Codes on the payslip

The payment form is approved by the employer.

It must contain both accrual and deduction indicators for the month, indicated either by words (“salary”, “bonus”, “personal income tax”, etc.) or special codes. Separate codes must be used for different types of payments and deductions by the employer. To enter codes, special columns must be provided in the calculation sheet. Deciphering the payroll sheet will make it possible to understand exactly why each employee was paid certain payments and what exactly was withheld. Should the payslip have codes or names of all components of the salary (salary, bonuses, coefficients, etc.)? Yes, definitely. In Part 2 of Art. 136 of the Labor Code of the Russian Federation states that an employer can use an independently developed pay slip form. At the same time, it is important that the employee is informed specifically about the components of the salary, i.e. the type of each accrual that makes up the employee’s income for the month must be visible and understandable.

Salary payment codes in the payment order

A payslip is a document that is drawn up by the employer to inform the worker about the accruals that are due to him. The obligation to draw up payment sheets follows from the provisions of Art. 136 of the Labor Code of the Russian Federation, according to which the employer is obliged to inform workers in writing on a monthly basis:

p, blockquote 2,0,1,0,0 –>

- information about the composition of salaries;

- information about other payments;

- information about withheld funds, in particular, tax deductions;

- information about the amount that will be paid to the employee for the pay period.

Important! The law does not contain mandatory requirements for the content of the payslip and the procedure for its execution. Each employer has the right to independently develop a form for this document and approve it by local act.

Based on the interpretation of the requirements of Art. 136 of the Labor Code of the Russian Federation, set out above, the following information must be reflected in the payslip:

p, blockquote 4,0,0,0,0 –>

- about funds accrued to the worker;

- about retained funds;

- about the amount to be paid.

Decoding the main codes

Often, income coding in calculations is taken from the 2-NDFL certificate. It should be noted that employers have the right to use not only generally accepted ciphers, but also codes of their own design. It is important that operating personnel are familiar with the decoding of such encodings. This can be done in two ways:

- indicating the decoding in the pay slip form itself;

- by issuing a local regulation that lists the current encodings and their interpretation, and familiarizing all employees with it.

The codes in the payslip corresponding to the codes for 2-NDFL certificates have the following meaning:

- 2000 – accrued salary for performing labor duties;

- 2010 – payments under the GPC agreement;

- 2012 – vacation payments;

- 2300 – temporary disability benefit;

- 2530 – salary in kind;

- 2720 – cost of gifts given;

- 2762 – financial assistance for the birth of a child, adoption;

- 1010 – dividends paid.

A complete list of income coding for 2-personal income tax is given in the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected]

Payslip: concept and requirements for its preparation

A payslip is a document that is drawn up by the employer to inform the worker about the accruals that are due to him. The obligation to draw up payment sheets follows from the provisions of Art. 136 of the Labor Code of the Russian Federation, according to which the employer is obliged to inform workers in writing on a monthly basis:

- information about the composition of salaries;

- information about other payments;

- information about withheld funds, in particular, tax deductions;

- information about the amount that will be paid to the employee for the pay period.

Important! The law does not contain mandatory requirements for the content of the payslip and the procedure for its execution. Each employer has the right to independently develop a form for this document and approve it by local act.

Based on the interpretation of the requirements of Art. 136 of the Labor Code of the Russian Federation, set out above, the following information must be reflected in the payslip:

- about funds accrued to the worker;

- about retained funds;

- about the amount to be paid.

What numeric value determines the income code “salary”? Other codes used in the pay slip, certificate 2-NDFL

Decoding of wage codes in the payslip is carried out using the information contained in Appendix No. 1 to the Order of the Federal Tax Service of Russia “On approval of codes...” dated September 10, 2015 No. ММВ-7-11 / [email protected]

This regulatory act defines not only wage codes, but also codes for other payments, as well as tax deductions. The code for wages is 2000.

In addition, to display income related to labor activity, which is reflected both in the payslip and in the 2-NDFL certificate, the following codes are used:

- 2012 – holiday pay code;

- 2530 – remuneration in kind;

- 2300 – sick pay;

- 2760 – amount of financial assistance;

- 2762 – the amount of financial assistance paid to employees in connection with the birth of children;

- 4800 – any income that is not named in Order No. ММВ-7-11/ [email protected]

A full list of income codes can be found below:

Types of codes that are used when filling out the 3-NDFL certificate

When filling out the 3-NDFL certificate, other income codes are used. They are enshrined in Appendix No. 4 to the Order of the Federal Tax Service of Russia dated December 24, 2014 N ММВ-7-11/ [email protected] 10 codes are used:

| Code | Type of income |

| 01 | Income received from the sale of real estate |

| 02 | Income received as a result of alienation of other property |

| 03 | Income received from the sale of securities |

| 04 | Profit from the transfer of property for rent |

| 05 | Income received free of charge, based on donation |

| 06 | Income from employment, if taxes were paid by the employer |

| 07 | Income from employment if tax was not paid by the employer |

| 08 | Dividend income |

| 09 | Sale of property at cadastral value |

| 10 | Other income |

Thanks to the above decoding, you can determine the composition of the amounts of money received from the employer, as well as correctly fill out the declaration in Form 3-NDFL.

