Documents to confirm the zero VAT rate

To confirm the zero VAT rate when exporting goods, the following documents are required (clause 1 of Article 165 of the Tax Code of the Russian Federation):

- a contract (a copy thereof) with a foreign person for the supply of goods outside the Customs Union;

- customs declaration (its copy) with the corresponding marks of the customs authorities;

- copies of transport, shipping and (or) other documents with appropriate marks from customs authorities.

This list of documents is exhaustive.

Filling out a VAT return when exporting

Now we will tell you how to fill out a VAT return for exporters. Separate sections of the declaration are provided for them - 4–6.

How to fill out the sections correctly, read the materials:

- “How to correctly fill out section 4 of the VAT return when applying a 0% rate”

- “The procedure for filling out section 6 of the VAT return.”

The rules for filling out a VAT return by an exporter from July 1, 2016 depend not only on whether he has documents confirming export, but also on the type of goods shipped abroad:

- For non-raw material varieties purchased after 07/01/2016, deductions are possible during the period of export shipment. There is no need to wait for documents confirming export to be collected (clause 1, paragraph 2, 3, clause 3 of Article 172 of the Tax Code of the Russian Federation).

- For exported raw materials, the procedure for confirming the right to deduction is preserved: you need to collect a full package of documents confirming the export within 180 days allotted for this by the Tax Code of the Russian Federation (clause 9 of Article 165 of the Tax Code of the Russian Federation).

For more information about confirming a 0% rate by collecting a complete package of documents, read the material What is the procedure for VAT refund at a 0% rate (receiving confirmation) .

For exports that are considered confirmed on time or do not require such a deadline (for non-commodity goods), Section 4 is completed in the VAT return.

In relation to raw materials, for which it was not possible to collect documents within 180 days to confirm the right to a 0% rate, you need to submit an updated declaration for the shipment period with completed section 6. It will reflect the accrual of tax at the rates applicable in the Russian Federation of 18 or 10%, as well as tax deductions.

For more information about actions in such a situation, read the article What to do if the export is not confirmed within the prescribed period .

If the documents are collected subsequently, after 180 days, then for the period in which they were collected, a declaration with completed Section 4 is submitted, and the tax paid in connection with non-confirmation of export is returned in accordance with Art. 176, 176.1 Tax Code of the Russian Federation.

Section 5 is completed if the validity of applying the 0% rate was confirmed earlier, but the right to VAT deductions arose only in the current period.

For a sample of filling out a declaration when exporting goods to Belarus, see ConsultantPlus, having received a trial demo access to the K+ system. It's free.

Registers of customs declarations

Starting from the fourth quarter of 2015, instead of transport and shipping documents, exporters can submit their electronic registers to the tax inspectorates. The forms, formats and procedure for compiling such registers are approved by Order of the Federal Tax Service of Russia dated September 30, 2015 No. MMV-7-15/427 (hereinafter referred to as the Order) (Part 4 of Article 3 of Federal Law dated December 29, 2014 No. 452-FZ).

“Electronic” registers do not replace all documents that must be submitted to confirm the application of the zero VAT rate. In particular, a contract with a foreign company for the supply of goods must be submitted on paper (Clause 19, Article 165 of the Tax Code of the Russian Federation).

In addition, during a desk audit, the tax inspectorate has the right to request transportation documents, information from which is included in the registers. And also request the necessary documents if the information on export operations received from customs authorities does not correspond to the data contained in the “electronic” registers. Documents will need to be submitted within 20 calendar days after receiving the request. They must have Russian customs marks (clauses 15–18 of Article 165 of the Tax Code of the Russian Federation). If the exporter has not fulfilled the inspection requirement (in whole or in part), the justification for applying a 0 percent tax rate in the relevant part is considered unconfirmed.

At the moment, 14 registers have been approved, depending on the type of export transactions performed (clause 15 of article 165 of the Tax Code of the Russian Federation, clause 1 of the Order). Each register is “linked” to the corresponding subparagraph or paragraph of Article 165 of the Tax Code of the Russian Federation, as one of the documents confirming the right to apply the zero VAT rate.

