Minutes of the meeting of the social insurance commission

Limited Liability Company "Beta" LLC "Beta" MINUTES of the meeting of the social insurance commission LLC "Beta" No. 1 Present: 1. Chairman of the commission: leading labor protection specialist Alexander Petrovich Yursky.2. Members of the commission: labor protection specialist Yuri Vasilievich Davydov, accountant Svetlana Vladimirovna Yudina, secretary-referent Ivanova Marina Evgenievna.3.

Secretary of the commission: secretary-referent Marina Evgenievna Ivanova. Agenda: Establishing the legality of reducing the amount of temporary disability benefits (to the minimum wage for a full calendar month) to driver Dmitry Valentinovich Efremov. Established: Driver Dmitry Valentinovich Efremov submitted a certificate of incapacity for work to the Beta accounting department, in which the doctor made a note about violation of the regime. Efremov D.V. was supposed to appear for a regular examination with a doctor on May 14, 2012, but came to the appointment only on May 17, 2012. Due to the presence of this violation, the Beta accounting department calculated temporary disability benefits for D.V. Efremov.

in an amount not exceeding the minimum wage for a full calendar month. The list of reasons why the amount of accrued temporary disability benefits is subject to reduction is contained in clause 1, part 1, art. 8 of Federal Law No. 255-FZ of December 29, 2006.

Possible circumstances include the failure of the insured person to appear without good reason at the appointed time for a medical examination (clause

2. Part 1 Art. 8 of Federal Law No. 255-FZ of December 29, 2006).

However, when determining the amount of the benefit, the following fact was not taken into account.

Efremov D.V. was unable to visit the doctor on the proper date due to the death of a relative (May 13, 2012). In confirmation of this circumstance, the employee submitted to Beta an explanatory note and a copy of the death certificate of the mother (Efremova A.A.).

The commission recognized this reason for failure to appear for the next examination with a doctor as valid. Thus, the provisions of clause 1, part 1, art. 8 of Federal Law No. 255-FZ of December 29, 2006 are not subject to application in this situation. Decided: Taking into account the insignificant period of missing the established deadline for appearing at an appointment with a doctor and the presence of valid reasons for such failure, confirmed by documents: 1.

Accounting "Beta" recalculate the amount payable to Efremov D.V. temporary disability benefits based on the employee’s average earnings.2. Make payment of benefits within the next deadline established for salary transfers.

Signatures: Chairman of the Commission _________________________ A.P.

Yursky Members of the commission:____________________Yu.V. Davydov____________________S.V. Yudina____________________M.E.

Ivanova Secretary of the Commission _________________________ M.E. Ivanova

Today there is a promotion - consultation of lawyers and advocates 0 - rubles. hurry to get an answer for free→

“User of the site https://online-sovetnik.ru” (hereinafter referred to as the User) - a person who has access to the site https://online-sovetnik.ru via the Internet and uses information, materials and products of the site https://online -sovetnik.ru.1.1.7.

“Cookies” are a small piece of data sent by a web server and stored on the user’s computer, which a web client or web browser sends to the web server every time in an HTTP request when trying to open a page of the corresponding site.1.1.8. “IP address” is a unique network address of a node on a computer network through which the User gains access to the Online Advisor.2.

General provisions2.1. Use of the site https://online-sovetnik.ru by the User means agreement with this Privacy Policy and the terms of processing of the User’s personal data.2.2. In case of disagreement with the terms of the Privacy Policy, the User must stop using the site https://online-sovetnik.ru .2.3. This Privacy Policy applies to the website https://online-sovetnik.ru.

Online Advisor does not control and is not responsible for third party sites that the User can access via links available on the website https://online-sovetnik.ru.2.4. The Administration does not verify the accuracy of the personal data provided by the User.3. Subject of the privacy policy 3.1.

This Privacy Policy establishes the Administration’s obligations to non-disclose and ensure a regime for protecting the confidentiality of personal data that the User provides at the Administration’s request when registering on the website https://online-sovetnik.ru or when subscribing to the e-mail newsletter. 3.2.

Personal data permitted for processing under this Privacy Policy is provided by the User by filling out forms on the website https://online-sovetnik.ru and includes the following information: 3.2.1.

How to draw up a sick leave protocol?

