Who can receive such a tax deduction?

The following are entitled to professional tax deductions:

- individual entrepreneurs, but only if they apply the general taxation system. Individual entrepreneurs on UTII and the simplified tax system are not entitled to receive PNV, since they are not personal income tax payers;

- individuals carrying out activities under civil contracts, performing work or providing services under such contracts and receiving income from such activities;

- authors (writers, performers, inventors, creators of industrial designs, etc., see Article 221 of the Tax Code of the Russian Federation);

- notaries, lawyers, other persons engaged in private practice and receiving appropriate remuneration (author's fees, etc.).

The composition of persons entitled to PNV specified in the Tax Code is established at the legislative level and cannot be changed arbitrarily. The next thing that needs to be taken into account: there are features established by law for certain categories of these persons related to the size and procedure for receiving preferences.

NVG for private entrepreneurs

According to Art. 227 of the Tax Code of the Russian Federation, individual entrepreneurs have the right to file professional deductions on OSNO. Those individual entrepreneurs who use special tax regimes do not pay personal income tax, so they cannot receive it. But a professional tax deduction for personal income tax for individual entrepreneurs is also received by those entrepreneurs who simultaneously receive income as a sole proprietor and pay from it.

IMPORTANT!

NVGs are provided to individual entrepreneurs at OSNO. At the end of the year, you can pay 13% only on the difference between income and expenses. But expenses must directly relate to business activities; they are confirmed by checks, contracts and other documents. An entrepreneur’s personal expenses—purchase of a personal car or smartphone—cannot be used to receive a payment.

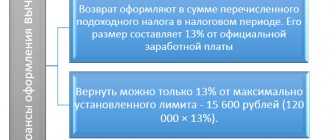

Amount of tax preference

The amount of professional tax deduction - what is it and by what regulatory act is it determined? In the general procedure set out in Art. 221 of the Tax Code, PNV is provided in the amount of expenses incurred in connection with the implementation of activities related to the generation of income. These costs must be documented and justified.

Individual entrepreneurs can receive PTC in the amount of 20% of the total amount of income they received during the reporting period. In this case, no documentary evidence of costs is required. Accounting for professional deductions is carried out by the interested person himself and, in particular, the individual entrepreneur has the right to choose independently which deduction of the two described to receive.

In relation to remunerations received by authors for the creation and use or other application of works of art, science, literature and art, in the absence of expenses confirmed by documents, the income they received during the reporting period may be reduced by the established standard of expenses (as a percentage of the amount of established income). The same rule applies to remunerations paid to the authors of inventions and discoveries.

Article 221 of the Tax Code of the Russian Federation specifies the maximum percentages of PNV, for example:

- for authors, writers, screenwriters - 20%;

- for graphic artists and photographers, filmmakers, inventors - 30%;

- for sculptors and painters, as well as composers - 40%.

Table of standards

A table of costs that may not be documented, with cost standards as a percentage of the amount of declared income.

| Type of activity: creation of a work in a certain field or a specific sample | Established standard |

| literature, theater, circus, stage, cinema | 20 |

| design, architecture, as well as art graphics, photographs for printing | 30 |

| sculpture, scenery for theater and cinema, including graphics, monumental and decorative and easel painting, works of decorative and decorative art (technique does not matter) | 40 |

| TV films, movies, videos | 30 |

| musical works: operas, musical comedies, ballets, symphonic, chamber, choral, for brass band, for cinema, television films and videos, theater (original) | 40 |

| other musical works | 25 |

| performance of various works of literature and art | 20 |

| creation of scientific developments and scientific works | 20 |

| utility models, inventions, industrial designs (only to the amount of income received during the first two years of use of such a work) | 30 |

How to get a professional tax deduction

To receive a preference, you must complete the following procedure:

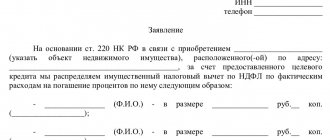

- submit a corresponding application to the tax agent, that is, the person who is the source of paid income for the citizen (usually the employer or customer);

- if there is none, you must contact the tax office at your place of residence and provide a 3-NDFL declaration. Documents confirming the expenses incurred must be attached to the declaration, but there is no need to draw up an application.

An application to an agent for a professional tax deduction is provided in free form. The application must be accompanied by copies of documents confirming the expenses incurred, as well as establishing a direct direct connection between the implementation of such expenses and the performance of work (provision of services) under the concluded contract.

Examples of such documents include contracts, receipt orders, sales and cash receipts - a standard set of documents confirming expenses. But in their absence, professional tax deduction is not provided.

Based on this package of documents, when calculating personal income tax, the tax agent will monthly reduce the income of an individual (rate 13%) by the amount of the deduction in the amount of expenses that are appropriately confirmed (clause 3 of Article 210, clause 2 of Article 221 of the Tax Code of the Russian Federation).