Decoding document sections

Deciphering the payslip may be required not only in relation to the codes, but also in relation to its main sections. Each section contains specific information:

- "Accrued." This section displays the amount of payments accrued to the employee. This includes accrued wages (broken down into salary, bonuses, coefficients, etc.), bonuses, vacation pay, sick leave and any other accruals.

- "Held." This section includes amounts of money that are withheld from accrued income - personal income tax, alimony, amounts for damages, etc. Indicate the grounds for withholding: current legislation, writs of execution, employee application or order of the general director.

- "Paid." The amount that was previously given to the employee as an advance is displayed here. This section may also contain information about other previously made payments, for example, vacation pay.

- "To payoff". This section will indicate the total amount of money that the employee should receive in hand on payday. All deductions and previously paid amounts will already be deducted from it.

All indicators of income and deductions in the calculation can be indicated by both words and digital codes.

Wage type code: additional explanation

In addition to the listed salary codes, the order of the Federal Tax Service approved the following designations for income indicated in the 2-NDFL certificate:

1010 — dividends;

2001 - remuneration or similar payment to the company’s management structure;

2010 - payment based on a civil contract;

2530 - remuneration in kind;

2720 - income received as a gift;

2762 - payment of financial assistance to employees at the birth, adoption of a child.

The importance of a payslip for employees

Employees often remember their right to decipher the payslip only when a conflict situation arises with the employer due to incorrectly accrued and paid wages. If it comes to legal proceedings, an employee of the organization must have documents with him with which he can prove the fact of incorrect calculation of wages. A payslip is just such a document.

The value of a payslip for employees is quite obvious. It helps to clearly understand what components make up their salary. By carefully studying the calculation, you can promptly detect a discrepancy between the accrued salary and the terms of a specific employment contract. To clarify controversial issues, a company employee has the right to contact the accounting department. Here they must explain to him in detail the procedure for calculating his wages, and if an error is discovered in the calculation, it is necessary to recalculate and pay additional money to the employee.

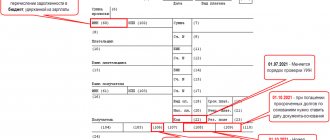

New codes in payment orders for salaries in the 1C program

The Central Bank of the Russian Federation has approved new codes in payment orders for salaries. Starting from June 1, 2022, in payments for the transfer of salaries and other payments to individuals, you must indicate an additional code (field 20 “Payment name”). The corresponding changes were made to the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”. In this article we will look at which codes are used in which cases.

This code was introduced for bailiffs and banks so that they know from what amounts funds can be withheld. According to the Directive of the Bank of Russia dated October 14, 2019 No. 5286-U, when transferring income to an individual, the code of the type of income for the purposes of enforcement proceedings should be indicated (Federal Law dated October 2, 2007 No. 229-FZ).

In the 1C program: Salaries and personnel management ed. 3.1, it has already become possible to select the required code in the document “Statement to the bank” when crediting salaries to a card for a salary project and “Statement to accounts” when transferring to an account.

The “Type of income” field has appeared at the top of the statement; the accountant himself selects the desired code (“1”, “2”, “3”).

| Revenue code | Legal basis | Explanation |

| «1» | - when paying wages - when paying other income for which there is a limit on the amount of deductions (Article 99 of Law 229-FZ) | When transferring wages and other income (for example, vacation pay, temporary disability benefits, payments under GPC agreements). As a general rule, no more than 50% of income of this type can be withheld from the debtor. Alimony for minor children, compensation for harm to health, compensation for harm associated with the loss of a breadwinner and compensation for damage caused by a crime - the amount of withholding in such cases should not exceed 70% of income |

| «2» | - when paying income from which deductions are not made (Article 101 of Law 229-FZ) | 18 types of income for 2022; child benefits, maternity benefits, business trip compensation, etc. Exceptions: the restriction on foreclosure does not apply to alimony for minor children and obligations for compensation for harm in connection with the death of the breadwinner (Part 2 of Article 101 of Law 229-FZ) |

| «3» | - when paying income, to which, in accordance with Part 2 of Art. 101 229-FZ restrictions on foreclosure do not apply | |

| Code not specified | - when paying income that can be levied without restrictions | No code will be assigned to payments that may be subject to collection. |

How to indicate the collected amount in payments

Let us pay attention to the procedure for indicating the collected amount in payment documents. Information about the amount collected should be indicated in the payment order in the “Purpose of payment” detail. The sequence is as follows: symbol “//”, “VZS” (amount collected), symbol “//”, amount in numbers, symbol “//”. When indicating the amount in numbers, rubles are separated from kopecks by a dash sign “‒”. When expressing the amount of recovery in whole rubles, “00” is indicated after the dash sign “‒”.

In this article we talked about new codes in salary payments. If you have any questions, please contact our dedicated 1C Consultation Line, where you can receive qualified support. Book your first consultation completely free!