The “electronic” register must contain information about the size of the tax base to which the zero VAT rate applies. The tax base is determined for each transaction, confirmed by documents, the details of which are reflected in the register.

VAT register

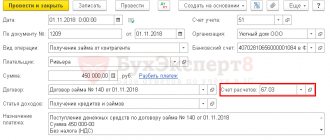

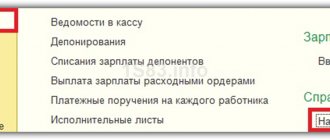

Next, we will fill out the register of documents itself. Section Reports

—

Regulated reports

We select the VAT Register we need from the list of reports, for example VAT Register Appendix No. 5. This register is generated automatically by clicking the Fill

Next, the Register of VAT customs declarations can be uploaded to a file for sending to the tax authority or sent directly from the program using the 1C-Reporting service.

Important!

During a desk audit of a declaration in which the right to a zero VAT rate is claimed, the tax authority may request documents from registers submitted by the taxpayer in electronic form. Within 20 calendar days from the date of receipt of the request, the taxpayer must submit copies of documents (clause 10 of Article 1 of the Law), this period is 10 days less than the period for submitting documents required from registers in paper form.

If the documents are not submitted, then the right to a zero VAT rate is considered unconfirmed. However, it is not entirely clear whether the zero rate will be confirmed if the documents are submitted to the tax authority in violation of the deadline.

This way, in the 1C: Accounting program (starting from release 3.0.43.50), users will be able to automatically fill out and send the register. I hope that our article will be useful to you. If you need help implementing new functionality, leave a request and we will definitely help you. We wish you successful reporting company!

Register No. 5

Registry form No. 5 is given in Appendix No. 5 to the Order. Here is the tabular part of the register:

| N p/p | Registration number of the customs declaration (full customs declaration) | Tax base for the corresponding transaction for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented (in rubles and kopecks) | Code of the type of vehicle by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation | Transport, shipping and (or) other document confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation | Note | ||

| Document type | Number | date | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Section VI of Appendix No. 15 to the Order is devoted to filling out register No. 5. The following information is indicated in register columns No. 5:

- in column 1 - the serial number of the corresponding operation for the sale of goods (works, services);

- in column 2 - registration number of the customs declaration (full customs declaration) for the corresponding operation for the sale of goods (work, services);

- in column 3 - the tax base for the sale of goods (work, services), the validity of applying a tax rate of 0 percent for VAT for which is documented;

- in column 4 - codes of types of vehicles by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation;

- in column 5 - types of transport, shipping or other documents (CMR, bill of lading, railway waybill, air waybill, TIR Carnet, shipping order, sea waybill, other document) confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation for the corresponding sale goods (works, services);

- in column 6 - the numbers of the documents indicated in column 5. If the number is missing, “b/n” is indicated;

- in column 7 - the dates of the documents indicated in column 5;

- in column 8 - other information related to the transaction, the details of the documents for which are reflected in register line No. 5. This is the type, number and date of the document submitted simultaneously with the VAT return, with the exception of the documents specified in columns 2, 5 - 7 For example, agreement (contract) No. 5-VAM-1991 dated May 21, 2015. If several documents are indicated, column 8 reflects the type, number and date of each document, separated by the sign “;”.

When and how to fill out the register of documents confirming the validity of VAT benefits

So, we have decided on the list of transactions for which the VAT benefit applies. Now let's see how to fill out the register of documents confirming the validity of VAT benefits. First, take the form recommended by the tax authority. You can download it at the end of our article.

Of course, you can create your own register form, but firstly, this is not necessary, and secondly, if the register is compiled in a different format, the Federal Tax Service will refuse you a selective approach to verification and will ask for a full list of documents.

As for the timing, the register of supporting documents for VAT benefits is submitted to the Federal Tax Service in response to the requirement to submit documents within 5 business days from the date of receipt by the taxpayer applying the benefits.

