How to form authorized capital in 1C 8.3

Cash, various property (buildings, equipment, etc.), all this can be a contribution to the authorized capital. The amount that determines the amount of the authorized capital is necessarily fixed in the constituent documents of the organization. On the same date when the registration took place for an amount equal to the amount of the authorized capital, the posting of Dt75 - Kt80 in 1C is carried out. The authorized capital itself can be formed later, but no more than 4 months from the date of registration. After the capital has been formed, using the 1C Accounting 8.3 program, you need to make entries to deposit funds by the founder into the cash desk or into the company's current account.

We fill out the balance sheet using a simplified form

Small businesses actively use simplified reporting forms when drawing up a balance sheet and financial statements for the past year. It would seem much simpler: the simplified balance sheet has only 5 items in its assets, and 6 items in its liabilities. However, even under these “three pines” there are hummocks. In this article we will talk about them.

Let me remind you that simplified reporting forms were approved by Order of the Ministry of Finance dated August 17, 2012. No. 113n. First, a few words about which assets and liabilities fall into which lines of the simplified balance sheet:

Assets:

1. Tangible non-current assets: fixed assets, unfinished capital investments (accounts 01, 03 minus 02, accounts 07, 08).

2. Intangible, financial and other non-current assets: intangible assets (account 04 minus 05), long-term financial investments (corresponding subaccount 58, subaccount 55/3, possibly 73), unfinished investments in intangible assets, results of research and development (corresponding subaccounts accounts 08, 04)

3. Inventories: raw materials and materials, work in progress, finished goods, goods (accounts 10, 20, 23, 41, 43, 45, etc.)

4. Cash and cash equivalents: money in cash and in accounts (accounts 50, 51, 52, 55 except deposits, 57)

5. Financial and other current assets: short-term financial investments (corresponding subaccount of account 58), VAT (account 19), accounts receivable and other assets (accounts 60, 62, 68, 69, 70, 71, 73, 75, 76).

Passive:

1. Capital and reserves: authorized capital (account 80), additional and reserve capital (if any, accounts 83 and 82), retained earnings (uncovered loss, account 84), revaluation of fixed assets (intangible assets), if such is carried out in organizations (account 83). This line also reflects own shares purchased from shareholders for cancellation (account 81). 2. Long-term borrowed funds: borrowed funds received under long-term loans and borrowings (account 67). 3. Other long-term liabilities (account 77, 96) 4. Short-term borrowed funds: borrowed funds received under short-term loans and borrowings (account 66). 5. Accounts payable: debt to creditors on accounts 70, 71, 68, 69, 76, etc. 6. Other short-term liabilities (account 96)

For each balance line, you need to enter the corresponding code in the column. What code to put if a line includes several indicators, each of which has its own code? Clause 5 of Order No. 66n of the Ministry of Finance “On Forms of Accounting Reports of Organizations” states that the code corresponding to the largest share is assigned.

For example, let Romashka LLC include in the line “Intangible, financial and other non-current assets”:

— intangible assets – 80 thousand rubles.

— long-term financial investments – 200 thousand rubles.

— results of research and development – 150 thousand rubles.

Total: 430 thousand rubles.

Financial investments have the greatest share. They correspond to code 1170. It is this code that will be entered in the simplified balance sheet in the line “Intangible, financial and other non-current assets” with the amount of 430 thousand rubles.

Question - what to do if there is nothing to write in a certain line? Those. There are no assets or liabilities that match the line. In this case, the string is simply not given.

A common situation is that a company has only recently been formed and is not yet active. A common question is: how to create a zero (empty) balance?

Despite the lack of activity, the balance will still not be completely empty. Not only the header will be filled in, but also some lines of liabilities and, possibly, assets.

If an organization is created, then at least it has formed an authorized capital:

Debit 75/1 – Credit 80

If the founders have not yet contributed the authorized capital in the form of property (money, goods, fixed assets, etc.), then there is a debt of the founders, which is a receivable.

Most often, founders contribute their capital in the form of cash to a current account:

Debit 51 – Credit 75/1

As a result, you will have the following lines filled in your balance sheet:

Capital and reserves (account balance 80)

Cash and cash equivalents (account balance 51).

Usually, even in the absence of activity, the bank debits funds from the current account for banking services. As a result, the funds in the account “melt”, and the balance sheet asset tends to zero.