Solution

Option 1: The amount in the contract is indicated without the amount of expenses and the amount of reimbursement of expenses is calculated separately

General concept

Contract (work, services) document when calculating insurance Contract (work, services) document, indicate the amount minus the professional deduction , and a non-taxable deduction amount for:

- a third-party individual - enter through the document Accrual of other income (Salary - Accrual of other income);

- employee – create a type of calculation not subject to insurance contributions and enter it, for example, through the One-time accrual (Salary - One-time accruals).

Registration of the amount under the contract minus professional deduction

In the Contract (work, services) , you should indicate the amount of the contract minus the professional deduction, i.e. in our case, enter 10,000 rubles Amount the Deduction amount field :

Registration of non-taxable amount of professional deduction

Since the agreement was concluded with a third-party individual, and not an employee of the organization, it is necessary to enter the amount of professional deduction through the document Accrual of other income (Salary - See also - Accrual of other income - Accrual of other income). In the settings for the type of income, in the Type of income (insurance premiums) , select the value Income that is entirely exempt from insurance premiums, except for benefits from the Social Insurance Fund and military allowances . Set the switch to the position subject to personal income tax, income code – 2010:

At the same time, in the Accrual of other income , the professional deduction code – 403 – is automatically loaded in the Deduction

Despite the fact that the deduction is shown, in fact it is not taken into account when calculating personal income tax, even after manual adjustments to the deduction and personal income tax, because When posting the document Accrual of other income, the deduction amount does not fall into the Amount of Deduction of the accumulation register Accounting for income for calculating personal income tax :

Therefore, it is necessary to add the deduction amount in the amount of 1,000 rubles. using the document Transfer of data (Administration – See also – Transfer of data) directly to the accumulation register Accounting for income for calculating personal income tax in the column Deduction amount :

Insurance premiums in the document Accrual of other income , as expected, were not calculated:

Calculation of personal income tax and insurance premiums

In the document Calculation of wages and personal income tax contributions for employee M.A. Kiparisov. calculated based on the amount specified in the Contract (work, services) - 10,000 rubles. and amounts to:

- 10,000 (taxable amount under the Agreement) * 13% = 1,300 rubles:

Insurance premiums were also calculated on a base equal to RUB 10,000. and it turned out:

Pension Fund:

- 10,000 (taxable amount under the Agreement) * 22% = 2,200 rubles.

FFOMS:

- 10,000 (taxable amount under the Agreement) * 5.1% = 510 rubles.

Reflection of information in reporting

After payment of the amounts under the GPC agreement in 2-NDFL, the information will be reflected correctly:

- The total amount of income is 11,000 rubles.

- The deduction amount with code 403 is 1,000 rubles.

- The amount of calculated personal income tax is 1,300 rubles.

The payment of income under the terms of our example took place on June 5, 2018, therefore, in Section 2 6-NDFL report , the amount under the GPC agreement will appear in the report for 9 months in the form of a separate block:

In the report Calculation of insurance premiums for the first half of 2022, the total amount under the GPC agreement is 11,000 rubles. will fall into line 030 of Subsection 1.1 of Appendix 1 to Section 1 . This can be seen by highlighting column 5 of line 030 and clicking the Decrypt :

The amount of the professional deduction will be reflected in line 040 of Subsection 1.1 of Appendix 1 to Section 1 :

Option 2: The amount in the contract includes the amount of reimbursement of expenses

General concept

the Contract (work, services) document indicates the total amount under the contract and the amount of the professional deduction. Before calculating wages, the document Transfer of data to the accumulation register Income accounting for the calculation of insurance premiums , where the amount of professional deduction is indicated. After this, the salary for the month is calculated.

Registration of the amount under the contract minus professional deduction

In the Contract (work, services) , in the Amount , you should indicate the total amount under the contract, including a professional deduction, i.e. in our case it will be the amount of 11,000 rubles. In the Deduction amount , enter a professional deduction in the amount of 1,000 rubles:

Registration of the amount of professional deduction for taking it into account when calculating insurance premiums

Before calculating wages, we will enter the document Transfer of data to the accumulation register Income accounting for the calculation of insurance premiums , indicating in it in the Discount the amount of professional deduction, i.e. in our example, 1,000 rubles:

Calculation of personal income tax and insurance premiums

In the document Calculation of wages and personal income tax contributions for employee M.A. Kiparisov. calculated based on the amount of 10,000 rubles. and amounts to:

- 10,000 (taxable amount under the Agreement) * 13% = 1,300 rubles.