The tax authorities presented the register form in Appendix No. 1 to the letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589. The same letter describes step by step the procedure for filling out the register. Download the registration form for free by clicking on the image below:

We have studied it and now we will tell you about the procedure for filling it out.

Advice: before moving on to entering information about supporting documents into the register, first group them by transaction codes, then by type of transaction (activity), and then by counterparty. Arrange documents for transactions in descending order of amounts, i.e., first indicate documents for large sales amounts, and at the end - for small ones.

First, we transfer the information from columns 1 and 2 of section 7 of the VAT declaration to columns 1 and 3 (respectively) of the register of supporting documents for the VAT benefit. If different types of sub-operations were carried out under the same operation code, then the amount in column 3 must also be broken down by these sub-operations. Moreover, their names must be written in column 2 of the register.

In columns 4, 5, 6, opposite the corresponding group of operations and sub-operations, insert the name, INN and KPP of the counterparties. And opposite each counterparty, in columns 7, 8, 9 and 10, we indicate the type of document confirming the validity of the application of tax benefits, as well as the number, date and amount of this document.

The Tax Code of the Russian Federation does not contain a list or description of documents that can prove the legality of using tax benefits. Therefore, in the register of supporting documents for VAT benefits that we are considering, we register all the primary and other accompanying documents related to the specific operation. In particular, these are:

- an agreement for the provision of services (works), which contains a description of the preferential operation;

- an invoice indicating the name of the transaction and the amount marked “excluding VAT”;

- payment order, cash register receipt or other payment document indicating the preferential transaction and its cost with the note “excluding VAT”;

- a license to provide a preferential operation, if it is subject to compulsory licensing, etc.

Try to indicate the most complete list of documents in the register. The more details it provides, the fewer documents tax inspectors will ask for later.

After submitting a correctly completed register, inspectors will be able to request no more than 40% of documents, and these 40% should include no more than 500 documents.

The exception is the situation when the number of supporting documents is less than 30 pieces. In this case, the taxpayer will have to prepare a full package of documents, regardless of whether he submitted the register to the Federal Tax Service or not.

ConsultantPlus experts have prepared a sample for filling out the register of documents confirming VAT benefits. Get trial demo access to the system and access expert explanations for free.

How to fill out column 4

Column 4 of register No. 5 indicates the codes of the types of vehicles with which goods were exported from the territory of the Russian Federation, by type of transport in accordance with Appendix No. 3 of the Decision of the Customs Union Commission dated September 20, 2010 No. 378.

In addition, in the declaration for goods in the first subsection of column 25 “Mode of transport at the border” the code of the type of vehicle is indicated in accordance with the classifier of types of transport and transportation of goods (subclause 25, clause 15 of section II of the Instructions for filling out customs declarations and customs declaration forms , approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257). That is, when filling out column 4, you can use the information from column 25 of the goods declaration “Mode of transport at the border”.

Checking the correctness of filling out the customs declaration

To check whether the customs declaration is filled out correctly, you first need to find out whether the shipper is using a valid form. The current sample document is enshrined in the annex to the decision of the Customs Union Commission No. 257 of May 20, 2010. The declaration is usually filled out in triplicate. One of them remains with the employees of the Federal Customs Service of the Russian Federation, and the rest are transferred to the seller. The shipper will be able to transfer one of the copies to his business partner in the future.

Note! Most legal entities and entrepreneurs have connected electronic document management to the Federal Customs Service of the Russian Federation. In this case, the declaration is sent via electronic communication channels, and it can be printed in any number of copies.

