With the modern rhythm of life, it is not always convenient for an employee to devote the whole day to work, and to pay the head of the company a full salary. In this regard, the concept of “part-time work” has already become firmly established in our lives. The employee, during the allotted time, will try to demonstrate his maximum abilities and output in order to go home sooner, and the director will be able to save a lot, since payment is made for a specific period worked. We’ll tell you about calculating wages for part-time work, and give examples with amounts and postings.

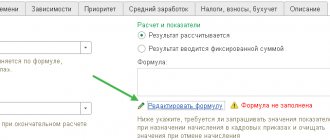

Payment methods, procedure and calculation formula

To learn how to correctly calculate the amount of payments, you need to clearly understand how a certain type of salary is calculated.

| Forms of payment | Calculation procedure |

| Time-based | Depends only on the amount of time worked, the amount of products produced does not affect this form of payment |

| Piecework | The calculation procedure is inversely proportional to the previous form. Payments are made only for the amount of work done, regardless of the time spent on it. |

In addition, the salary can be divided into:

Main:

- salary or piece income;

- bonuses for a job well done;

- other surcharges.

Additional:

- payment for required vacation and sick leave in case of incapacity for work;

- reimbursement of expenses incurred in connection with travel, accommodation and meals (for example, during business trips);

- bonus payments that are not part of the main employment agreement.

The established calculation formulas are applied depending on the forms of remuneration:

- For piecework wages, the following calculation is used: Salary = cost of production specified in the contract * volume of products produced for the period + accrued bonuses + other additional payments – income tax – other deductions.

- Time-based payment is calculated using the formula: Salary = salary amount / total number of working days * number of days actually worked + bonus amount - personal income tax - withheld amounts . Read also the article: → “Calculating salaries for employees (piecework, temporary payment, calculation example).”

The above formulas are relevant when the employment contract states that the terms of employment are part-time and the employee has worked the required hours.

Payroll calculation for part-time work

When an employee has not fully worked the required hours, the calculation algorithm will be different:

| Period | Formula |

| Calculation for less than a month | Salary for an incomplete month = the value obtained by calculation using the formula for the standard calculation of payments due / number of working days for a certain period * number of days actually worked. |

| Calculation for the day worked | Wages for one day = value obtained by calculation using the formula / number of working days in the period. |

| Calculation for the year worked | Average salary per day = amount of salary for the year / number of months / 29.3. |

| Calculation of wages with a vacation break | Wages, if there was a vacation in the billing period = employee’s salary / total number of working days in the period * number of days actually worked in the month. |

Calculation of wages at a salary rate at a rate of ½ or ¼:

- Salary at ½ rate = salary at full rate*0.5

- Salary at ¼ rate = salary at full rate *0.25

Calculation example No. 1. Employee Kovalev A.A. drawn up under an employment contract, rate - ½, from November 11, 2016 to the position of equipment sales manager. The full salary for this position is 25,000, according to the staffing table. Calculate wages for less than a month.

First you need to determine the number of working days and weekends that fell in November:

- workers - 21 days;

- weekend - 9 days.

From November 11 to November 30, the employee worked 14 days. Next, the calculation is carried out according to the formula: 25,000 / 21 * 14 = 16,666.67 rubles - wages for the period from November 11 to November 30. The rate of Kovalev A.A is ½, accordingly the amount of payment will be:

Salary for November = 16,666.67*0.5=8,333.34 rubles

Under piecework conditions, the calculation is much simpler. It is enough to know the amount of payment per unit of production and the quantity of goods sold.

More about the legal basis

The country's Labor Code does not have a clear definition of the concept of wages. This term refers to the generally accepted length of the work week - 40 hours (on average 8 hours a day), during which a person must be at his workplace and perform his duties.

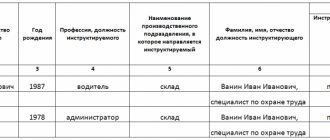

Accordingly, for a person who is employed part-time, the production norm will be 20 hours per week – i.e. half of the generally accepted norm. In order to be able to calculate wages for employees at 0.5 rates, the employer must keep a separate journal for each such employee. This statement, or as it is also called a summary, contains data on the hours actually worked, on the basis of which wages are then paid.

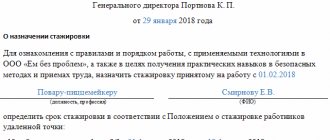

If the boss wants to have an employee on his staff who will perform his duties only half of the working day established by law, these relations must be formalized accordingly. The employee will work at 0.5 rate and, if he does not have a main place of work, he should be assigned to this position in strict accordance with Chapter 11 of the Labor Code of the Russian Federation.

Now, in order to understand how the minimum wage is determined for part-time work in Russia, let us again turn to Art. 132 of the Labor Code of the Russian Federation, which states that an employee’s salary depends on the following aspects:

- The complexity of the work he performs;

- Quality of labor spent;

- The worker's skill level.

Obviously, at half the rate, such an employee will receive less than his colleague in the same position, but who works the full 40 hours a week. The main thing is to enter into an agreement when hiring that a person will perform job duties for half a day or a week. For this reason, the minimum wage for him will be set at 50% of the minimum amount for an employee who is on site for at least 8 hours daily, 5 days a week.

In particular, the following categories of citizens have the full right to find employment part-time:

- A pregnant woman or one who is on maternity leave;

- Parent or guardian of a child under 14 years of age or a disabled child under 18 years of age;

- Persons who are caring for a seriously ill relative and at the same time have a medical certificate on the basis of which care is required.