In this case, the organization has an uncovered loss at the end of the year, the negative value of which “eats up” the authorized capital and the liability becomes equal to zero.

In this case, it is better to use the general form of the balance sheet to show the authorized capital and uncovered loss in brackets in separate liability lines. Or provide explanations for the balance.

If you do not have time to prepare “zero reporting” yourself and waste time on trips to the tax office, then contact us for help here:

Another common situation for young organizations is that uncovered losses exceed the amount of the authorized capital, due to which the Capital and reserves line becomes negative.

Let LLC “Forget-Me-Not” have an authorized capital of 10 thousand rubles, an uncovered loss of 30 thousand rubles. Then, when filling out a simplified balance sheet in the Capital and reserves line, it will show the value (20) and line code 1300.

A situation close to this begins with the words: we are trying to draw up a balance sheet, the asset turns out to be less than the liability. In principle, this cannot happen. Options: something was not reflected in the asset, or more likely, there are uncovered losses in excess of the authorized capital.

Example of a simplified balance sheet

Romashka LLC is a small business entity and fills out the balance sheet in a simplified form based on the results of 2014.

As of December 31, 2014, the company has the following assets:

- purchased goods reflected on account 41, in the amount of 20,000 rubles. This amount is reflected in the balance sheet item “Inventories”;

— funds in the current account in the amount of 10,000 rubles. This amount is reflected on line 1250;

— debt of buyers to pay for goods (i.e. accounts receivable) in the amount of 15,000 rubles. This data is entered in line 1230.

Total assets (line 1600): RUB 45,000.

Company liabilities:

— authorized capital — 10,000 rubles, retained earnings — 25,000 rubles. In total, line 1300 reflects 35,000 rubles;

- arrears of wages - 3,000 rubles, debt to suppliers - 5,000 rubles, arrears of taxes and fees - 2,000 rubles. Total accounts payable: RUB 10,000.

The total amount of liabilities on line 1700: RUB 45,000.

The balance sheet of Romashka LLC is filled out in thousands of rubles and looks like this:

SCREENSHOT

The company began operations in February 2014, so it does not have data for 12/31/13 and 12/31/12, so dashes are placed in the columns dedicated to previous years.

We discussed the problems that arise when preparing a statement of financial results in an abbreviated form in this article.

Good luck with your reporting!

You might be interested in:

How to reflect a contribution to the authorized capital in the 1C 8.3 program

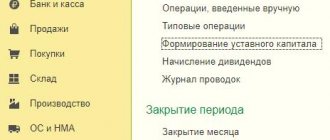

Let's look at the list of opportunities for capital formation, which can be seen by going from the "main menu" section to "Operations-Accounting".

Using the “Create” button, fill out the new opened document. It is necessary to enter the date when the capital was formed (usually it coincides with the date of registration of the company) and the name of the organization.

Next, we proceed to filling out the table. We click the “Add” button, the program in the drop-down list asks us to select a company, legal entity or individual as the founder.

Then a list appears with the names of persons, from which we select the one we need, and also enter the contribution amount of the specific founder.

Then click “Pass” and control the transactions using the DtKt button. The generated entry reflects the debt of the founder to the organization for the authorized capital.

It is worth noting that the above formation document makes it possible to print a list of founders, which will reflect the following data:

- Full name of the founder;

- Passport information;

- Place of registration;

- The size of the share in the authorized capital;

- The amount of the contribution made;

- Form of payment.

Various fixed assets can serve as a contribution to capital.

To determine their initial cost, you need to make a monetary valuation and agree on it with all the founding partners of the company. To formalize them as a contribution to the authorized capital, program 1C 8.3 suggests using the same formation document that was described earlier. If you are reflecting your authorized capital in 1C for the first time, we recommend leaving a free request for 1C support through the Bit.Personal Account service. A 1C consultant will call you back and help.

You can reflect the receipt and acceptance for accounting of the received fixed asset using the document “Acceptance for accounting of fixed assets”. This document is located in the “Purchases-Receipts (acts, invoices)” menu.

In the list that appears, using the “+ Receipt” button, we obtain a new document for the receipt of fixed assets.

Fill out the created document.

Click “Conduct” and then DtKt to control the postings.