If an organization has created a social insurance commission, then it considers issues of assigning and paying benefits only in controversial situations.

last name, first name, patronymic of the User; 3.2.2. User's contact phone number; 3.2.3. email address (e-mail)3.2.4.

Its meetings and conclusions are recorded. But the decisions made by the commission are advisory in nature, since the responsibility for the correct expenditure of compulsory social insurance funds rests with the administration of the policyholder represented by the head and chief accountant MINUTES No. 1 of the meeting of the social insurance commission of LLC "Pz,kbr" ...... ... February 5, 2000

PRESENT: Members of the social insurance commission: Chairman Secretary Members of the commission: INVITED: customer service manager position full name AGENDA: payment of temporary disability benefits position full name HEARD: statement full name of the chairman on the payment of temporary disability benefits to an employee of Mir Tovarov LLC Kulakova Irina Alekseevna.

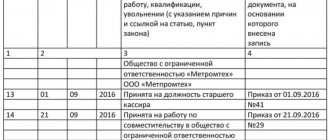

ESTABLISHED: Customer Service Manager Full name works in LLC…. under an employment contract and is subject to state social insurance.

On February 2, 2000, the full name presented for payment a certificate of incapacity for work, series 15855207 No. 222222222, issued on January 00, 2009, drawn up in accordance with the requirements established by the legislation of the Russian Federation.

Type of disability – maternity leave lasting 140 calendar days. Period of temporary incapacity for work: from…. By …. inclusive. The insurance period is …………… The monthly salary of the employee is 5,000 rubles.

The period for temporary disability subject to payment is calculated from ...... to...... inclusive.

The billing period for calculating average daily earnings is set from …… to …… inclusive. The average daily earnings of a female worker is 240 rubles 96 kopecks.

DECIDED: Guided by the legislation on social security of the Russian Federation and this protocol: 1. The HR department will issue maternity leave based on the application of the employee, full name.

2. The accounting department will accept the certificate of incapacity for payment. 3. Pay no later than 10 days to Irina Alekseevna Kulakova temporary disability benefits in the amount of 100% of earnings in the amount of 23,373 rubles 12 kopecks at the expense of …………. Chairman of the commission __________________ Secretary of the commission __________________ Resolution of October 26, 2006 No. 193 “On approval of the standard form of minutes of the meeting of the commission (authorized) for social insurance of an enterprise, institution, organization” In accordance with Federal Law dated December 29, 2004 No. 202-FZ

“On the budget of the Social Insurance Fund of the Russian Federation for 2005”

Is incapacity for work due to a domestic injury paid from the first day on the basis of a sick leave certificate?

jan explanatory note from the employee who submitted a certificate of incapacity for work in connection with a domestic injury is not required.

If there is a controversial situation, an act can be drawn up in any form.

Social insurance at the enterprise

The Labor Code gives an employee hired under an employment contract a number of social guarantees that he can claim if he loses the opportunity to work for reasons beyond his control. The most common examples of such guarantees include payment for sickness periods and benefits in connection with the birth of a child. For the most part, such payments are paid by the social insurance fund. However, initially their source of financing is actually the employers themselves, whose responsibilities include monthly contributions to the social insurance of employees. At the same time, the employer’s fulfillment of obligations related to the payment of benefits to employees can be controlled not only by the Social Insurance Fund.

Regulations on the Social Insurance Commission

Based on clause 11 of the Regulations “On the Social Insurance Fund of the Russian Federation”, approved by Decree of the Government of the Russian Federation of February 12, 1994 No. 101, to ensure control over the correct calculation and payment of social insurance benefits in institutions and organizations, regardless of ownership, by labor collectives social insurance commissions should be formed at the enterprise. In companies with fewer than 100 employees, the functions of such a social insurance commission can be performed by a social insurance commissioner.

The procedure for creating this structure itself is regulated by the regulations on the social insurance commission, approved by Resolution of the Federal Social Insurance Fund of Russia on July 15, 1994 No. 556a.

Thus, according to this document, commission members are elected at a general meeting of the labor collective from among representatives of its administration. These may be employees of the personnel department, accounting and other administrative personnel, as well as trade unions. The decision made by the meeting of the labor collective must be documented in a protocol, on the basis of which an order is issued to create a social insurance commission at the enterprise.

The commission is elected for a period of 1 to 3 years. Members of the commission may be re-elected before the expiration of their term of office by decision of the general meeting of the labor collective.

The main issues considered by the commission and authorized persons relate to the expenditure of funds for sanatorium-resort treatment and recreation of employees and members of their families, the distribution of vouchers to the insured for sanatorium-resort treatment, recreation, medical (dietary) nutrition purchased from the Fund’s funds. Also, the responsibilities of the commission or the social insurance commissioner include monitoring the correct completion of certificates of incapacity for work, the accrual and timely payment by the employer of temporary disability benefits and funeral benefits. They also consider other controversial issues regarding the provision of social insurance benefits to workers.

Meetings of the commission are held as necessary, but at least once a month. The decisions made are documented in the minutes of the meeting of the social insurance commission.

If violations of the current legislation on social insurance are detected, the commission is obliged to inform the management of the organization, as well as the FSS department, about this. The Social Insurance Fund can interact with this structure, requesting certain materials on insurance issues in the organization directly from representatives of the commission. The social insurance commission in an institution is obliged to report on its own work directly to the workforce and to the company administration at least once a year, as well as after the expiration of the term of office of a specific commission.

Sample minutes of a meeting of the social insurance commission in an institution

Minutes No. 1 of the meeting of the social insurance commission of Alpha LLC (Sample)

Moscow July 01, 2016

Present: Members of the social insurance commission: Chairman: Ivanov Ivan Ivanovich; Secretary: Petrov Petr Petrovich; Members of the commission: Sidorov Nikolay Ivanovich, Smirnova Tatyana Valerievna.

AGENDA : payment of benefits in connection with pregnancy and childbirth to an employee of Alpha LLC, I.V. Konstantinova.

HEARD: Ivan Ivanovich Ivanov’s statement regarding the payment of benefits in connection with pregnancy and childbirth to an employee of Alpha LLC, I.V. Konstantinova.

INSTALLED:

Konstantinova I.V. works at Alpha LLC under an employment contract and is subject to state social insurance.

June 27, 2016 Konstantinova I.V. presented for payment a certificate of incapacity for work in connection with pregnancy and childbirth, issued in accordance with the requirements established by the legislation of the Russian Federation. The beginning of the hospital period in connection with pregnancy and childbirth according to this document is June 24, 2016, duration is 140 calendar days.

Konstantinova I.V. has been working at Alpha LLC since February 1, 2012, but in the period from December 9, 2013 to August 17, 2015, this employee was also on maternity leave and subsequent maternity leave for up to 1.5 years. The employee did not take leave to care for a child under 3 years of age and started working on August 18, 2015.

According to Article 14 of the Federal Law of December 29, 2006 No. 255-FZ, if in the two calendar years immediately preceding the year of the insured event, or in one of the specified years, the insured person was on maternity leave and (or) on parental leave, the corresponding calendar years (calendar year), at the request of the insured person, can be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this leads to an increase in the amount of the benefit.

The employee's application to replace the 2014-2015 calendar years of the billing period for the purpose of calculating maternity benefits for 2012-2013 is attached.

DECIDED:

Guided by the legislation on social security of the Russian Federation and this protocol:

1. The HR department will issue, based on the application of employee Konstantinov I.V. maternity leave.

2. The accounting department will accept the certificate of incapacity for payment with the replacement of the billing period for 2012-2013 based on the corresponding application of the employee, calculate and pay the amount of temporary disability benefits in connection with pregnancy and childbirth within the time limits established by law.

Chairman of the commission __________________ I.I.Ivanov

Secretary of the commission __________________ P.P. Petrov

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

advocatus54.ru

inclusive.

4. Continuous work experience at the beginning of (name of organization) disability amounted to a year of months a day. 5. The total work experience at the beginning of incapacity for work was a year of months a day.

6. The monthly salary of the employee(s) is rubles.

7. The period for temporary disability subject to payment is calculated from » »

up to »» inclusive. 8. The billing period for calculating the average daily earnings is set from » » to » » 9. The average daily wage of the employee(s) is the amount of rubles. kopecks DECIDED: Guided by the social security legislation of the Russian Federation and this protocol: 1. The accounting department will accept the certificate of incapacity for payment.

Attention: Auditors will report suspicious transactions of the client “where appropriate.” The State Duma approved amendments to the “anti-money laundering” law, according to which audit organizations and individual auditors will have the obligation to notify Rosfinmonitoring about suspicious transactions and operations of the audited entity.

How to properly issue sick leave in an organization?

Members of the social insurance commission are elected from among representatives of the enterprise administration (personnel department employees, accounting department and others) and trade unions (labor collective) at a general meeting (conference) of the labor collective. The social insurance commissioner is elected in the same manner. On the basis of this Model Regulation, the Regulations on the commission (authorized) for social insurance of the enterprise are developed and approved by the general meeting (conference) of the labor collective, which determines the number of members of the commission, the norms of representation from the administration and trade unions (labor collective), the term of office and the procedure for making decisions The commission provides for the creation of commissions in the structural divisions of the enterprise, specifies the functions and responsibilities of the commission, and also establishes additional benefits and guarantees for members of the commission, including remuneration for their labor, at the expense of the enterprise.

The commission is elected for a period of 1 to 3 years. Members of the commission may be re-elected before the expiration of their term of office by decision of the general meeting (conference) of the labor collective, including on the proposal of a department (branch department) of the Fund.

The chairman of the commission is elected from among the members of the commission by a majority vote. Meetings of the commission are held as necessary, but at least once a month.

Decisions of the commission (commissioner) for social insurance are documented in a protocol.

The procedure for organizing the work of the commission is established by the Regulations on the commission (authorized) for social insurance of an enterprise.

During the performance of the duties of members of the commission, if these duties are carried out during working hours, employees may be guaranteed the preservation of their place of work (position) and average earnings in accordance with the collective agreement or agreement.

By decision of the department (branch department) of the Fund, members of the commission may be paid a one-time remuneration from the funds of the Social Insurance Fund of the Russian Federation.

Features of creation

IMPORTANT! A sample order for the creation of a social insurance commission from ConsultantPlus is available here

The commission includes employees working in the organization. To elect members, a general meeting must be scheduled. Members of the commission are appointed on the basis of their voluntary consent.

As a rule, the commission includes representatives of the company administration and leaders of the local trade union. It makes sense to appoint them specifically, since these employees have a common understanding of working in a social direction. Their work will be more efficient.

If the company has fewer than 1,000 employees, a general commission is sufficient. If the number of employees exceeds this limit, commissions must be created for each division. The management body is formed on the basis of the order of the head. It includes this information:

- Company name.

- Order number.

- Publication date.

- Reference to the law on the basis of which the commission is created (clause 11 of Regulation No. 101).

- Full name and position of all commission members.

- Functioning life of the organ.

- Manager's signature.

The work team must be familiarized with the document. The leader can determine the rights and obligations of the participants and give them various guarantees.

After the commission is appointed, its chairman is elected. A majority of votes is required to elect him. The main function of the chairman is to organize the activities of the commission and coordinate all its participants.

What benefits require a protocol?

220073, Minsk, lane. 1st Zagorodny, 20 Author: Tatyana Ignatyuk Paying sick leave and assigning benefits for children is not an easy matter for an employer.

In many cases, the participation of a commission specially created for this purpose is required. A benefit assignment commission must be created in all organizations with more than 15 employees.

If such a number is less than 15 people, the head of the organization, by order (instruction), appoints an employee who will perform the functions of this commission. The decision to assign (refuse to assign) benefits is made by the commission within 10 days from the date of filing the application (application) with all the necessary documents. If some documents need to be requested, the commission makes such a request within 5 calendar days from the date of receipt of the application, and makes a decision within one month.

The decision of the commission is documented in a protocol.

Separate forms of protocols have been established for the assignment of benefits for temporary disability and for benefits for children. The commission must inform the applicant of its decision. The decision (extract from the decision, notice) is issued or sent to the applicant within 5 days from the date of its adoption.

In case of refusal to grant benefits, the documents submitted by him are returned to the applicant. On the back of the sick note in the line

“Decision of the commission on the assignment of benefits, protocol N, date”

an entry is made: “Assign (refuse to assign) benefit(s)”, indicate the protocol number and the date of the meeting of the commission for assigning benefits.

When assigning child benefits, a protocol with the commission’s decision is filed in the file along with all the documents on the basis of which these benefits were assigned. In case of granting temporary disability benefits, the protocol is transferred to the accounting department.

All cases in which benefits are assigned by decision of the commission are established by law (VN - temporary disability): We draw attention to the following: 1) maternity benefits are assigned without the participation of the commission.

In this case, no protocol is required; 2) if, in continuation of the first sick leave, which was paid by decision of the commission, a second sick leave was issued (one continuous case of temporary disability), then on its reverse side the same protocol number and the date of the commission meeting are indicated as in the first sick leave; 3) if an employee applies to the commission with an application for the assignment of several types of benefits for children (for example, in connection with the birth of a child and for caring for a child under 3 years of age), one protocol of the meeting of the commission for the assignment of these benefits may be drawn up; 4) if, during the period of payment of child benefits, circumstances arise due to which the amount of the benefit changes or the payment of benefits is terminated, a protocol is drawn up at the discretion of the commission. Did you like the article? Thank the author.

Say thank you Sample Filling Article on the topic Sample Filling Article on the topic Other articles by the author 10/09/2022 79245 10/02/2022 23202 07/29/2022 2617 06/28/2022 67121 Other articles by category 10/23/2022 1223 10/21/2022 298 1 10/15/2022 6200 09/27/2022 2717 Online service of ready-made legal solutions How can I contact you? Online service of ready-made legal solutions Don't have an account yet?

Try for free ilex clients Login to the service Online service of ready-made legal solutions Cancel Go © YurSpektr LLC 2016-2022 All rights reserved. The information and technological components of the reference data bank of legal information of the Republic of Belarus are provided by the National Center for Legal Information of the Republic of Belarus. Thank you, your letter has been sent.

Close Sorry, the email was not sent.

Try again. Close *>*>*>*>*>*>*>*>

How to organize everything

First of all, let’s decide: is it necessary to create a commission at the enterprise or is it enough to appoint a social insurance commissioner?

If your company has 15 employees (insured persons) or less than 15, then you can do without a commission. It is enough to elect a social insurance commissioner.

If there are 16 or more employees, then in this case a commission is needed.

What if there were 15 employees and there was an authorized agent at the enterprise, and now they hired another employee and there were 16 of them? In this case, the enterprise has an obligation to create a social insurance commission instead of an authorized one. At the same time, the Ministry of Social Policy in a letter dated July 22, 2013 No. 378/18/99-13

noted that in this case the commissioner will perform the duties assigned to him until the creation of such a commission.

Individual entrepreneurs should also take care of creating a social insurance commission if they have more than 15 employees, or appoint an authorized representative if there are 15 or fewer employees

This was, in particular, pointed out by FVPT in a letter dated July 4, 2006 No. 07-35-1439

.

If, based on the number of employees of a sole proprietor, it is enough to appoint an authorized person, then the sole proprietor appoints himself as an authorized person (FVPT letter dated April 29, 2016 No. 2.4-46-674

).

At a newly created enterprise, a commission (authorized) for social insurance is created (elected) within a month after the state registration of the enterprise.

Who should be on the commission? The commission consists of representatives of the enterprise administration on the one hand, and insured persons, i.e., employees of the enterprise, on the other.

As a rule, the representative of the insured persons is the trade union organization of the enterprise, and in its absence, another authorized body that represents the interests of the insured persons. Each party delegates commission members depending on the number of insured persons in the enterprise. The terms of office and the number of commission members are determined by the parties by joint decision. The employer formalizes the decision to delegate members to the commission by order (another administrative document), and the representatives of the insured persons - by a resolution of the elected body of the trade union organization or by a decision of another authorized body.

Well, a few formalities about how the commission should work.

The main form of work of the commission is meetings, which are held in accordance with the plan approved by it, but at least twice a month. If during this period the enterprise did not have a single insured event (i.e. there is nothing for the commission to consider), we believe that commission meetings are not mandatory.

Members of the commission participate in its meetings personally without the right to delegate their powers to other officials. The commission is authorized to make decisions if more than half of its members are present at the meeting and a representative of each party is present. The meeting of the commission is recorded. The decision of the commission is considered adopted if the majority of the members of the commission present at the meeting vote for it. In the event of an equal distribution of votes, the vote of the chairman is decisive ( clause 4.1 of Regulation No. 13

).

Important! The documents required for the assignment of benefits for temporary disability or pregnancy and childbirth are reviewed by the commission (authorized) no more than 10 days from the date of their receipt ( Part 1 of Article 32 of Law No. 1105

).

Instructions for filling out sick leave in 2022-2022.

Sample filling

As a result, the employee is deprived of benefits from the Fund, which the employer is obliged to compensate. The first part of the sheet is filled out by an employee of the medical institution that issues the sick leave.

Below are step-by-step instructions for filling out the main lines of a sick leave certificate. Stages Procedure for filling out a sick leave certificate Explanations 1. At the top of the certificate of incapacity for work (next to the number and barcode), the first line indicates the primary sick leave or the issuance of a duplicate of it. If there are two marks, the certificate of incapacity for work is invalid.

If “duplicate” is indicated, the number of the lost sheet must be indicated next to it.

If the illness is long-term, then several sheets are issued and in each subsequent one the number of the previous one is indicated. 2. Next, indicate the name and address of the medical institution. Between words and numbers, one cell must be empty. If the data does not fit on the lines, then the word can be shortened. 3. Write down the date of issue of the form and the OGRN of the medical institution (main state registration number). The registration number is useful if the name of the institution has been shortened.

For legal entities, the OGRN consists of 13 numbers, for individual entrepreneurs - 154. Information about care. They are filled in when sick leave is issued when caring for a sick family member. The age, relationship and name of the family member who needs care is indicated. In the “age” line, the first two cells indicate the number of full years, and the second – the number of full months. If the child is less than a year old, then only the second two are filled out.

Then the relationship code. If there are more than two sick children, then two certificates of incapacity for work are issued. They differ only in the data of those children whom the parent is caring for. 5. Fill out information about the patient: - Full name, date of birth and gender Be sure to check the correct spelling of the date of birth and gender.

Instead of the date of birth, they may indicate the date of onset of disability—TIN and SNILSP will help establish the patient’s identity—the cause of disability indicated by the code. The meanings of the codes are on the reverse side of the sheet—type of place of work (main or part-time) Data are entered from the patient’s words.

Act on violation of hospital regulations

0 Employees of the organization who are insured persons have the right to receive benefits in a timely manner and in full in case of temporary disability and in connection with maternity ().

For their part, the insured persons are obliged, among other things, to comply with the treatment regimen determined for the period of temporary disability ().

Violation of the hospital regime may be grounds for reducing the amount of temporary disability benefits. In the current form of sick leave, in the line “Notes on violation of the regime”, depending on the type of violation, the attending physician indicates the following two-digit code (, approved.

By Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n):

- 23 - failure to comply with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician;

- 24 – late attendance at a doctor’s appointment;

- 25 - going to work without being discharged;

- 26 - refusal to refer to a medical and social examination institution;

- 27 - late appearance at the medical and social examination institution;

- 28 - other violations.

Having received from the employee a sick leave with the completed line “Notes on violation of the regime”, the employer has the right to reduce the amount of temporary disability benefits in the following cases ():

- violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician;

- failure of the insured person to appear without good reason at the appointed time for a medical examination or for a medical and social examination.

From the day on which such a violation was committed, the employer pays the insured person a temporary disability benefit in an amount not exceeding the minimum wage for a full calendar month ().

The legislation does not oblige the employer to draw up any document confirming the employee’s violation of the sick leave regime and justifying the reduction in the amount of temporary disability benefits.

At the same time, in such an act it is convenient to record the fact of violation of the regime, as well as to calculate benefits. Moreover, if the employer decides that the reasons for violating the regime are valid, the amount of the benefit may not be reduced.

In any case, the decision made must be justified in the act.

A new form for an act of violation of the sick leave regime is available.

For an act of violation of the sick leave regime, we also provide a sample of how to fill it out:

Minutes of the meeting of the social insurance commission

Minutes N ______ meeting of the social insurance commission ___________________________________________________ (name of organization) “___”________ ___ _______________ PRESENT: Chairman of the commission: ________________________ (full name) Secretary: ________________________ (full name) Members of the commission : ________________________ (full name) ________________________ (full name) ________________________ (full name) INVITE: ____________________________________________________________. (position, name of organization, full name) AGENDA: payment of temporary disability benefits __________________________________________________________________________.

(position, name of organization, full name) HEARD: application _____________________ for payment of temporary (full name) disability benefits _______________________________________________________. (position, name of organization, full name) ESTABLISHED: 1. __________________________, works in __________________________ under (position, name of organization) (name of organization) employment contract and is subject to state social insurance.

2. “___”________ ___, _______________________ presented for payment (full name) a certificate of incapacity for work, series ________ N ____, issued by “___”________ ___, drawn up in accordance with the legislation of the Russian Federation and requirements.

3. Type of disability - ___________________.

Period of temporary incapacity for work: from “___”________ ___ to “___”________ ___ inclusive.

4. Continuous work experience in _________________________________ at the beginning of (name of organization) incapacity for work amounted to ___ year ___ months ___ days. 5. The total work experience at the beginning of disability was ___ year ___ months ___ days. 6. The monthly salary of an employee is ____________________ rubles.

7. The period for temporary disability subject to payment is calculated from “___”________ ___ to “___”________ ___ inclusive.

8. The billing period for calculating the average daily earnings is set from “___”________ ___ to “___”________ ___ 9. The average daily earnings of an employee(s) is the amount of _______________ rub.____ kopecks. DECIDED: Guided by the legislation on social security of the Russian Federation and this protocol: 1.

The accounting department will accept the certificate of incapacity for payment. 2. Pay no later than ___ days ________________________ benefits for (full name) temporary disability in the amount of 100% of earnings in the amount of ______________ rubles ________ kopecks at the expense of the Social Insurance Fund of the Russian Federation. Chairman of the commission _______________/_________________ (signature) (full name) Secretary of the commission _______________/_________________ (signature) (full name) Source - Kasenov E.B.

How to fill out the minutes of a meeting (decision of the authorized person)

All decisions of the commission (both on the assignment of benefits and on the refusal to assign) on the day of their adoption are formalized in the appropriate protocol/decision of the authorized person .

Please note: Regulation No. 13

approved a new form of minutes of the meeting of the social insurance commission (decision of the commissioner).

We fill out the protocol using the new form starting from July 27, 2018.

What if the protocols were drawn up using old forms? We recommend re-registration.

See below for an example of filling out the protocol. Here we will briefly explain some aspects of filling it out.

If the commission (commissioner) for social insurance decided to assign benefits, they fill out section I of the protocol.

It indicates the necessary information, including the amount of the benefit (%) and the number of days that must be paid, both at the expense of the enterprise and at the expense of the Social Insurance Fund.

Please note that

The company pays for all days of maternity leave at the expense of the Fund

Also, at the expense of the Fund, starting from the first day, sick leave is paid for caring for: a sick child (but no more than 14 calendar days), a sick family member (but no more than 3 calendar days, and in special cases - 7 calendar days). But in case of illness or injury not related to an industrial accident, the first 5 days of illness are paid by the employer, and starting from the 6th day and for the entire period until the restoration of working capacity or until disability is established, sick leave is paid from the Fund.

The completed protocol, together with the documents that are the basis for the assignment of benefits, is transferred to the accounting department of the enterprise for calculation, accrual and payment of the required amounts.

If for some reason the commission (authorized) cannot make a positive decision on the payment of benefits, we fill out Section II of the Protocol indicating the reasons for refusing the benefit. The list of grounds for refusal of benefits is given in Art. 23 of Law No. 1105

. Thus, temporary disability benefits are most often not provided:

- in case of temporary disability due to illness or injury due to alcohol, drug, toxic intoxication or actions caused by such intoxication;

— during the period the insured person is on unpaid leave, sabbatical leave, additional educational leave;

- in case of violation of the treatment regime by the insured person during the period of receiving temporary disability benefits.

Important! The benefit is assigned and paid if the applicant applied for its appointment no later than 12 calendar months from the date of restoration of working capacity, establishment of disability, end of maternity leave ( Part 5 of Article 32 of Law No. 1105

). Therefore, if an employee missed the established deadline for providing sick leave, the social insurance commission (authorized) has the right to refuse to grant him benefits.

The reason for refusal to pay for a period of incapacity for work may also be errors made when filling out a certificate of incapacity for work. The applicant is informed about the refusal to grant benefits, indicating the reasons for the refusal no later than 5 days after the relevant decision is made ( Part 1, Article 32 of Law No. 1105

).

When is it possible not to reduce sick leave benefits if the regime is violated?

And even if the organization does not have a permanent commission, it can be created specifically for a specific case. If the organization employs only three or four people, then the members of the commission can be appointed by the head of the organization by his order.

The commission may include, for example, the head of the organization, the chief accountant, the head of the human resources department, or the head of the department where the sick employee works. If the commission includes the head of the organization, then there is no need to separately issue an order to assign benefits in full. If the head is not a member of the commission, then its decisions are advisory in nature.

And in this case, the decision to recognize the reason for violating the regime as valid and to pay the employee temporary disability benefits in full is made by the head of the organization.” STEP 1. We receive a statement from the employee explaining the reason for the violation of the regime.

It is compiled in any form. General Director of Razdolye LLC N.N. Savinov from the confectionery shop technologist Vera Ivanovna Neskuchnaya I was sick from August 24 to September 12, 2011, which is confirmed by a certificate of temporary incapacity for work dated August 24, 2011.

No. 000 345 122 452. Please do not reduce my temporary disability benefit to the minimum wage for the period of illness from September 2 to September 12, 2011 due to late attendance at a doctor’s appointment. I did not show up for my appointment with the doctor on September 2, 2011.

due to the fact that I could not leave the house because my three-year-old child was sick, for whom I called a doctor. This is confirmed by a doctor’s certificate dated September 2, 2011.

/ Neskuchnaya V.I. / September 13, 2011 If, due to poor health, it is impossible to attend an appointment with a doctor on the day set by him, then so that the doctor does not make a note about this on the sick leave and the benefit is not reduced to the minimum wage, you need to call a doctor at home.

STEP 2. Elect a social insurance commissioner. So that the manager’s decision on payment to the employee,

Minutes of the meeting of the commission on the assignment of state benefits to families raising children and temporary disability benefits (Form) (Decision of the commission on the assignment (refusal to assign) temporary disability benefits)

Assign temporary disability benefits according to certificates of incapacity for work: N ___________ ______________________________________________________________ (last name, first name, patronymic (if any) for the period from _____________ to _____________ in the amount of _____________________, for the period from _____________ to _____________ in the amount of ______________________ in accordance with _________________________________________________________; (link on a normative legal act) N ___________ _______________________________________________________________ (last name, first name, patronymic (if any) for the period from _____________ to _____________ in the amount of _____________________, for the period from _____________ to _____________ in the amount of ______________________ in accordance with _________________________________________________________.

(link to a regulatory legal act) 2. Refuse to grant temporary disability benefits on certificate of incapacity for work N _________ _____________________________________ (last name, first name, ___________________________________________________________________________ patronymic (if any) for the period from __________ to __________ in accordance with _____________________ (reason for refusal __________________________________________________________________________. with reference to a normative legal act) 3.

The commission's decision can be appealed to the territorial body of the Social Protection Fund of the Ministry of Labor and Social Protection at the place where the organization is registered as a payer of mandatory insurance contributions, and in case of disagreement with its decision - in court.

Sample log of sick leave certificates

Like the design of the magazine, its structure and text are left to the employees of the enterprise. At the same time, when drawing up the form, several important points should be taken into account.

On the title page you should write:

- Company name;

- journal opening date and end date (entered, of course, after the document is closed);

- person responsible for maintaining the journal;

- if the organization has adopted a nomenclature of cases, then you need to provide a link to the journal index in accordance with this accounting document.

The main part of the journal is best presented in the form of a table. The following information should be included here:

- number of the certificate of incapacity for work (it consists of twelve digits);

- the name of the organization (read: clinic, hospital, medical center) that issued it;

- position and full name of the employee;

- the department in which he works;

- period of sick leave;

- code of the cause of disability (inscribed on the sick leave);

- the date of presentation of the sheet to the employer's representative.

If desired, you can supplement the table with other columns (for example, for the signature of the bearer of the certificate of incapacity for work and the accountant to whom the certificates are transferred to carry out accounting operations on them).