You can check the declaration by checking the requirements contained in the decision of the Customs Union Commission No. 257 and the information specified in the document. The latter should contain:

- the name of the entrepreneur, commercial organization or customs broker who compiled the declaration;

- information about the unique characteristics of the cargo, as well as the presence of possible restrictions (for example, explosive substances are transported);

- a list of documents confirming both the name and characteristics of the product (passport, certificate, instruction manual);

- information about compliance with shipping requirements or other procedures (for example, information that the goods are fragile and were packaged in a protective form);

- data on the transaction with a foreign partner - the number of the purchase and sale agreement, delivery agreement, dealer agreement, other grounds for the emergence of legal relations, the currency in which the purchase and sale is made;

- the customs value of goods, which will be used by employees of the Federal Customs Service of the Russian Federation to calculate the amount of state duty;

- number of packages in a batch, full description of the goods (starting from the name in the declaration and ending with net and gross weight), cargo code according to the foreign economic activity commodity nomenclature;

- type of customs procedure;

- type of transport for transporting goods (you will also need to indicate the registration number of the transport in the customs declaration);

- complete information about the seller and buyer.

If the customs declaration contains all of the above information, then employees of the Federal Customs Service of the Russian Federation will accept the document for registration.

Important! The customs declaration is drawn up within 15 days after the cargo is moved to a warehouse for temporary storage. To check whether a product requires a declaration, you need to know the relevant conditions. The cargo must be more than 100 euros and be one of the items whose circulation is controlled by government agencies of the Russian Federation. The manufacturer pays excise duty on the product.

Customs officers have the legal right to check carriers' documents. If they have doubts about the legality of the transaction, the cargo will not be transported abroad. This right is enshrined in Art. 324 of the Customs Code of the Eurasian Economic Union (EAEU Customs Code).

How to fill out columns 6 and 7

Column 6 of Register No. 5 indicates the numbers of transport, shipping or other documents confirming the export of goods outside the Russian Federation for the corresponding sale of goods (work, services). Column 7 indicates the dates of these documents. Regardless of the type of transport, if there is no number on the document, “b/n” is indicated in the register.

International waybill

With regard to filling out columns 6 and 7 of the international consignment note (hereinafter referred to as CMR), the Federal Tax Service of Russia notes the following.

The consignment note must contain the place and date of its preparation (Article 6 of the Convention on the Contract for the International Carriage of Goods by Road (CMR), concluded in Geneva on May 19, 1956, hereinafter referred to as the Convention). However, the Convention does not provide for a universal form of CMR. The CMR number can be indicated in the upper right corner, and the date of its completion (registration) and the name of the locality where the CMR was compiled can be indicated in column 21 “Compiled on/date”.

Railway consignment note

In the column “Consignment note No.” the shipment number assigned by the carrier is indicated (clause 3.3 of the Rules for filling out transportation documents for the transportation of goods by rail, approved by order of the Ministry of Railways of Russia dated June 18, 2003 No. 39 (hereinafter referred to as the Rules). In the column “Calendar stamps, documentation acceptance of cargo for transportation" on the reverse side of the original waybill and waybill, as well as on the front side of the spine of the waybill and receipt of cargo acceptance, a calendar stamp "Documentary registration of acceptance of cargo for transportation" is affixed, which indicates the date of documentary registration of acceptance of cargo for transportation (p 3.10 of the Rules) The consignment note must also contain the shipment number and the date of conclusion of the contract of carriage (Article 15 of the Agreement on International Rail Freight Transport of November 1, 1951).

In this regard, the register should indicate the shipment number and either the date of documentary registration of acceptance of the cargo for transportation, or the date of conclusion of the contract of carriage.

Shipping order and bill of lading

In column 7, when exporting goods by sea, river, mixed (river-sea) transport, the date of the transport, shipping or other document (bill of lading, sea waybill or any other document) confirming the fact of acceptance of the goods for transportation and the order for shipment is indicated.

The bill of lading must include the time and place of issue of the bill of lading, as well as the date of acceptance of the cargo by the carrier at the port of loading (Article 144 of the Merchant Shipping Code of the Russian Federation dated April 30, 1999 No. 81-FZ). Appendix 8 to Order No. 182 of the Ministry of Transport of Russia dated July 09, 2014 provides a recommended sample of an order for the shipment of export cargo, which contains the columns “Date of loading” and “Date of issue of the order.” Therefore, if there is no date on the document confirming the fact of acceptance of the goods for transportation, or in the order for shipment, the date of acceptance of the goods for transportation is indicated in column 7 of register No. 5.