Insurance premiums were also calculated on a base equal to RUB 10,000. and it turned out:

Pension Fund:

- 10,000 (taxable amount under the Agreement) * 22% = 2,200 rubles.

FFOMS:

- 10,000 (taxable amount under the Agreement) * 5.1% = 510 rubles.

Features of NVGs for some people

A professional tax deduction for a lawyer is provided in the amount of expenses incurred related to the provision of legal services, according to the declared type of activity. Expenses for the acquisition and maintenance of property that can be used not only for professional activities cannot be taken into account for the purpose of granting preferences. At the same time, if the costs of maintaining and using personal property are directly related to the provision of services to customers, they can be taken into account for the purpose of receiving benefits if they are documented.

In this regard, people often think about the trade union deduction, but the trade union deduction has nothing to do with tax legislation. A trade union organization is created within an organization at the initiative of workers to protect their rights, after which a procedure for financing its activities is established on the basis of monthly contributions and other income withheld from wages. Trade unions can be organized not only within an organization, but also in a certain area, on an industry basis.

General conditions for deductions

Many entrepreneurs believe that they are obviously not entitled to tax deductions for individuals. However, this is not always the case. In fact, the possibility of applying preferences is not related to the status of an individual entrepreneur, because he continues to remain an ordinary citizen. The application of the deduction depends on how the income is taxed .

If an individual entrepreneur applies the main tax regime, he pays personal income tax on his own income. In this case, he can fully count on tax deductions.

However, in practice, many entrepreneurs use special tax regimes , which, instead of personal income tax, require payment of tax on income - real or imputed. For such individual entrepreneurs, in general, deductions are not applicable, but sometimes they can still use them.

For example, a citizen combines employment and entrepreneurial activity . At the same time, as an employee, he receives a salary, which is subject to personal income tax at a rate of 13%. This means that he has the right to count on deductions for this tax. The same is true if an individual entrepreneur receives other income subject to personal income tax at a rate of 13% , for example, from leasing property.

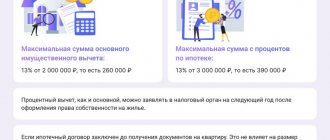

Most often, questions arise about the possibility of an individual entrepreneur to apply a property deduction when purchasing real estate, since it is very significant. With a maximum amount of 2 million rubles (the deduction is applied to the tax base), the tax savings will be 260 thousand rubles . However, as stated above, only the entrepreneur who applies OSNO or pays personal income tax on income received in addition to business activities will be able to receive a deduction. But individual entrepreneurs on other systems also have the option to take advantage of the preference. The bottom line is that in such a situation, the spouse of an individual entrepreneur, if he or she has income subject to personal income tax at a rate of 13%, has the right to receive a deduction in full.

Another important condition is that the property, the acquisition of which gives the right to a deduction, must be registered in the name of an individual entrepreneur, his spouse or children.

Examples of calculations

Let's give an example of calculating tax and professional tax deduction with postings.

Initial data: the notary wrote and published an article in a magazine, for which he received a remuneration of 5,000 rubles, but did not provide documents for expenses, so the standard for expenses is 20% (literary work).

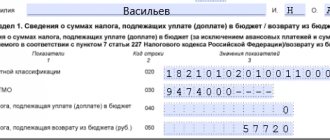

The amount of personal income tax that must be withheld by the customer as an agent is:

(5000 - 5000 x 20%) x 13% = 520 rubles.

Therefore, the executor is entitled to the following:

5000 - 520 = 4480 rubles including deductions.

In accounting, you must use the following entries to reflect transactions for the transfer of fees.

- Debit 26 and Credit 76

5000 rubles is the accrued fee under the agreement with the author

- Debit 76 Credit 68, subaccount “Calculations for personal income tax”

520 rubles - tax, personal income tax, which must be withheld as an agent

- Debit 50 Credit 51

4480 rubles - funds received from a credit institution as a fee by the author under the agreement

- Debit 76 Credit 50

4480 rubles - transferred and paid fee, taking into account tax withholdings

- Debit 68, subaccount “Calculations for personal income tax”, Credit 51

520 rubles - transferred to the personal income tax budget.

The tax calculation in this case will be as follows:

- income for work performed - 10,000 rubles;

- unconfirmed expenses (20%) - 2000 rubles;

- profit - 8,000 rubles;

- Personal income tax at the rate of 13% - 1040 rubles.

For authors of works who cannot confirm expenses, a percentage has been established by which the tax base can be reduced (20-40% depending on the type of creative activity). For example, when creating a work of literature, unconfirmed expenses account for 20% of accrued income, and when creating sculptures - 40%. The full list of deduction rates is established in Part 5 of Art. 221 of the Tax Code of the Russian Federation,” shares Glushko.

Article on the topic

Multiplication by subtraction. How will the new tax deduction work?