However, any other citizen can get a part-time job if he has such a desire, and the employer allows him to do so. There are no restrictions. The remuneration of such an employee will be according to the number of hours worked or depending on the amount of work performed, but cannot be lower than 0.5 of the minimum wage for an ordinary employee.

Minimum payout amount

According to Article 133 of the Labor Code, if an employee has fully worked the time established by the employment agreement, the amount of his remuneration should not be lower than the minimum wage (minimum wage). For example, in 2016 this figure in Moscow was 17,561 rubles. Under working conditions at a rate of ½, wages cannot be less than 8,780.50 rubles, that is, in proportion to the established minimum:

Salary = 17,561*0.5 = 8,780.50 rubles

Calculation example No. 2. In 2016, the Podsolnushko farm in the Krasnodar Territory had two employees: tractor driver Klyuev and driver Petrov. Klyuev is employed full-time and his salary is 11,000 rubles, Petrov works at a rate of ½ and his salary is 5,000 rubles. We will determine whether these payments in the prescribed amount do not violate labor laws.

The minimum wage in the Krasnodar region in 2016 was 10,366 rubles. Klyuev’s salary exceeds this value, and therefore management does not violate his rights. But in relation to Petrov, their actions are illegal, since his rate is ½, then the amount of payment should not be less than 5,183 rubles.

It is worth remembering that the minimum wage in different regions is set individually. The table shows how the indicators differ. It all depends on the different levels of inflation in different regions and on the established cost of living. Wages for part-time work may be less than the minimum wage, but only in proportion to the rate.

| Region | Minimum wage in 2016 |

| Bryansk region | 7,500 rubles |

| Murmansk region | 13,650 rubles |

| Tyumen region | 7,700 rubles |

| Moscow | 17,300 rubles |

Can the minimum wage for part-time workers be lower than the established value?

The Labor Code of the Russian Federation has clearly established the salary level for citizens of the country, but if the employer decides to be more cunning and lowers the bar, this action will be considered an administrative offense. Art. speaks about this. 5.27 of the Administrative Code, on the basis of this law, a fine of 50 thousand rubles can be imposed on an organization; for a repeated violation, the fine increases to 100 thousand rubles. Not only all budgetary, but also commercial organizations must follow the letter of the law. If a certain level of minimum wage has been established in the region, the employer simply does not have the right to pay employees less wages. Exactly the same rule applies to part-time workers. However, there are a number of cases when a citizen can receive a salary less than the limit established by the state:

- His employment contract specifies a salary that does not include mandatory deductions such as taxes, contributions, insurance contributions, etc.;

- If a person works part-time part-time with a flexible schedule;

- If an employee goes on sick leave for a month, even if working part-time, in practice he will receive less than what is promised by law.

Although in the latter option the difference can be covered by sick leave.

Read also: Sick leave on probation in 2022

Pre-holiday days with part-time work

Labor legislation stipulates that the pre-holiday day should be shortened by one hour. Employees registered at 0.5 rate also have the right to use this privilege. This benefit does not apply to the category of workers whose work should not be interrupted. The employer, in turn, can compensate for unused benefits with payments or additional rest.

Pre-holiday days are the days before official holidays. Their list is established long before the start of the calendar year and is available in any information source, along with the production calendar. If an official holiday falls on a Monday, then Friday is not a pre-holiday day.

Which days are considered pre-holidays: (click to expand)

- This category includes workdays on the eve of a holiday. For example, if February 23 falls on a Monday, then Friday does not fall under this definition and cannot be a shortened day.

- Religious customs established in the respective regions are also considered federal holidays. For example, Parents' Day in the Krasnodar Territory has been a day off for many years, by decree of the governor. And in Moscow it’s an ordinary working day.

For part-time workers who doubt their rights, the labor code states: employees registered at ½ rate have the same advantages and benefits along with everyone else: the right to paid leave, accrual of seniority and others. Based on this, employees who work part-time also work an hour less, and proper documentation of this fact is mandatory:

- Drawing up an order establishing a working hours schedule, which will clearly define this range, taking into account the lunch break;

- Instead of 8 hours worked, the timesheet must indicate 7, and for part-time workers, instead of 4, enter the number 3.

Definition of part-time work

Part-time work is a reduced amount of time that an employee is willing to spend on performing his or her job duties.

The practice of part-time work exists in many companies, but it is not available to all employees, but only to people belonging to the following categories of citizens:

- employees on maternity leave and those wishing to leave it early;

- workers with disabilities and health problems;

- workers who combine work in several places at once;

- workers who are faced with difficult life circumstances that require a reduction in working hours;

- employees who wish to change working conditions if they have a positive labor reputation or long experience and length of service.

Obviously, to shorten the working day or week, you need at least a good reason. It is also worth considering that the maximum period of stay for a part-time employee should not officially exceed six months.

The decision to transfer an employee belonging to any of these categories to part-time work must be approved by both the employee and the employer. For example, an employee can work four or three days a week instead of the required five, or he can work six hours instead of eight according to the general rules of the Labor Code of the Russian Federation.

Only all this must be officially agreed upon with management and established in accordance with official regulations. In this case, the wage rate is cut and calculated based on the amount of salary, bonuses and other social benefits to the employee. Please note that a part-time employee has the same rights and benefits as other full-time employees. He is also provided with vacation within the period established by the employment contract and taking into account all vacation payments. An entry in the work book about part-time work is not provided: in this case, there is no need to put any notes in the document.

We will tell you in more detail about how to calculate wages for an employee who has decided to switch to part-time work.