tax Service

An electronic power of attorney confirms that an individual has the authority to submit any documents to the Federal Tax Service for the organization. It must be signed by a valid manager’s certificate issued by the Federal Tax Service CA or an accredited certification center, for example, the Kontur CA.

An electronic power of attorney will replace the current paper power of attorney with the signature of the director.

The format of the electronic power of attorney of the taxpayer’s representative for sending documents to the Federal Tax Service is specified in the draft order. However, the entire new work scheme - with the transition to individual certificates and electronic powers of attorney - will become mandatory from January 1 or later - the exact date has not yet been officially approved. At the same time, if you have a valid Contour certificate in your hands in 2022, you can continue to use it until the end of its validity period.

Commercial certification authorities

In the second half of 2022, individual entrepreneurs and legal entities can apply for an electronic signature to private certification centers that are accredited in accordance with the new standards of the Ministry of Telecom and Mass Communications of the Russian Federation.

The SKB Kontur certification center is accredited in accordance with the decision of the Government Commission authorized to make decisions on the accreditation of certification centers (protocol dated June 21, 2021 No. 3).

Please note that only individual entrepreneurs, legal entities and notaries have the right to receive a free qualified certificate from the Federal Tax Service. Other electronic signatures, that is, the CEP of an individual , as well as a person planning to act on behalf of a legal entity by proxy , can only be obtained from commercial accredited CAs, for example, from the SKB Kontur CA.

Individuals representing an individual entrepreneur or a company by power of attorney (this can be either full-time employees of the company or an individual entrepreneur), from January 1, 2022, are required to accompany the certified documents with their electronic machine-readable power of attorney (MRP) signed by the individual entrepreneur or the director of the company.

A list of such certification centers is published on the website of the Ministry of Telecom and Mass Communications in the general list of accredited CAs whose accreditation date is later than July 1, 2022.

How to send an electronic power of attorney to the Federal Tax Service

In Externa, in the “Payer Details” in the “Signing of Documents” block, you can select an individual’s certificate and then click on the “Add power of attorney” button.

Then there will be options:

- “Fill” - a window will appear where you need to enter data.

- “There is an accepted electronic power of attorney” - if you have previously worked in another reporting system with an individual’s certificate, you can simply enter the data of a valid electronic power of attorney.

The manager will be able to issue the rights to send reports to a specific Federal Tax Service Inspectorate, and not all at once, but by default Extern will consider that the power of attorney is valid in all Federal Tax Service Inspectors.

How to sign and send an electronic power of attorney

There can be two situations here.

- If you have access to the manager’s certificate, you need to select the “Sign and Send” button. For example, the manager is in the next room and you can ask him to come up with his certificate.

- If you do not have access to the manager’s certificate, click on the “Request signature” button, in the window that opens, enter the manager’s e-mail, you can leave a comment and click “Submit”.

The “Payer Details” will reflect the date on which the signature request was sent to the manager, and the status “Power of Attorney awaiting signature” will appear in the list of organizations.

When the manager signs the power of attorney using the link from the received letter, you will see the changed status of the power of attorney in the “Payer Details” and will be able to send the power of attorney to the Federal Tax Service. After this, you will need to wait for a response from the Federal Tax Service.

If you receive a refusal from the Federal Tax Service, you can look at the reason for the refusal and reissue the power of attorney.

If the Federal Tax Service has accepted the power of attorney, you will be able to report for the organization; the data from the power of attorney will be included in the message about the representation, which is sent along with reports and other documents to the Federal Tax Service.

How to revoke an electronic power of attorney

The electronic power of attorney must be revoked, for example, if the individual no longer works in the accounting department and should not have the authority to sign documents for the organization.

Revocation of an electronic power of attorney is a formalized document that must be signed with a certificate from the head issued by the Federal Tax Service Center. The format for revoking the power of attorney has not yet been approved. You can revoke a power of attorney in the “Payer details” in the power of attorney block. Complete the review form and submit it by signing with a supervisor's certificate or by first requesting a supervisor's signature. When the Federal Tax Service receives a response that the revocation has been accepted, the power of attorney will cease to be valid.

Our recommendations

- Set up an alternative way to log in to Extern. This will avoid a situation where you will not be able to enter Extern with a new certificate. Fill in your email, password and phone number (instructions) in Extern’s personal account in “Login Settings”. We recommend that you indicate your phone number, so you can always log in to Extern, even if you forget your login login.

- So that even during the transition period when changing the certificate you have access to your documents from reporting to the Federal Tax Service and Rosstat, enable the “Storage of decrypted reports” setting. And also install Kontur.Archive on your computer, which saves and decrypts documents from reports to the Federal Tax Service, Social Insurance Fund, Rosstat, as well as the requirements of the Federal Tax Service, formalized responses to them and primary (supporting) documents for reports. Kontur.Archive downloads and decrypts documents for the selected period, and then continues to download new documents from Extern. This way, you will always have a complete, up-to-date reporting archive at your fingertips.

- No need to worry. Until January 1, 2022, there are two scenarios for working in Externa: with certificates issued by commercial CAs, and with certificates issued by the Federal Tax Service CA. And in 2022, you will also be able to continue working at Externa with valid certificates from Contour or other commercial CAs accredited under the new rules. Follow the notifications in Externa - we will tell you what to do to make the transition to new certificates smooth.

Trustees of the CA of the Federal Tax Service of Russia

The authorized representatives will, on behalf of the Tax Service, accept applications, identify individuals and issue UKEP certificates to applicants. (Clause 8 of the Procedure)

SKB Kontur plans to become a trustee of the Federal Tax Service . At the moment there are no such proxies; as soon as they appear, the Federal Tax Service Center will create a list on its official website.

Federal Law N63-FZ, as well as the “Procedure for the provision of services of the Federal Tax Service Certification Center” (clause 8 of the Procedure) allow contacting the authorized representatives of the Federal Tax Service CA instead of the local branch of the Federal Tax Service.

The services of authorized representatives of the CA of the Federal Tax Service of the Russian Federation will become available from January 1, 2022 .