The fixed asset that was received as a contribution must be taken into account, put into operation, and, in the future, depreciation must be calculated on it. This is reflected by the following entries:

- Dt 75 – Kt 80 the authorized capital was formed;

- Dt 08.04 – Kt 75.01 reflects the cost of the received asset, which the founder made as a contribution to capital;

- Dt 01 – Kt 08.04 The OS facility was put into operation.

The contribution of materials is reflected in the same way. First, we create and fill out the formation document. Then we prepare “Receipts (acts, invoices)”. To do this, go to “Purchases-Receipts (acts, invoices)”.

Using the “+ Receipt” button, we create a new document in which we select Goods (invoice).

We draw up a document, and as an accounting account, we indicate 75.01 calculations for contributions to the authorized capital.

Then click “Conduct” and check the wiring using the DtKt button.

Accounting for additional capital

Additional capital is a source of increasing the value of an organization's property.

To account for additional capital, passive balance sheet account 83 “Additional capital” is used.

The formation and increase in additional capital is reflected in the credit of account 83 and can be carried out through:

- increase in the value of fixed assets as a result of revaluation;

- share premium from the issue of securities;

- directing part of the net profit to it;

- formation of exchange rate difference when making a contribution to the authorized capital of foreign currency.

Organizations have the right to revalue fixed assets no more than once a year (at the beginning of the reporting year). The amount of additional valuation of fixed assets as a result of revaluation is charged to additional capital:

D-t 01 K-t 83 - for the amount of increase in value;

D-t 83 K-t 02 - for the amount of increase in depreciation.

The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous periods and attributed to other expenses, is included in other income of the reporting period.

Share premium is generated by organizations when they sell shares of an OJSC at a market price above par value:

D-t 75 K-t 83.

Foreign currency can be made as a contribution to the authorized capital. In accordance with PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency,” the exchange rate difference associated with the formation of the authorized capital is subject to credit to additional capital.

Added to the additional capital are appropriations received from the budget of any level, which are spent by the organization to finance long-term investments:

D-t 86 “Targeted financing” D-t 83 “Additional capital”.

Entries in the debit of account 83 can be made in the following cases of using additional capital:

- allocation of funds to increase the authorized capital: D-t 83 K-t 75; D-t 83 K-t 80;

- loss repayment: D-t 83 K-t 84;

- distribution of amounts between the founders of the organization: Dt 83 Kt 75.

When disposing of fixed assets, the amount of revaluation is transferred from additional capital to the organization’s retained earnings:

Dt 83 Kt 84 “Retained earnings (uncovered loss).”

Analytical accounting for account 83 is organized separately for each type of funds from which additional capital was formed.

Synthetic accounting of additional capital is maintained in journal order No. 12.

Deposit to current account and cash register

The next step is to deposit capital. The most common methods are: to a current account and to the cashier. When depositing capital into the current account, go through the main menu to “Bank and cash desk-Bank-Bank statements”. Select “+ Receipt” and fill in the new document with data:

- Date – indicate the date when the payment was received;

- According to the document – we enter the details from the payer’s payment order;

- Type of operation – indicate other receipt;

- Payer – founder;

- Sum;

- We enter the settlement account - for us it is 75.01;

- Founders;

- Accounting account – in our example 51;

- The name of our organization;

- Bank account.

Next, select “Carry out”, checking the wiring using DtKt. The posting has been completed, the contribution has been made.

Cash deposit through the cash register is another method that is available in the 1C 8.3 program. Let's talk about this option. In the main menu, select “Bank and cash desk-Cash desk-Cash documents”. Using the “+ Receipt” button, we get a new document. Then enter the necessary information:

- Document number – we set the date ourselves, and the number is entered automatically;

- Type of transaction – indicate “other income”;

- Payment amount – indicate “contribution”;

- We enter the credit account - for us it is 75.01;

- The founder is the person paying the contribution;

- We enter the accounting account - in our case 50.01;

- Organization is the name of our company.

Then click the “Conduct” button and check the wiring by clicking the DtKt button. The necessary wiring has been carried out, Dt50.01 - Kt75.01. The debt on the deposit has been repaid.

In this article, we talked about various ways to form authorized capital using the 1C Accounting 8.3 program, examined the accounting entries associated with this, as well as the registration of the contribution received from the founders to the current account or to the cash desk of the company.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter