The KND code is an indication of the type of tax return according to a special directory. The article describes the functions of the classifier, its structure and provides the main values for the most common reporting.

In accounting documentation, there is often a combination of numbers that means the KND code: the decoding of the abbreviation is quite simple - this is the tax return code. The KNI code can be found in a special reference book approved by the Order of the Federal Tax Service of Russia dated May 28, 2013 (it correlates the values of KNI and BCC). In addition, the structure of the tax document classifier was approved by Order of the Federal Tax Service of Russia dated March 22, 2017 No. ММВ-7-17/.

Any document that has a 7-digit codification represents a calculation of a particular tax in written or electronic form, made by the taxpayer himself in order to pay it. For verification and control, the taxpayer also indicates in the form other necessary information: the object of taxation, sources of income, basis for calculation, applied benefits, etc.

Tasks

The reference book itself focuses on the relationship between budget classification codes and tax return codes. This is necessary, from the point of view of tax regulation, in order to automatically open obligations to the Federal Tax Service of the Russian Federation.

The LPCs themselves are also intended for:

- simplified reception and prompt processing of reports from individuals and legal entities, organizations and individual entrepreneurs (according to the indicator under discussion, specialists from the Federal Tax Service of the Russian Federation can quickly check the correctness of the BCC indication, which significantly reduces the time spent on processing);

- correct and prompt conduct of on-site inspections by the Federal Tax Service of the Russian Federation (based on the indicator under discussion, specialists quickly establish a list of BCCs; it is also used when checking zero reporting forms).

Purpose of the directory

The purpose of developing and implementing a directory of compliance of tax return codes with budget classification codes was purely applied, that is, not related to statistics, but aimed exclusively at coordinating the work of the Federal Tax Service with tax returns.

Thus, in accordance with the above-mentioned Order of the Federal Tax Service, a directory of compliance of tax return codes with budget classification codes is intended to unify all available software and algorithms that are in one way or another involved in the preparation, acceptance and processing of tax returns and other documents drawn up for the purpose of calculation and subsequent payment various taxes and fees.

From an applied point of view, the directory is used for the purpose of automated generation of budget classification codes:

- in tax returns;

- updated tax returns;

- other documents whose purpose is the calculation and payment of taxes.

In addition, the guide applies:

- for the purpose of direct (automatic) opening of tax obligations;

- for receiving and subsequent processing of tax reports;

- to determine the register of KBK codes for KND and to check the submitted zero reporting in cases of tax audits.

Structure and specific examples

The indicator is a combination of seven digits, each position consists of a block required for identification and a block of the name of the identification object itself. The KND form includes a form class, a subclass, a registration number within the subclass (three digits) and the last two digits - a control number.

We present the most common values in the table.

| Meaning | Name of the document (for which tax declaration) |

| On the profits of organizations | |

| For the income of individuals | |

| Information on the average number of employees |

Classifier of tax documentation (KND)

— a documentation classifier developed and used by the Federal Tax Service of the Russian Federation (FTS RF).

Structure

Visually, the directory consists of a table, each row of which includes:

- serial number;

- field name and length in the “representation in ASVK” section;

- field name;

- field content.

Thus, each line of the compliance directory contains the following information:

- budget classification code in accordance with the KDB (budget income classifier);

- tax documentation code for KND;

- name of the document, date of its approval and details of the order;

- start and end date of validity.

A comment

The tax documentation classifier (KND) has been developed and used by the Federal Tax Service of the Russian Federation. The KND was approved by Order of the Ministry of Taxes and Taxes of the Russian Federation dated October 12, 1999 N AP-3-14/319.

The objects of classification in the CND are the forms of documents used by the tax authorities, approved by the Federal Tax Service of Russia.

KNI is indicated on tax reporting forms approved by the Federal Tax Service of the Russian Federation.

Classifier structure

The structure of the KND completely coincides with the structure of the OKUD:

the tax document form code consists of seven digital decimal places;

the adopted classification system is hierarchical with three levels;

Each CND position consists of an identification block (identification of the FND is carried out through classification) and a block for the name of the classification object.

Structure of the FND code designation for KND:

KK.PP.RRR.CH,

where: КК - class of forms (a sign reflecting whether the document form belongs to tax documentation);

PP - a subclass of forms (a feature reflecting the common content of a subset of tax document forms and the direction of their use);

RRR - registration number of the FND within the subclass;

CC - control number.

Classifier of tax documentation

The KND presents the following subclasses of document forms:

10 - documentation on accounting for NP received by the NO (input documents);

20 - documentation issued (sent) by tax authorities when carrying out procedures for accounting for NP and cash registers (output documents);

30 - documentation exchanged between non-commercial organizations;

40 - accounting documentation maintained by the tax authorities (magazines, registers, accounting sheets, etc.);

50 - documentation on tax reporting (input documents: tax returns, calculations, tax reports, certificates, etc.);

60 - documentation to ensure the fulfillment of obligations to pay taxes and fees (output documents: requirements for the payment of taxes and fees, notices of appearance at the tax authority on tax issues, etc.);

70 — payment documentation;

80 - reporting and reference documentation (on work on accounting for NP; on receipts of tax payments, debts, fines and penalties; on control and audit activities).

Example

Tax return for corporate income tax - 1151006

Value added tax declaration - 1151001

Act on reconciliation of payments to the budget - 1142006

Additionally

Tax return is a taxpayer’s statement (in written or electronic form) about the objects of taxation, about income received and expenses incurred, about sources of income, about the tax base, tax benefits, about the calculated amount of tax and (or) about other data that serves as the basis for calculation and paying tax

About products «

OOO «

For more than sixty years, it has occupied the first position as a leading Russian organization in the field of development, development, as well as serial production and repair of pneumatic equipment and devices in the market of pneumatic automation devices.

Over its sixty-year history, it has mastered more than a hundred types of products, which have found wide application in all industries. Specialists of the design and technological departments of the LLC "

constitute the main intellectual potential of a manufacturing enterprise.

This is where the complex technological sequence of creating new pneumatic equipment originates: from design development to a new pneumatic device. To produce unique equipment, company specialists have to work with various technical documentation. Ultimately, with the use of highly skilled workers and automation of production in the workshops of the LLC

, a powerful arsenal of products is born.

The main products manufactured by LLC "include:

— pneumatic power amplifiers; — pneumatic control devices with electric drive diagrams; — pneumatic regulating devices; — pneumatic control stations; — pressure reducers with filter; - a device for selecting pneumatic signals and many other devices and equipment.

Our company, being a supplier of OOO, offers you a complete list of the company’s products. We guarantee the execution of any order in the shortest possible time with mutually beneficial terms of cooperation.

The online catalog of our resource, as well as highly qualified technical specialists, will be happy to help you make the optimal and correct choice of plant products.

We dare to say that the many years of experience of engineers and designers of the “old school”, multiplied by the progressive knowledge of young specialists of AnalitTeploControl LLC, as well as a streamlined dialogue scheme with the Customer, will fully allow you to take control of the regulation and automation of any technological process.

Commission on Minors' Affairs and Protection of Their Rights

is a body that is primarily

involved in the prevention of crime among minors.

Therefore, the operating system of the CDN can be represented as follows:

- Working with parents or persons replacing them, in the form of issuing public censure for failure to fulfill the duty of raising children (limitation of legal capacity, deprivation of parental rights).

- Identifying the negative role of adults who involve teenagers in criminal activities.

Work on the prevention of crimes of juvenile offenders:

- registration of offenders;

- establishing the reasons for committing crimes;

- ways to eliminate these causes.

In the modern period, the delinquency of a minor is considered as evidence of shortcomings in educational work, and the totality of facts of antisocial behavior and delinquency of adolescents in the city of Smolensk is considered as a serious indicator of shortcomings in the educational and preventive work carried out here. The role of the public is especially important in the prevention and elimination of juvenile delinquency. One of the main forms of citizen participation in educational and preventive work with adolescents is the CDN under the city administration. KDN is a government agency. Its activities are organizational and legal in nature. She is endowed with powers of an imperious nature. Almost all members of the commission - representatives of government bodies and public organizations - perform their duties free of charge.

The main tasks of the KDN are:

Organization of work to prevent neglect and juvenile delinquency. Organization and protection of the rights and interests of minors. Coordination of efforts of government bodies and public organizations on these issues.

Consideration of cases of juvenile delinquency.

Monitoring the conditions of detention and conducting educational work with minors in institutions.

The Commission systematically informs public organizations and groups about its work. The composition of the CDN is constant. Temporary replacement of a CDN member by another person is unacceptable. As the practice of work in the KDN has shown, with the existing volume of work of the commission, it is impossible to ensure the effectiveness of its activities through the efforts of the public alone; the volume of work is increasing more and more. The resolutions issued by the CDN have legal force and are subject to mandatory execution (the deadlines for execution are indicated). The KDN builds its work according to plan together with the prosecutor’s office, the court and the police.

KDN identifies and registers:

- Children and teenagers left without parents.

- Minors with parents who do not provide adequate conditions for raising children.

- Teenagers who have left school and are not working and others in need of government assistance.

- They are taking measures to arrange them. The KDN identifies families in which children are in unfavorable upbringing conditions and keeps records of such families.

The KDN is responsible for considering cases of minors in the following cases:

- committing a socially dangerous act under the age of 14;

- committing a socially dangerous act at the age of 14 to 16 years;

- committing petty hooliganism under the age of 16 or petty profiteering or an administrative offense under the age of 18;

- committing another antisocial act;

- avoiding school or work.

The basis for consideration of the case in the CDN is the protocol for each violation. The KDN can apply the following measures to teenagers: Oblige the teenager to make a public apology. Issue a warning. Give a reprimand or severe reprimand. Impose a fine on a minor who has reached 16 years of age and has independent income. Place the minor under the supervision of parents or persons replacing them. Send the minor to a special treatment and educational institution. Place a minor in a special treatment and educational institution if he commits a socially dangerous act. Conditional referral of adolescents to special institutions is widely used in the practice of the Children's Supervision Center. This form of influence is effective and in most cases brings positive results. It should be noted that the KDN is a body involved in the prevention and prevention of delinquency among minors, so working with “negligent” parents is also an important area of its activities. Public censure is the public condemnation of parents or persons in their stead for failure to fulfill their duty to raise children. It is most often announced at a meeting of the CDN. The KDN has the right to impose a fine on parents. Restrictions on legal capacity are applied to citizens who, due to the abuse of alcoholic beverages or narcotic substances, put their family in a difficult financial situation (Article 30 of the Civil Code of the Russian Federation).

Parents, or one of them, may be deprived of parental rights if they are found to be shirking their responsibilities for raising children or abusing their parental rights. Deprivation of parental rights is a last resort.

KDN considers cases:

- transferred in the manner prescribed by Articles 8 and 10 of the Code of Criminal Procedure of the RSFSR;

- on the recommendation of the police, public education and vocational education;

- on the representation of parent committees at schools, house committees, house managements and other organizations;

- according to statements from citizens;

- on their own initiative.

The KDN considers cases no later than 15 days from the date of their receipt. The bulk of cases of delinquency come from juvenile affairs inspectorates. The KDN transfers some cases to a comrade's court at the place of study or work of the teenager.

The KDN is obliged to identify the causes and conditions that contributed to the commission of offenses by minors. And take measures to eliminate them. During the examination, the motives for the offense are revealed, as well as the harmful influence that formed the criminal intent of the teenager and the unfavorable situation in the family. If a minor refuses to appear at the commission without good reason, he may be delivered through the police. A meeting of the commission is valid if at least half of its members are present. The teenager, parents and representatives of educational institutions are called to the CDN. The commission has the right to remove the minor from the meeting while investigating circumstances, the discussion of which may adversely affect him. Commission meetings are conducted with great tact, skill and experience and should have an educational effect on adolescents. A formal procedure for the trial of a case should not be allowed.

At meetings, minutes are kept with a brief record of the explanations and testimony of the people summoned. The study of generalized systematic data helps the commission to establish the causes of juvenile delinquency, identifying weak links in the work, and outline ways to eliminate them.

Regulations on Juvenile Justice Commissions (DOC)

On every tax return that taxpayers are required to submit, and on many other tax forms, the KNI code is indicated in the upper right corner. What is KND and why is it needed?

The abbreviation KND stands for a classifier of tax documents (clause 1 of the Standard for the composition, structure, procedure for the formation and maintenance of a departmental classifier of tax documents, approved by Order of the Federal Tax Service of March 22, 2017 N MMV-7-17/, hereinafter referred to as the Standard). And each specific declaration form indicates its own KND code. But let's talk about everything in order.

KND structure

Each code consists of 7 digits of the form KKPPRRRR. They can be divided into 3 levels (clause “b”, clause 5 of the Standard):

- the first 2 digits of QC indicate the class of the document. Class 11 indicates that the form relates specifically to tax documentation;

- the next 2 digits of the PP are the document subclass. It reflects the “nature” of the tax document and its purpose (reporting form, internal tax document, etc.);

- the last 3 digits of the PPP are the registration number within the subclass.

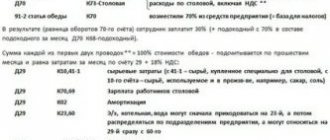

That is, the numbers in the subclass carry the most information. If there is a 3rd digit in the KND, for example (Appendix No. 1 to the Standard):

- 1, then you have before you a document necessary for accounting for taxpayers/cash registers, or for licensing, accounting for the activities of taxpayers, or for establishing the obligation to pay taxes and fees. Such documents are submitted to the tax authorities, i.e. they are input documents for tax authorities. Let's say KND 1112501 is on the application for state registration of an individual as an individual entrepreneur (approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/);

- 2, then this is documentation issued / sent by tax authorities in connection with the accounting of taxpayers, cash registers, as well as in connection with licensing, accounting for the activities of taxpayers (output documents). These are documents such as a certificate of registration of a Russian organization with the tax authority at its location with KND 1121007, a notice of deregistration of a Russian organization with the tax authority with KND 1121013 (approved by Order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7 -6/), etc.;

- 5, then this is a document related to the payment of taxes. This may include a form of tax reporting: tax return, calculation, tax report, etc. For example, KND 1151006 is indicated on the tax return for corporate income tax (approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/).

By the way, subclass 51 in the code means that the document relates to federal taxes and fees, 52 to regional, and 53 to local.

Note that the hierarchical structure of the codes corresponds to the All-Russian Classifier of Management Documentation (approved by Resolution of the State Standard of Russia dated December 30, 1993 No. 299). This was done specifically so that tax documentation could also be represented as part of OKUD, and the principles of its coding did not differ from the generally accepted system.

Information on the average number of employees (ASH) is information about the number of payroll members of an organization or individual entrepreneur. The payroll includes only workers hired under. The data is submitted on a special form (the form is called KND 1110018), approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/

Table of correspondence between KND codes and KBK codes

| KND | KBK | Title of the document | Number and date of approval of the order |

| 1151001 | 18210301000011000110 | Tax return for value added tax | Order of the Ministry of Finance of Russia dated October 15, 2009 N 104n as amended on April 21, 2010 N 36n |

| 1151003 | 18210302050011000110 18210302141011000110 18210302142011000110 18210302143011000110 18210902030021000110 | Excise tax return | Order of the Ministry of Taxes and Taxes of Russia dated January 4, 2002 N BG-3-03/3 as amended dated July 16, 2002 N BG-3-03/365 |

| 1151006 | 18210101011011000110 18210101012021000110 18210101040011000110 18210101060011000110 18210101070011000110 18210901010031000110 18210901020041000110 18210901030051000110 | Tax return for corporate income tax | Order of the Federal Tax Service of Russia dated March 22, 2012 N ММВ-7-3/ [email protected] |

| 1151020 | 18210102010011000110 18210102020011000110 18210102030011000110 18210102040011000110 18210903021051000110 | Tax return for personal income tax (form 3-NDFL) | Order of the Federal Tax Service of Russia dated November 10, 2011 N ММВ-7-3/ [email protected] |

| 1151026 | 18210702010011000110 18210702020011000110 18210702030011000110 18210903021031000110 18210903021041000110 18210903021051000110 18210903022011000110 18210903023011000110 18210903024011000110 18210903025011000110 18210903040011000110 18210903050011000110 18210903061011000110 18211202030010000120 18211202080010000120 | Calculation of regular payments for subsoil use | Order of the Ministry of Taxes and Taxes of Russia dated February 11, 2004 N BG-3-21/ [email protected] |

| 1151038 | 18210101011011000110 18210101012021000110 18210101050011000110 18210101070011000110 18210901010031000110 18210901020041000110 18210901030051000110 | Tax return for income tax of foreign organizations | Order of the Ministry of Taxes and Taxes of Russia dated January 5, 2004 N BG-3-23/1 |

| 1151039 | 18210902020011000110 | Tax return on excise taxes on petroleum products | Order of the Ministry of Finance of Russia dated 03.03.2005 N 32n as amended on 30.12.2005 N 168n |

| 1151040 | 18210902010011000110 | Tax return for excise duty on excisable mineral raw materials (natural gas) | Order of the Ministry of Finance of Russia dated March 3, 2005 N 32n |

| 1151044 | 18210905030011000110 | Calculation of fees for the use of the names “Russia”, “Russian Federation” and words and phrases formed on their basis | Order of the Ministry of Taxes and Taxes of Russia dated June 29, 2000 N BG-3-02/246 |

| 1151046 | 18210909010011000110 18210909020071000110 18210909030081000110 18210909040091000110 | Tax return for the unified social tax for taxpayers making payments to individuals | Order of the Ministry of Finance of Russia dated December 29, 2007 N 163n |

| 1151050 | 18210909010011000110 18210909020071000110 18210909030081000110 18210909040091000110 | Calculation of advance payments for the unified social tax for taxpayers making payments to individuals | Order of the Ministry of Finance of Russia dated 02/09/2007 N 13n |

| 1151054 | 18210701011011000110 18210701012011000110 18210701013011000110 18210701020011000110 18210701030011000110 18210701040011000110 18210701050011000110 18210701060011000110 | Tax return for mineral extraction tax | Order of the Federal Tax Service of Russia dated December 16, 2011 N ММВ-7-3/ [email protected] |

| 1151056 | 18210101030011000110 18210101050011000110 18210101070011000110 | Tax calculation (information) on amounts paid to foreign organizations for income and taxes withheld | Order of the Ministry of Taxes and Taxes of Russia dated April 14, 2004 N SAE-3-23/ [email protected] |

| 1151059 | 18210503010011000110 18210503020011000110 | Tax return for the unified agricultural tax | Order of the Ministry of Finance of Russia dated June 22, 2009 N 57n |

| 1151063 | 18210909010011000110 18210909030081000110 18210909040091000110 | Tax return for the unified social tax for individual entrepreneurs, lawyers, notaries engaged in private practice | Order of the Ministry of Finance of Russia dated December 17, 2003 N 132n |

| 1151066 | 18210905020011000110 | Calculation (declaration) of tax on transactions with securities | Order of the Ministry of Taxes and Taxes of Russia dated November 18, 2003 N BG-3-24/633 |

| 1151072 | 18210703000011000110 | Tax return for water tax | Order of the Ministry of Finance of Russia dated 03.03.2005 N 29n as amended on 12.02.2007 N 15n |

| 1151074 | 18210302030011000110 | Tax return on excise taxes on tobacco products | Order of the Ministry of Finance of Russia dated November 14, 2006 N 146n as amended on December 20, 2007 N 142n |

| 1151081 | 18210909010011000110 18210909030081000110 18210909040091000110 | Data on the calculated amounts of the single social tax on the income of lawyers | Order of the Ministry of Finance of Russia dated 02/06/2006 N 23n |

| 1151082 | 18210101020011000110 | Tax return for corporate income tax upon implementation of production sharing agreements | Order of the Ministry of Finance of Russia dated 04/07/2006 N 55n as amended on 01/09/2007 N 2n |

| 1151084 | 18210302011011000110 18210302012011000110 18210302013011000110 18210302020011000110 18210302041011000110 18210302042011000110 18210302060011000110 18210302070011000110 18210302080011000110 18210302090011000110 18210302100011000110 18210302110011000110 18210302130011000110 18210302210011000110 | Tax return on excise taxes on excisable goods with the exception of tobacco products | Order of the Federal Tax Service of Russia dated June 14, 2011 N ММВ-7-3/ [email protected] |

| 1151088 | 18210401000011000110 18210402011011000110 18210402012011000110 18210402013011000110 18210402020011000110 18210402030011000110 18210402040011000110 18210402060011000110 18210402070011000110 18210402080011000110 18210402090011000110 18210402100011000110 18210402110011000110 18210402130011000110 18210402140011000110 18210402150011000110 | Tax declaration on indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the Customs Union | Order of the Ministry of Finance of Russia dated July 7, 2010 N 69n |

| 1152001 | 18210904010021000110 | Calculation of corporate property tax | Order of the Ministry of Taxes and Taxes of Russia dated April 21, 2003 N BG-3-21/203 |

| 1152002 | 18210904010021000110 | Calculation of corporate property tax (for a separate division) | Order of the Ministry of Taxes and Taxes of Russia dated January 18, 2002 N BG-3-21/22 |

| 1152004 | 18210604011021000110 | Tax return for transport tax | Order of the Federal Tax Service of Russia dated February 20, 2012 N ММВ-7-11/ [email protected] |

| 1152011 | 18210605000021000110 | Tax return for gambling business tax | Order of the Federal Tax Service of Russia dated December 28, 2011 N ММВ-7-3/ [email protected] |

| 1152016 | 18210502010021000110 18210502020021000110 | Tax return for single tax on imputed income for certain types of activities | Order of the Federal Tax Service of Russia dated January 23, 2012 N ММВ-7-3/ [email protected] |

| 1152017 | 18210501011011000110 18210501012011000110 18210501021011000110 18210501022011000110 18210501030011000110 18210501050011000110 | Tax return for tax paid in connection with the application of the simplified taxation system | Order of the Ministry of Finance of Russia dated June 22, 2009 N 58n as amended on April 20, 2011 N 48n |

| 1152019 | 18210903091011000110 | Calculation of forest taxes when selling timber, taking into account the area and number of trees assigned for felling | Instruction of the State Tax Service of the Russian Federation dated April 19, 1994 N 25 |

| 1153001 | 18210904051031000110 18210904052041000110 18210904053051000110 18210904053101000110 | Tax return for land tax | Order of the Ministry of Taxes and Taxes of Russia dated December 29, 2003 N BG-3-21/725 |

| 1153005 | 18210606011031000110 18210606012041000110 18210606013051000110 18210606013101000110 18210606021031000110 18210606022041000110 18210606023051000110 18210606023101000110 | Tax return for land tax | Order of the Federal Tax Service of Russia dated October 28, 2011 N ММВ-7-11/ [email protected] |

| 1152026 | 18210602010021000110 18210602020021000110 | Tax return for corporate property tax | Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/ [email protected] |

| 1152028 | 18210602010021000110 18210602020021000110 | Tax calculation for advance payment of corporate property tax | Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/ [email protected] |

| 1110011 | 18210704020011000110 18210704030011000110 | Information on received permits for the extraction (catch) of aquatic biological resources, the amount of fees for the extraction (catch) of aquatic biological resources, subject to payment in the form of one-time and regular contributions | Order of the Federal Tax Service of Russia dated February 26, 2006 N SAE-3-21/ [email protected] as amended dated July 7, 2010 N ММВ-7-3/321 |

| 1110012 | 18210704010011000110 | Information on the licenses (permits) received for the use of objects of the animal world, the amounts of fees for the use of objects of the animal world subject to payment, and the amounts of fees actually paid | Order of the Federal Tax Service of Russia dated February 26, 2006 N SAE-3-21/ [email protected] |

| 1110022 | 18210704020011000110 18210704030011000110 | Information on the number of objects of aquatic biological resources subject to removal from their habitat as permitted by-catch, on the basis of a permit for the extraction (catch) of aquatic biological resources, and the amount of collection to be paid in the form of a one-time contribution | Order of the Federal Tax Service of the Russian Federation dated 07/07/2010N ММВ-7-3/ [email protected] |

FILES

Who is required to take KND 1110018

Judging by the title of the report, only employers must report information on the average number of employees, but this is not entirely true. Indeed, individual entrepreneurs who did not hire personnel under employment contracts in the reporting year do not submit KND form 1110018.

As for legal entities, this obligation is established for them even in the absence of personnel. Article 80 (3) of the Tax Code of the Russian Federation states that information on the average number of employees for the previous year is presented by the organization (individual entrepreneur who hired employees during the specified period). That is, the reservation about the availability of personnel is made only in relation to individual entrepreneurs, and organizations are required to report in any case.

The same opinion is reflected in the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for the exemption of organizations that do not have employees from submitting information on the average number of employees to the tax authorities within the prescribed period.”

In total, the following must report the average number of employees in 2019:

- individual entrepreneurs who have entered into employment contracts with employees;

- all legal entities, regardless of the presence of employees.

The deadline for submitting information on the number of employees is set for everyone: no later than January 20 of the current year for the previous one. Even if this number has not changed over the year, it is necessary to submit KND 1110018.

In addition, no later than the 20th day of the month following the month of registration, newly created organizations must submit information on the average number of employees.

For example, an LLC registered on August 25, 2022, first submits the SFR until September 20, 2019 inclusive, and then at the end of the year - no later than January 20, 2022.